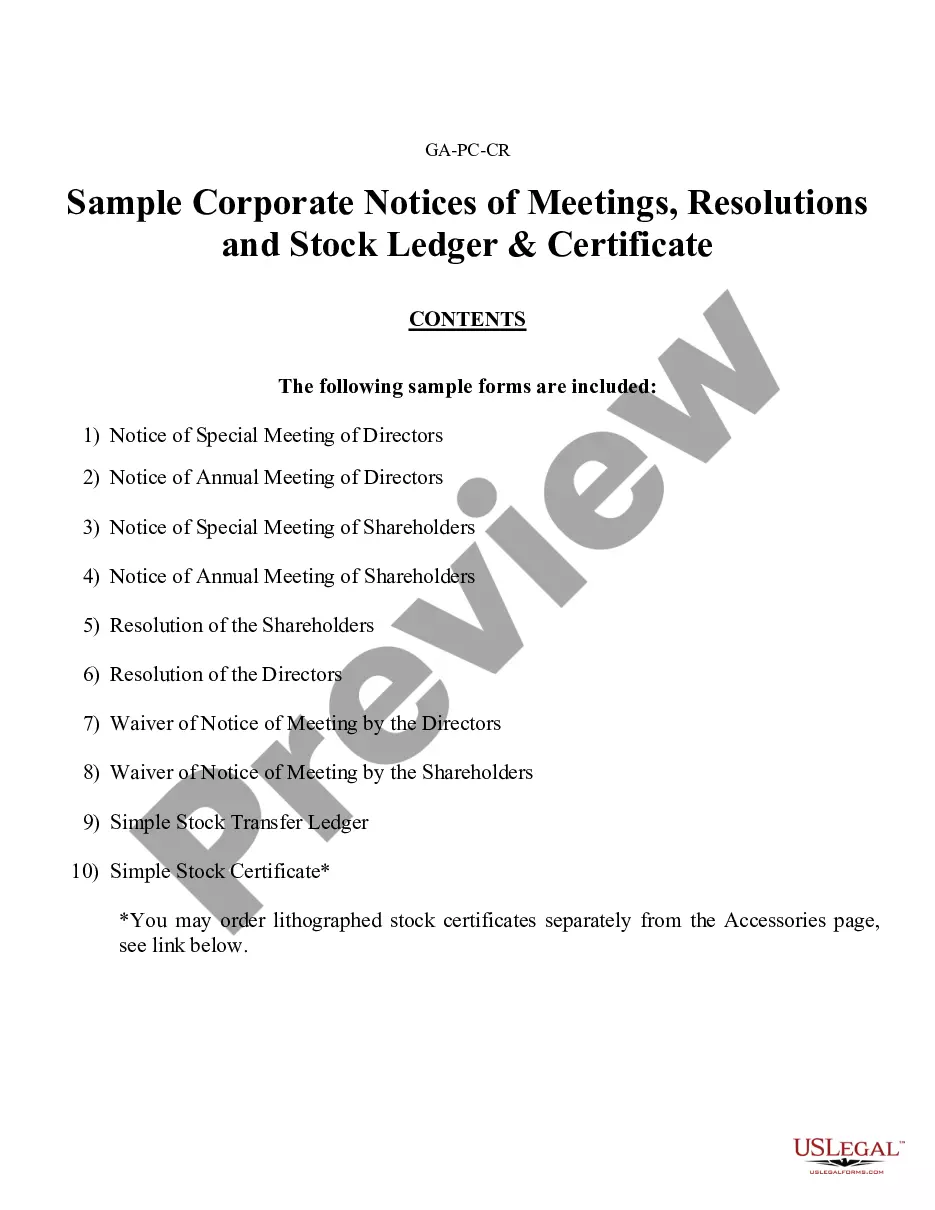

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

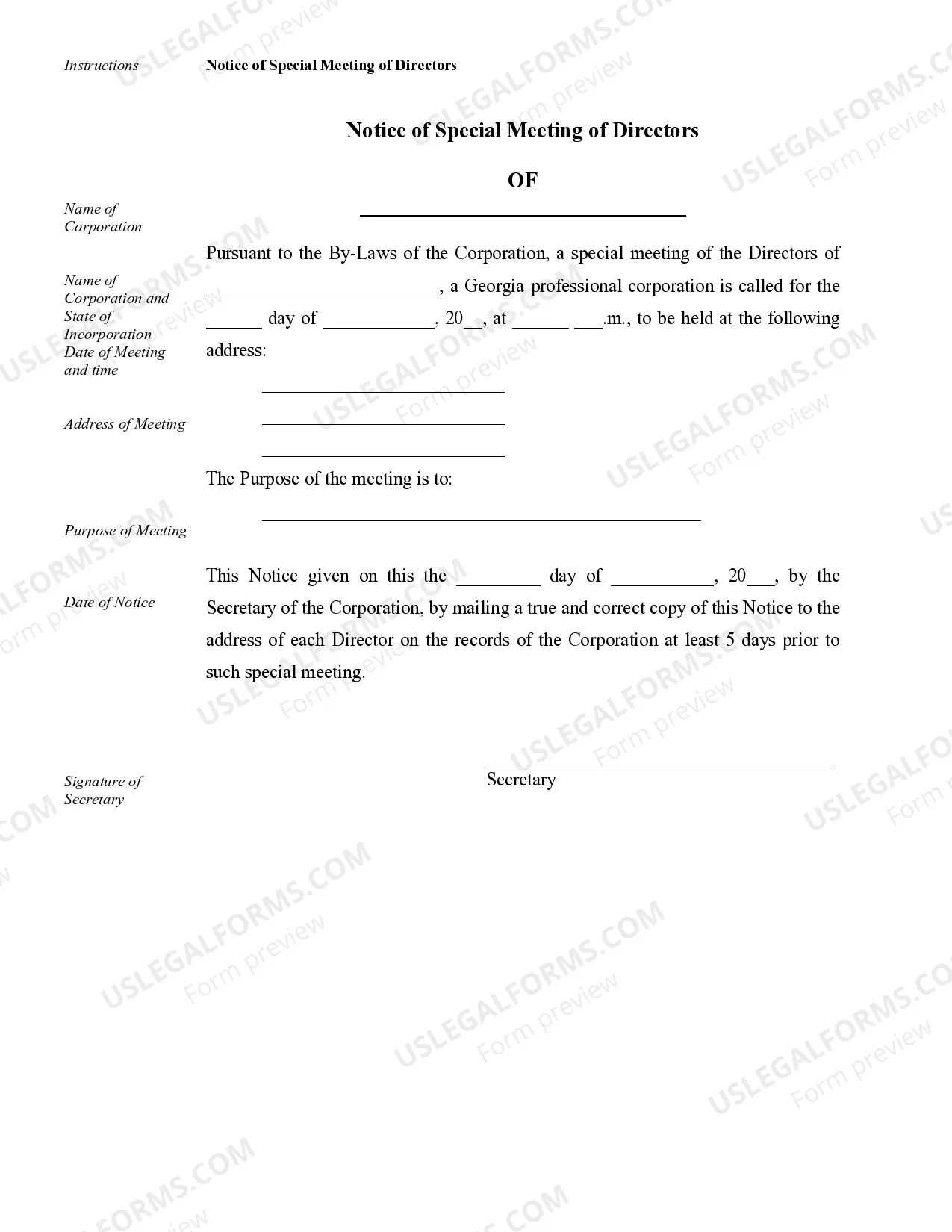

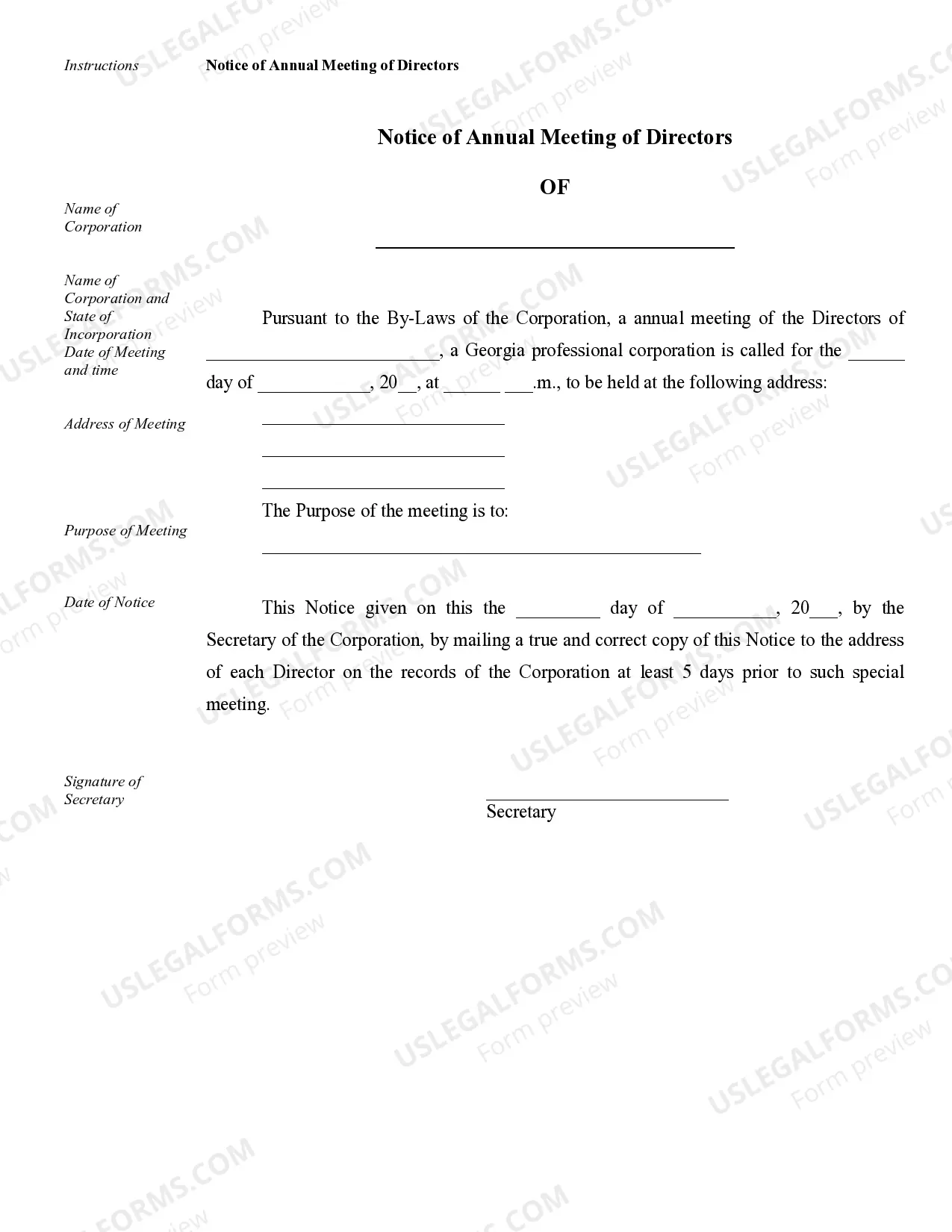

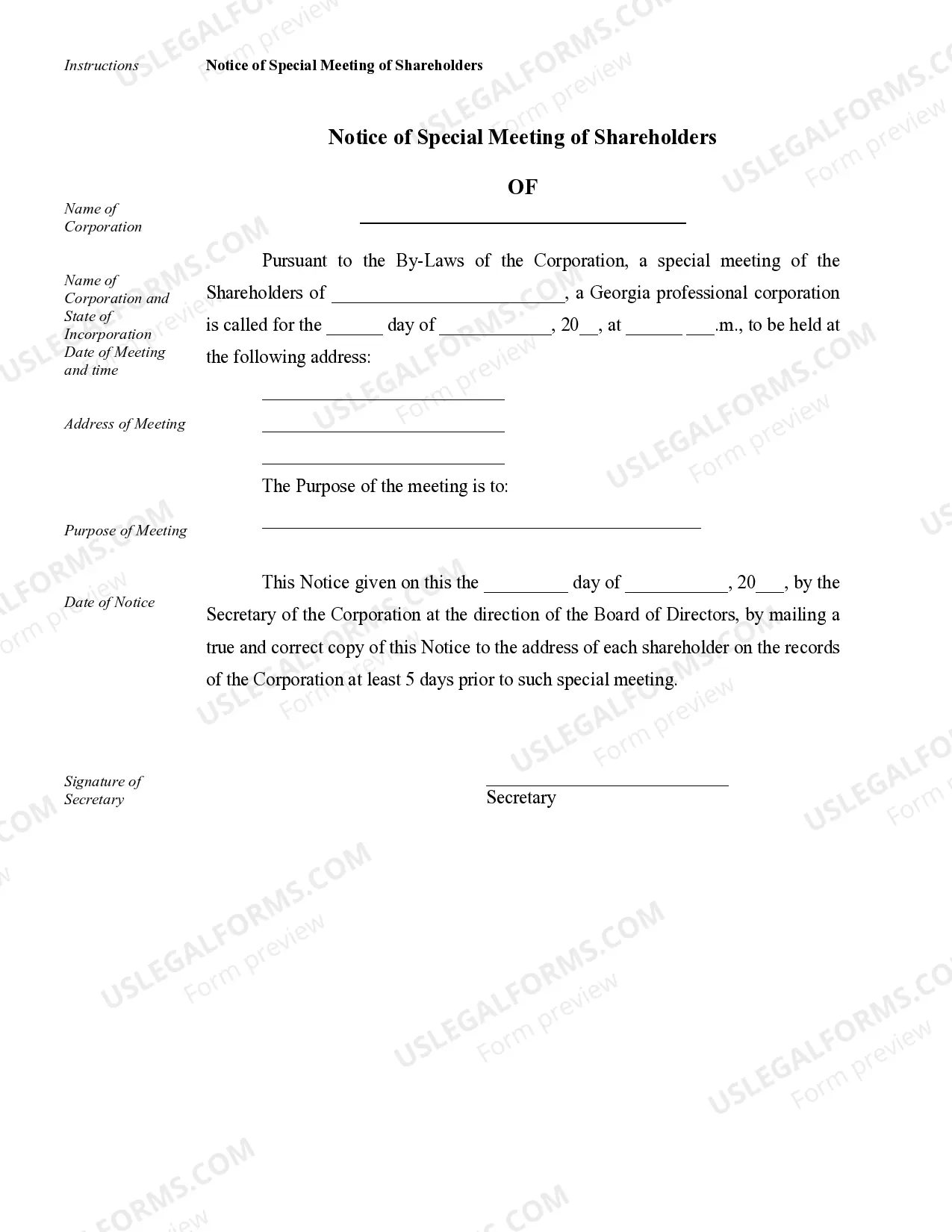

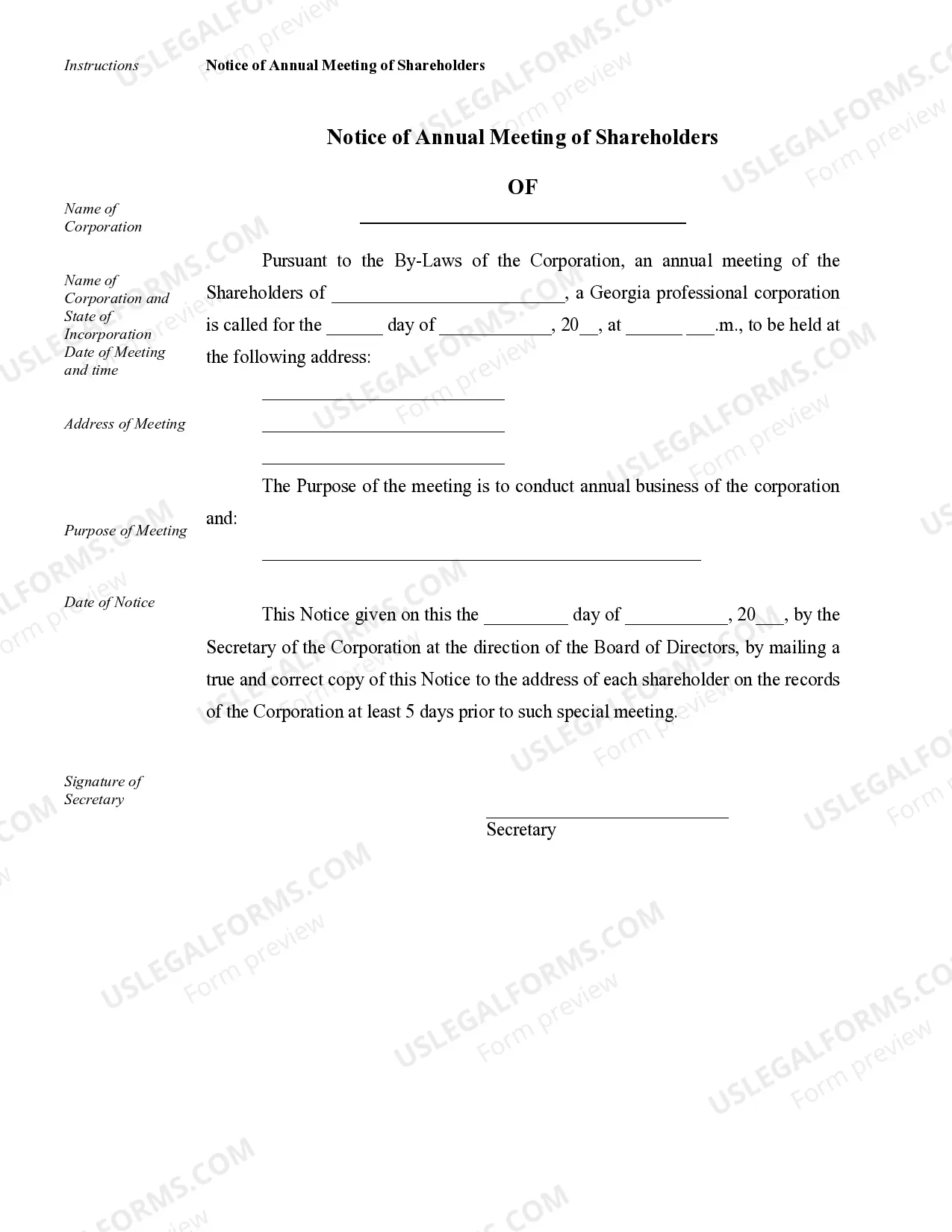

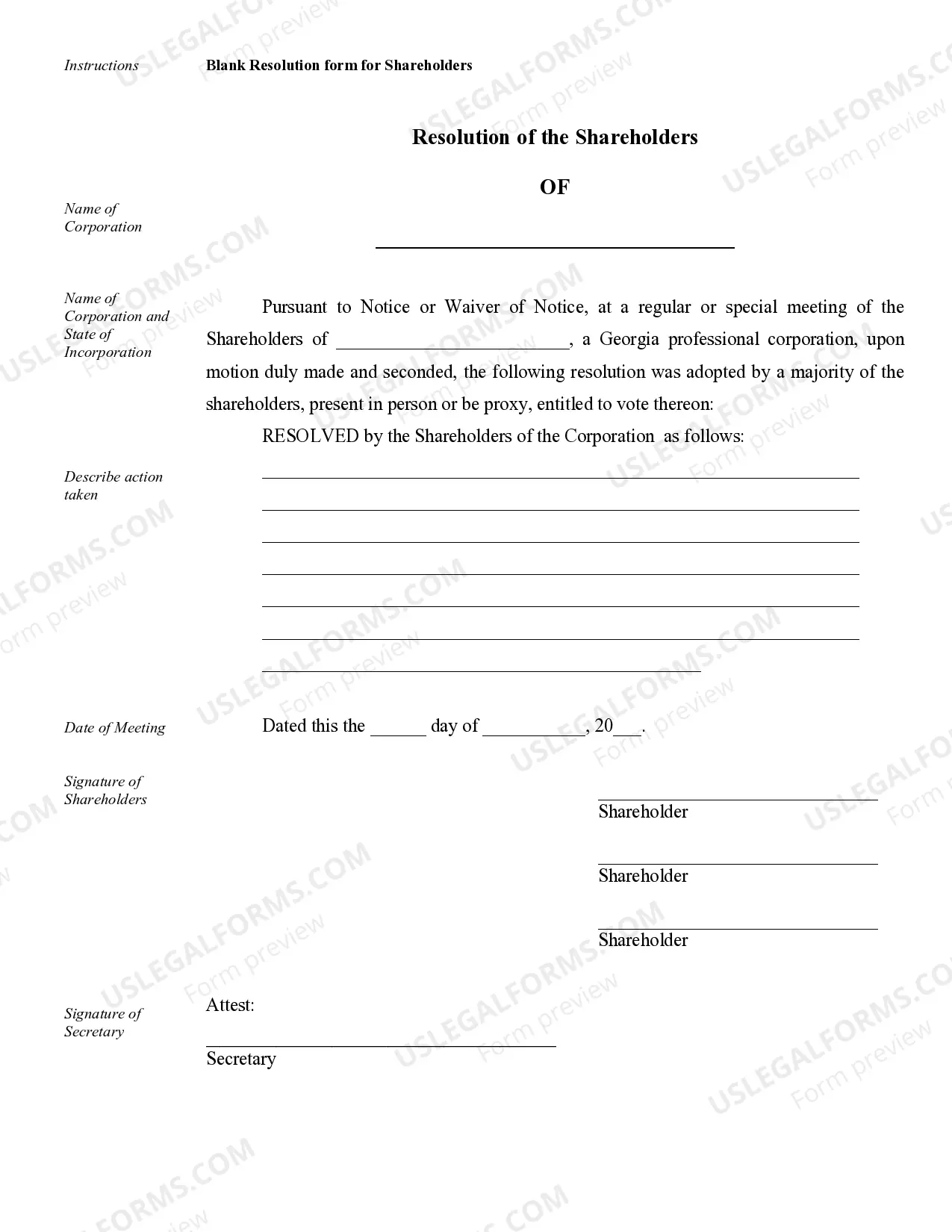

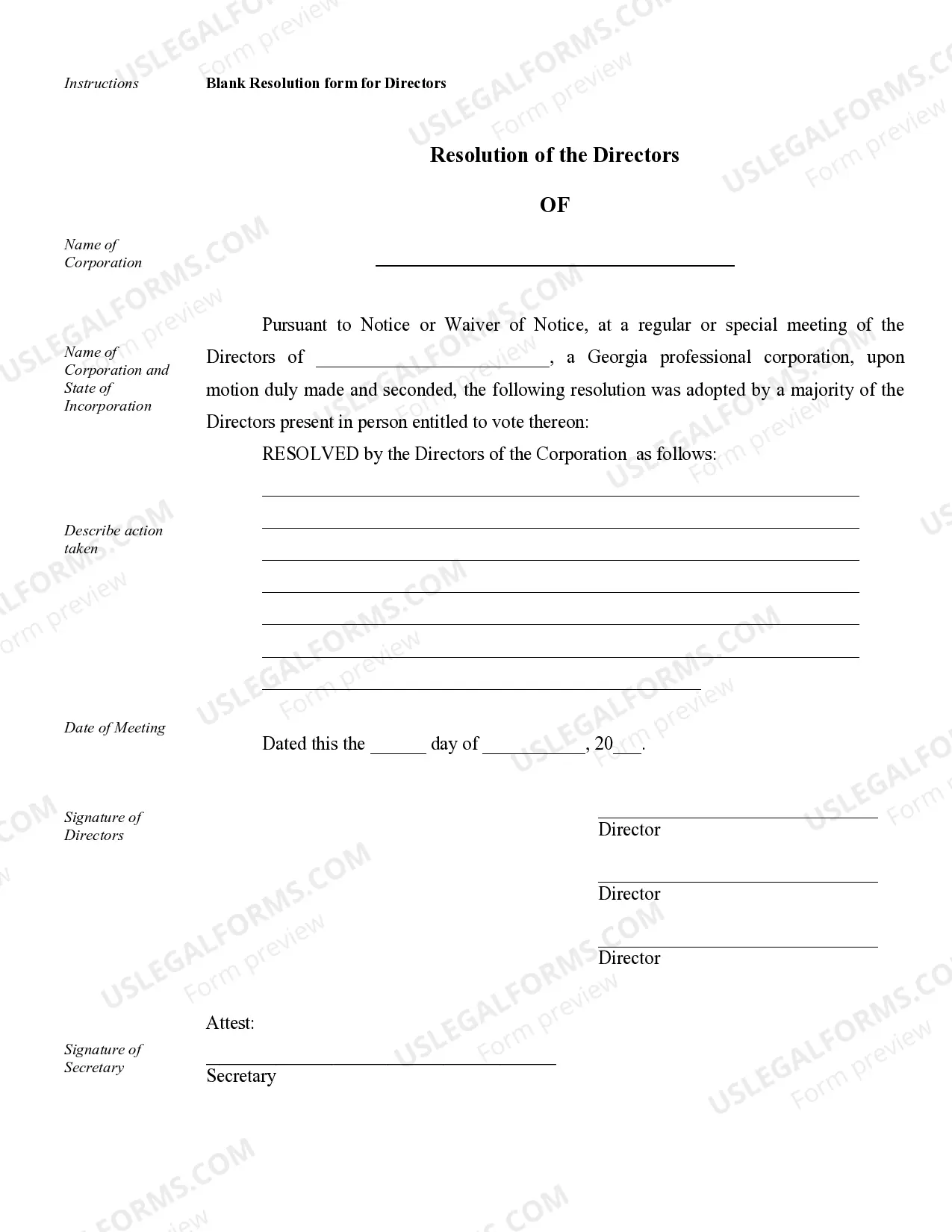

Atlanta Sample Corporate Records for a Georgia Professional Corporation are essential documents that contain crucial information about the company's activities, financial transactions, and legal obligations. These records are vital for maintaining transparency and compliance with state regulations. The following are some key types of corporate records that a Georgia Professional Corporation in Atlanta should maintain: 1. Articles of Incorporation: This document establishes the corporation's existence and provides details about its purpose, management, and authorized shares. It is filed with the Georgia Secretary of State's office. 2. Bylaws: The bylaws outline the rules and procedures for governing the corporation, including guidelines for corporate decision-making, roles of directors and officers, meeting protocols, and voting procedures. 3. Shareholder Meeting Minutes: These records document the proceedings of shareholder meetings, including resolutions, voting results, and discussions regarding the corporation's significant decisions. They serve as evidence of corporate decision-making and are essential for legal purposes. 4. Board of Directors Meeting Minutes: Similar to shareholder meeting minutes, these records provide a detailed account of directors' meetings, including discussions, actions taken, and resolutions passed. They serve as evidence of compliance with the corporation's fiduciary responsibilities. 5. Stock Ledger: The stock ledger represents the ownership of company shares and records all issued and transferred shares, including details about shareholders' names, date of issuance, and the number of shares held by each individual. 6. Financial Statements: These statements, including income statements, balance sheets, and cash flow statements, provide a comprehensive overview of the corporation's financial position. They are crucial for internal decision-making, investor relations, and compliance with accounting standards. 7. Contracts and Agreements: This category includes copies of all legally binding contracts, such as purchase agreements, employment contracts, leases, and service agreements. These records ensure that the corporation fulfills its obligations and protects its interests. 8. Licenses and Permits: Copies of licenses and permits obtained by the corporation, such as professional licenses or local business permits, should be maintained for compliance with applicable laws and regulations. 9. Annual Reports: As required by Georgia law, a professional corporation must file an annual report with the Secretary of State. This report typically includes information about the corporation's current directors, officers, and registered agent. Keeping copies of these reports is essential for future reference and to demonstrate compliance with reporting requirements. 10. Tax Filings: All corporate tax returns and related documents, such as W-2 and 1099 forms, should be included in the corporate records to ensure compliance with state and federal tax laws. Properly organizing and maintaining these Atlanta Sample Corporate Records for a Georgia Professional Corporation is crucial for the corporation's ongoing operations, legal compliance, and financial stability. Staying on top of record-keeping is essential in case of audits, legal disputes, or mergers and acquisitions.Atlanta Sample Corporate Records for a Georgia Professional Corporation are essential documents that contain crucial information about the company's activities, financial transactions, and legal obligations. These records are vital for maintaining transparency and compliance with state regulations. The following are some key types of corporate records that a Georgia Professional Corporation in Atlanta should maintain: 1. Articles of Incorporation: This document establishes the corporation's existence and provides details about its purpose, management, and authorized shares. It is filed with the Georgia Secretary of State's office. 2. Bylaws: The bylaws outline the rules and procedures for governing the corporation, including guidelines for corporate decision-making, roles of directors and officers, meeting protocols, and voting procedures. 3. Shareholder Meeting Minutes: These records document the proceedings of shareholder meetings, including resolutions, voting results, and discussions regarding the corporation's significant decisions. They serve as evidence of corporate decision-making and are essential for legal purposes. 4. Board of Directors Meeting Minutes: Similar to shareholder meeting minutes, these records provide a detailed account of directors' meetings, including discussions, actions taken, and resolutions passed. They serve as evidence of compliance with the corporation's fiduciary responsibilities. 5. Stock Ledger: The stock ledger represents the ownership of company shares and records all issued and transferred shares, including details about shareholders' names, date of issuance, and the number of shares held by each individual. 6. Financial Statements: These statements, including income statements, balance sheets, and cash flow statements, provide a comprehensive overview of the corporation's financial position. They are crucial for internal decision-making, investor relations, and compliance with accounting standards. 7. Contracts and Agreements: This category includes copies of all legally binding contracts, such as purchase agreements, employment contracts, leases, and service agreements. These records ensure that the corporation fulfills its obligations and protects its interests. 8. Licenses and Permits: Copies of licenses and permits obtained by the corporation, such as professional licenses or local business permits, should be maintained for compliance with applicable laws and regulations. 9. Annual Reports: As required by Georgia law, a professional corporation must file an annual report with the Secretary of State. This report typically includes information about the corporation's current directors, officers, and registered agent. Keeping copies of these reports is essential for future reference and to demonstrate compliance with reporting requirements. 10. Tax Filings: All corporate tax returns and related documents, such as W-2 and 1099 forms, should be included in the corporate records to ensure compliance with state and federal tax laws. Properly organizing and maintaining these Atlanta Sample Corporate Records for a Georgia Professional Corporation is crucial for the corporation's ongoing operations, legal compliance, and financial stability. Staying on top of record-keeping is essential in case of audits, legal disputes, or mergers and acquisitions.