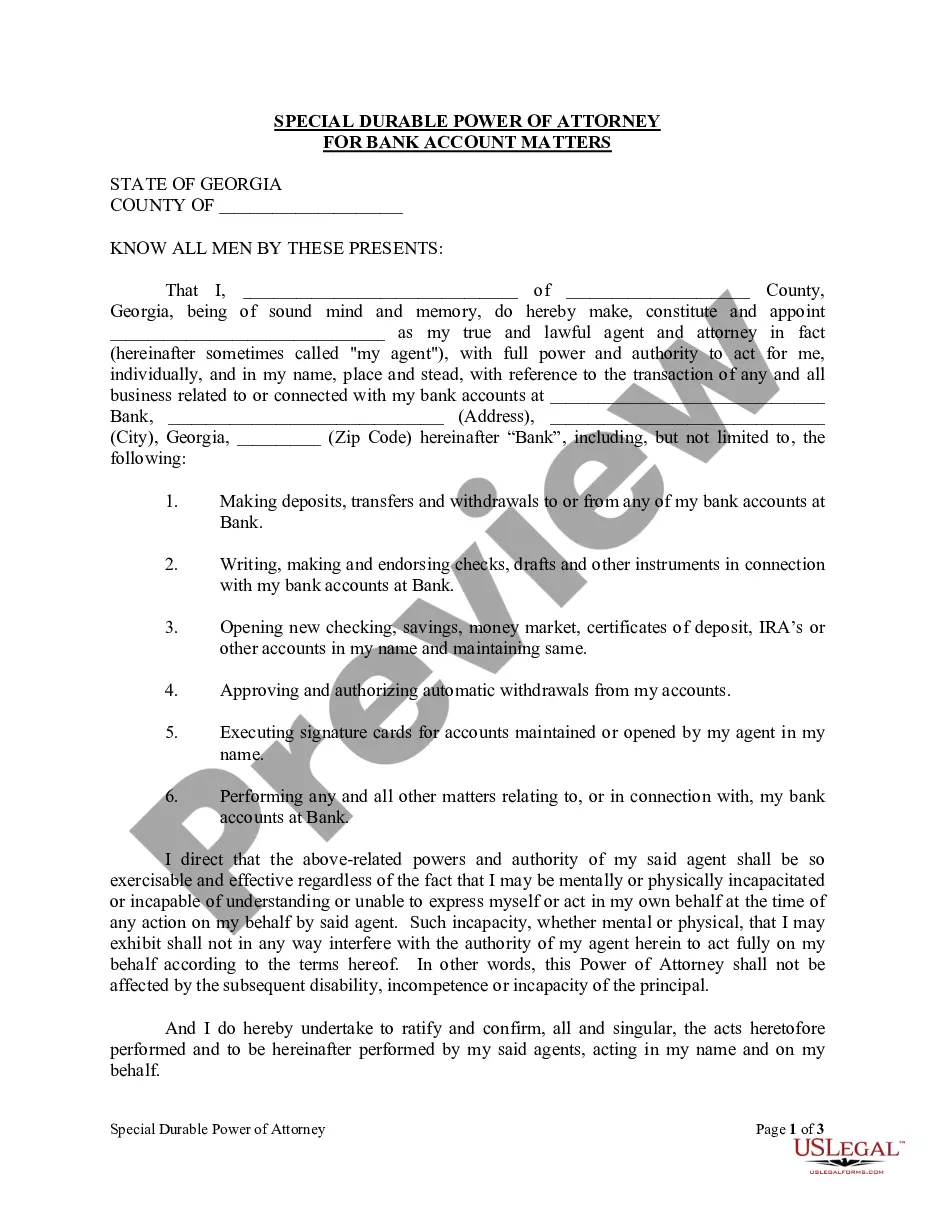

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

Savannah Georgia Special Durable Power of Attorney for Bank Account Matters

Description

How to fill out Georgia Special Durable Power Of Attorney For Bank Account Matters?

We consistently aim to reduce or avert legal harm when addressing subtle legal or financial issues.

To achieve this, we seek legal remedies that are often very expensive.

Nonetheless, not all legal challenges are equally intricate.

Many of them can be handled by ourselves.

Make use of US Legal Forms whenever you require to obtain and download the Savannah Georgia Special Durable Power of Attorney for Bank Account Matters or any other document conveniently and securely.

- US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our platform empowers you to manage your affairs independently without employing an attorney's services.

- We offer access to legal template documents that aren't always readily available.

- Our templates are specific to states and regions, which greatly simplifies the search process.

Form popularity

FAQ

One of the key disadvantages of a durable power of attorney is that it can lead to misuse or abuse if the agent acts dishonestly. Additionally, you may feel a loss of control, as you grant significant power to another individual regarding your bank account matters. It's also important to note that this document remains effective even if you become incapacitated, which can lead to complications if your situation changes. Understanding these factors helps ensure that a Savannah Georgia Special Durable Power of Attorney for Bank Account Matters serves your needs properly.

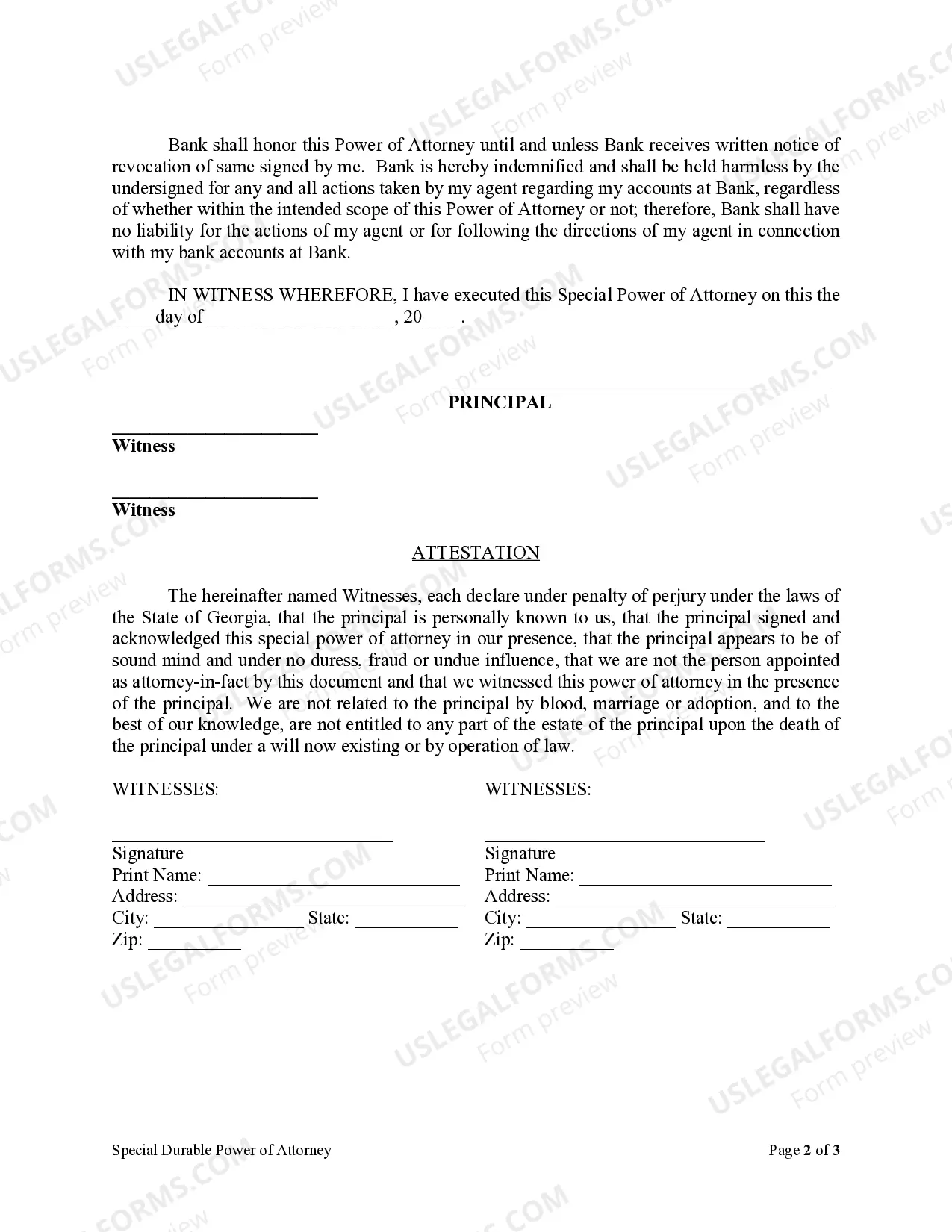

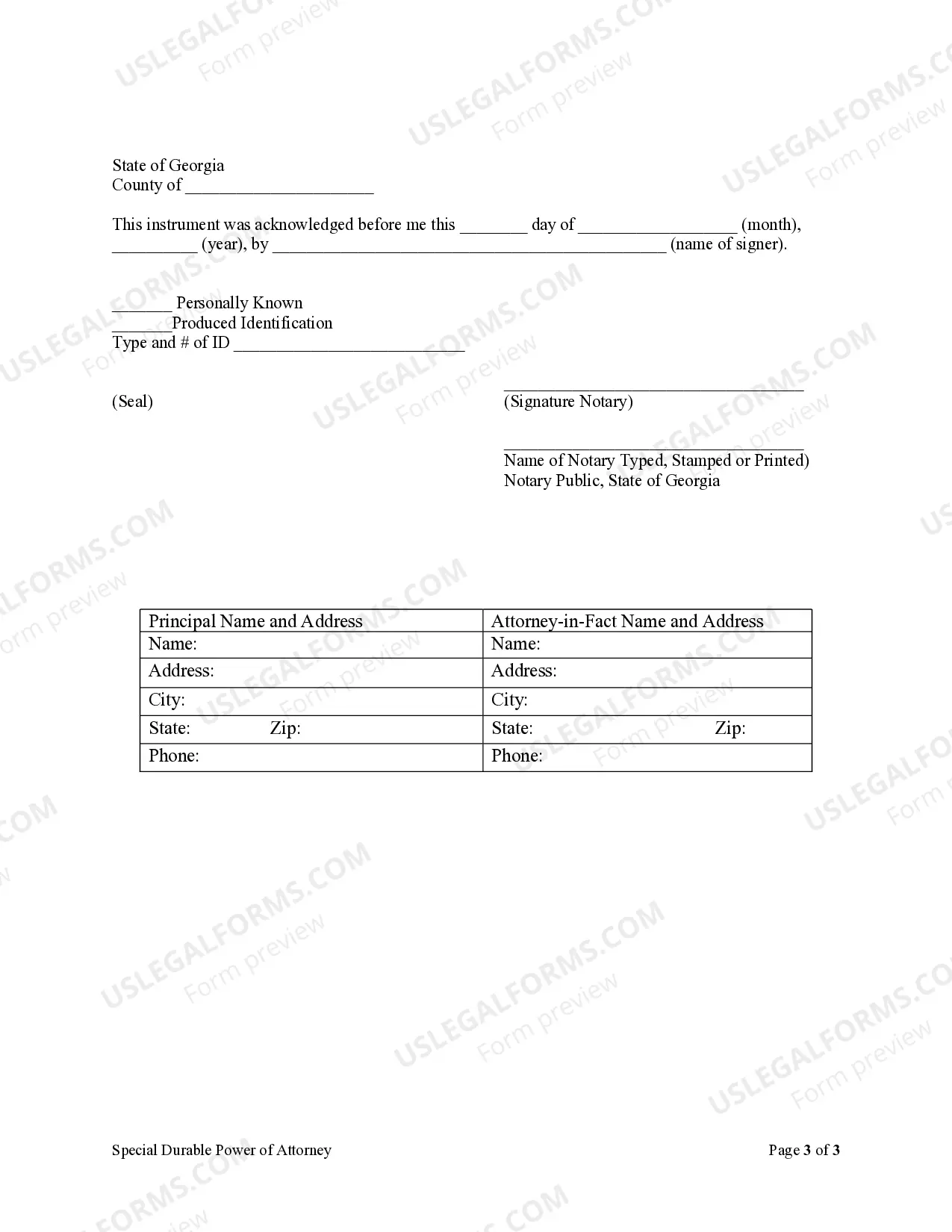

To obtain a durable power of attorney in Georgia, you need to create a document that clearly states your intentions. This document must identify the agent who will act on your behalf regarding your bank account matters. It's crucial to have the document signed in the presence of a notary public and, if desired, witnesses. For ease and compliance, you may consider using USLegalForms, which provides templates specifically for Savannah Georgia Special Durable Power of Attorney for Bank Account Matters.

Banks are often very attentive to the details of a Savannah Georgia Special Durable Power of Attorney for Bank Account Matters due to the potential for fraud. They want to ensure that the document is legitimate and that the agent has clear authority. Therefore, it is important to follow bank-specific guidelines closely to avoid denial.

Yes, there are some disadvantages to having a Savannah Georgia Special Durable Power of Attorney. One concern is the potential for misuse of power, which can lead to financial issues. Additionally, it may create complications if the principal's wishes are not clearly outlined or understood.

To write a power of attorney letter for a bank, start by clearly stating your intentions and identifying both the principal and the agent. Specify the powers granted related to bank account matters. Utilizing a template from a reliable service like uslegalforms can streamline the process, ensuring all necessary details are included.

Banks may deny a Savannah Georgia Special Durable Power of Attorney for various reasons. Common issues include incomplete documentation, unclear authority, or lack of proper signatures. It’s crucial to ensure that all forms are filled out correctly and comply with the bank’s requirements to avoid any potential issues.

Yes, many banks do accept copies of the Savannah Georgia Special Durable Power of Attorney for Bank Account Matters. However, it is essential to check with the specific bank, as some may require an original document. Providing a clear, signed copy can help ensure the bank processes your request smoothly.

Yes, most banks will honor a Savannah Georgia Special Durable Power of Attorney for Bank Account Matters, provided it is compliant with state law. It is essential to present the document to bank officials and ensure that it meets their specific requirements. Make sure to discuss any needed provisions in advance to guarantee smooth transactions.

Serving as a power of attorney involves significant responsibility and can lead to potential liability if financial decisions do not align with the best interests of the person you represent. Additionally, being a power of attorney often requires diligent record-keeping and the need to navigate complex financial matters. Consider using resources like USLegalForms to simplify the setup of a Savannah Georgia Special Durable Power of Attorney for Bank Account Matters.

In Georgia, a Power of Attorney does not need to be filed with the court to be effective. However, it is advisable to provide copies to banks and financial institutions to facilitate transactions. The Savannah Georgia Special Durable Power of Attorney for Bank Account Matters typically remains valid as long as it is executed correctly and in accordance with state laws.