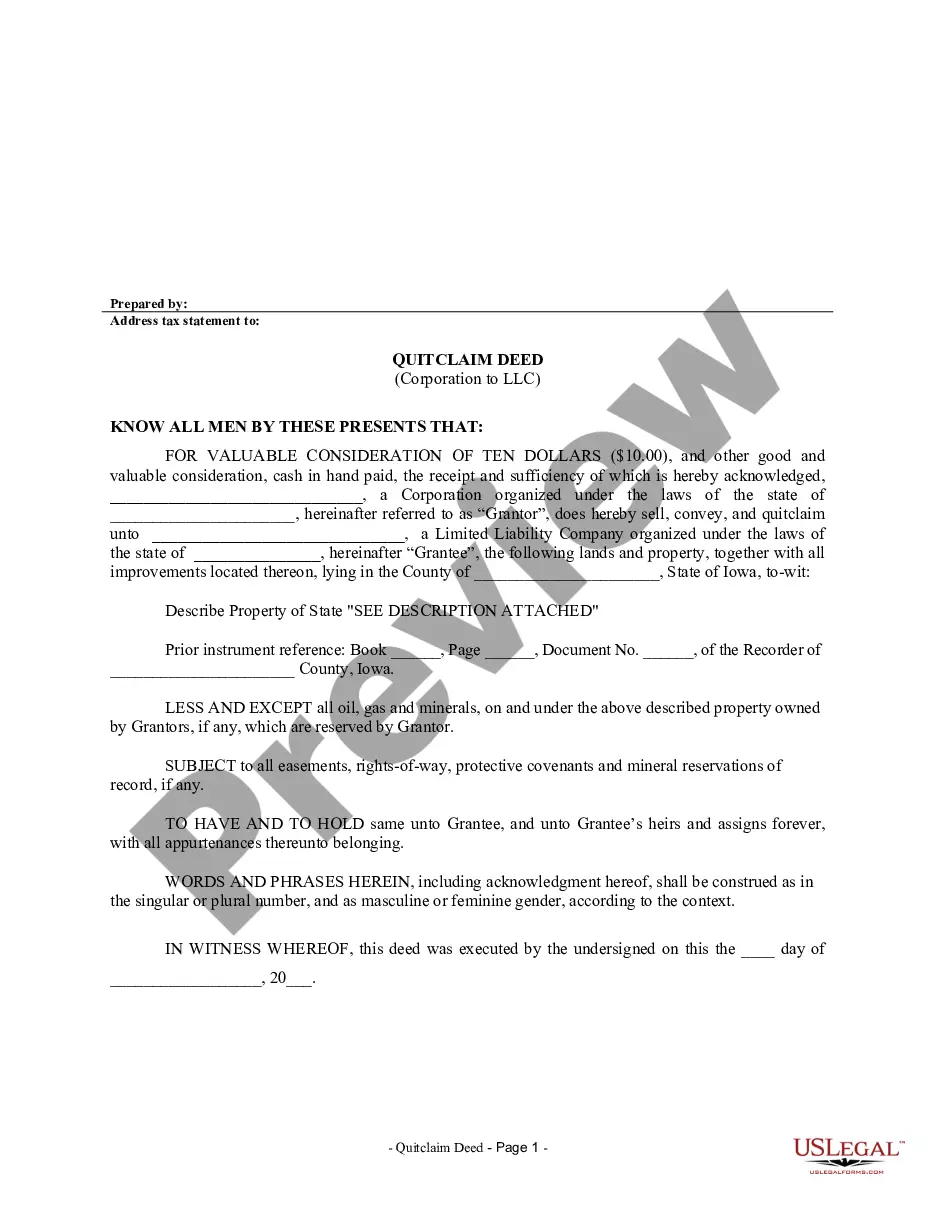

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

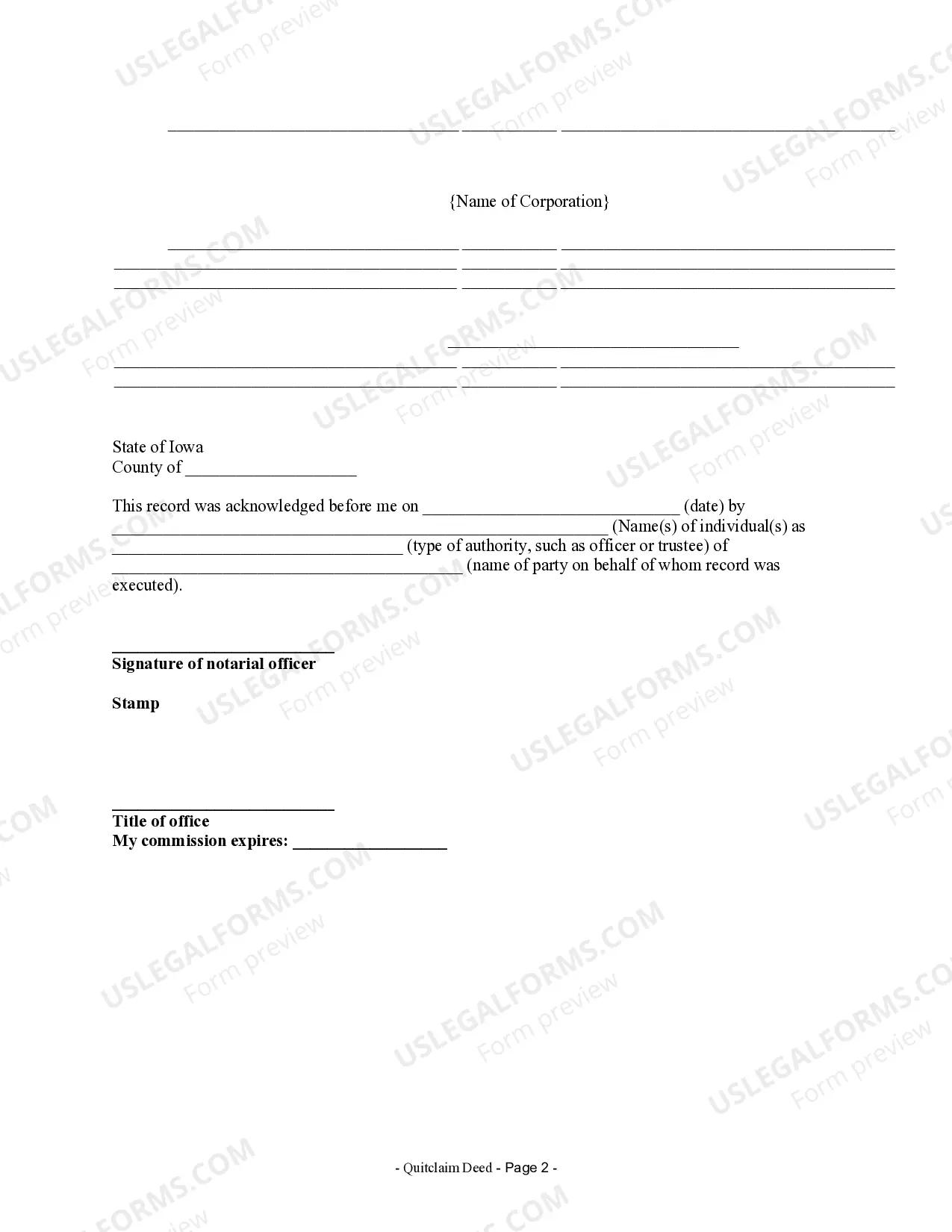

A Cedar Rapids Iowa Quitclaim Deed from Corporation to LLC is a legal document used to transfer ownership of real estate from a corporation to a limited liability company (LLC) in the city of Cedar Rapids, Iowa. This type of deed is commonly used when a corporation wants to transfer property to an LLC entity it owns or establish a new limited liability company to hold and manage the real estate assets. The quitclaim deed serves as evidence of the transfer, showing that the corporation relinquishes any interests, rights, or claims it may have had in the property and transfers them to the LLC. Unlike a warranty deed, a quitclaim deed does not provide any guarantees or warranties regarding the property's title, but it simply transfers whatever interest the corporation has in the property to the LLC. Cedar Rapids Iowa offers various types of quitclaim deeds from a corporation to an LLC, including: 1. General Quitclaim Deed: This is the most common type of quitclaim deed used for transferring real estate from a corporation to an LLC. It transfers the corporation's interest in the property without making any specific promises or guarantees about the property's title. 2. Special Warranty Quitclaim Deed: In some cases, a corporation may choose to use a special warranty quitclaim deed. This type of deed conveys the corporation's interest in the property, but it also includes a limited warranty from the corporation that it has not incurred any undisclosed debts or liens on the property during its ownership. 3. Enhanced Life Estate Quitclaim Deed: This type of quitclaim deed is sometimes used when a corporation wants to transfer property to an LLC while retaining certain rights to the property during their lifetime. The deed grants the LLC immediate ownership of the property upon transfer, but the corporation retains a life estate, allowing them to occupy or use the property until their death. It is crucial to consult with a qualified real estate attorney or a title company specializing in Cedar Rapids, Iowa, to ensure the correct quitclaim deed type is used and that all legal requirements are met during the transfer process from a corporation to an LLC. The attorney or title company will guide the parties involved in drafting and executing the quitclaim deed, ensuring a smooth and legally sound transaction.A Cedar Rapids Iowa Quitclaim Deed from Corporation to LLC is a legal document used to transfer ownership of real estate from a corporation to a limited liability company (LLC) in the city of Cedar Rapids, Iowa. This type of deed is commonly used when a corporation wants to transfer property to an LLC entity it owns or establish a new limited liability company to hold and manage the real estate assets. The quitclaim deed serves as evidence of the transfer, showing that the corporation relinquishes any interests, rights, or claims it may have had in the property and transfers them to the LLC. Unlike a warranty deed, a quitclaim deed does not provide any guarantees or warranties regarding the property's title, but it simply transfers whatever interest the corporation has in the property to the LLC. Cedar Rapids Iowa offers various types of quitclaim deeds from a corporation to an LLC, including: 1. General Quitclaim Deed: This is the most common type of quitclaim deed used for transferring real estate from a corporation to an LLC. It transfers the corporation's interest in the property without making any specific promises or guarantees about the property's title. 2. Special Warranty Quitclaim Deed: In some cases, a corporation may choose to use a special warranty quitclaim deed. This type of deed conveys the corporation's interest in the property, but it also includes a limited warranty from the corporation that it has not incurred any undisclosed debts or liens on the property during its ownership. 3. Enhanced Life Estate Quitclaim Deed: This type of quitclaim deed is sometimes used when a corporation wants to transfer property to an LLC while retaining certain rights to the property during their lifetime. The deed grants the LLC immediate ownership of the property upon transfer, but the corporation retains a life estate, allowing them to occupy or use the property until their death. It is crucial to consult with a qualified real estate attorney or a title company specializing in Cedar Rapids, Iowa, to ensure the correct quitclaim deed type is used and that all legal requirements are met during the transfer process from a corporation to an LLC. The attorney or title company will guide the parties involved in drafting and executing the quitclaim deed, ensuring a smooth and legally sound transaction.