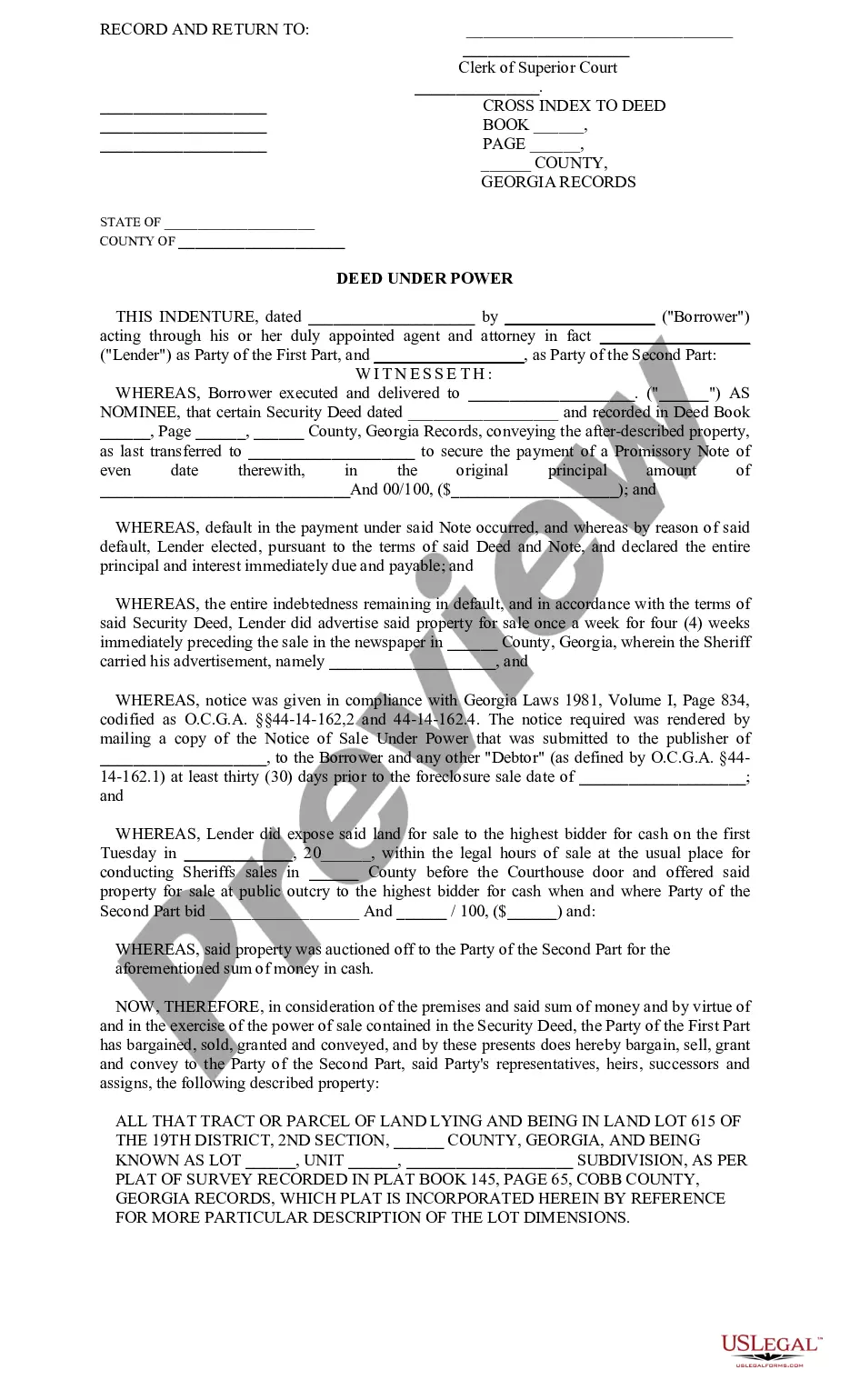

Savannah Georgia Deed Under Power — A Comprehensive Overview In Savannah, Georgia, a "Deed Under Power" refers to a legal instrument used during the foreclosure process whereby a lender initiates non-judicial foreclosure proceedings against a borrower who has defaulted on their mortgage loan. This process is governed by the Georgia law, specifically the Official Code of Georgia Annotated (O.C.G.A.) §44-14-162, commonly known as the Georgia Power of Sale Foreclosure Act. When a borrower signs a mortgage or deed of trust to finance a property in Savannah, they agree to grant the lender a security interest in the property. This security interest is known as a "Deed to Secure Debt" or "Security Deed." In the event of a default, the lender has the power to sell the property and recover the loan amount through a non-judicial foreclosure process using the Deed Under Power. The Deed Under Power provides the lender with the legal authority to sell the property at a foreclosure auction without needing to involve the court. This type of foreclosure is considered faster and less costly than a judicial foreclosure, which involves court proceedings. The specific steps involved in a Savannah Georgia Deed Under Power foreclosure typically include: 1. Notice of Default: After the borrower defaults on their loan payments, the lender must issue a written Notice of Default, informing the borrower of their intention to initiate foreclosure proceedings. This notice must be sent via certified mail and posted on the property. 2. Advertisement: The lender is required to advertise the foreclosure sale in a local newspaper for four consecutive weeks before the auction date. The advertisement provides information about the property, terms of sale, and the auction date. 3. Foreclosure Sale: The auction typically takes place on the county courthouse steps, conducted by a trustee appointed by the lender or by the lender themselves. The property is sold to the highest bidder, generally subject to confirmation by the court. 4. Redemption Period: In some cases, Georgia law allows a redemption period during which the borrower has the right to reclaim the property by paying the outstanding debt, interest, and associated costs within a specified timeframe. It is important to note that there are different types of Savannah Georgia Deeds Under Power. Some may include: 1. Residential Deed Under Power: This type of deed refers to foreclosures on residential properties such as single-family homes, townhouses, or condominiums. 2. Commercial Deed Under Power: Commercial properties, such as office buildings, retail spaces, or industrial facilities, may also be subject to foreclosure through a Deed Under Power. 3. Land Deed Under Power: Vacant land, undeveloped lots, or agricultural properties can also be foreclosed upon using a Deed Under Power, providing the land serves as collateral for the loan. In conclusion, a Savannah Georgia Deed Under Power is a legal instrument utilized in the foreclosure process, granting the lender the authority to sell the property securing the loan. This process is governed by Georgia's Power of Sale Foreclosure Act and is a non-judicial alternative to court-based foreclosures. Understanding the intricacies of the Deed Under Power is crucial for borrowers and lenders involved in mortgage transactions in Savannah, Georgia.

Savannah Georgia Deed Under Power

Description

How to fill out Savannah Georgia Deed Under Power?

Do you need a trustworthy and inexpensive legal forms supplier to buy the Savannah Georgia Deed Under Power? US Legal Forms is your go-to option.

Whether you need a basic agreement to set regulations for cohabitating with your partner or a package of forms to move your separation or divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and frameworked based on the requirements of specific state and county.

To download the form, you need to log in account, locate the required form, and hit the Download button next to it. Please remember that you can download your previously purchased form templates at any time from the My Forms tab.

Is the first time you visit our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Savannah Georgia Deed Under Power conforms to the regulations of your state and local area.

- Read the form’s description (if provided) to learn who and what the form is good for.

- Start the search over in case the form isn’t suitable for your legal scenario.

Now you can create your account. Then select the subscription option and proceed to payment. Once the payment is done, download the Savannah Georgia Deed Under Power in any provided file format. You can get back to the website when you need and redownload the form without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about wasting hours researching legal papers online once and for all.