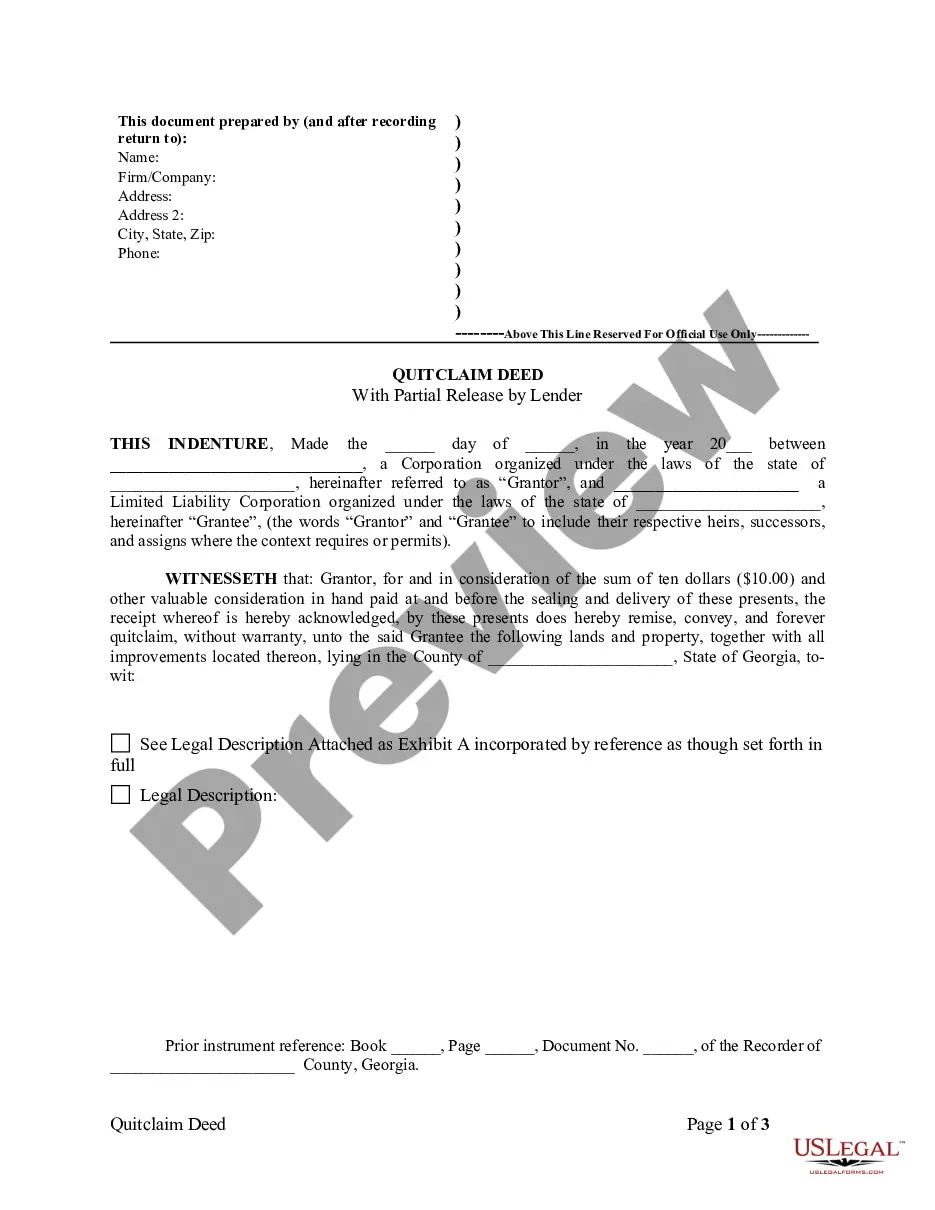

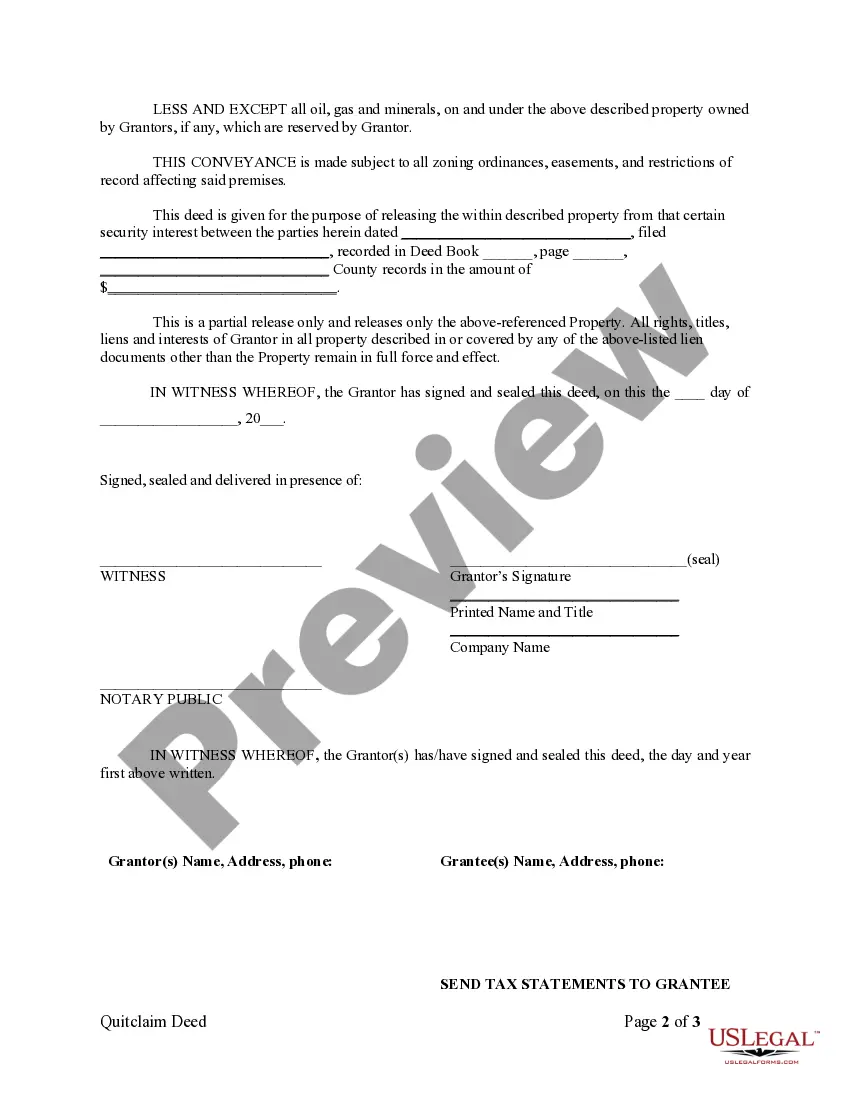

Fulton Georgia Quitclaim Deed with Partial Release by Lender is a legal document that transfers a property in Fulton County, Georgia, from one party to another, specifically involving a lender. This type of quitclaim deed is often used in situations where a lender wants to release its interest in a property while maintaining certain rights or restrictions. In this case, the lender retains a partial release on the property, meaning they relinquish some of their interests in the property but still hold certain claims or restrictions. These partial releases can vary depending on the agreement between the lender and the borrower. There are several types of Fulton Georgia Quitclaim Deed with Partial Release by Lender: 1. Partial Release of Lien: This type of quitclaim deed allows the lender to release a specific lien or encumbrance on the property. It might involve releasing a mortgage lien on a specific portion of the property or a particular type of lien like a tax lien. 2. Partial Release of Restrictions: This variant of the quitclaim deed enables the lender to release certain restrictions imposed on the property. These restrictions may include limitations on land use, building restrictions, or easements. The lender can choose to release some or all of these restrictions while maintaining others. 3. Partial Release of Equity: In this case, the lender partially releases its claim on the equity of the property. The borrower may have built up some equity over time, and the lender agrees to release a portion of their interest, allowing the borrower to have a share in the property's value. 4. Partial Release of Title: This type of quitclaim deed with partial release involves the lender relinquishing a specific portion of their title interest in the property. It could be a fractional interest or a specific part of the property such as an unused lot or acreage. It's important to note that the specific terms and conditions of a Fulton Georgia Quitclaim Deed with Partial Release by Lender may vary depending on the agreement between the parties involved. Furthermore, it is recommended to consult with a legal professional to ensure all necessary provisions and requirements are properly addressed in the deed.

Fulton Georgia Quitclaim Deed with Partial Release by Lender

Description

How to fill out Fulton Georgia Quitclaim Deed With Partial Release By Lender?

If you are searching for a valid form, it’s difficult to find a better service than the US Legal Forms site – one of the most extensive online libraries. Here you can find a huge number of form samples for company and individual purposes by categories and regions, or keywords. With the high-quality search function, discovering the latest Fulton Georgia Quitclaim Deed with Partial Release by Lender is as easy as 1-2-3. Additionally, the relevance of each and every record is confirmed by a group of skilled lawyers that regularly check the templates on our platform and revise them in accordance with the most recent state and county laws.

If you already know about our system and have a registered account, all you should do to get the Fulton Georgia Quitclaim Deed with Partial Release by Lender is to log in to your user profile and click the Download button.

If you utilize US Legal Forms for the first time, just refer to the instructions below:

- Make sure you have opened the sample you need. Look at its information and utilize the Preview feature to see its content. If it doesn’t meet your needs, utilize the Search field at the top of the screen to get the appropriate document.

- Confirm your selection. Click the Buy now button. Next, pick the preferred subscription plan and provide credentials to sign up for an account.

- Make the financial transaction. Utilize your credit card or PayPal account to complete the registration procedure.

- Receive the template. Pick the file format and download it on your device.

- Make changes. Fill out, edit, print, and sign the acquired Fulton Georgia Quitclaim Deed with Partial Release by Lender.

Each template you add to your user profile does not have an expiration date and is yours permanently. You always have the ability to access them using the My Forms menu, so if you need to receive an extra duplicate for editing or printing, you may come back and save it again at any time.

Take advantage of the US Legal Forms professional library to gain access to the Fulton Georgia Quitclaim Deed with Partial Release by Lender you were looking for and a huge number of other professional and state-specific samples on a single website!