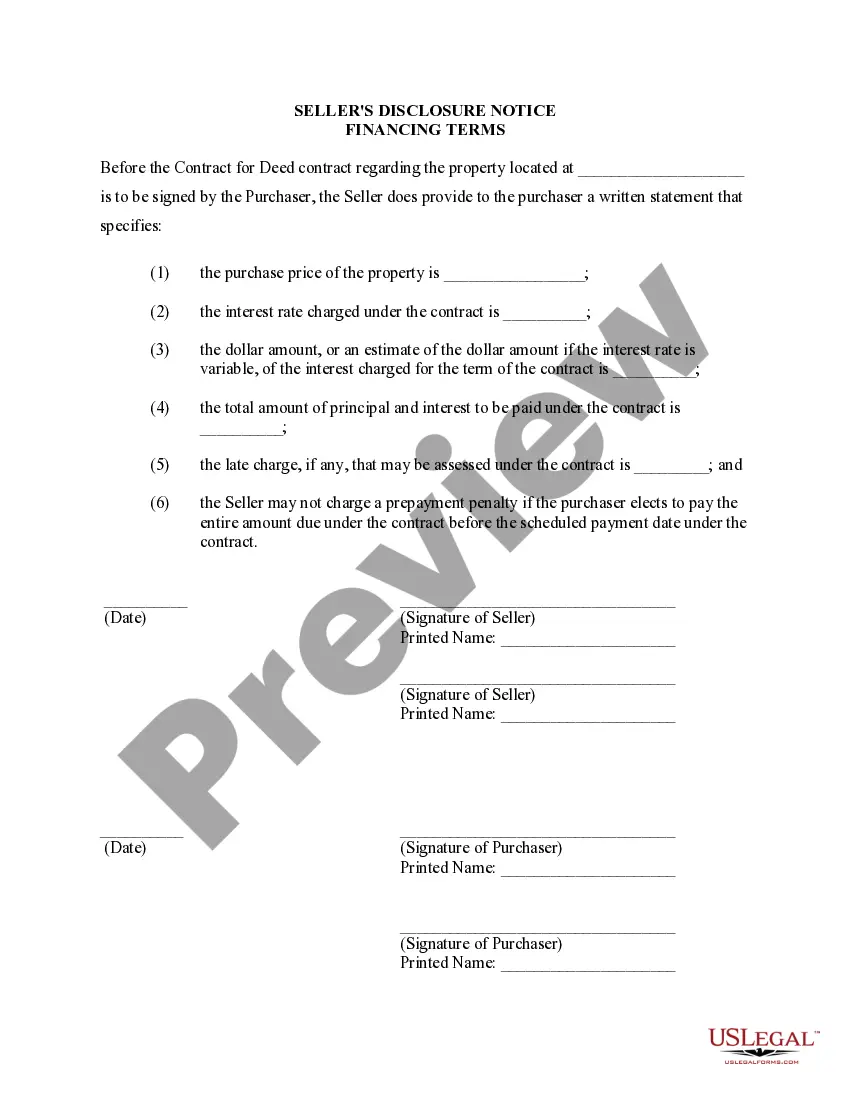

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

Cedar Rapids Iowa Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out Iowa Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

We consistently aim to reduce or avert legal repercussions when navigating intricate legal or financial issues.

To achieve this, we opt for legal services that are typically quite costly.

Nonetheless, not every legal situation is as complicated.

Most of them can be managed independently.

Utilize US Legal Forms whenever you need to obtain and download the Cedar Rapids Iowa Seller's Disclosure of Financing Terms for Residential Property related to a Contract or Agreement for Deed aka Land Contract or any other document quickly and securely.

- US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our library empowers you to handle your affairs without relying on a lawyer’s assistance.

- We offer access to legal form templates that aren’t frequently publicly available.

- Our templates are tailored to specific states and regions, which greatly simplifies the search process.

Form popularity

FAQ

Exchange of contracts is the point at which the buyer pays a deposit and the sale/purchase contract becomes legally binding. Completion is when the balance of the payment for the property is passed over to the seller's solicitor and ownership transfers to the buyer.

The buyer and seller will agree to a purchase price as well as other terms. The buyer usually agrees to make an initial down payment and then a number of regular payments. After the buyer makes all payments and completes other important obligations the seller then transfers title of the home to the buyer.

In real estate, a home is under contract when a buyer and seller have signed and dated a legal document to purchase a home. The written agreement provides details about both parties and the property being purchased, along with a breakdown of the price and costs involved in the transaction.

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.

With a traditional mortgage, your score is everything. Buying on contract, your credit score won't carry as much weight. This makes it great for people who may not have the best credit scores. Keep in mind that should you need to take out a loan to pay for the balloon payment, then your score will matter.

Under contract means that a seller has accepted an offer on the property, but the sale is not final until all contingencies are met. It typically takes 4 ? 8 weeks from the date the offer is accepted until the sale is complete.

Buying a house on contract simply means agreeing to buy a house and entering into a contract with the seller. The buyer and seller will agree to a purchase price as well as other terms. The buyer usually agrees to make an initial down payment and then a number of regular payments.

A contract for deed is an agreement for buying property without going to a mortgage lender. The buyer agrees to pay the seller monthly payments, and the deed is turned over to the buyer when all payments have been made.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.

Iowa Code 558A requires home sellers to deliver written disclosure statements to any person interested in buying a property before they have made a formal offer or the offer has been accepted. If problems such as a wet basement are disclosed, ask follow-up questions in writing for more details.