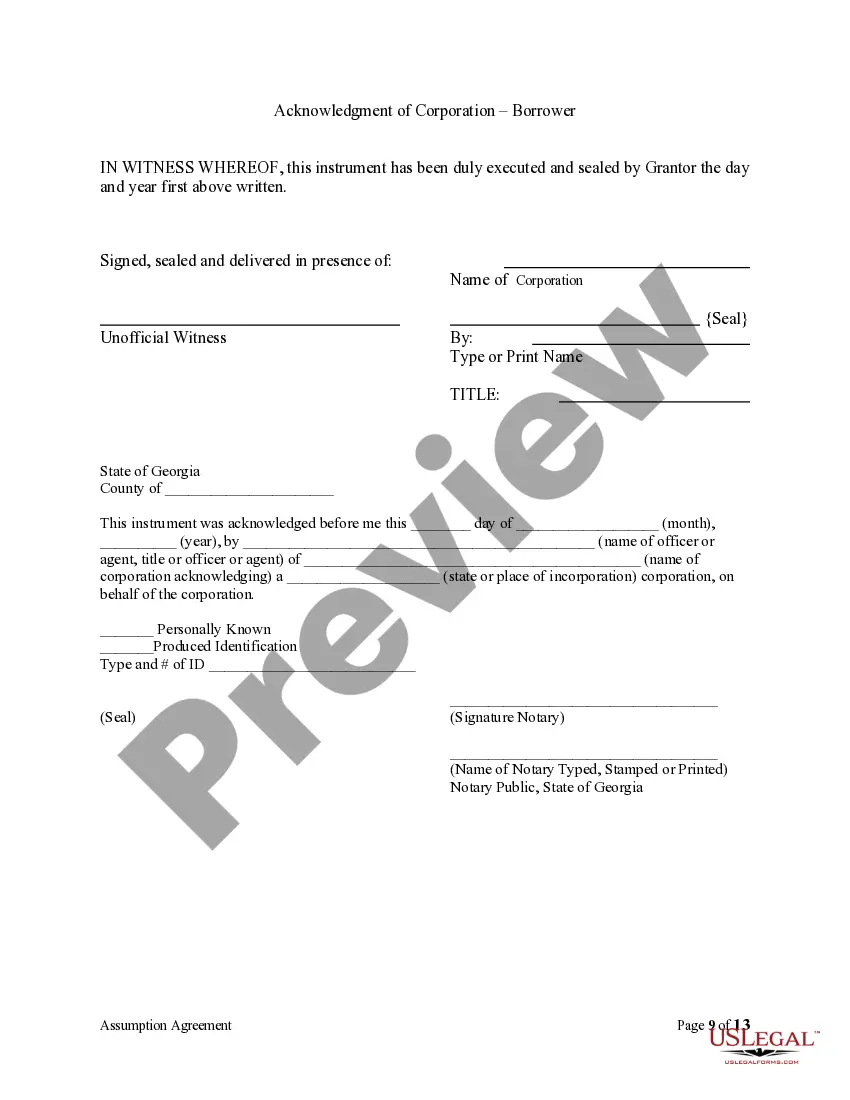

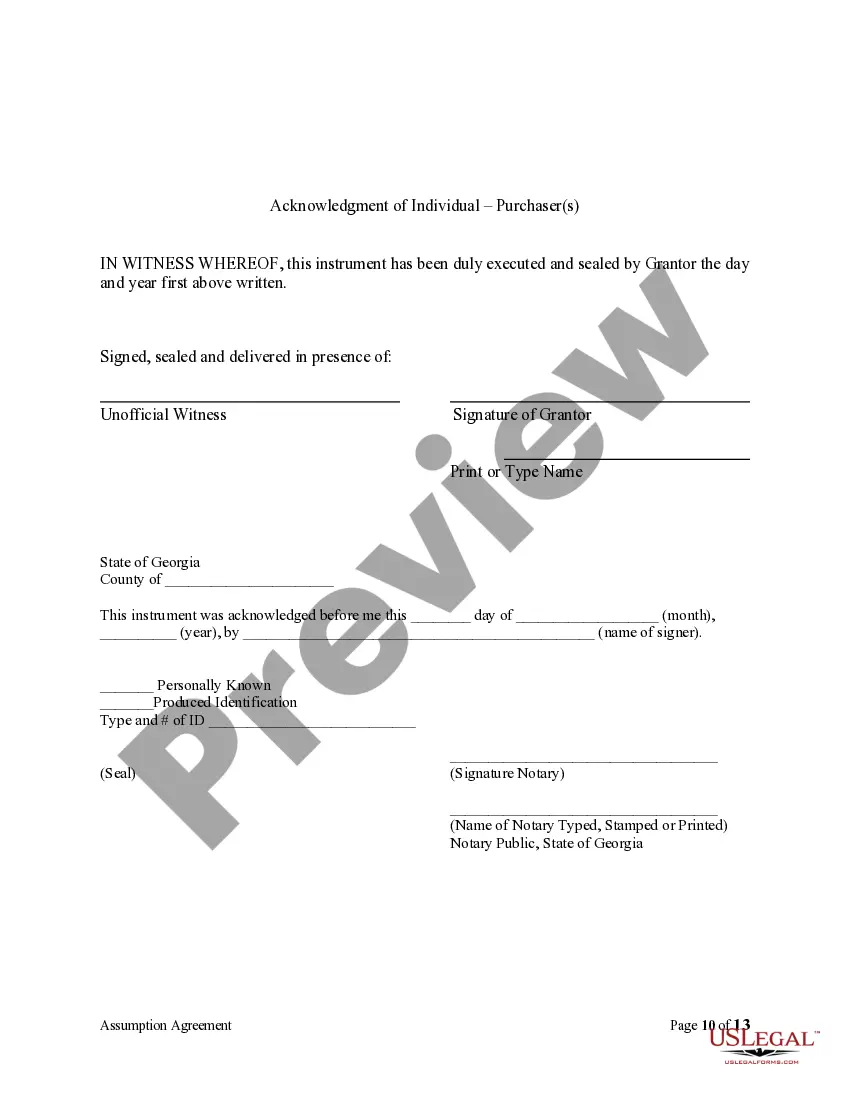

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

Atlanta Georgia Assumption Agreement of Security Deed and Release of Original Mortgagors

Description

How to fill out Georgia Assumption Agreement Of Security Deed And Release Of Original Mortgagors?

Do you require a reliable and affordable legal forms supplier to purchase the Atlanta Georgia Assumption Agreement of Security Deed and Release of Original Mortgagors? US Legal Forms is your ideal answer.

Whether you need a straightforward arrangement to establish guidelines for living with your partner or a collection of forms to facilitate your divorce through the judicial system, we have you supported. Our platform offers over 85,000 current legal document templates for personal and business purposes. All templates that we provide are not generic and designed in accordance with the stipulations of specific state and locality.

To obtain the form, you must Log In to your account, find the necessary template, and press the Download button adjacent to it. Please remember that you can retrieve your previously acquired document templates at any moment in the My documents section.

Are you unfamiliar with our site? No problem. You can set up an account within minutes, but first, guarantee the following.

You can now create your account. Then select the subscription choice and proceed to the payment process. After the payment is completed, download the Atlanta Georgia Assumption Agreement of Security Deed and Release of Original Mortgagors in any available file type. You can revisit the website at any time and redownload the form without incurring any additional charges.

Obtaining current legal forms has never been simpler. Give US Legal Forms a chance now, and stop wasting your precious time learning about legal documents online for good.

- Verify that the Atlanta Georgia Assumption Agreement of Security Deed and Release of Original Mortgagors adheres to the rules of your state and locality.

- Review the form’s specifications (if available) to ascertain who and what the form is meant for.

- Restart the search if the template does not suit your legal situation.

Form popularity

FAQ

A letter of assumption is a written agreement between a current homeowner and a prospective buyer. The letter states that the buyer agrees to take over the homeowner's debt in the home in exchange for ownership.

In real estate transactions, an assumption agreement allows a third party to ?assume? or take over the loan of the property's seller. Mortgages may be assumed when the house is sold, a divorcing spouse is awarded the property in a settlement or when someone inherits property.

A Debt Assignment and Assumption Agreement is a very simple document whereby one party assigns their debt to another party, and the other party agrees to take that debt on. The party that is assigning the debt is the original debtor; they are called the assignor.

A mortgage deed has to be cancelled jointly by both the parties. You can always get a certified copy of the mortgage deed from sub registrar office and then prepare a cancellation deed. technically a mortgage deed gets automatically renewed for 12 years from every single instance of payment.

Assumption and Release means the agreement to be entered into by ADI, the Subsidiary Borrower and the Administrative Agent pursuant to which the Subsidiary Borrower assumes all of the Obligations and becomes the ?Borrower?, in each case for all purposes of this Agreement and the other Loan Documents, and ADI is

In consideration of the assumption of the Debtor's Liabilities, the Creditor (a) agrees to look solely to the Assuming Party for the payment and the performance of the Liabilities; and (b) forever releases and discharges the Debtor from the Liabilities.

In Georgia, a security deed is the document that secures a loan on real estate. OCGA § 44-14-80 states that security deeds expire seven years after the maturity of the last installment date stated in the security deed.

A deed of trust, or security deed, as it is known in some jurisdictions, is a form of mortgage. A borrower of money signs a promissory note demonstrating the debt owed to the lender. The promissory note will generally recite the purpose of the loan and indicate that it is secured by real property.

Georgia law provides that a security deed can be cancelled by the Clerk of Superior Court upon receipt of an affidavit from an attorney with specified attachments. To find a lawyer, you may visit the State Bar of Georgia website at .