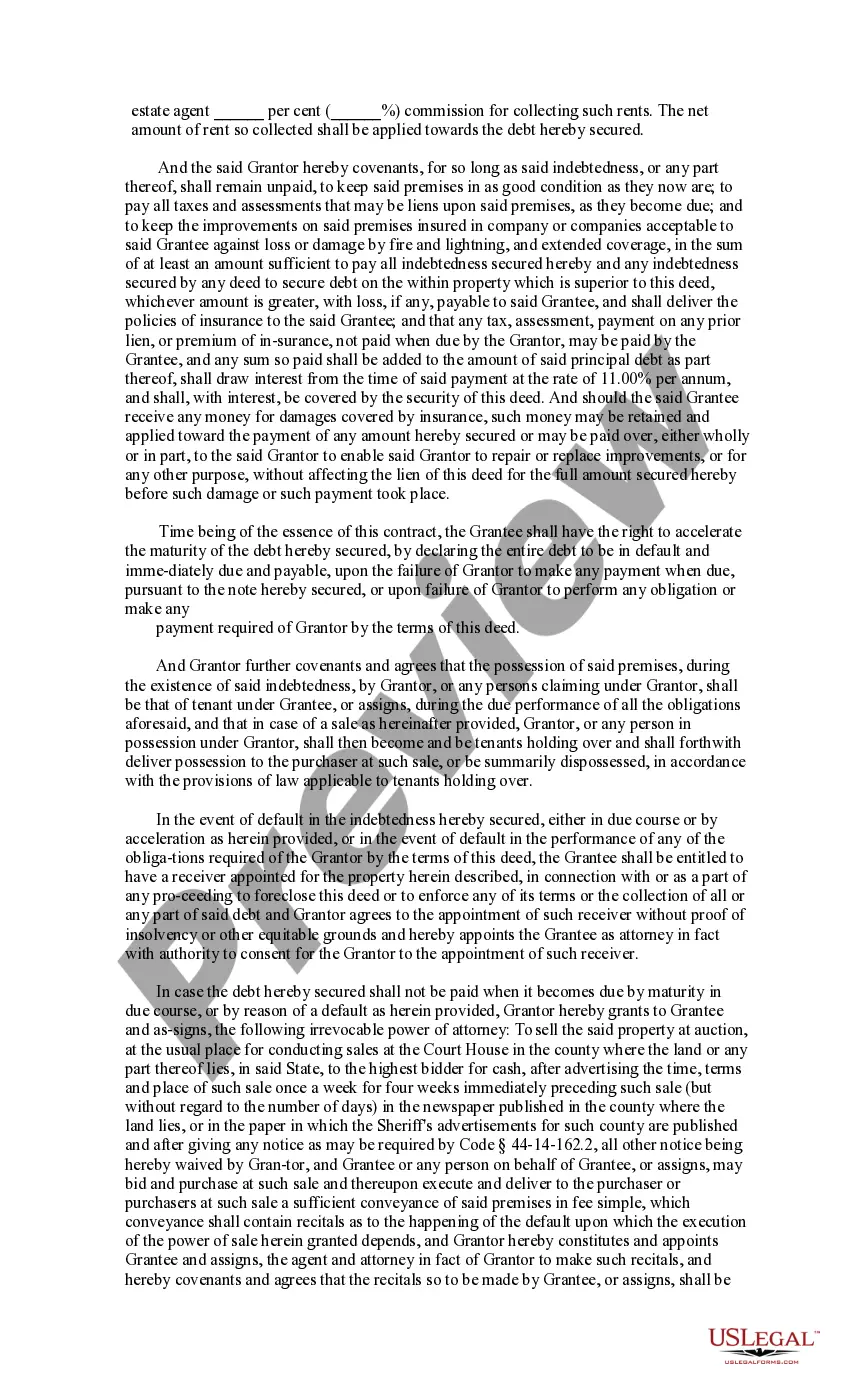

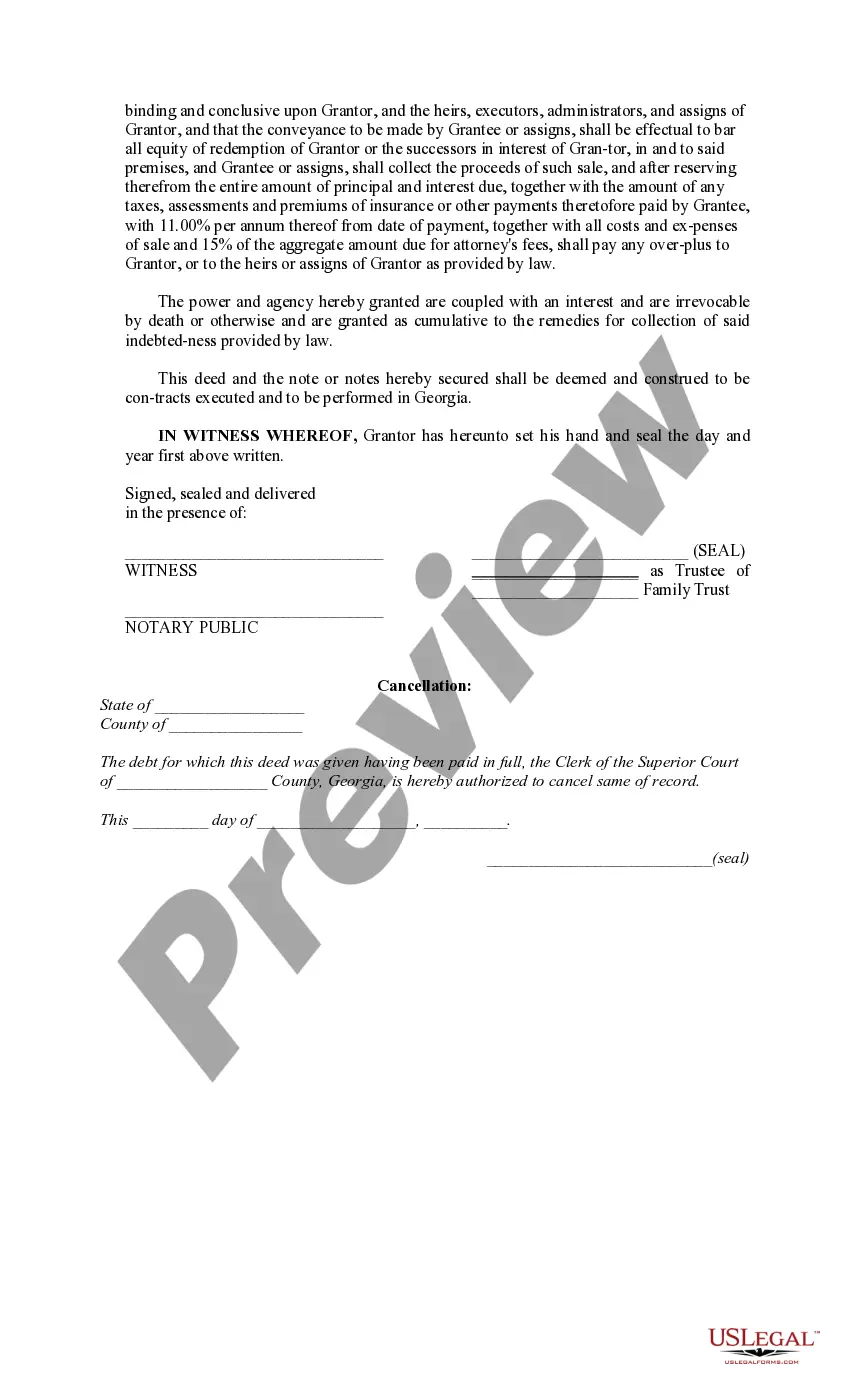

Fulton Georgia Deed to Secure Debt is a legal document used in Fulton County, Georgia that establishes a lien against a property as collateral for a debt. The purpose of this deed is to provide security to the lender in case the borrower defaults on the loan. It is commonly used in real estate transactions, such as when purchasing a home or securing a mortgage. This type of deed is governed by Georgia state laws and must meet specific requirements to be considered valid and enforceable. The Fulton Georgia Deed to Secure Debt outlines the terms and conditions of the loan, including the principal amount, interest rate, repayment schedule, and any additional fees or charges. There are different types of Fulton Georgia Deed to Secure Debt, including: 1. First Deed to Secure Debt: This is the most common type of deed used in Fulton County. It is considered the primary lien against the property and takes precedence over any subsequent liens or encumbrances. 2. Second Deed to Secure Debt: In some cases, multiple loans may be taken out on a property. A second deed is used when there is already an existing first lien on the property. The second lien holder's rights and priorities are subordinate to the first lien holder. 3. Open-Ended Deed to Secure Debt: This type of deed allows for additional borrowing against the property without creating a new deed. It provides flexibility for the borrower to take out future loans under the same security. 4. Wrap-Around Deed to Secure Debt: This involves a new loan that incorporates the existing debt on the property. The new lender assumes the responsibility of paying the original loan while receiving payments from the borrower. When a borrower fails to meet the terms of the loan, such as non-payment or default, the lender may initiate foreclosure proceedings. The Fulton Georgia Deed to Secure Debt allows the lender to sell the property through a foreclosure sale to recover the outstanding debt. In conclusion, the Fulton Georgia Deed to Secure Debt is an essential legal document used in real estate transactions to secure a loan against a property in Fulton County. Understanding the different types of deeds can help both borrowers and lenders navigate the complexities of property financing.

Fulton Georgia Deed to Secure Debt is a legal document used in Fulton County, Georgia that establishes a lien against a property as collateral for a debt. The purpose of this deed is to provide security to the lender in case the borrower defaults on the loan. It is commonly used in real estate transactions, such as when purchasing a home or securing a mortgage. This type of deed is governed by Georgia state laws and must meet specific requirements to be considered valid and enforceable. The Fulton Georgia Deed to Secure Debt outlines the terms and conditions of the loan, including the principal amount, interest rate, repayment schedule, and any additional fees or charges. There are different types of Fulton Georgia Deed to Secure Debt, including: 1. First Deed to Secure Debt: This is the most common type of deed used in Fulton County. It is considered the primary lien against the property and takes precedence over any subsequent liens or encumbrances. 2. Second Deed to Secure Debt: In some cases, multiple loans may be taken out on a property. A second deed is used when there is already an existing first lien on the property. The second lien holder's rights and priorities are subordinate to the first lien holder. 3. Open-Ended Deed to Secure Debt: This type of deed allows for additional borrowing against the property without creating a new deed. It provides flexibility for the borrower to take out future loans under the same security. 4. Wrap-Around Deed to Secure Debt: This involves a new loan that incorporates the existing debt on the property. The new lender assumes the responsibility of paying the original loan while receiving payments from the borrower. When a borrower fails to meet the terms of the loan, such as non-payment or default, the lender may initiate foreclosure proceedings. The Fulton Georgia Deed to Secure Debt allows the lender to sell the property through a foreclosure sale to recover the outstanding debt. In conclusion, the Fulton Georgia Deed to Secure Debt is an essential legal document used in real estate transactions to secure a loan against a property in Fulton County. Understanding the different types of deeds can help both borrowers and lenders navigate the complexities of property financing.