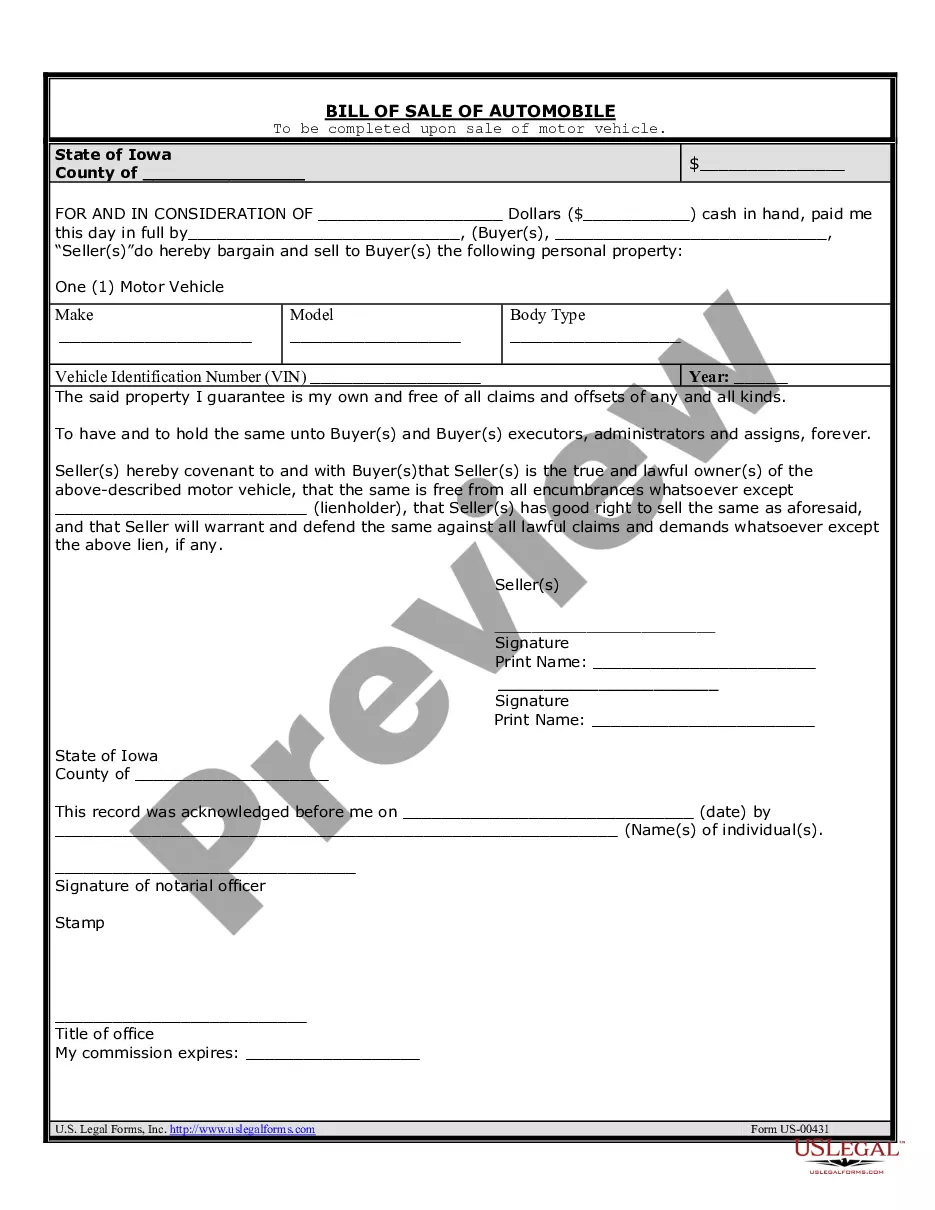

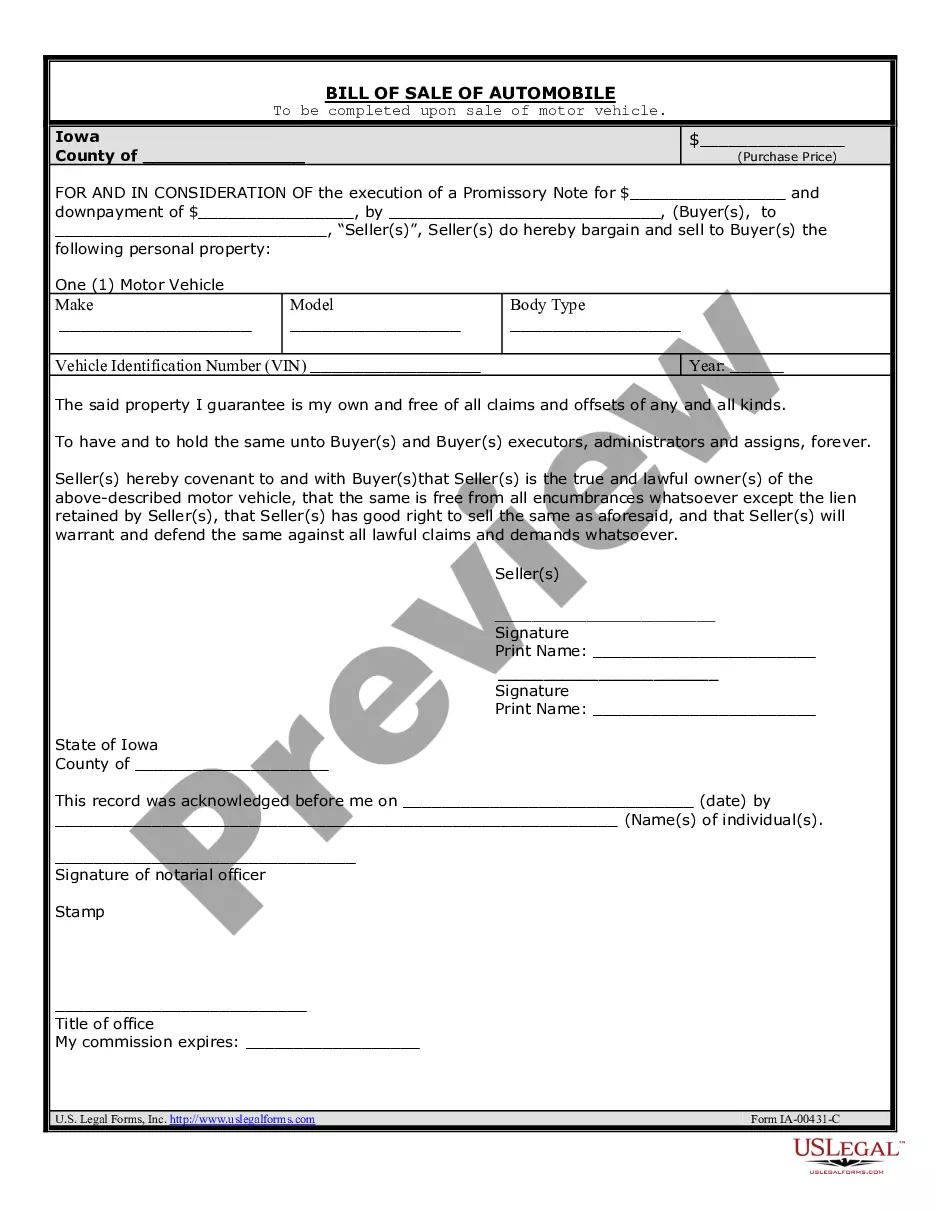

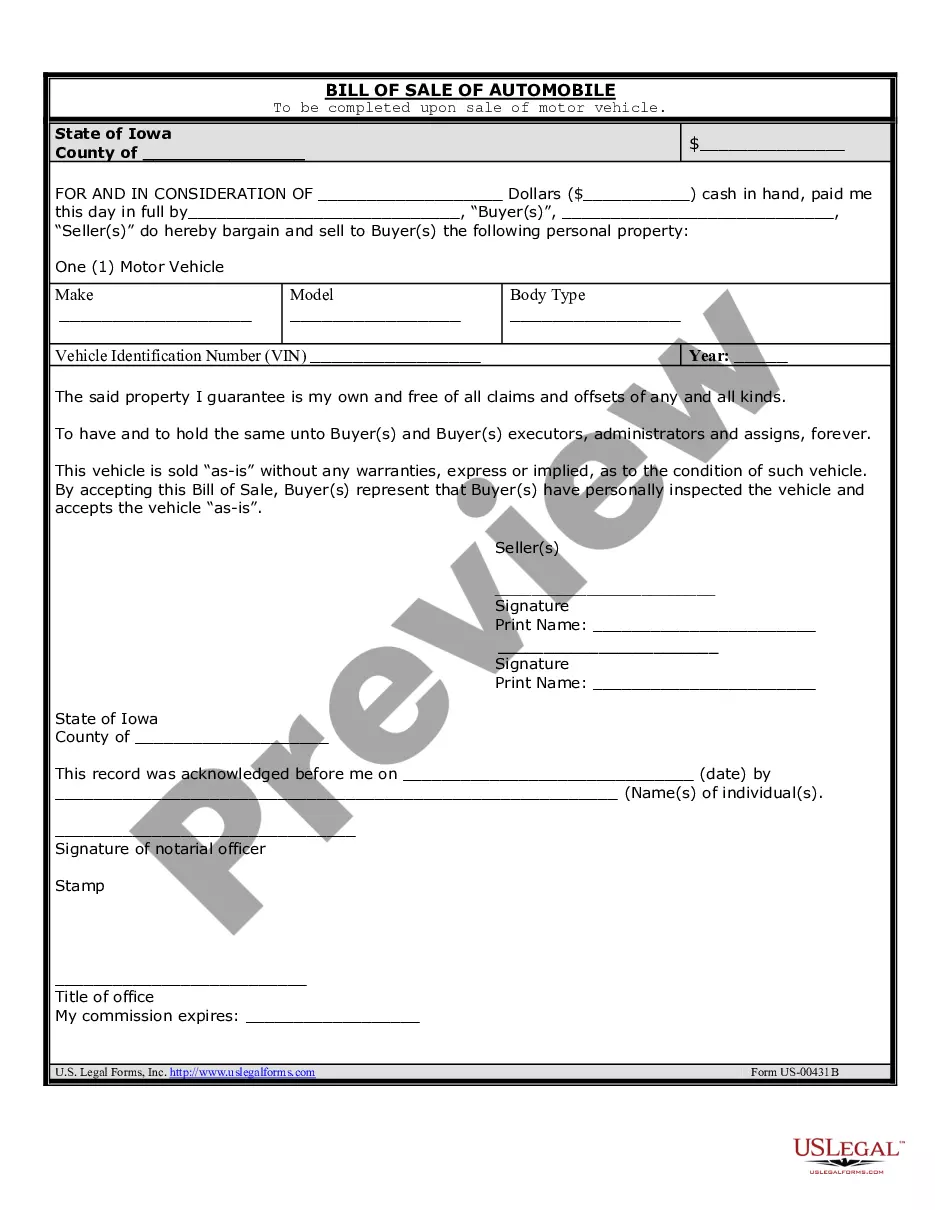

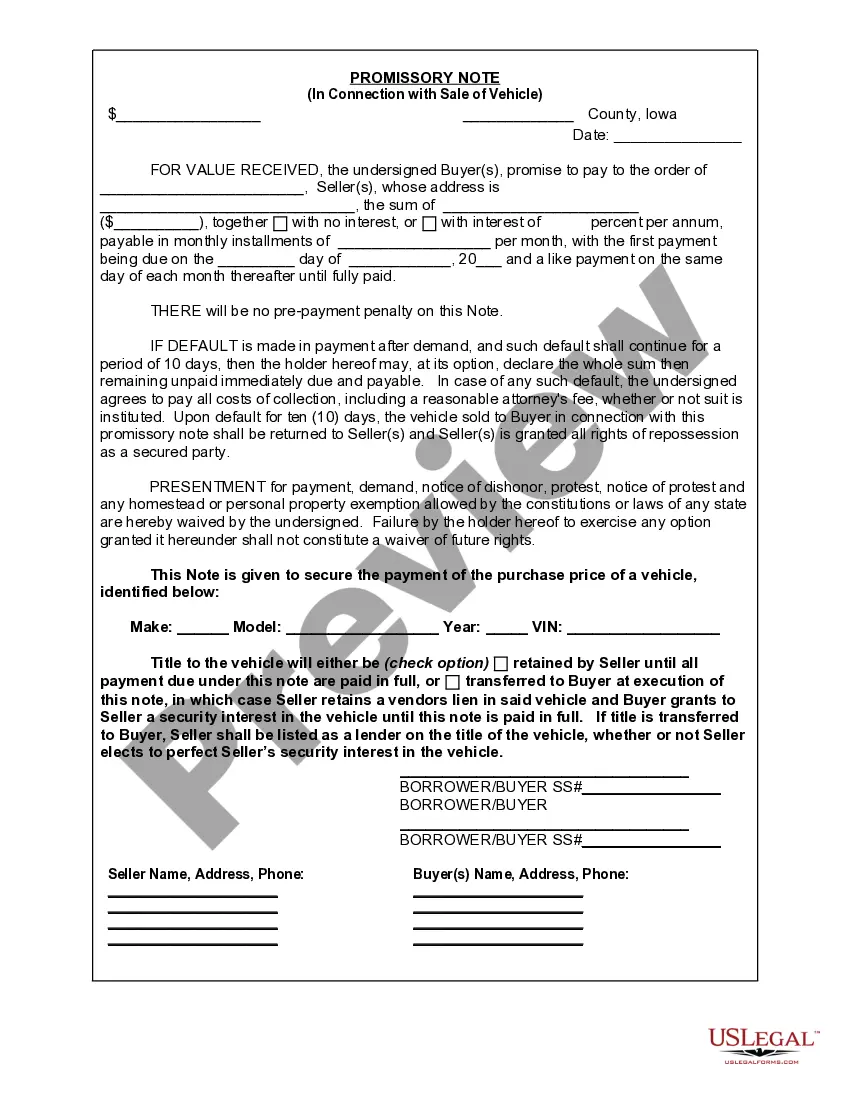

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Davenport Iowa promissory note in connection with the sale of a vehicle or automobile refers to a legal document that outlines the financial agreement between a buyer and a seller when purchasing a vehicle. This promissory note serves as evidence of the buyer's promise to repay the seller for the vehicle according to certain terms and conditions. When creating a Davenport Iowa promissory note, it is crucial to include several key elements. These typically include: 1. Parties Involved: Clearly state the names and contact information of both the buyer and the seller involved in the transaction. 2. Vehicle Details: Provide a detailed description of the vehicle being sold, including its make, model, year, vehicle identification number (VIN), and any relevant characteristics. 3. Purchase Price: State the agreed-upon purchase price for the vehicle and specify if any down payment or trade-in value is included in the total amount. Ensure the currency and date of the transaction are mentioned. 4. Repayment Terms: Specify the terms of repayment, such as the total repayment period, the frequency of payments (e.g., monthly, quarterly), and the amount of each installment. Additionally, include the interest rate (if applicable) that will be charged on the outstanding balance. 5. Late Payment: Clearly state the consequences of late payment, including any penalties, additional interest, or actions that may be taken by the seller in the event of non-payment. 6. Security Agreement: If the promissory note is secured by the vehicle being sold, mention the specifics of the security interest, such as the conditions for repossession in the event of default. 7. Governing Law: State that the promissory note is governed by the laws of the state of Iowa, particularly in Davenport, ensuring consistency with local regulations. It's important to note that while there might not be specific types of Davenport Iowa promissory notes for vehicle sales, the content and format can vary depending on individual circumstances and the agreement reached between the buyer and seller. It is always advisable to consult with a legal professional or utilize a template specifically designed for Davenport Iowa to ensure compliance with local laws and regulations. Keywords: Davenport Iowa, promissory note, connection, sale, vehicle, automobile, legal document, financial agreement, buyer, seller, purchase price, repayment terms, interest rate, late payment, security agreement, governing law.A Davenport Iowa promissory note in connection with the sale of a vehicle or automobile refers to a legal document that outlines the financial agreement between a buyer and a seller when purchasing a vehicle. This promissory note serves as evidence of the buyer's promise to repay the seller for the vehicle according to certain terms and conditions. When creating a Davenport Iowa promissory note, it is crucial to include several key elements. These typically include: 1. Parties Involved: Clearly state the names and contact information of both the buyer and the seller involved in the transaction. 2. Vehicle Details: Provide a detailed description of the vehicle being sold, including its make, model, year, vehicle identification number (VIN), and any relevant characteristics. 3. Purchase Price: State the agreed-upon purchase price for the vehicle and specify if any down payment or trade-in value is included in the total amount. Ensure the currency and date of the transaction are mentioned. 4. Repayment Terms: Specify the terms of repayment, such as the total repayment period, the frequency of payments (e.g., monthly, quarterly), and the amount of each installment. Additionally, include the interest rate (if applicable) that will be charged on the outstanding balance. 5. Late Payment: Clearly state the consequences of late payment, including any penalties, additional interest, or actions that may be taken by the seller in the event of non-payment. 6. Security Agreement: If the promissory note is secured by the vehicle being sold, mention the specifics of the security interest, such as the conditions for repossession in the event of default. 7. Governing Law: State that the promissory note is governed by the laws of the state of Iowa, particularly in Davenport, ensuring consistency with local regulations. It's important to note that while there might not be specific types of Davenport Iowa promissory notes for vehicle sales, the content and format can vary depending on individual circumstances and the agreement reached between the buyer and seller. It is always advisable to consult with a legal professional or utilize a template specifically designed for Davenport Iowa to ensure compliance with local laws and regulations. Keywords: Davenport Iowa, promissory note, connection, sale, vehicle, automobile, legal document, financial agreement, buyer, seller, purchase price, repayment terms, interest rate, late payment, security agreement, governing law.