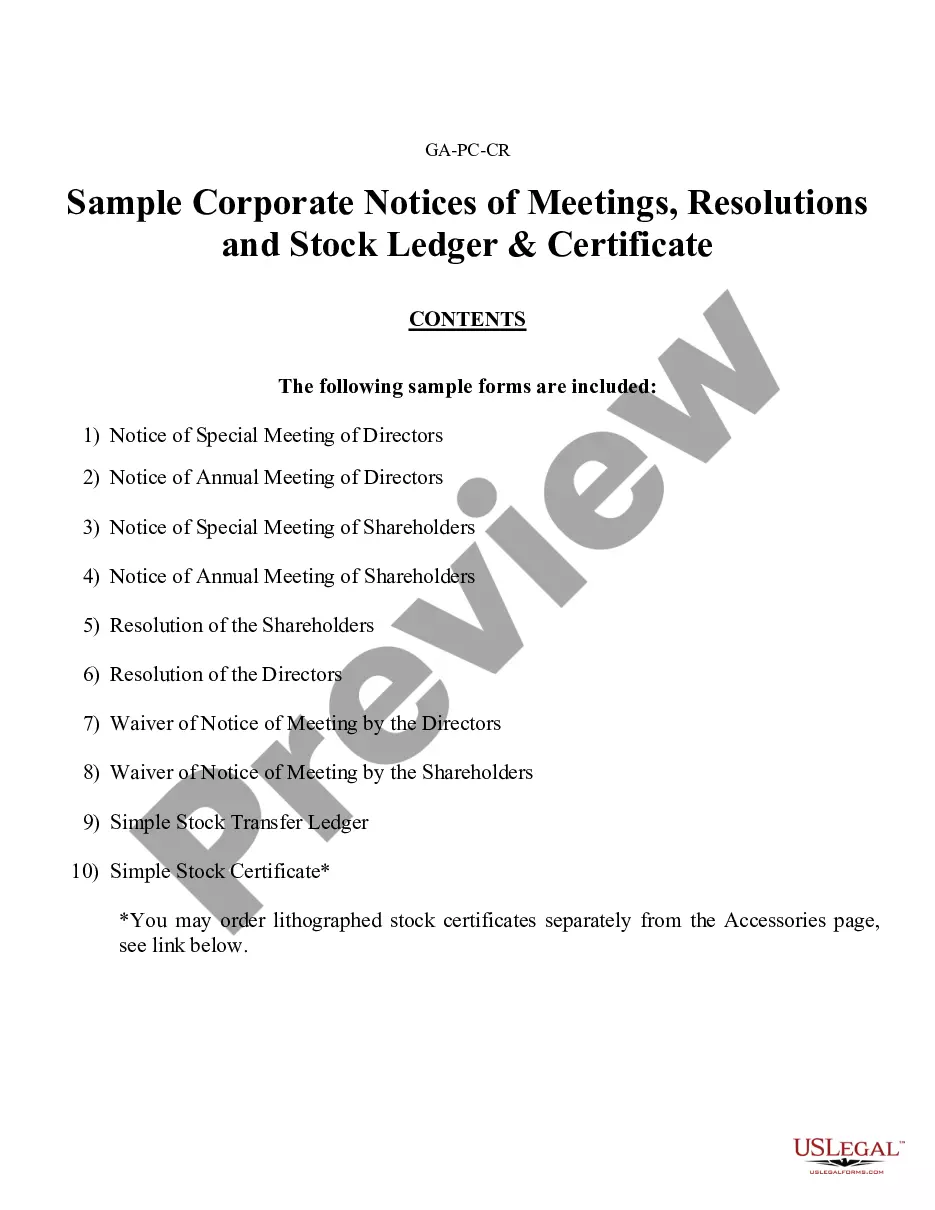

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

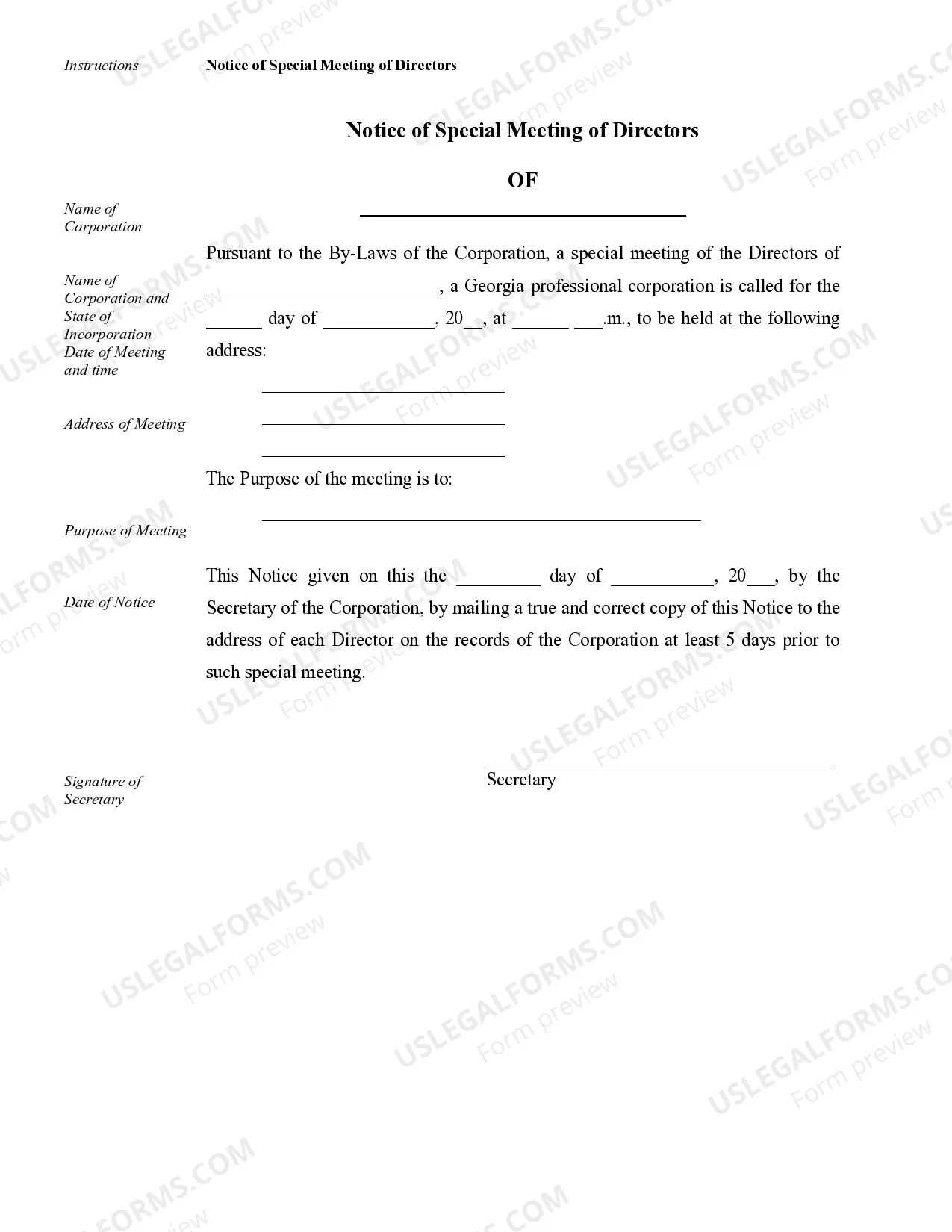

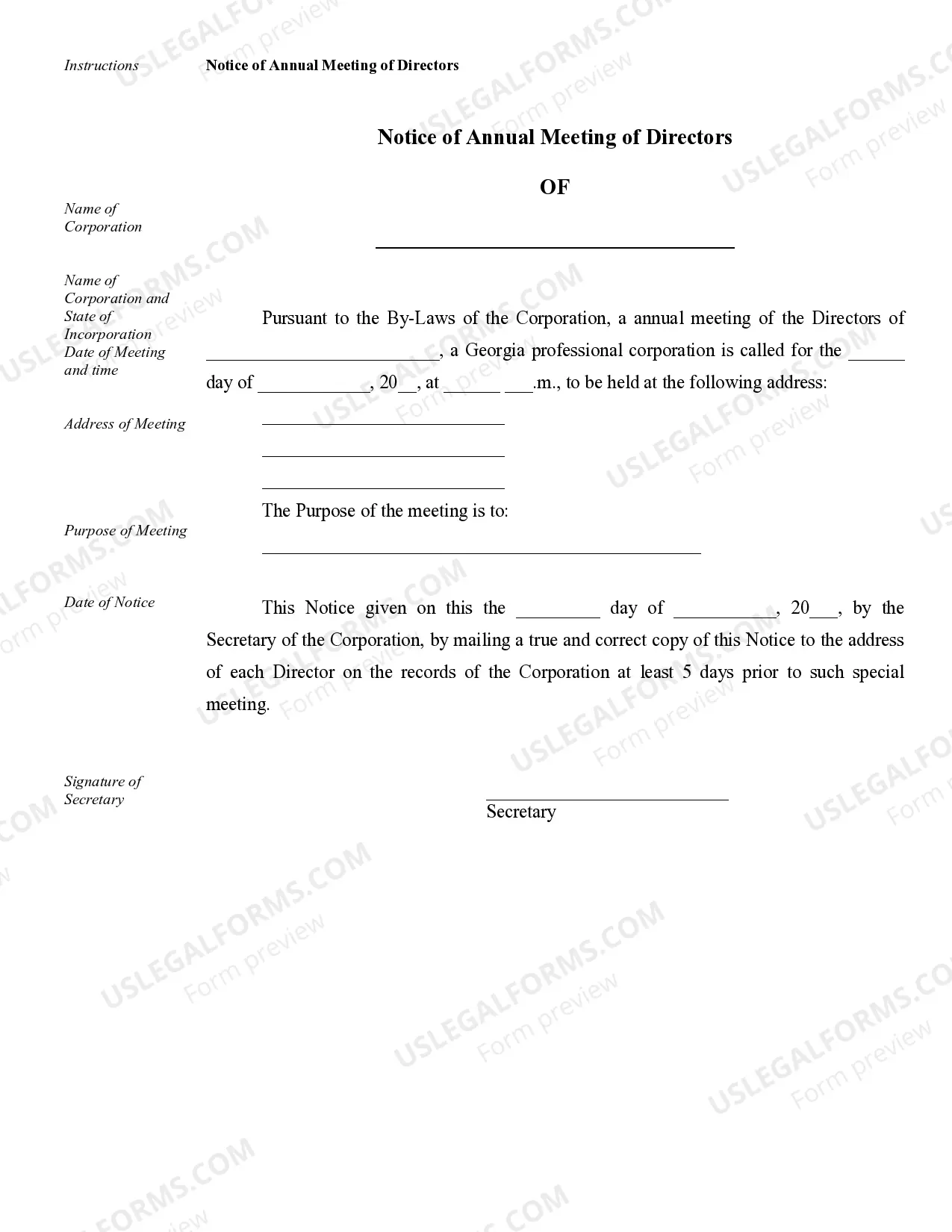

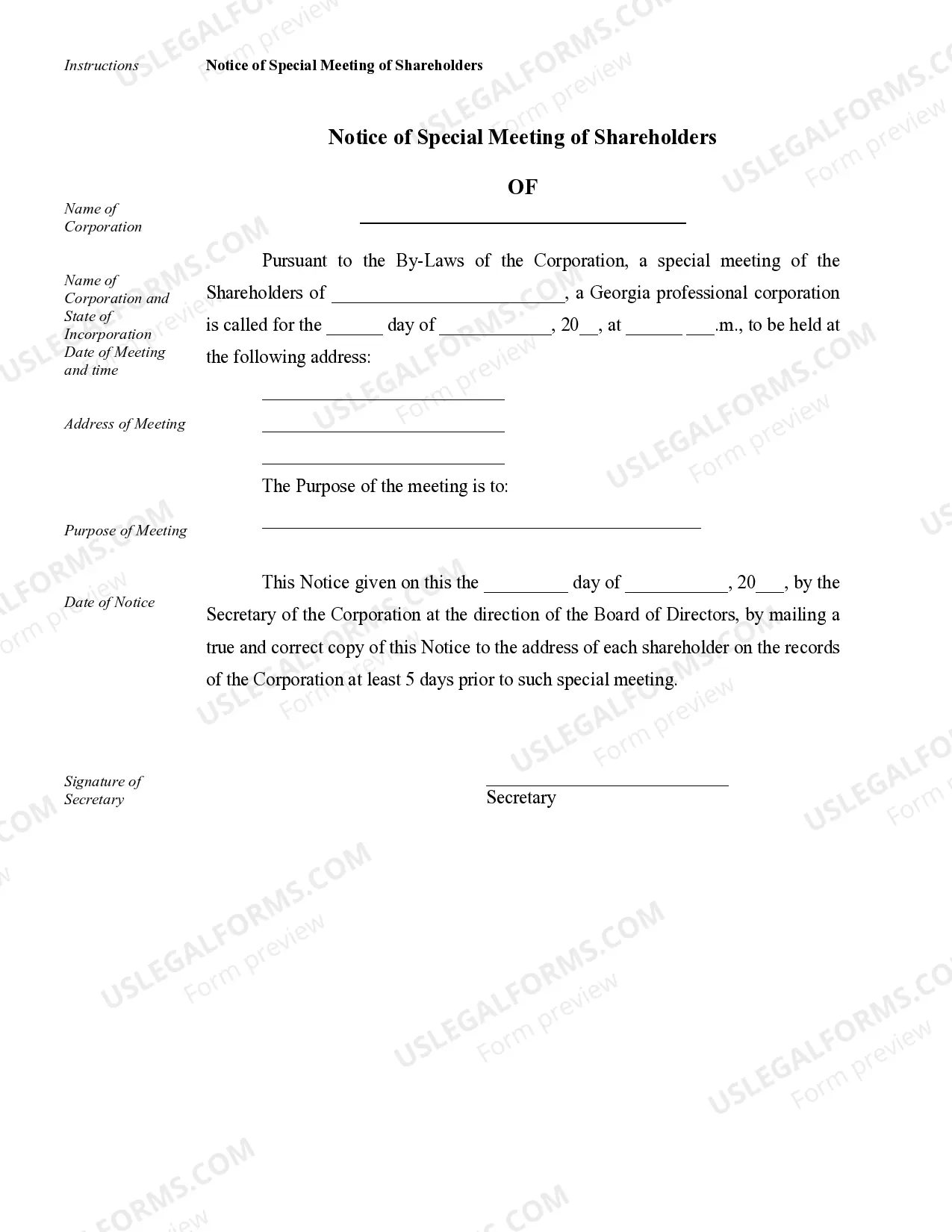

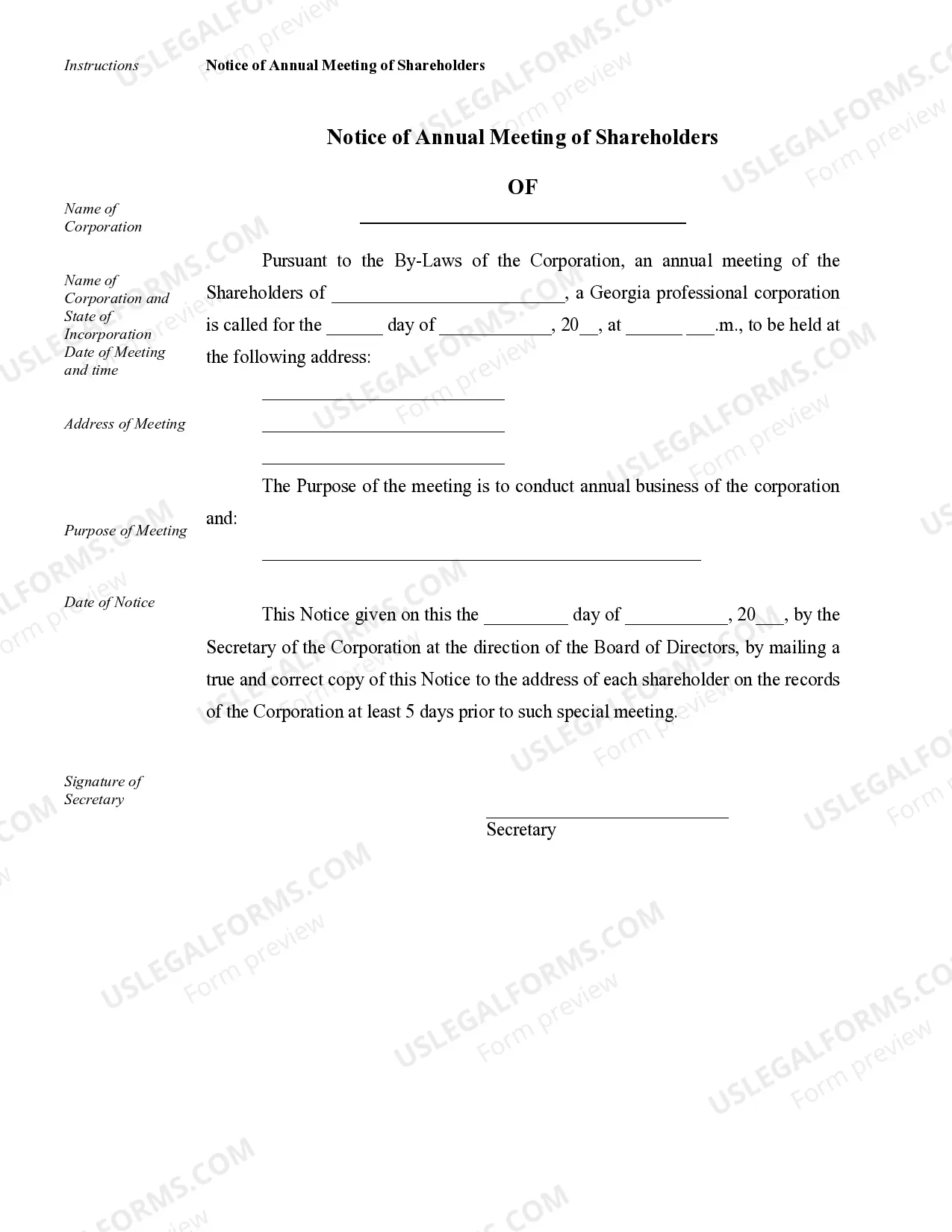

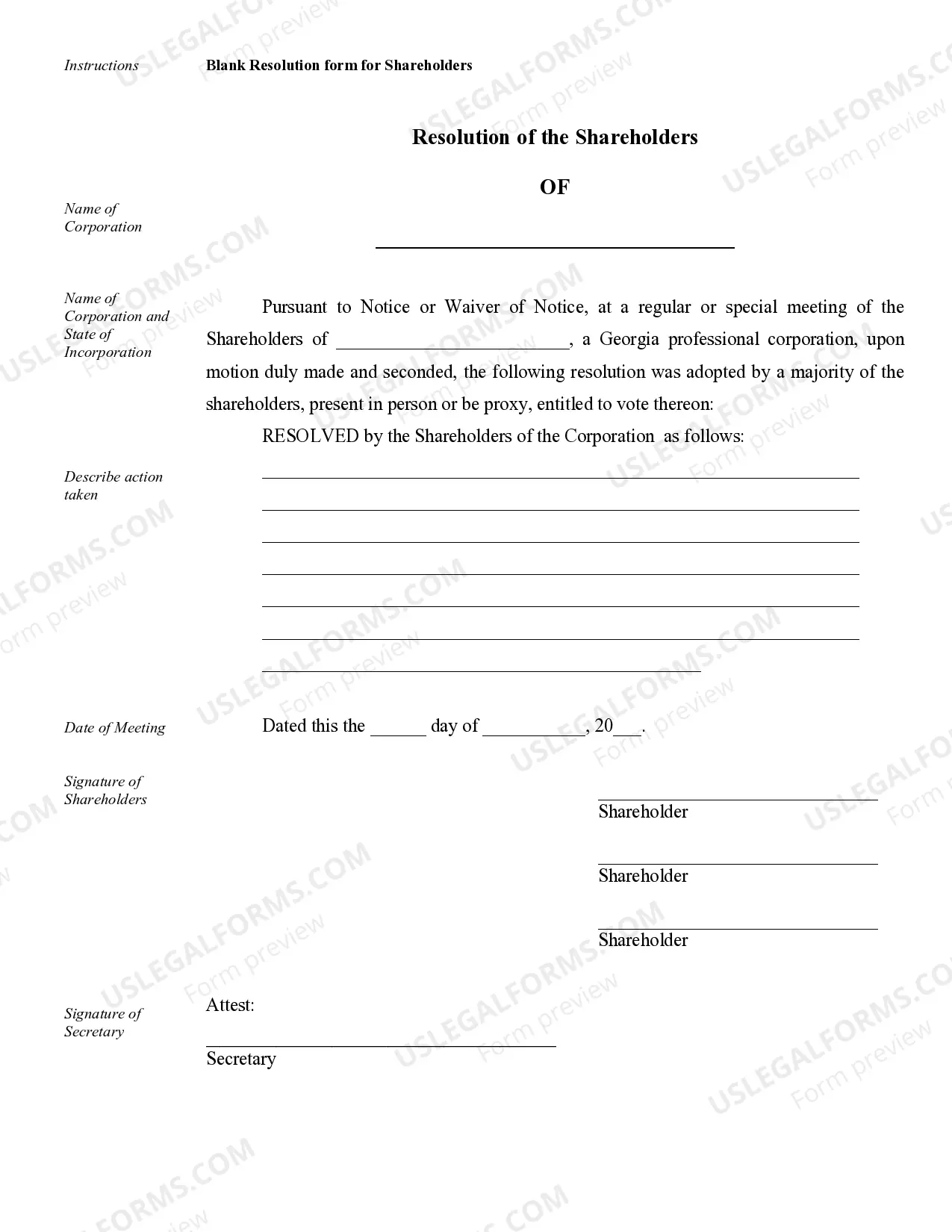

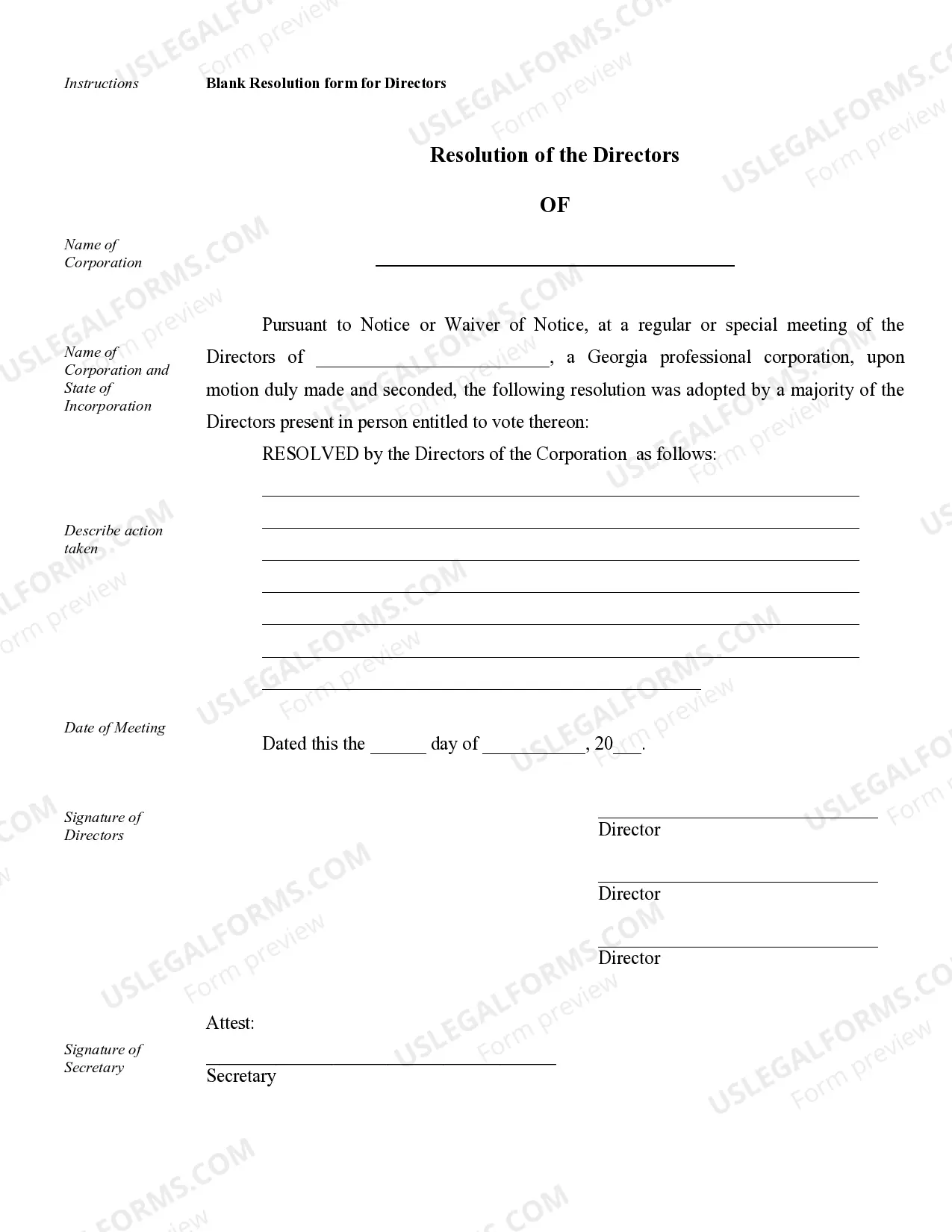

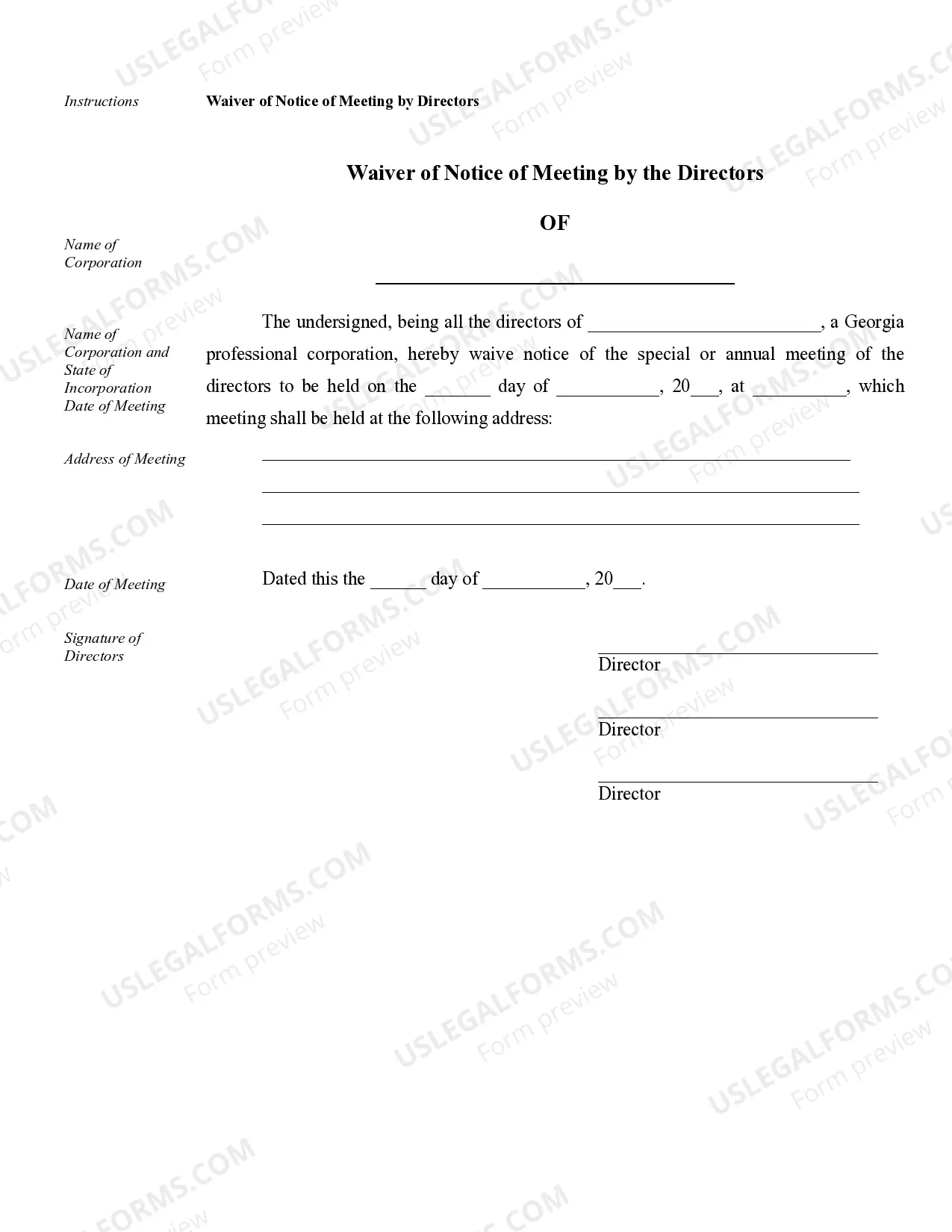

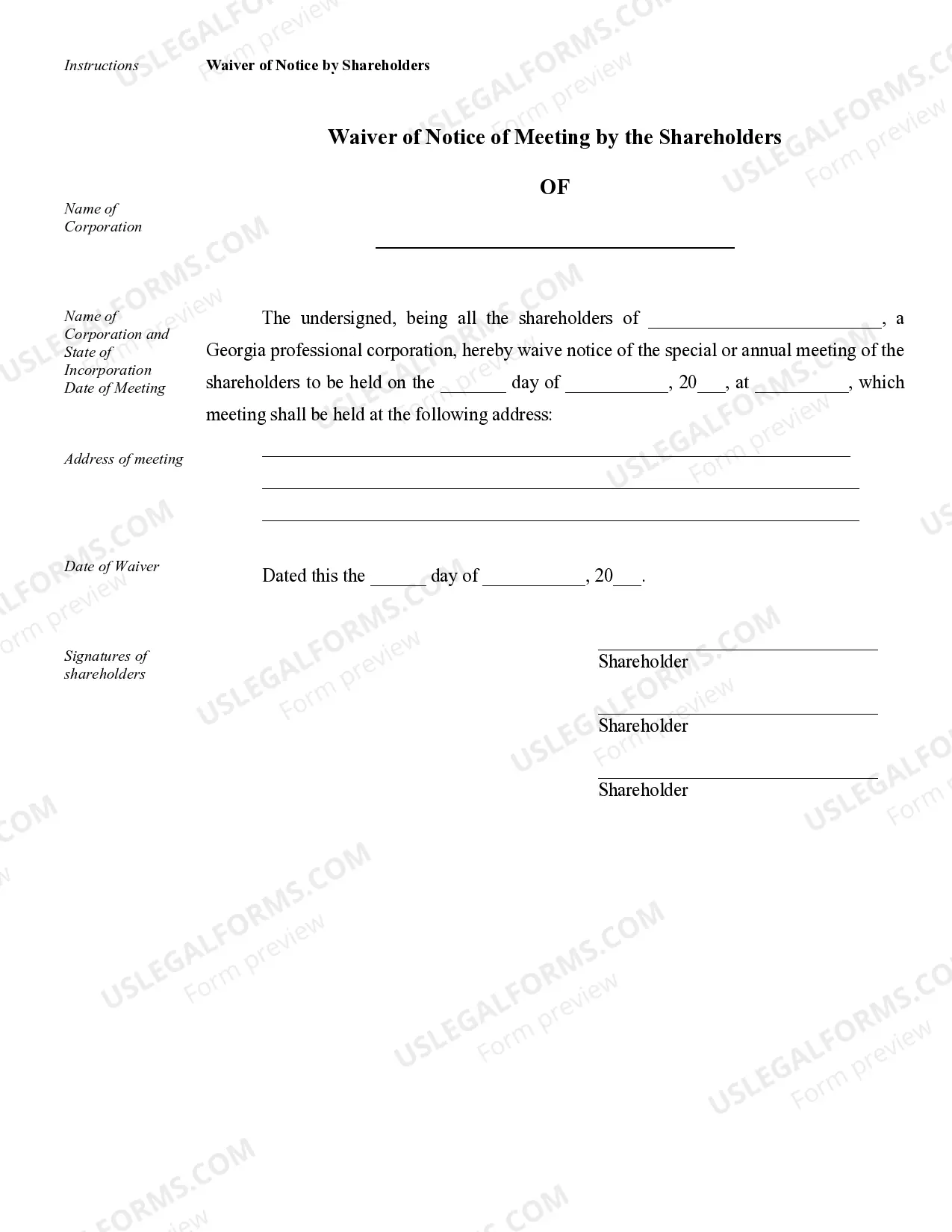

Fulton Sample Corporate Records are a collection of important documents that a Georgia Professional Corporation must maintain to comply with legal requirements and ensure efficient corporate governance. These records serve as an organized documentation of the corporation’s activities, structure, and key decisions. Fulton Sample Corporate Records provide an accurate historical record and are crucial in demonstrating the corporation's compliance with regulatory authorities, shareholders, or potential investors. Here are some key documents found in the Fulton Sample Corporate Records for a Georgia Professional Corporation: 1. Articles of Incorporation: This is the foundational document that creates the corporation and includes essential information such as the corporation's name, purpose, registered agent, and the number of authorized shares. 2. Bylaws: These are the internal rules and regulations that govern the corporation's operations and management. Bylaws outline procedures for holding meetings, electing directors and officers, and other key corporate procedures. 3. Minutes of Meetings: These documents record the discussions, resolutions, decisions, and voting outcomes of the corporation's shareholders, board of directors, and committee meetings. Minutes of meetings are essential for transparency and accountability. 4. Shareholder Records: These records maintain an up-to-date list of the corporation's shareholders, including their contact information, the number and class of shares they own, and any changes in ownership through transfers or new issuance. 5. Director and Officer Information: This includes documentation of the current and previous directors and officers of the corporation, their roles, addresses, and any potential conflicts of interest. 6. Financial Statements: Fulton Sample Corporate Records may include financial statements, such as income statements, balance sheets, and cash flow statements. These records help track the corporation's financial performance and comply with accounting standards. 7. Annual Reports: These reports summarize the corporation's activities and financial performance over the past year. They may be filed with the Secretary of State or other regulatory authorities. 8. Corporate Resolutions: These documents record major decisions made by the board of directors, such as approving annual budgets, entering into contracts or agreements, appointing officers, or authorizing loans. 9. Shareholder Agreements: In some cases, Fulton Sample Corporate Records may include agreements between shareholders that outline their rights, obligations, and restrictions, such as buy-sell agreements or voting agreements. 10. Stock Transfer Records: These records document any transfers or changes in ownership of the corporation's shares. They include details such as the buyer and seller information, date of transfer, and number of shares transferred. It is important to note that the specific types and contents of Fulton Sample Corporate Records may vary depending on the nature of the business and applicable laws. Consulting with legal professionals or using pre-designed templates specific to Georgia Professional Corporations can ensure accurate and compliant record-keeping.Fulton Sample Corporate Records are a collection of important documents that a Georgia Professional Corporation must maintain to comply with legal requirements and ensure efficient corporate governance. These records serve as an organized documentation of the corporation’s activities, structure, and key decisions. Fulton Sample Corporate Records provide an accurate historical record and are crucial in demonstrating the corporation's compliance with regulatory authorities, shareholders, or potential investors. Here are some key documents found in the Fulton Sample Corporate Records for a Georgia Professional Corporation: 1. Articles of Incorporation: This is the foundational document that creates the corporation and includes essential information such as the corporation's name, purpose, registered agent, and the number of authorized shares. 2. Bylaws: These are the internal rules and regulations that govern the corporation's operations and management. Bylaws outline procedures for holding meetings, electing directors and officers, and other key corporate procedures. 3. Minutes of Meetings: These documents record the discussions, resolutions, decisions, and voting outcomes of the corporation's shareholders, board of directors, and committee meetings. Minutes of meetings are essential for transparency and accountability. 4. Shareholder Records: These records maintain an up-to-date list of the corporation's shareholders, including their contact information, the number and class of shares they own, and any changes in ownership through transfers or new issuance. 5. Director and Officer Information: This includes documentation of the current and previous directors and officers of the corporation, their roles, addresses, and any potential conflicts of interest. 6. Financial Statements: Fulton Sample Corporate Records may include financial statements, such as income statements, balance sheets, and cash flow statements. These records help track the corporation's financial performance and comply with accounting standards. 7. Annual Reports: These reports summarize the corporation's activities and financial performance over the past year. They may be filed with the Secretary of State or other regulatory authorities. 8. Corporate Resolutions: These documents record major decisions made by the board of directors, such as approving annual budgets, entering into contracts or agreements, appointing officers, or authorizing loans. 9. Shareholder Agreements: In some cases, Fulton Sample Corporate Records may include agreements between shareholders that outline their rights, obligations, and restrictions, such as buy-sell agreements or voting agreements. 10. Stock Transfer Records: These records document any transfers or changes in ownership of the corporation's shares. They include details such as the buyer and seller information, date of transfer, and number of shares transferred. It is important to note that the specific types and contents of Fulton Sample Corporate Records may vary depending on the nature of the business and applicable laws. Consulting with legal professionals or using pre-designed templates specific to Georgia Professional Corporations can ensure accurate and compliant record-keeping.