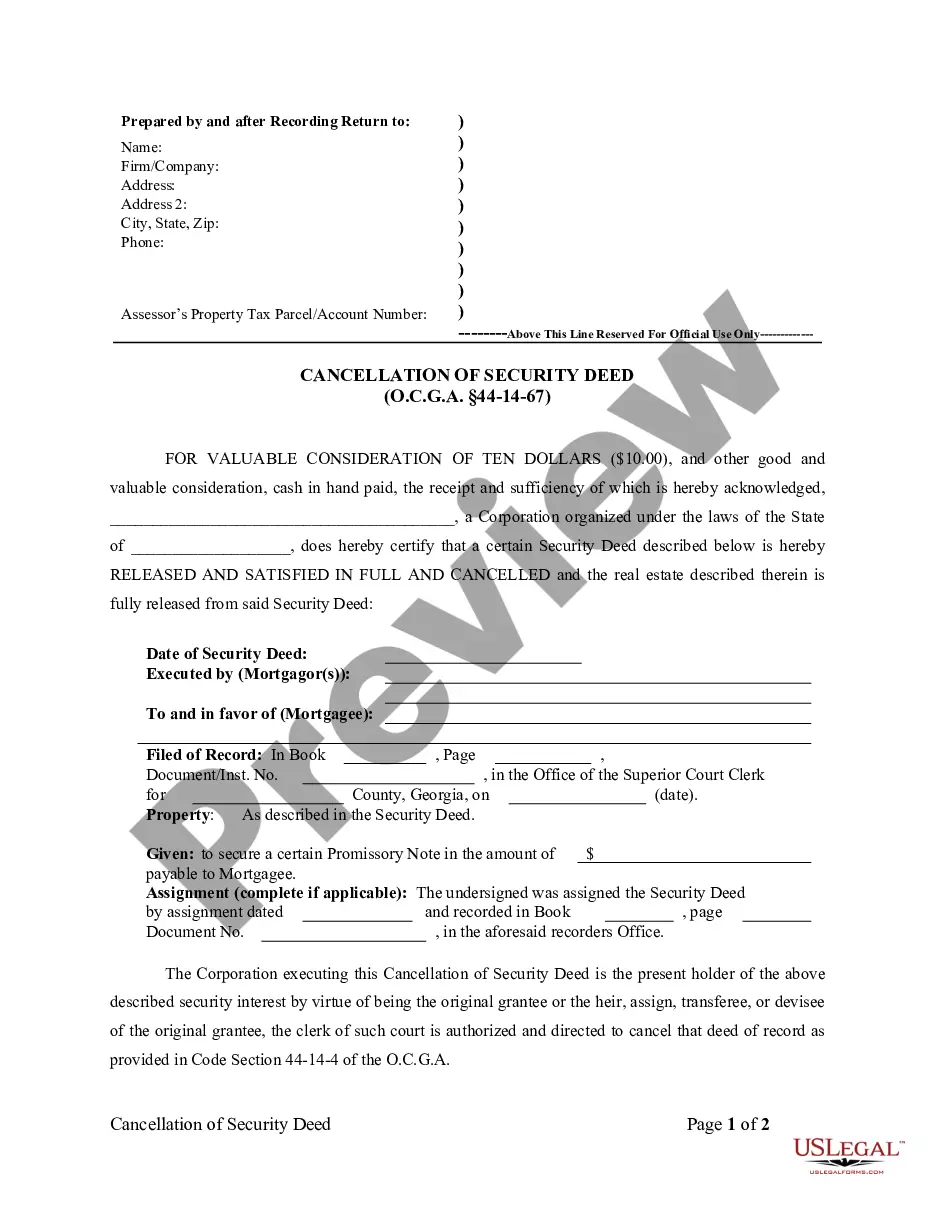

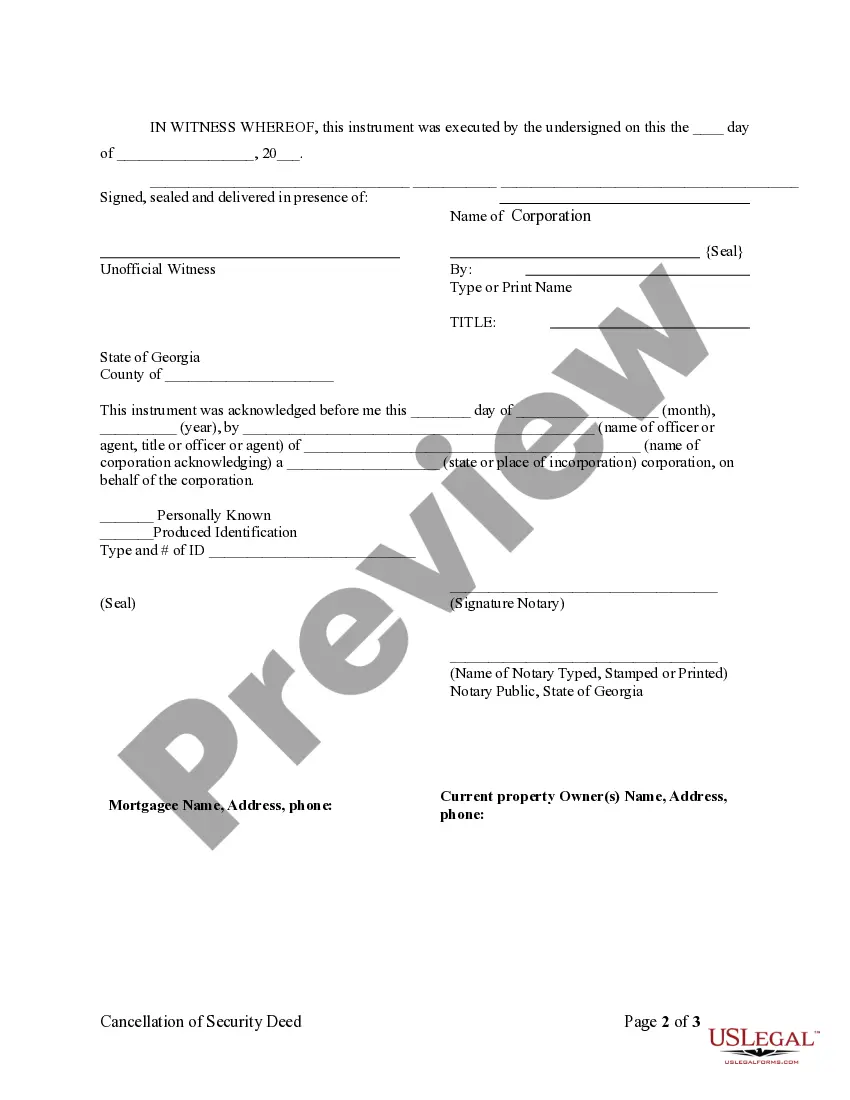

This Release - Satisfaction - Cancellation Deed of Trust - by Corporate Lender is for the satisfaction or release of a mortgage for the state of Georgia by a Corporation. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Fulton Georgia Satisfaction, Release or Cancellation of Security Deed by Corporation: A Detailed Description In Fulton, Georgia, the Satisfaction, Release, or Cancellation of Security Deed by Corporation is an essential process in the real estate industry. When a corporation grants a security deed to secure a loan or mortgage, this legal document serves as collateral for the lender until the debt is fully repaid. However, once the loan has been settled, the corporation must take the necessary steps to formally release or cancel the security deed. The satisfaction, release, or cancellation process involves several key steps and documents. It is crucial for corporations to understand these procedures and fulfill their obligations promptly and accurately. Failure to do so can lead to issues with property ownership or future transactions. There are a few different types of satisfaction, release, or cancellation of security deed by a corporation, namely: 1. Full Satisfaction: This occurs when the corporation has fulfilled its loan obligations entirely, including repayment of the principal amount, interest, and any applicable fees. The corporation, in conjunction with the lender, must draft a Satisfaction of Security Deed document, sign it, and have it notarized. This document states that the loan has been repaid in full and that the corporation has no further obligations under the security deed. 2. Partial Satisfaction: If the corporation pays off a portion of the loan, the lender may agree to release a portion of the collateral, effectively reducing the security deed amount. For this, a Partial Satisfaction of Security Deed document is prepared, signed, and notarized, serving as evidence of the reduced liability. 3. Deed of Release: In some cases, the corporation and the lender may agree to release the security deed altogether, even if the loan has not been repaid in full. This can occur when refinancing or restructuring a loan. A Deed of Release document is created, signed, and notarized to formally cancel the security deed, releasing the collateral. However, the corporation is still responsible for fulfilling the revised loan terms. To initiate the satisfaction, release, or cancellation process, the corporation must contact the lender and request the necessary documentation. Typically, this includes a Satisfaction of Security Deed form or a Release of Security Deed form. The corporation must complete these forms accurately, ensuring all required information is provided. These documents should be executed in accordance with Georgia state laws and decoration requirements. Once the satisfaction, release, or cancellation forms are completed and notarized, they should be submitted to the Fulton County Clerk's office for recording. This step is crucial to protect the corporation's interests and provide evidence of the debt's satisfaction or cancellation. Recording fees will apply, and it is essential to follow the specific procedures outlined by the Clerk's office. In conclusion, the satisfaction, release, or cancellation of security deed by corporation in Fulton, Georgia is a vital process for ensuring the proper completion of loan obligations. Precise documentation, accurate completion of relevant forms, and adherence to procedures are necessary to protect the corporation's rights and interests. By following these steps diligently, corporations can successfully release or cancel security deeds, providing closure to a loan and enabling future transactions.Fulton Georgia Satisfaction, Release or Cancellation of Security Deed by Corporation: A Detailed Description In Fulton, Georgia, the Satisfaction, Release, or Cancellation of Security Deed by Corporation is an essential process in the real estate industry. When a corporation grants a security deed to secure a loan or mortgage, this legal document serves as collateral for the lender until the debt is fully repaid. However, once the loan has been settled, the corporation must take the necessary steps to formally release or cancel the security deed. The satisfaction, release, or cancellation process involves several key steps and documents. It is crucial for corporations to understand these procedures and fulfill their obligations promptly and accurately. Failure to do so can lead to issues with property ownership or future transactions. There are a few different types of satisfaction, release, or cancellation of security deed by a corporation, namely: 1. Full Satisfaction: This occurs when the corporation has fulfilled its loan obligations entirely, including repayment of the principal amount, interest, and any applicable fees. The corporation, in conjunction with the lender, must draft a Satisfaction of Security Deed document, sign it, and have it notarized. This document states that the loan has been repaid in full and that the corporation has no further obligations under the security deed. 2. Partial Satisfaction: If the corporation pays off a portion of the loan, the lender may agree to release a portion of the collateral, effectively reducing the security deed amount. For this, a Partial Satisfaction of Security Deed document is prepared, signed, and notarized, serving as evidence of the reduced liability. 3. Deed of Release: In some cases, the corporation and the lender may agree to release the security deed altogether, even if the loan has not been repaid in full. This can occur when refinancing or restructuring a loan. A Deed of Release document is created, signed, and notarized to formally cancel the security deed, releasing the collateral. However, the corporation is still responsible for fulfilling the revised loan terms. To initiate the satisfaction, release, or cancellation process, the corporation must contact the lender and request the necessary documentation. Typically, this includes a Satisfaction of Security Deed form or a Release of Security Deed form. The corporation must complete these forms accurately, ensuring all required information is provided. These documents should be executed in accordance with Georgia state laws and decoration requirements. Once the satisfaction, release, or cancellation forms are completed and notarized, they should be submitted to the Fulton County Clerk's office for recording. This step is crucial to protect the corporation's interests and provide evidence of the debt's satisfaction or cancellation. Recording fees will apply, and it is essential to follow the specific procedures outlined by the Clerk's office. In conclusion, the satisfaction, release, or cancellation of security deed by corporation in Fulton, Georgia is a vital process for ensuring the proper completion of loan obligations. Precise documentation, accurate completion of relevant forms, and adherence to procedures are necessary to protect the corporation's rights and interests. By following these steps diligently, corporations can successfully release or cancel security deeds, providing closure to a loan and enabling future transactions.