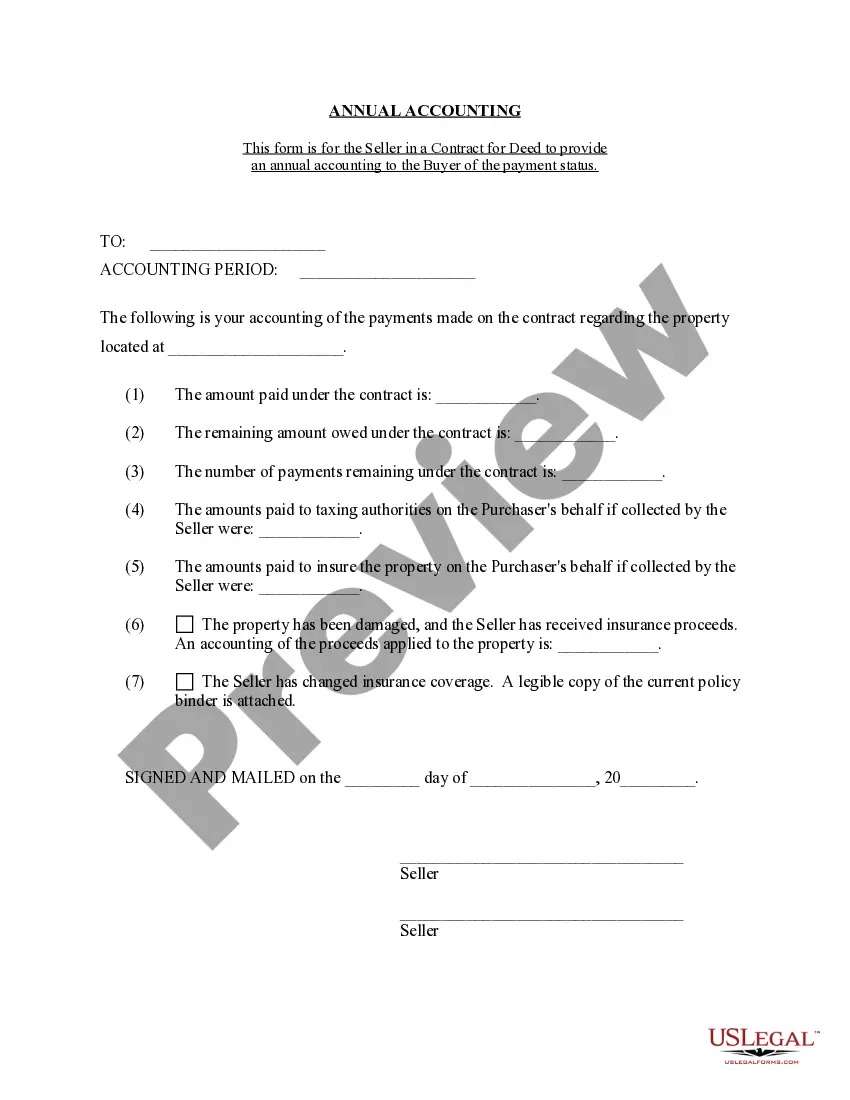

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

The Cedar Rapids Iowa Contracts for Deed Seller's Annual Accounting Statement is a crucial document that outlines the financial transactions and obligations between the seller and buyer in a contract for deed arrangement. This statement provides a detailed breakdown of the income, expenses, and overall financial condition of the property under the contract. It serves as a record-keeping tool that ensures transparency and accountability in the contract for deed agreement. The Cedar Rapids Iowa Contracts for Deed Seller's Annual Accounting Statement includes various key components, such as: 1. Property Information: This section includes the property address, legal description, and the names of both the seller and buyer. 2. Financial Summary: A comprehensive overview of the property's financial aspects, including the total income generated, expenses incurred, and any outstanding balances. 3. Income: This section lists all the income sources associated with the property, such as monthly payments made by the buyer, rental income (if applicable), and any other revenue streams related to the property. 4. Expenses: A breakdown of all the expenses related to the property, including property taxes, insurance costs, maintenance expenses, and any other relevant charges. 5. Outstanding Balances: If there are any outstanding payments or balances owed by the buyer, they will be clearly stated in this section, ensuring both parties are aware of their financial obligations. 6. Amendments or Modifications: In the event of any changes made to the contract for deed agreement throughout the year, such as adjustments in payment schedules or interest rates, this section highlights the details of those alterations. 7. Dispute Resolution: This section outlines the process for resolving any disputes or discrepancies that may arise between the seller and buyer regarding the accounting statement or the contract for deed agreement. Overall, the Cedar Rapids Iowa Contracts for Deed Seller's Annual Accounting Statement plays a pivotal role in maintaining transparency and financial clarity between the contracting parties. It ensures that both the seller and buyer are informed about the financial status of the property, facilitating a smooth and equitable contractual relationship. Different types of Cedar Rapids Iowa Contracts for Deed Seller's Annual Accounting Statement may include variations based on specific contract terms, such as: 1. Basic Annual Accounting Statement: This is a standard statement that provides a general overview of the property's financial status and transactions. 2. Detailed Income-Expense Statement: This type of accounting statement includes a more detailed breakdown of the income sources and expenses incurred, allowing for a comprehensive understanding of the property's financial performance. 3. Amended Annual Accounting Statement: In cases where the initial contract for deed agreement has been amended or modified during the year, this statement reflects the changes made to the financial terms of the contract. 4. Escrow Account Statement: If an escrow account is set up for the contract for deed arrangement, a separate statement may be provided, outlining the balances, interest earned, and disbursements made from the account. It is essential for both the seller and buyer to review the Cedar Rapids Iowa Contracts for Deed Seller's Annual Accounting Statement meticulously to ensure accuracy, address any discrepancies, and maintain a healthy working relationship throughout the contract term.