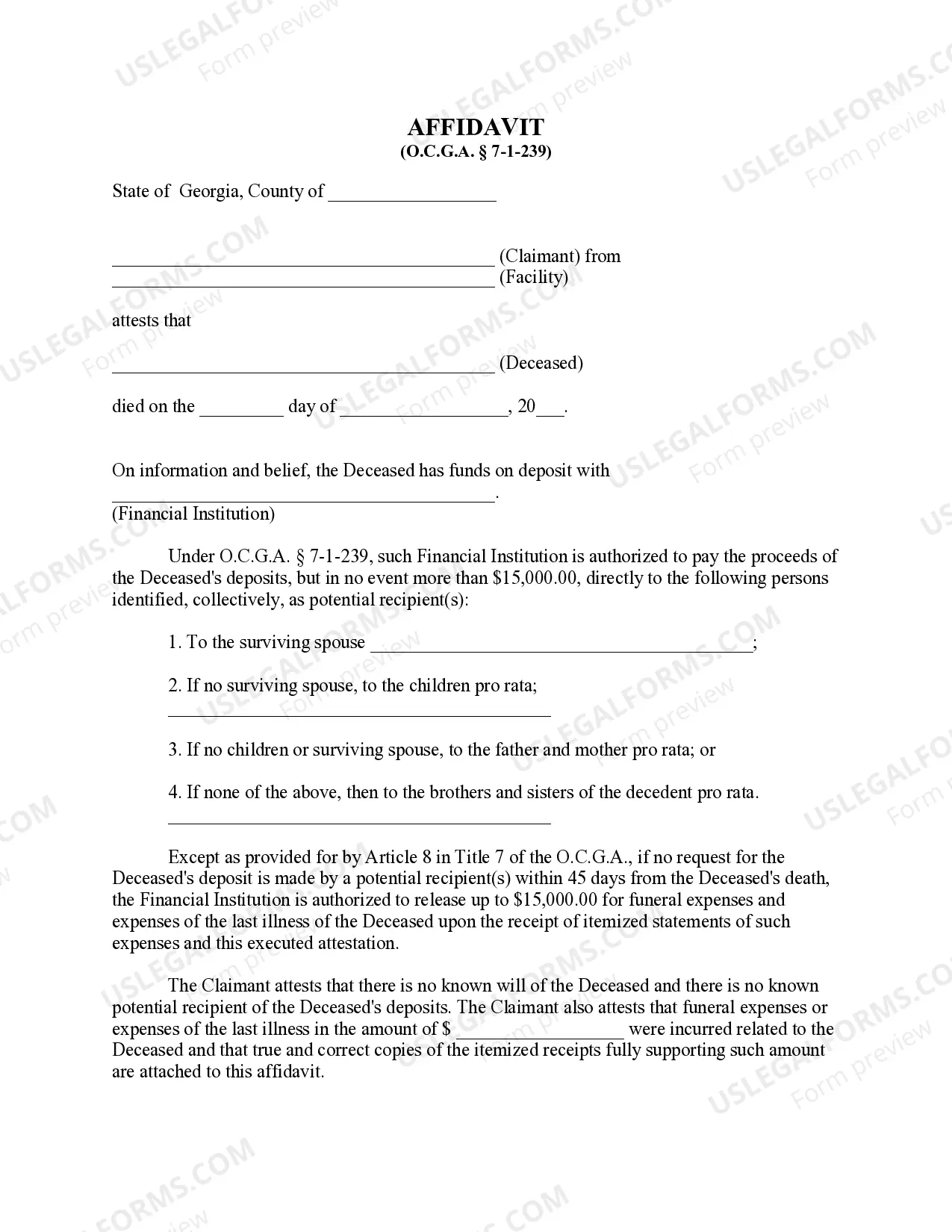

The Savannah Georgia Banking Affidavit of Surviving Relative — Intestate Estate is a legal document used in the state of Georgia to ensure the proper administration of assets and finances in the event of a person's death without a valid will (intestate). This affidavit involves the identification and verification of the surviving relative(s) who are entitled to inherit the deceased person's estate. The affidavit serves as proof of the surviving relative's rightful claim to the estate and their authority to manage and distribute the assets. Savannah Georgia Banking Affidavit of Surviving Relative — Intestate Estate is a critical document that helps financial institutions, such as banks, recognize the legal authority of the surviving relative to access and handle the deceased person's accounts and financial transactions. Key components of the Savannah Georgia Banking Affidavit of Surviving Relative — Intestate Estate may include: 1. Identification Information: The affidavit typically requires the surviving relative to provide their full legal name, address, contact details, and relationship to the deceased person. 2. Deceased Person's Information: This section includes essential details about the deceased individual, such as their full legal name, social security number, date of death, and last known address. 3. Relationship Confirmation: The surviving relative must establish their relationship to the deceased person, such as being a spouse, child, parent, or sibling. Any supporting documents, like birth or marriage certificates, may need to be attached to validate the relationship. 4. Asset Identification: The affidavit may list the various assets owned by the deceased person, such as bank accounts, investment portfolios, real estate properties, and any other significant properties or valuables. 5. Consent and Acceptance: The surviving relative acknowledges their responsibility to manage and distribute the estate according to the laws of intestate succession in Georgia. They also consent to any necessary verifications and investigations by the banking institution. Different types of Savannah Georgia Banking Affidavit of Surviving Relative — Intestate Estate may include variations specific to the particular financial institution that is requesting the document, but the general content and purpose remain consistent. It's crucial to consult with an attorney or legal professional to ensure the accurate completion of the Savannah Georgia Banking Affidavit of Surviving Relative — Intestate Estate, as any errors or discrepancies may lead to complications or delays in accessing the deceased person's assets.

Savannah Georgia Banking Affidavit of Surviving Relative - Intestate Estate

Description

How to fill out Savannah Georgia Banking Affidavit Of Surviving Relative - Intestate Estate?

We always strive to minimize or prevent legal issues when dealing with nuanced legal or financial affairs. To accomplish this, we sign up for attorney services that, as a rule, are extremely expensive. However, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online collection of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of turning to an attorney. We offer access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Savannah Georgia Banking Affidavit of Surviving Relative - Intestate Estate or any other document easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it in the My Forms tab.

The process is equally straightforward if you’re unfamiliar with the platform! You can register your account in a matter of minutes.

- Make sure to check if the Savannah Georgia Banking Affidavit of Surviving Relative - Intestate Estate adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Savannah Georgia Banking Affidavit of Surviving Relative - Intestate Estate would work for your case, you can select the subscription plan and proceed to payment.

- Then you can download the document in any suitable format.

For more than 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!

Form popularity

FAQ

Many banks offer notary services, allowing you to get an affidavit notarized on-site. This is convenient as it saves you time, especially if you are preparing a Savannah Georgia Banking Affidavit of Surviving Relative - Intestate Estate. Be sure to bring identification and the completed affidavit to complete the notarization process smoothly.

Yes, Georgia does have a small estate affidavit procedure for eligible estates that meet specific criteria. This option allows certain surviving relatives to claim assets without going through formal probate, streamlining the process significantly. The Savannah Georgia Banking Affidavit of Surviving Relative - Intestate Estate is often used in these cases to access funds quickly.

To get an affidavit from a bank, you usually need to visit the bank and provide necessary documentation, including identification and proof of your relationship to the deceased. The bank may have its own forms, but utilizing a Savannah Georgia Banking Affidavit of Surviving Relative - Intestate Estate can facilitate this process. If you need guidance, consider using legal resources like US Legal Forms.

An affidavit is typically prepared by the individual seeking to claim the deceased's assets, often with the help of an attorney. However, many forms can be easily completed by using reputable services like US Legal Forms. They provide the Savannah Georgia Banking Affidavit of Surviving Relative - Intestate Estate template to ensure accuracy and compliance with local laws.

You can obtain an affidavit by preparing the necessary documents according to your situation. A local attorney can guide you through this process, or you may find templates on reliable legal sites like US Legal Forms. Utilizing a Savannah Georgia Banking Affidavit of Surviving Relative - Intestate Estate template can provide a clear path and save you time.

To obtain a bank affidavit, you generally need to complete a form that states your relationship to the deceased and details about the bank account. It’s advisable to consult with an attorney who specializes in estate matters or use platforms like US Legal Forms for assistance. This ensures you correctly fill out a Savannah Georgia Banking Affidavit of Surviving Relative - Intestate Estate, meeting all legal requirements.

When no beneficiary is designated on a bank account and no will exists, the assets typically enter probate. In this scenario, the estate must be handled according to Georgia's intestacy laws. The process can be expedited through a Savannah Georgia Banking Affidavit of Surviving Relative - Intestate Estate, allowing surviving relatives to access funds without lengthy probate.

An affidavit to obtain deceased depositors' bank property serves as a legal document that allows survivors to claim the assets of a deceased individual from their bank. This affidavit is crucial when the deceased did not leave a will or has not named a beneficiary. In Savannah, Georgia, this process commonly utilizes a Savannah Georgia Banking Affidavit of Surviving Relative - Intestate Estate, which simplifies the transfer of assets in accordance with state law.

Filling out an affidavit of Next of Kin involves specifying the decedent's name, date of death, and relationship to you. This document is crucial for legal processes, especially when dealing with matters like the Savannah Georgia Banking Affidavit of Surviving Relative - Intestate Estate. Make sure to provide complete and accurate information to facilitate a smooth procedure.

Writing a next of kin affidavit starts with a clear introduction that identifies you and your relationship to the decedent. Detail the circumstances, and reference the Savannah Georgia Banking Affidavit of Surviving Relative - Intestate Estate. Lastly, conclude with a declaration statement and your signature, emphasizing your sworn truthfulness.