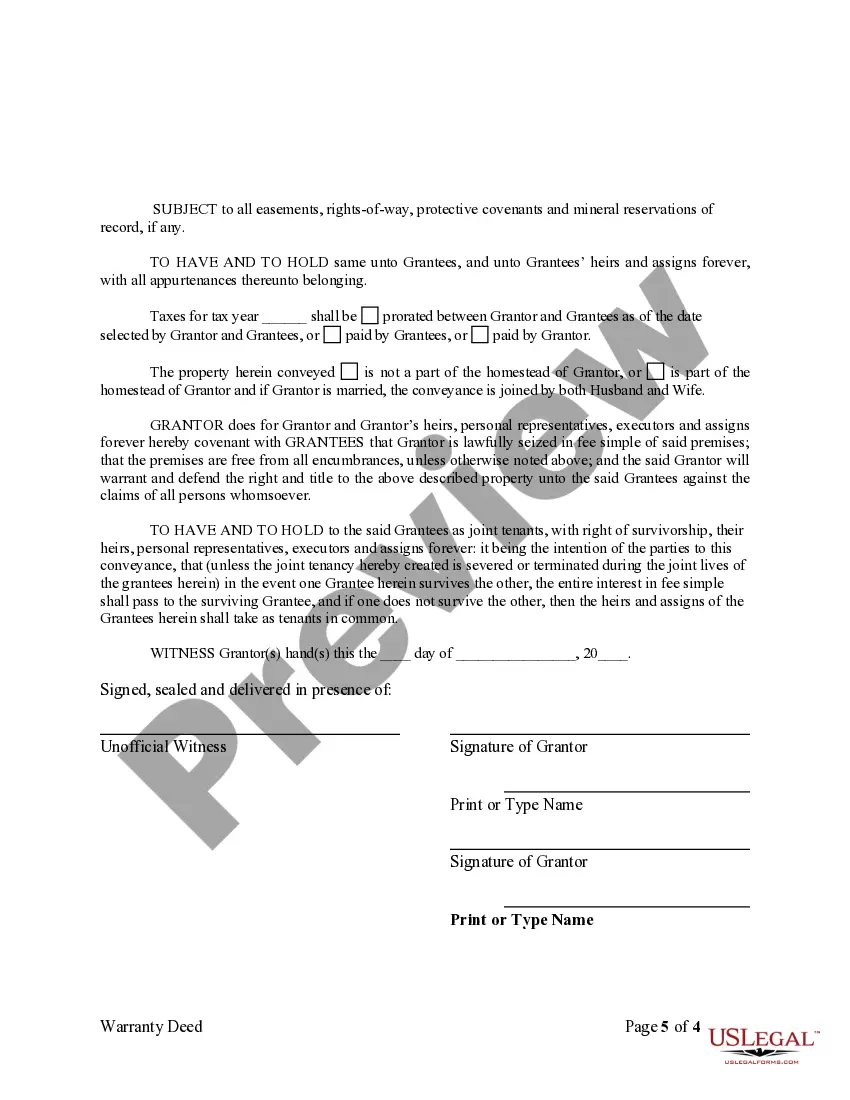

This form is a Warranty Deed where the grantees hold title to the property as joint tenants.

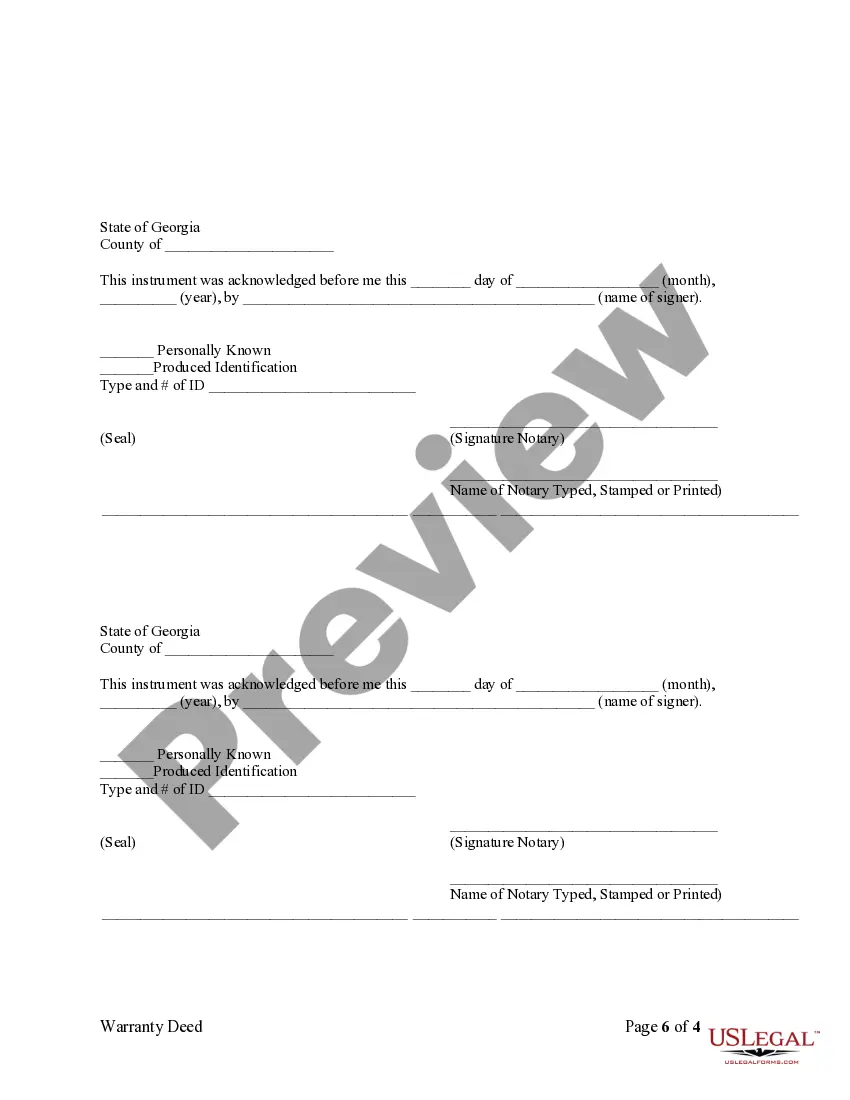

A Fulton Georgia Warranty Deed for Separate or Joint Property to Joint Tenancy is a legal document that transfers ownership of real estate from one party to another, specifically with the intention of creating joint tenancy. This type of deed is commonly used in Fulton County, Georgia, to facilitate the seamless transfer of property rights and interests. With joint tenancy, multiple individuals, typically spouses or business partners, hold equal shares of ownership in the property. In the event of one owner's death, their share automatically passes to the surviving owner(s) without the need for probate. There are various types of Fulton Georgia Warranty Deed for Separate or Joint Property to Joint Tenancy, each having specific considerations depending on the circumstances: 1. General Warranty Deed: This type of deed provides the highest level of protection for the buyer. The granter warrants and guarantees that they have clear title to the property and defend against any claims or encumbrances arising before or during their ownership. 2. Limited Warranty Deed: With a limited warranty deed, the granter only guarantees against title defects that occurred during their ownership. It offers less protection to the buyer compared to a general warranty deed. 3. Quitclaim Deed: A quitclaim deed transfers whatever interest the granter has in the property, with no warranties or guarantees. It is often used for transferring property between family members or in situations where the parties have a high level of trust. When completing a Fulton Georgia Warranty Deed for Separate or Joint Property to Joint Tenancy, it is essential to ensure accurate information is provided. The deed typically includes details like the names and addresses of the granter(s) and the grantee(s), a legal description of the property, the consideration or purchase price, and any relevant encumbrances or restrictions. Seeking professional legal advice is highly recommended when dealing with any property transfer to ensure compliance with local laws and to protect the parties involved.A Fulton Georgia Warranty Deed for Separate or Joint Property to Joint Tenancy is a legal document that transfers ownership of real estate from one party to another, specifically with the intention of creating joint tenancy. This type of deed is commonly used in Fulton County, Georgia, to facilitate the seamless transfer of property rights and interests. With joint tenancy, multiple individuals, typically spouses or business partners, hold equal shares of ownership in the property. In the event of one owner's death, their share automatically passes to the surviving owner(s) without the need for probate. There are various types of Fulton Georgia Warranty Deed for Separate or Joint Property to Joint Tenancy, each having specific considerations depending on the circumstances: 1. General Warranty Deed: This type of deed provides the highest level of protection for the buyer. The granter warrants and guarantees that they have clear title to the property and defend against any claims or encumbrances arising before or during their ownership. 2. Limited Warranty Deed: With a limited warranty deed, the granter only guarantees against title defects that occurred during their ownership. It offers less protection to the buyer compared to a general warranty deed. 3. Quitclaim Deed: A quitclaim deed transfers whatever interest the granter has in the property, with no warranties or guarantees. It is often used for transferring property between family members or in situations where the parties have a high level of trust. When completing a Fulton Georgia Warranty Deed for Separate or Joint Property to Joint Tenancy, it is essential to ensure accurate information is provided. The deed typically includes details like the names and addresses of the granter(s) and the grantee(s), a legal description of the property, the consideration or purchase price, and any relevant encumbrances or restrictions. Seeking professional legal advice is highly recommended when dealing with any property transfer to ensure compliance with local laws and to protect the parties involved.