Cedar Rapids Iowa Farm Lease- Cash or Crop Shares: An Insight into Farmland Agreements The Cedar Rapids Iowa Farm Lease- Cash or Crop Shares is a legally binding agreement between a landowner (typically referred to as the lessor) and a farmer (referred to as the lessee), dictating the terms and conditions of using agricultural land for the cultivation of crops. This lease agreement can be structured in two primary ways: Cash Lease or Crop Share Lease. 1. Cedar Rapids Iowa Cash Lease: In a cash lease arrangement, the farmer pays a fixed amount of money to the landowner as rent for using the farmland. This fixed payment is typically determined on an annual basis, regardless of the crop yield or market fluctuations. The cash lease offers stability for both parties, as the landowner receives a known income, while the farmer assumes the risk of both positive and negative crop outcomes. 2. Cedar Rapids Iowa Crop Share Lease: In a crop share lease, the landowner and farmer agree to share the proceeds derived from the cultivated crops. The exact percentage of the crop share may vary depending on factors such as land productivity, expenses borne by each party, and market conditions. This type of lease spreads risk between the landowner and farmer, as they divide potential gains or losses based on the yield and market prices. Both cash lease and crop share lease types have their own pros and cons, and the choice between the two depends on the specific goals and preferences of both parties involved. Factors such as land fertility, expected crop yield, commodity prices, and cost-sharing responsibilities influence the decision-making process. Key terms included in the Cedar Rapids Iowa Farm Lease- Cash or Crop Shares may encompass land use restrictions, duration of the lease, payment dates, terms of payment collection, maintenance responsibilities, provision for yearly crop rotation, allocation of production costs, and regulations regarding the use of chemicals or GMOs. Landowners benefit from farm leasing by generating additional income from their property while relieving themselves of the operational and marketing responsibilities associated with agriculture. Farmers, on the other hand, gain access to arable land without having to bear the significant financial burden of land ownership. These agreements provide an opportunity to grow and expand farm operations without substantial upfront investments. Whether cultivating corn, soybeans, wheat, or other crops, the Cedar Rapids Iowa Farm Lease- Cash or Crop Shares presents an important legal framework that sets expectations and safeguards the interests of both landowners and farmers. By clarifying responsibilities, rights, and financial arrangements, this lease agreement fosters a mutually beneficial relationship in the dynamic world of agricultural land tenure.

Cedar Rapids Iowa Farm Lease- Cash of Crop Shares

Category:

State:

Iowa

City:

Cedar Rapids

Control #:

IA-005LRS

Format:

Word;

Rich Text

Instant download

Description

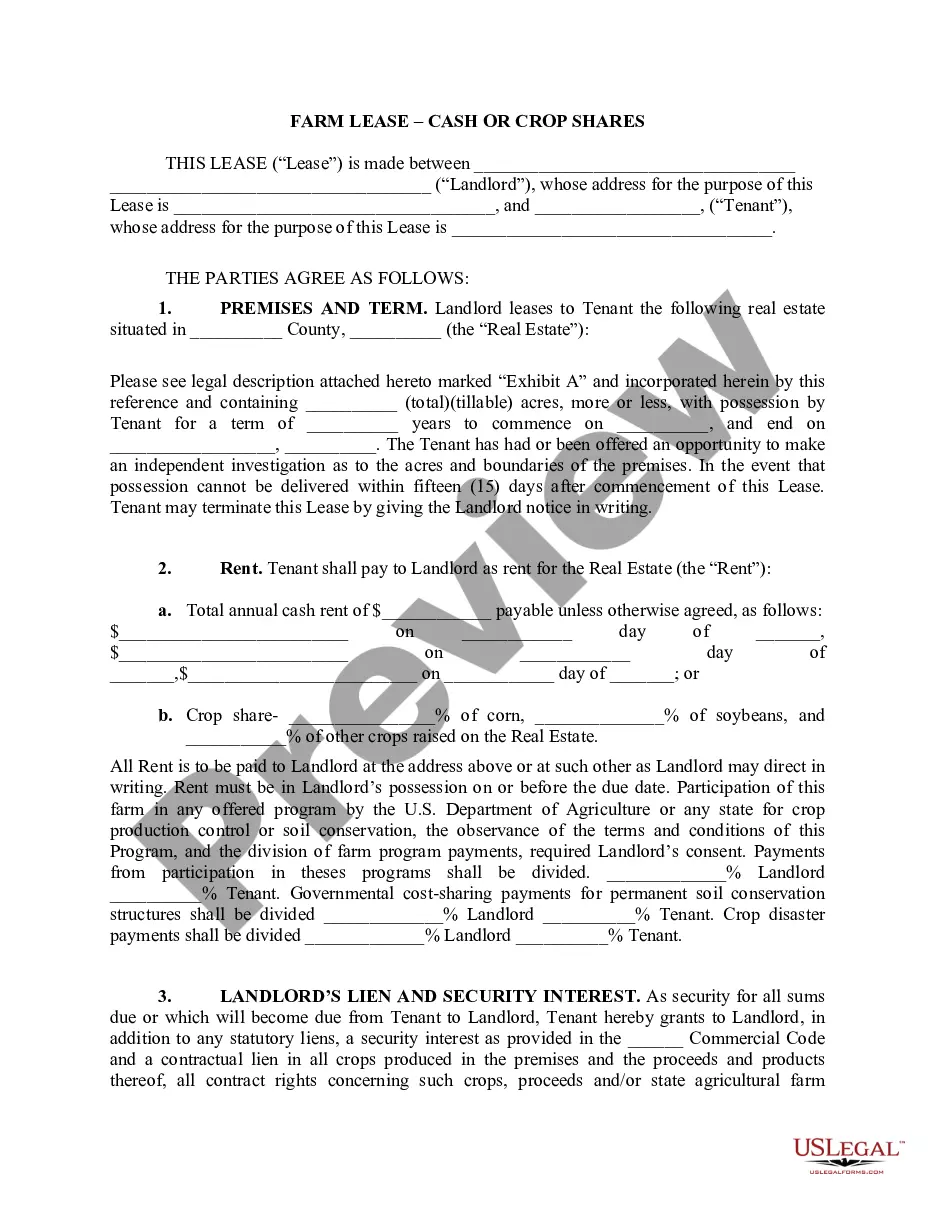

Detailed crop share farmland lease. Costs and crops are shared by landowner and tenant. Provides for detailed division of costs.

Cedar Rapids Iowa Farm Lease- Cash or Crop Shares: An Insight into Farmland Agreements The Cedar Rapids Iowa Farm Lease- Cash or Crop Shares is a legally binding agreement between a landowner (typically referred to as the lessor) and a farmer (referred to as the lessee), dictating the terms and conditions of using agricultural land for the cultivation of crops. This lease agreement can be structured in two primary ways: Cash Lease or Crop Share Lease. 1. Cedar Rapids Iowa Cash Lease: In a cash lease arrangement, the farmer pays a fixed amount of money to the landowner as rent for using the farmland. This fixed payment is typically determined on an annual basis, regardless of the crop yield or market fluctuations. The cash lease offers stability for both parties, as the landowner receives a known income, while the farmer assumes the risk of both positive and negative crop outcomes. 2. Cedar Rapids Iowa Crop Share Lease: In a crop share lease, the landowner and farmer agree to share the proceeds derived from the cultivated crops. The exact percentage of the crop share may vary depending on factors such as land productivity, expenses borne by each party, and market conditions. This type of lease spreads risk between the landowner and farmer, as they divide potential gains or losses based on the yield and market prices. Both cash lease and crop share lease types have their own pros and cons, and the choice between the two depends on the specific goals and preferences of both parties involved. Factors such as land fertility, expected crop yield, commodity prices, and cost-sharing responsibilities influence the decision-making process. Key terms included in the Cedar Rapids Iowa Farm Lease- Cash or Crop Shares may encompass land use restrictions, duration of the lease, payment dates, terms of payment collection, maintenance responsibilities, provision for yearly crop rotation, allocation of production costs, and regulations regarding the use of chemicals or GMOs. Landowners benefit from farm leasing by generating additional income from their property while relieving themselves of the operational and marketing responsibilities associated with agriculture. Farmers, on the other hand, gain access to arable land without having to bear the significant financial burden of land ownership. These agreements provide an opportunity to grow and expand farm operations without substantial upfront investments. Whether cultivating corn, soybeans, wheat, or other crops, the Cedar Rapids Iowa Farm Lease- Cash or Crop Shares presents an important legal framework that sets expectations and safeguards the interests of both landowners and farmers. By clarifying responsibilities, rights, and financial arrangements, this lease agreement fosters a mutually beneficial relationship in the dynamic world of agricultural land tenure.

Free preview

How to fill out Cedar Rapids Iowa Farm Lease- Cash Of Crop Shares?

If you’ve already utilized our service before, log in to your account and download the Cedar Rapids Iowa Farm Lease- Cash of Crop Shares on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your document:

- Ensure you’ve located the right document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Cedar Rapids Iowa Farm Lease- Cash of Crop Shares. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!