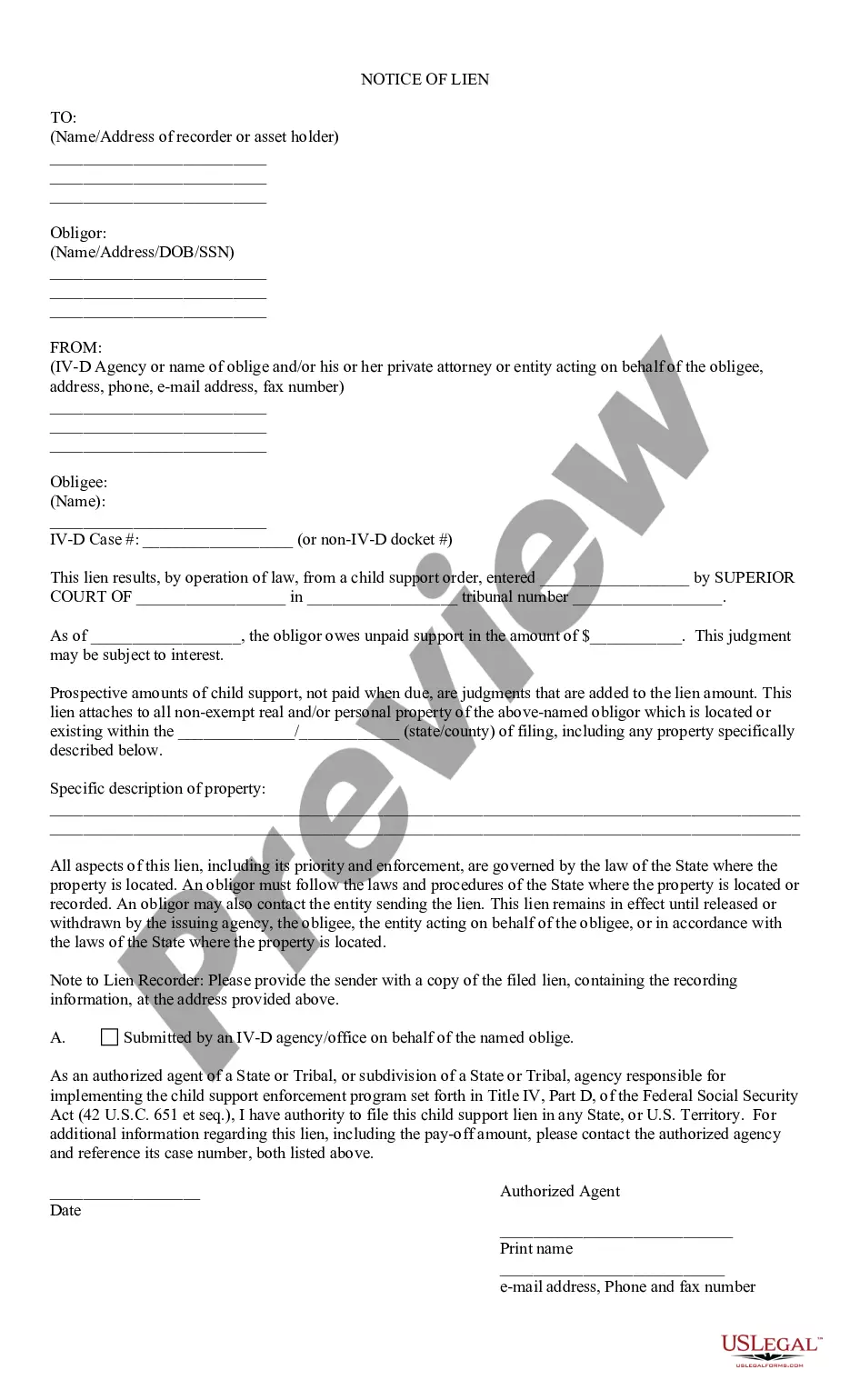

South Fulton Georgia Notice of Lien: A Detailed Description and Types In South Fulton, Georgia, the Notice of Lien is a legal document that plays a significant role in property ownership and financial transactions. This notice provides official notification to property owners about an impending or existing lien placed on their property. Understanding the ins and outs of the South Fulton Georgia Notice of Lien is crucial for homeowners, buyers, lenders, contractors, and anyone else involved in property transactions. Types of South Fulton Georgia Notice of Lien: 1. Mechanic's Lien: A Mechanic's Lien is commonly used in construction projects when contractors, subcontractors, or suppliers seek payment for work done or materials provided. If the property owner fails to pay for these services, the South Fulton Georgia Mechanic's Lien ensures that the contractor can claim a legal interest in the property until the payment dispute is resolved. This type of lien provides protection for those involved in the construction or improvement of properties. 2. Property Tax Lien: When property owners fail to pay their property taxes, the South Fulton Georgia Notice of Lien allows the local government to place a Property Tax Lien on the property. This lien serves as a claim against the property, ensuring that the taxes owed are eventually paid. In the event of non-payment or delinquency, the government may foreclose on the property to collect the outstanding tax debt. 3. Judgment Lien: A Judgment Lien is filed when a person or entity has obtained a court judgment against the property owner for an unpaid debt or legal claim. By recording the South Fulton Georgia Notice of Lien, the judgment creditor secures their right to satisfy the debt by forcing the sale of the property. 4. Association Lien: Has (Homeowners' Associations) or condominium associations may file an Association Lien when homeowners fail to pay their association fees or assessments. This lien protects the association's interest in the property and ensures the collection of outstanding dues. 5. Federal Tax Lien: In cases where a property owner owes back taxes to the Internal Revenue Service (IRS), the South Fulton Georgia Notice of Lien can be filed as a Federal Tax Lien. This lien attaches the debt to the owner's property and notifies other potential creditors of the government's claim. It is crucial for property owners to promptly address any South Fulton Georgia Notice of Lien to avoid severe consequences, such as foreclosure or legal action. Taking immediate action to resolve the underlying issues with payment or disputes is essential for protecting property rights and creditworthiness. If you receive a South Fulton Georgia Notice of Lien, it is advisable to consult with a qualified attorney who specializes in real estate law. They can provide guidance on how to resolve the issue, negotiate with creditors, or contest the validity of the lien if necessary. Understanding the different types of South Fulton Georgia Notice of Lien and their implications is vital for navigating property transactions and ensuring a smooth ownership experience.

South Fulton Georgia Notice of Lien

Description

How to fill out South Fulton Georgia Notice Of Lien?

Make use of the US Legal Forms and obtain immediate access to any form sample you need. Our helpful platform with a large number of documents makes it simple to find and obtain virtually any document sample you want. You can export, fill, and sign the South Fulton Georgia Notice of Lien in a couple of minutes instead of surfing the Net for several hours attempting to find the right template.

Using our catalog is a wonderful strategy to raise the safety of your record submissions. Our professional legal professionals regularly review all the records to make certain that the templates are relevant for a particular state and compliant with new laws and polices.

How do you get the South Fulton Georgia Notice of Lien? If you already have a subscription, just log in to the account. The Download button will be enabled on all the documents you view. Furthermore, you can get all the previously saved records in the My Forms menu.

If you haven’t registered an account yet, stick to the tips listed below:

- Open the page with the template you need. Make sure that it is the form you were hoping to find: verify its headline and description, and make use of the Preview option if it is available. Otherwise, use the Search field to look for the needed one.

- Start the saving procedure. Select Buy Now and select the pricing plan that suits you best. Then, sign up for an account and pay for your order using a credit card or PayPal.

- Export the document. Choose the format to obtain the South Fulton Georgia Notice of Lien and edit and fill, or sign it for your needs.

US Legal Forms is among the most extensive and trustworthy document libraries on the internet. We are always ready to assist you in any legal procedure, even if it is just downloading the South Fulton Georgia Notice of Lien.

Feel free to take advantage of our platform and make your document experience as efficient as possible!