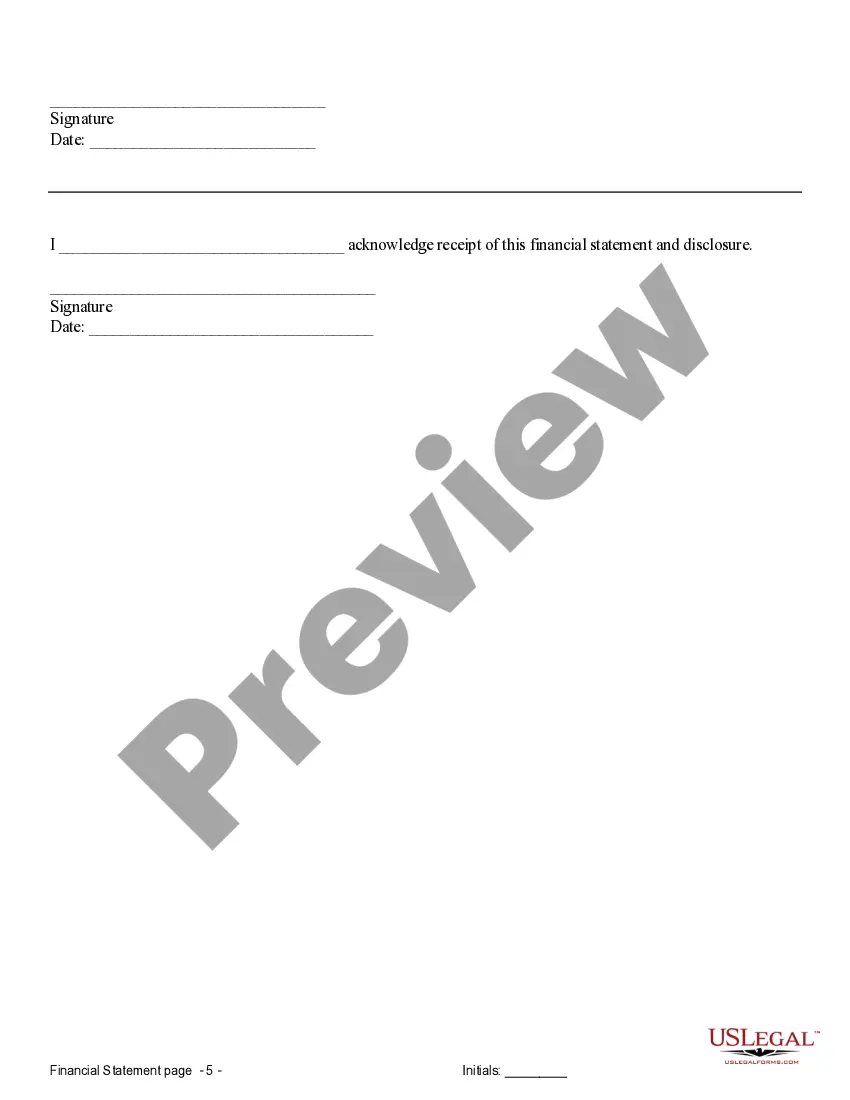

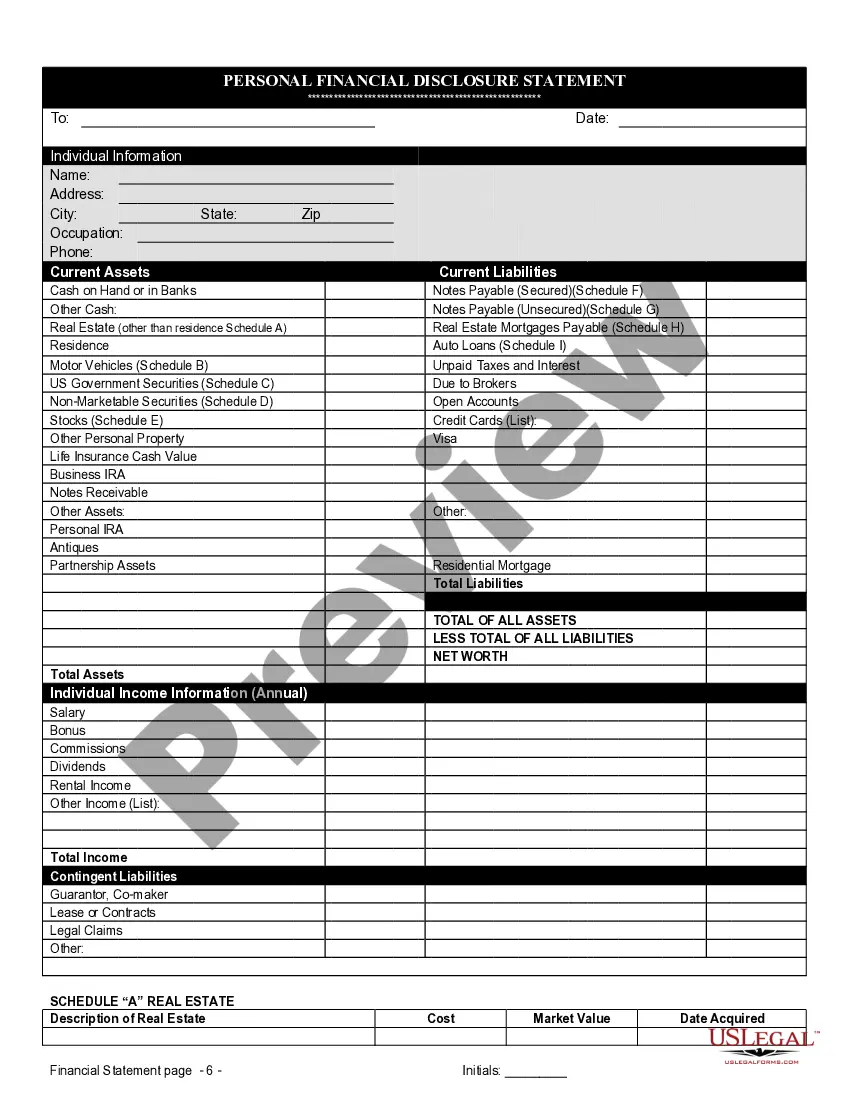

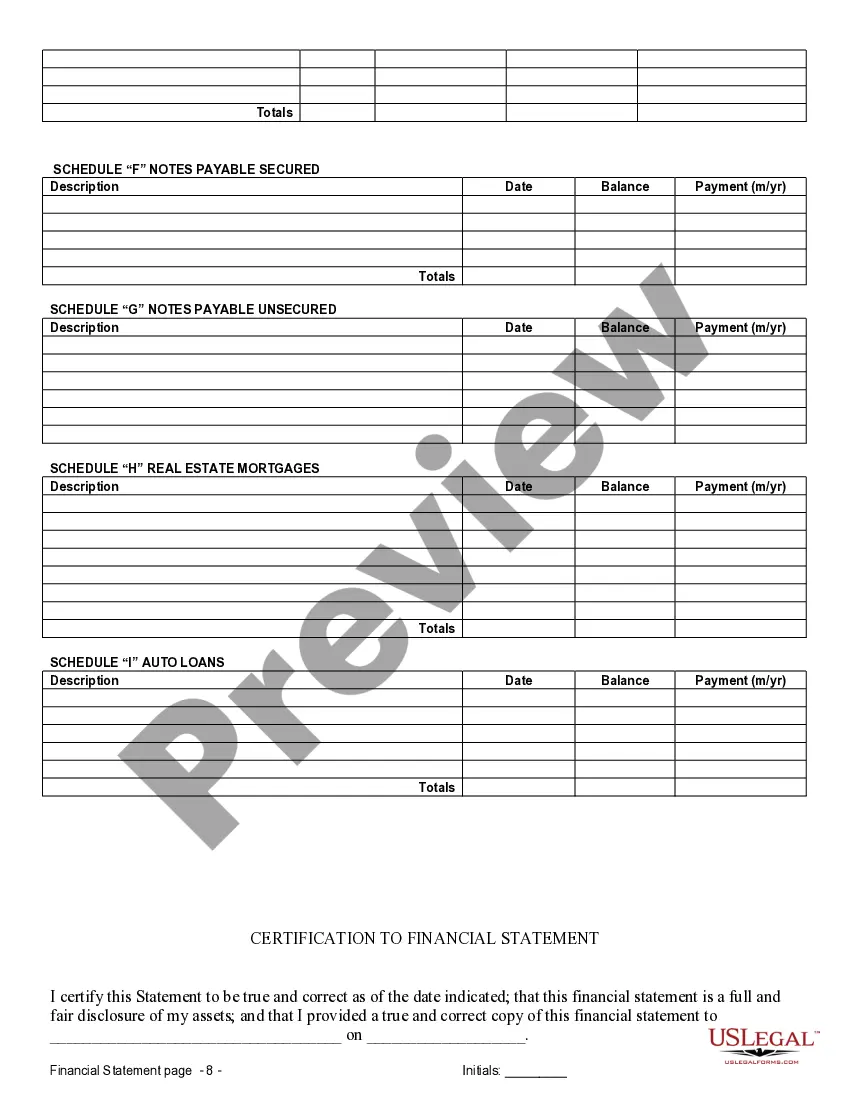

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

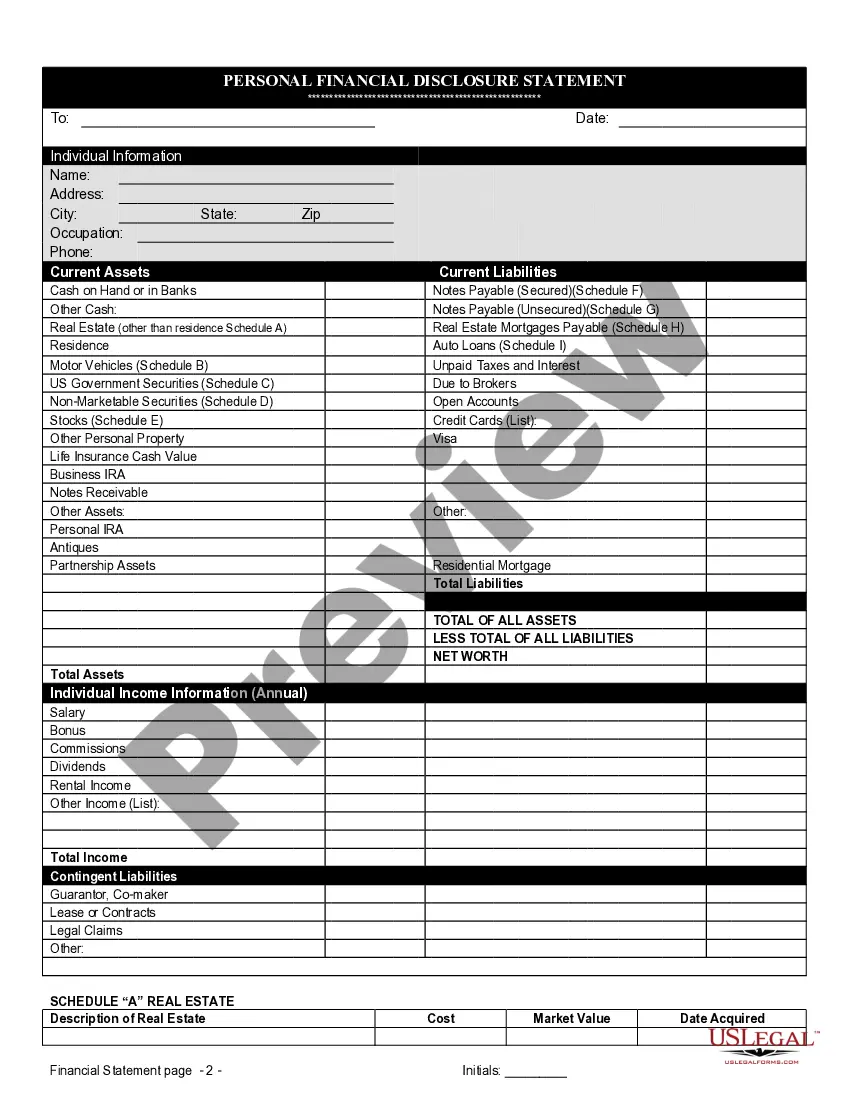

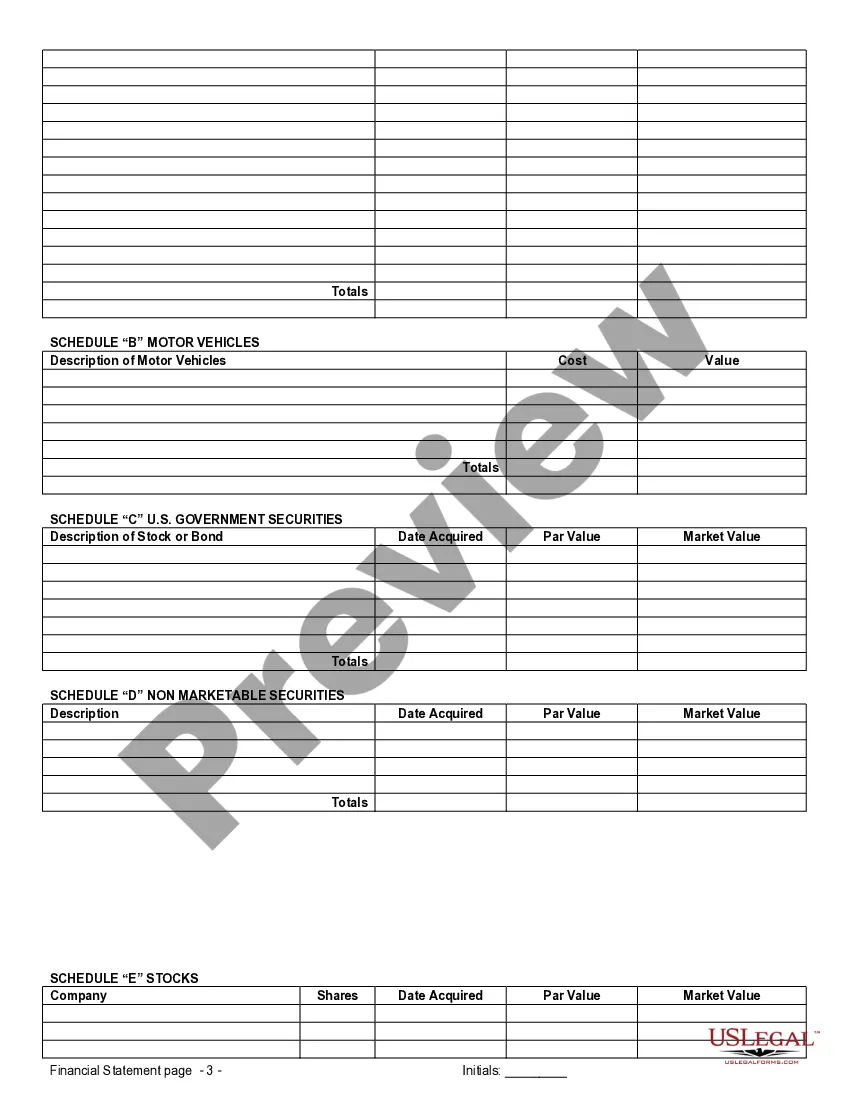

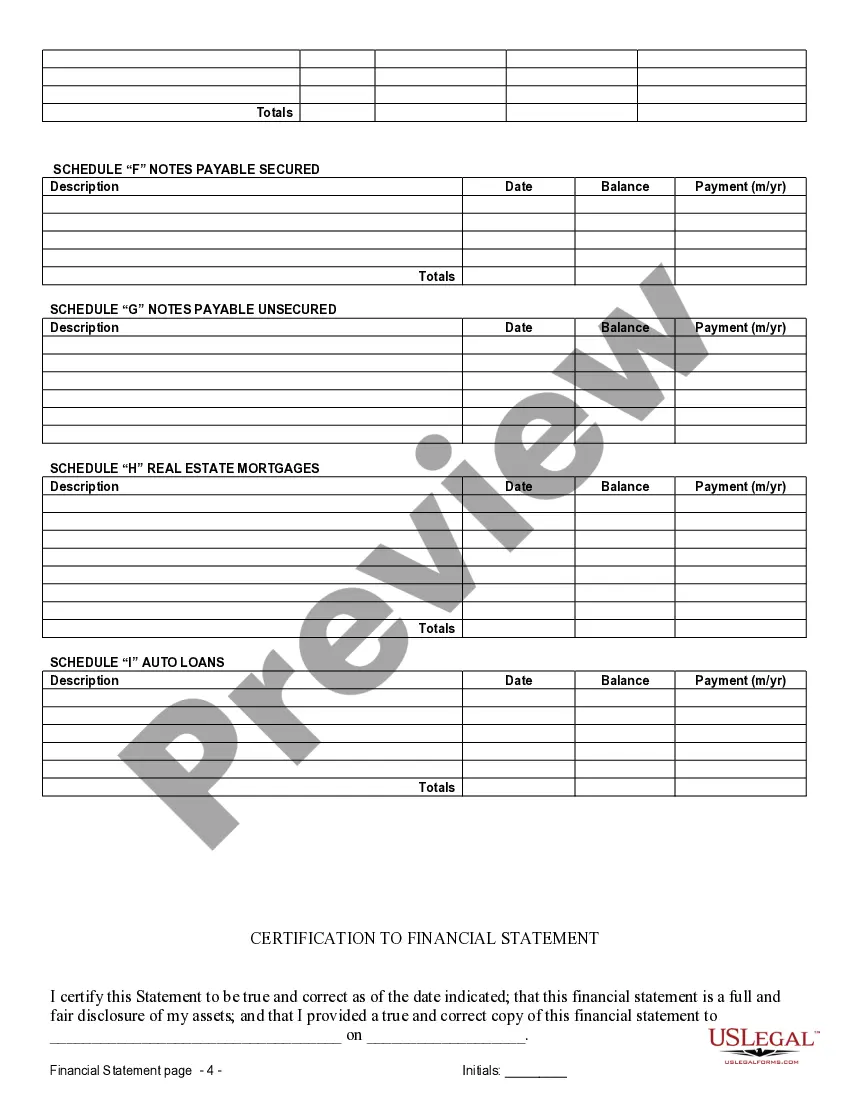

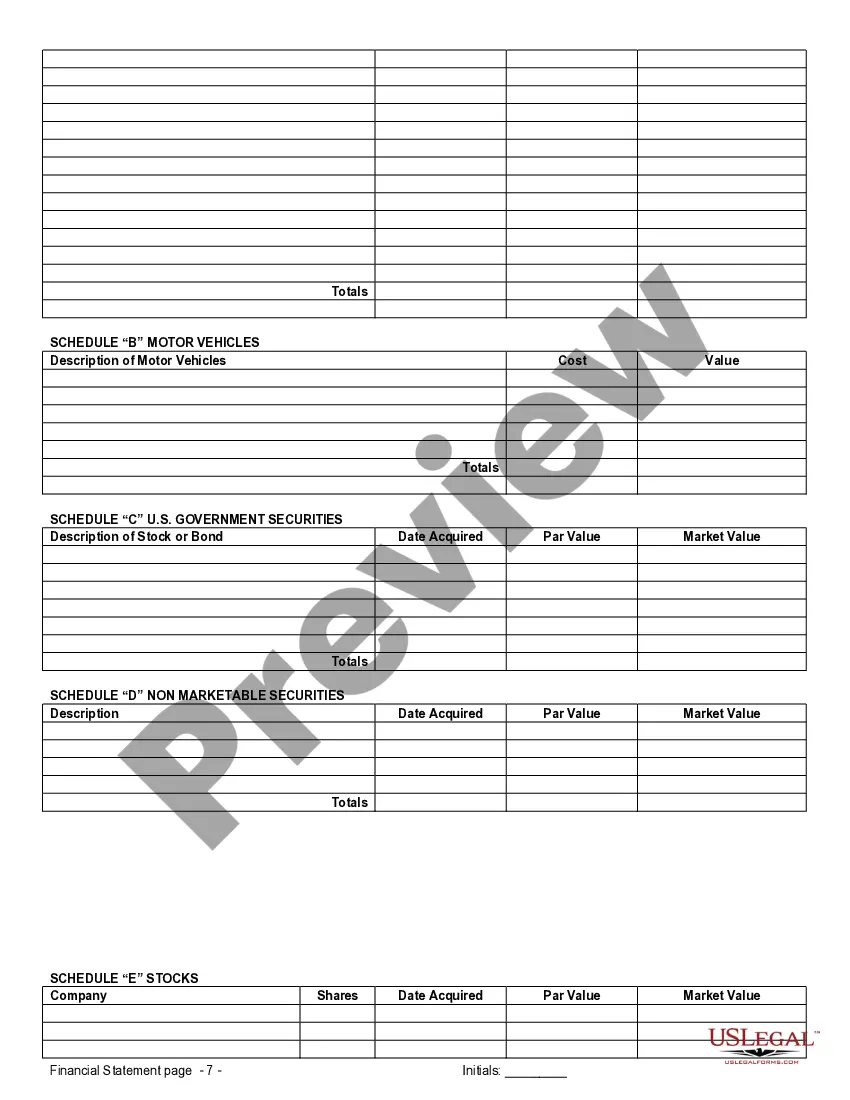

Davenport Iowa Financial Statements in Connection with Prenuptial Premarital Agreement: Key Details and Types When considering a prenuptial or premarital agreement in Davenport, Iowa, financial statements play a critical role in ensuring transparency, fairness, and protection for both parties involved. Financial statements provide a comprehensive overview of each individual's assets, liabilities, income, and expenses. These statements carry great significance as they aid in establishing the foundation for the agreement's financial provisions and can greatly impact the division of assets and obligations in the event of divorce or separation. There are different types of Davenport Iowa financial statements that are commonly used in connection with prenuptial or premarital agreements, including: 1. Personal Financial Statement: This statement encompasses an individual's personal financial information, such as bank accounts, investments, real estate properties, stocks, and any other form of valuable assets. It also covers liabilities, including mortgages, loans, and credit card debts. Providing accurate details in a personal financial statement is crucial to ensure a fair and transparent prenuptial or premarital agreement process. 2. Income Statement: An income statement outlines an individual's sources of income, including employment salaries, business profits, rental income, and other investments. It helps establish each party's financial standing and determine the potential spousal support obligations if required. 3. Expense Statement: An expense statement provides a breakdown of an individual's regular and recurring expenses, such as housing costs, utilities, transportation, education loans, healthcare, and other essential expenses. By examining the expense statement, both parties gain insight into the lifestyle and financial commitments of the other party, contributing to a more equitable prenuptial or premarital agreement. 4. Property and Asset Valuation Reports: In addition to statements summarizing financial details, property and asset valuation reports can be crucial elements tied to prenuptial or premarital agreements. These reports provide a professional assessment of the worth of tangible and intangible assets, including real estate properties, businesses, intellectual property, vehicles, and artwork. Accurate valuation forms a foundation for equitable asset division if the marriage ends in separation or divorce. It is important to note that the types and depth of financial statements required for a prenuptial or premarital agreement can vary depending on the complexity of each individual's financial situation. Parties seeking such agreements in Davenport, Iowa, are advised to consult with experienced family law attorneys or financial advisors who can guide them through the process and ensure compliance with the legal requirements of the state. In conclusion, Davenport Iowa financial statements assist in establishing a fair and transparent prenuptial or premarital agreement process. Personal financial statements, income statements, expense statements, and property and asset valuation reports are among the key types of statements utilized to evaluate each party's financial standing and facilitate equitable asset division in case of separation or divorce. Seeking professional assistance is highly recommended navigating through the complexities of these financial statements and ensure compliance with the applicable legal standards in Davenport, Iowa.Davenport Iowa Financial Statements in Connection with Prenuptial Premarital Agreement: Key Details and Types When considering a prenuptial or premarital agreement in Davenport, Iowa, financial statements play a critical role in ensuring transparency, fairness, and protection for both parties involved. Financial statements provide a comprehensive overview of each individual's assets, liabilities, income, and expenses. These statements carry great significance as they aid in establishing the foundation for the agreement's financial provisions and can greatly impact the division of assets and obligations in the event of divorce or separation. There are different types of Davenport Iowa financial statements that are commonly used in connection with prenuptial or premarital agreements, including: 1. Personal Financial Statement: This statement encompasses an individual's personal financial information, such as bank accounts, investments, real estate properties, stocks, and any other form of valuable assets. It also covers liabilities, including mortgages, loans, and credit card debts. Providing accurate details in a personal financial statement is crucial to ensure a fair and transparent prenuptial or premarital agreement process. 2. Income Statement: An income statement outlines an individual's sources of income, including employment salaries, business profits, rental income, and other investments. It helps establish each party's financial standing and determine the potential spousal support obligations if required. 3. Expense Statement: An expense statement provides a breakdown of an individual's regular and recurring expenses, such as housing costs, utilities, transportation, education loans, healthcare, and other essential expenses. By examining the expense statement, both parties gain insight into the lifestyle and financial commitments of the other party, contributing to a more equitable prenuptial or premarital agreement. 4. Property and Asset Valuation Reports: In addition to statements summarizing financial details, property and asset valuation reports can be crucial elements tied to prenuptial or premarital agreements. These reports provide a professional assessment of the worth of tangible and intangible assets, including real estate properties, businesses, intellectual property, vehicles, and artwork. Accurate valuation forms a foundation for equitable asset division if the marriage ends in separation or divorce. It is important to note that the types and depth of financial statements required for a prenuptial or premarital agreement can vary depending on the complexity of each individual's financial situation. Parties seeking such agreements in Davenport, Iowa, are advised to consult with experienced family law attorneys or financial advisors who can guide them through the process and ensure compliance with the legal requirements of the state. In conclusion, Davenport Iowa financial statements assist in establishing a fair and transparent prenuptial or premarital agreement process. Personal financial statements, income statements, expense statements, and property and asset valuation reports are among the key types of statements utilized to evaluate each party's financial standing and facilitate equitable asset division in case of separation or divorce. Seeking professional assistance is highly recommended navigating through the complexities of these financial statements and ensure compliance with the applicable legal standards in Davenport, Iowa.