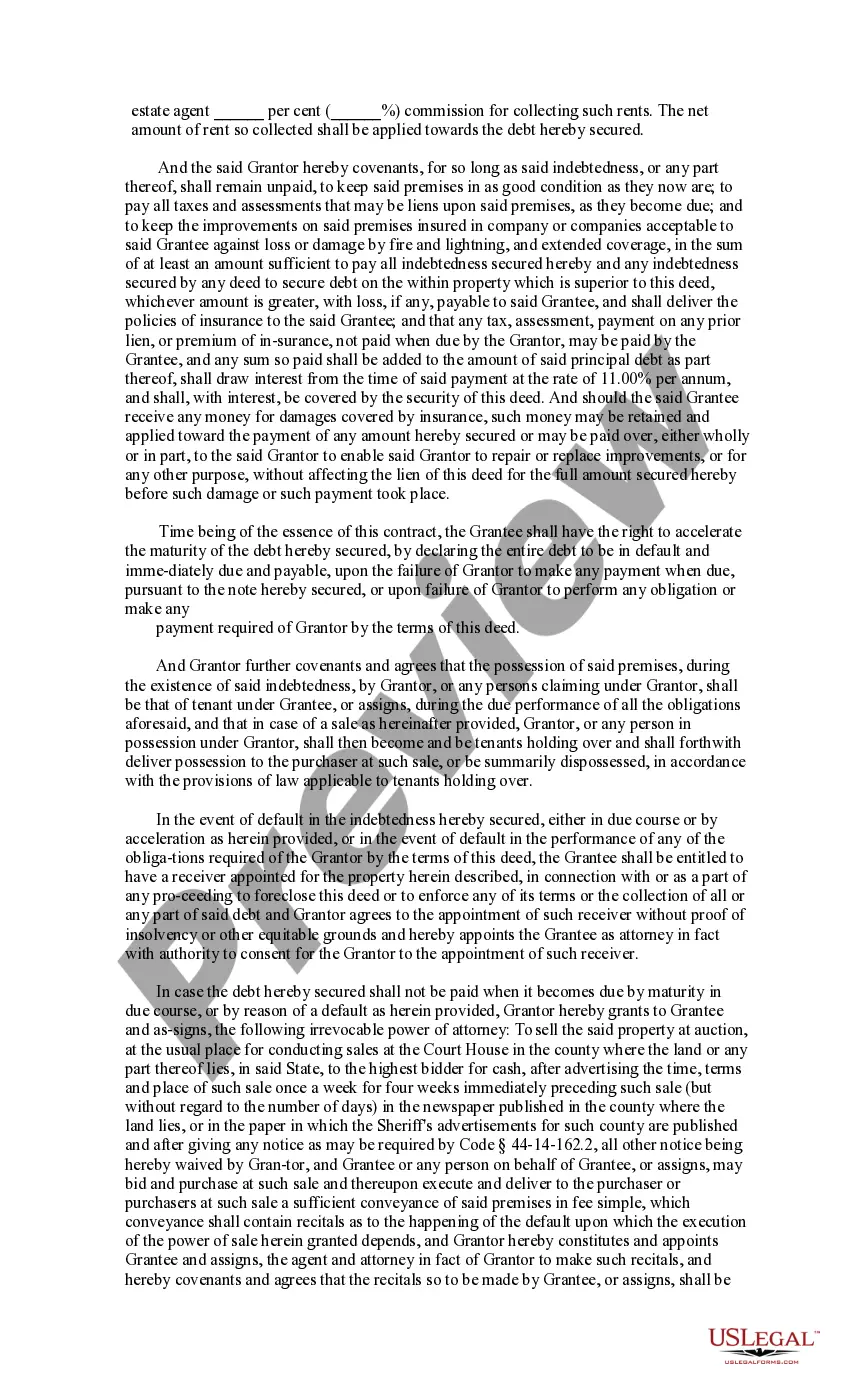

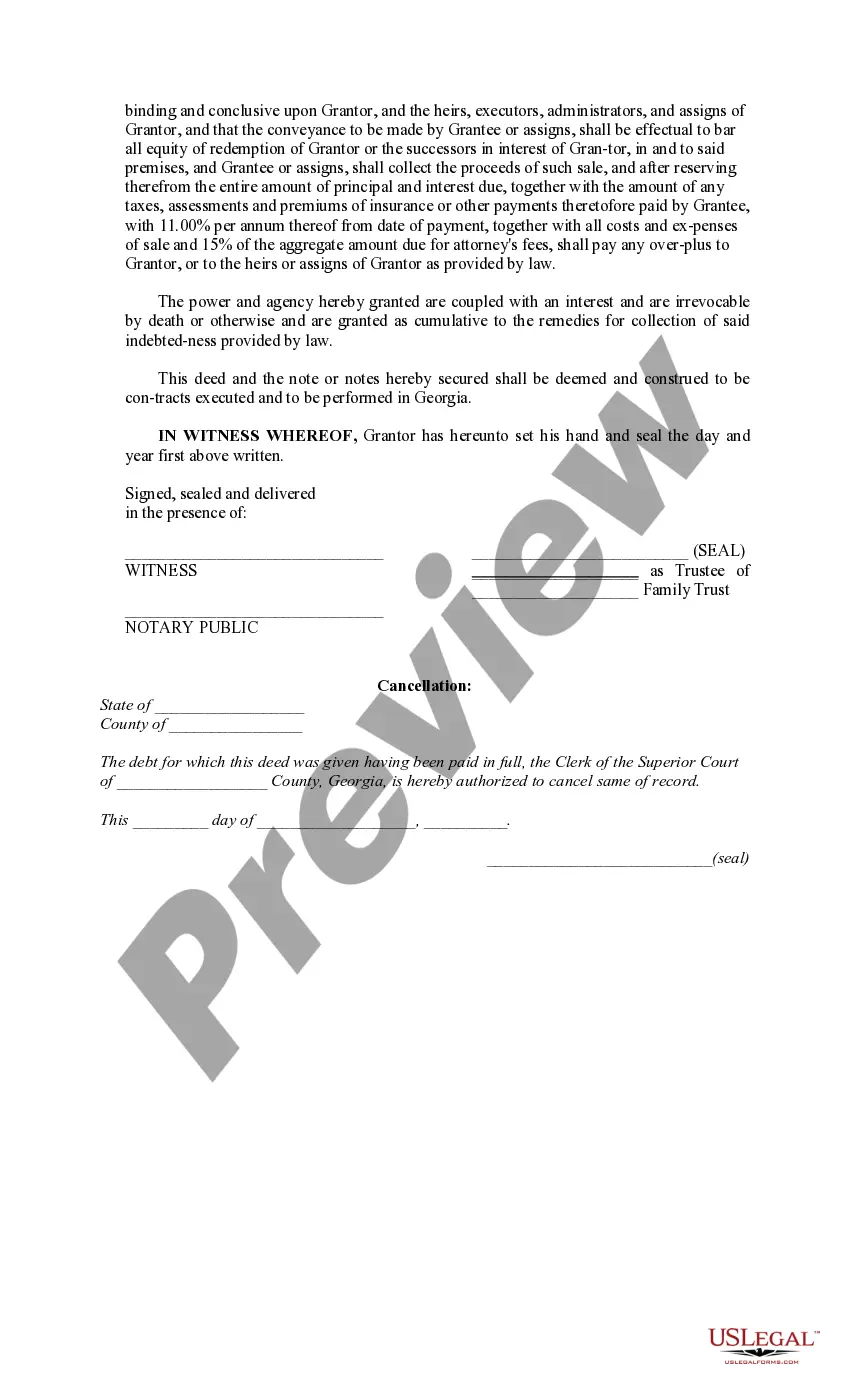

Atlanta Georgia Deed to Secure Debt is a legal document used in Atlanta, Georgia, to provide security for a loan or debt. It is a type of mortgage instrument that allows the lender to have a claim on the property if the borrower fails to repay the debt. The Atlanta Georgia Deed to Secure Debt is a critical component of the real estate industry in Atlanta. It provides protection and assurance for lenders, making it easier for borrowers to obtain loans and access financing options for purchasing properties or managing existing debts. There are different types of Atlanta Georgia Deed to Secure Debt, including: 1. General Warranty Deed: This type of deed offers the highest level of protection for lenders as it guarantees that the borrower holds clear and marketable title to the property. 2. Limited Warranty Deed: This deed also assures the lender that the borrower holds clear title to the property but only during the time the borrower owned it. Any previous encumbrances or defects in title are not covered. 3. Quitclaim Deed: This deed transfers the borrower's interest in the property to the lender but does not guarantee clear title or the absence of any existing liens or encumbrances. 4. Security Deed: The Security Deed in Atlanta Georgia is the most common type used. It grants the lender a security interest in the property, allowing them to foreclose and sell the property if the borrower defaults on the loan. Atlanta Georgia Deed to Secure Debt is a legal protection for lenders, offering them a sense of security when providing loans. It is crucial for borrowers to understand and comply with the terms of the deed to avoid potential foreclosure or legal complications. Professional legal advice is recommended for both lenders and borrowers involved in Atlanta Georgia Deed to Secure Debt transactions. In conclusion, Atlanta Georgia Deed to Secure Debt is a vital legal instrument in Atlanta's real estate industry. It ensures the protection of lenders and allows borrowers to access financing options for their properties. By understanding the various types of deeds available and seeking legal guidance, both lenders and borrowers can navigate this process with confidence.

Atlanta Georgia Deed to Secure Debt

Description

How to fill out Atlanta Georgia Deed To Secure Debt?

No matter the social or professional status, filling out law-related forms is an unfortunate necessity in today’s professional environment. Very often, it’s virtually impossible for someone without any law education to create this sort of papers from scratch, mainly because of the convoluted terminology and legal nuances they entail. This is where US Legal Forms can save the day. Our service provides a massive library with more than 85,000 ready-to-use state-specific forms that work for practically any legal scenario. US Legal Forms also is an excellent resource for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

No matter if you want the Atlanta Georgia Deed to Secure Debt or any other paperwork that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the Atlanta Georgia Deed to Secure Debt in minutes using our trustworthy service. If you are presently an existing customer, you can proceed to log in to your account to download the needed form.

However, in case you are unfamiliar with our library, ensure that you follow these steps before obtaining the Atlanta Georgia Deed to Secure Debt:

- Ensure the template you have found is specific to your location considering that the regulations of one state or area do not work for another state or area.

- Preview the document and go through a brief description (if available) of scenarios the document can be used for.

- In case the form you chosen doesn’t meet your requirements, you can start over and search for the necessary document.

- Click Buy now and pick the subscription plan that suits you the best.

- utilizing your credentials or register for one from scratch.

- Select the payment gateway and proceed to download the Atlanta Georgia Deed to Secure Debt as soon as the payment is done.

You’re good to go! Now you can proceed to print out the document or complete it online. Should you have any problems locating your purchased forms, you can easily find them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.