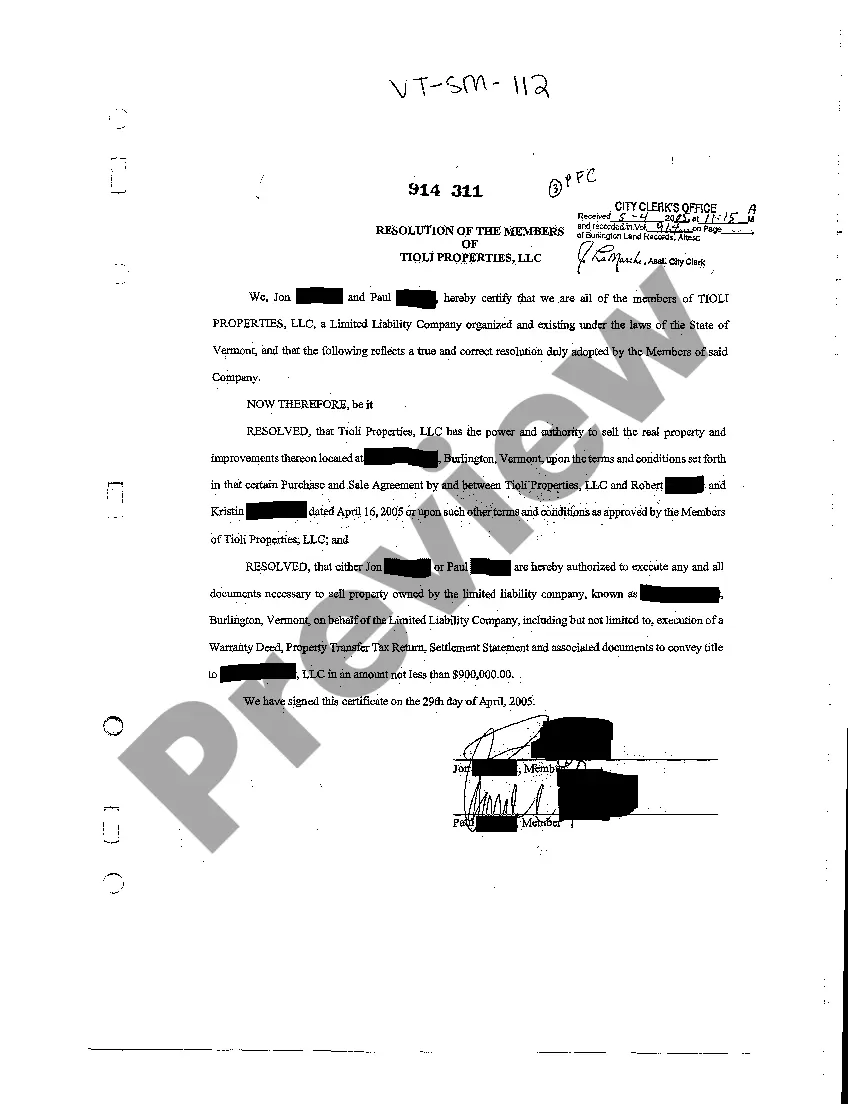

Cedar Rapids Iowa Trust Deed serves as a legal document establishing a trust relationship between a borrower and a lender in the context of real estate transactions. This type of deed is commonly used in Cedar Rapids, Iowa, to secure a loan for purchasing or refinancing property. A Cedar Rapids Iowa Trust Deed, also known as a deed of trust, involves three key parties: the borrower (trust or), the lender (beneficiary), and a neutral third-party (trustee). The trust or transfers the legal title of the property to the trustee as collateral for the loan obtained from the beneficiary. In the event of default by the borrower, the trustee may initiate the foreclosure process, selling the property to repay the outstanding debt to the lender. There are various types of Cedar Rapids Iowa Trust Deeds available, catering to different needs and situations: 1. Standard Trust Deed: The most common type, where the trust deed is used to secure a loan for purchasing residential or commercial property in Cedar Rapids, Iowa. It includes standard terms and conditions agreed upon by the borrower, lender, and trustee. 2. Deed in Lieu of Foreclosure: This type of trust deed allows the borrower to transfer the property title back to the lender voluntarily to avoid foreclosure. It may be an option when the borrower is unable to meet the loan obligations and wants to avoid the negative impact of foreclosure on their credit. 3. Trust Deed with Power of Sale: Here, the trust deed includes a power of sale clause, granting the trustee the authority to sell the property directly without court intervention in case of borrower default. This expedites the foreclosure process, facilitating a quicker resolution for the lender. 4. Wraparound Trust Deed: This type of trust deed allows the borrower to assume an existing loan on the property while securing additional financing from the lender. The new loan "wraps around" the original mortgage, combining both into a single monthly payment. 5. Construction Trust Deed: Used when a property is being constructed or undergoing significant renovations, this trust deed disburses funds to the borrower in stages based on completion milestones. It ensures that the lender's investment is protected throughout the construction process. Overall, Cedar Rapids Iowa Trust Deeds provide a legal framework for securing loans in real estate transactions within the region. These documents protect both the borrower and lender's interests while establishing clear guidelines for the repaying and securing the loan against the property.

Trust Deed

Description

How to fill out Cedar Rapids Iowa Trust Deed?

Obtaining validated templates tailored to your local statutes can be challenging unless you utilize the US Legal Forms collection.

It’s an online repository of over 85,000 legal documents catering to both personal and professional requirements and all real-world situations.

All the papers are accurately classified by the area of use and jurisdiction, making the discovery of the Cedar Rapids Iowa Trust Deed as swift and straightforward as ABC.

Maintain organized paperwork that adheres to legal obligations is of great significance. Take advantage of the US Legal Forms collection to always have crucial document templates for any requirements right at your fingertips!

- Check the Preview mode and form description.

- Ensure you’ve selected the right one that fulfills your specifications and fully aligns with your local jurisdiction standards.

- Search for an alternative template, if necessary.

- If you notice any discrepancies, use the Search tab above to locate the appropriate one. If it meets your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

To get a copy of your deed in Iowa, visit your county recorder's office or check their website for online access to property records. In Cedar Rapids, the recorder's office can provide certified copies and assist you in confirming the details of your deed. For added convenience, platforms like USLegalForms offer resources and templates to help you navigate the retrieval process. Utilizing these tools can save you time and ensure you have the correct documentation.

To obtain a deed in Cedar Rapids, Iowa, you typically need to go through your local county recorder's office. This office maintains property records, including deeds and trust deeds. If you're unsure about the process, consider using online resources from platforms like USLegalForms to help streamline your experience. They provide guidance on how to acquire the necessary documentation efficiently.

One key disadvantage of a deed of trust is the potential for non-judicial foreclosure, which can happen more quickly than with a mortgage. In Cedar Rapids, Iowa, trust deeds allow lenders to foreclose without going through court, potentially leaving borrowers with limited options. Additionally, some borrowers may feel less secure since the trustee holds the title, which can complicate ownership perceptions. It's essential to weigh these factors carefully.

Iowa is primarily a deed of trust state. This means that home loans are secured using a deed of trust instead of a traditional mortgage. In Cedar Rapids, Iowa, trust deeds play an essential role in the lending process, allowing security for both the borrower and the lender. Understanding this difference can help you navigate the home-buying process more effectively.

Yes, you can sell a house with a deed of trust, but there may be specific conditions involved. Usually, you will need to settle any outstanding obligations tied to the deed. If you are dealing with a Cedar Rapids Iowa Trust Deed, consult a legal expert to understand how this process may affect your sale.

A trust deed and a deed of trust are essentially two terms for the same concept, depending on the terminology used in your state. Both documents serve to secure loans with real estate as collateral. You should familiarize yourself with the implications of a Cedar Rapids Iowa Trust Deed to navigate your property transactions more effectively.

In real estate, the three main types of deeds are warranty deeds, quitclaim deeds, and trust deeds. Each type serves a specific purpose, such as transferring ownership or protecting the rights of the parties involved. Understanding the Cedar Rapids Iowa Trust Deed is essential for ensuring proper legal procedures in any real estate transaction.

To request public records in Cedar Rapids Iowa, you can visit the local government offices or submit a request online. The Cedar Rapids city website offers a straightforward process for accessing these records. Ensure you have the necessary details regarding the Cedar Rapids Iowa Trust Deed or other records you seek to expedite your request.

One disadvantage of a trust deed in Cedar Rapids, Iowa, is the potential for foreclosure. If you fail to meet your payment obligations, your property may be sold without a court's intervention. Additionally, trust deeds may limit your ability to negotiate favorable terms with lenders. Understanding these risks is crucial when navigating your options in Cedar Rapids, Iowa.

Accessing your house deed is simple in Cedar Rapids, Iowa. You can either visit the county recorder's office in person or use their online resources for convenience. If you're unsure how to navigate the process, platforms like USLegalForms can provide easy-to-follow directions for accessing your trust deed.