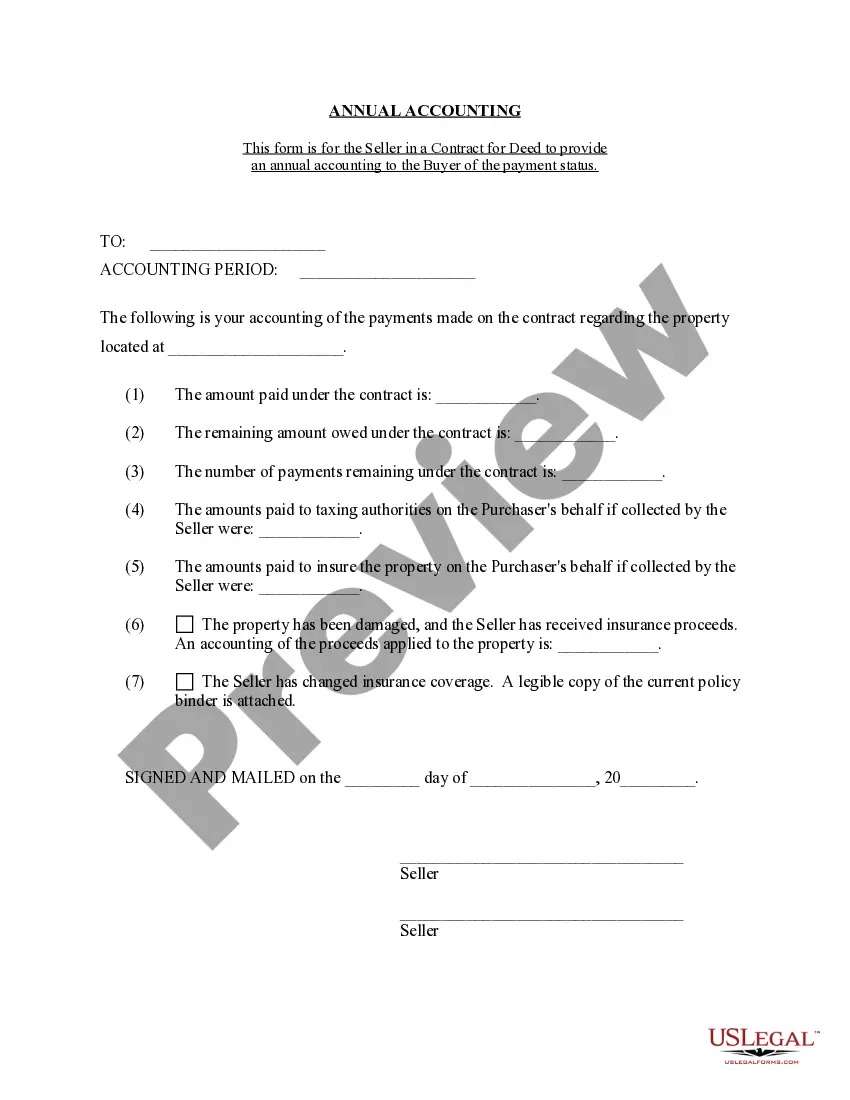

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

The Davenport Iowa Contract for Deed Seller's Annual Accounting Statement is a vital document used in real estate transactions governed by the contract for deed arrangement. This statement is designed to provide a comprehensive overview of the financial transactions related to the contract for deed between the seller and the buyer. It outlines the seller's income, expenses, and any other relevant financial information, ensuring transparency and accountability in the contractual agreement. The Davenport Iowa Contract for Deed Seller's Annual Accounting Statement serves various purposes, including enabling sellers to track their income generated by the contract for deed, ensuring accurate disclosure of financial data to both parties involved in the agreement, and facilitating compliance with legal requirements. This statement is typically prepared on an annual basis, summarizing the financial activities of the preceding year. Keywords: Davenport Iowa, Contract for Deed, Seller's, Annual Accounting Statement, real estate transactions, financial transactions, contract for deed arrangement, seller, buyer, income, expenses, financial information, transparency, accountability, contractual agreement, disclosure, compliance, legal requirements, annual basis, financial activities. Different types of Davenport Iowa Contract for Deed Seller's Annual Accounting Statements may include: 1. Basic Annual Accounting Statement: A simple statement providing a general overview of the seller's income, expenses, and financial activities related to the contract for deed. 2. Detailed Income and Expense Statement: A more comprehensive statement presenting a breakdown of the seller's income and expenses, including a detailed analysis of all financial transactions concerning the contract for deed. 3. Tax Report: A specialized accounting statement specifically prepared to comply with tax regulations, itemizing the seller's taxable income and deductible expenses associated with the contract for deed. 4. Cash Flow Statement: This type of statement focuses on the inflow and outflow of cash within the contract for deed arrangement, highlighting the seller's cash-based financial activities. 5. Profit and Loss Statement: An essential accounting document that summarizes the seller's revenue, costs, and resulting profit or loss from the contract for deed during a specific period, often prepared annually. By utilizing these different types of Davenport Iowa Contract for Deed Seller's Annual Accounting Statements, sellers can effectively manage their financial records, ensure transparency with buyers, and remain compliant with legal and tax obligations.The Davenport Iowa Contract for Deed Seller's Annual Accounting Statement is a vital document used in real estate transactions governed by the contract for deed arrangement. This statement is designed to provide a comprehensive overview of the financial transactions related to the contract for deed between the seller and the buyer. It outlines the seller's income, expenses, and any other relevant financial information, ensuring transparency and accountability in the contractual agreement. The Davenport Iowa Contract for Deed Seller's Annual Accounting Statement serves various purposes, including enabling sellers to track their income generated by the contract for deed, ensuring accurate disclosure of financial data to both parties involved in the agreement, and facilitating compliance with legal requirements. This statement is typically prepared on an annual basis, summarizing the financial activities of the preceding year. Keywords: Davenport Iowa, Contract for Deed, Seller's, Annual Accounting Statement, real estate transactions, financial transactions, contract for deed arrangement, seller, buyer, income, expenses, financial information, transparency, accountability, contractual agreement, disclosure, compliance, legal requirements, annual basis, financial activities. Different types of Davenport Iowa Contract for Deed Seller's Annual Accounting Statements may include: 1. Basic Annual Accounting Statement: A simple statement providing a general overview of the seller's income, expenses, and financial activities related to the contract for deed. 2. Detailed Income and Expense Statement: A more comprehensive statement presenting a breakdown of the seller's income and expenses, including a detailed analysis of all financial transactions concerning the contract for deed. 3. Tax Report: A specialized accounting statement specifically prepared to comply with tax regulations, itemizing the seller's taxable income and deductible expenses associated with the contract for deed. 4. Cash Flow Statement: This type of statement focuses on the inflow and outflow of cash within the contract for deed arrangement, highlighting the seller's cash-based financial activities. 5. Profit and Loss Statement: An essential accounting document that summarizes the seller's revenue, costs, and resulting profit or loss from the contract for deed during a specific period, often prepared annually. By utilizing these different types of Davenport Iowa Contract for Deed Seller's Annual Accounting Statements, sellers can effectively manage their financial records, ensure transparency with buyers, and remain compliant with legal and tax obligations.