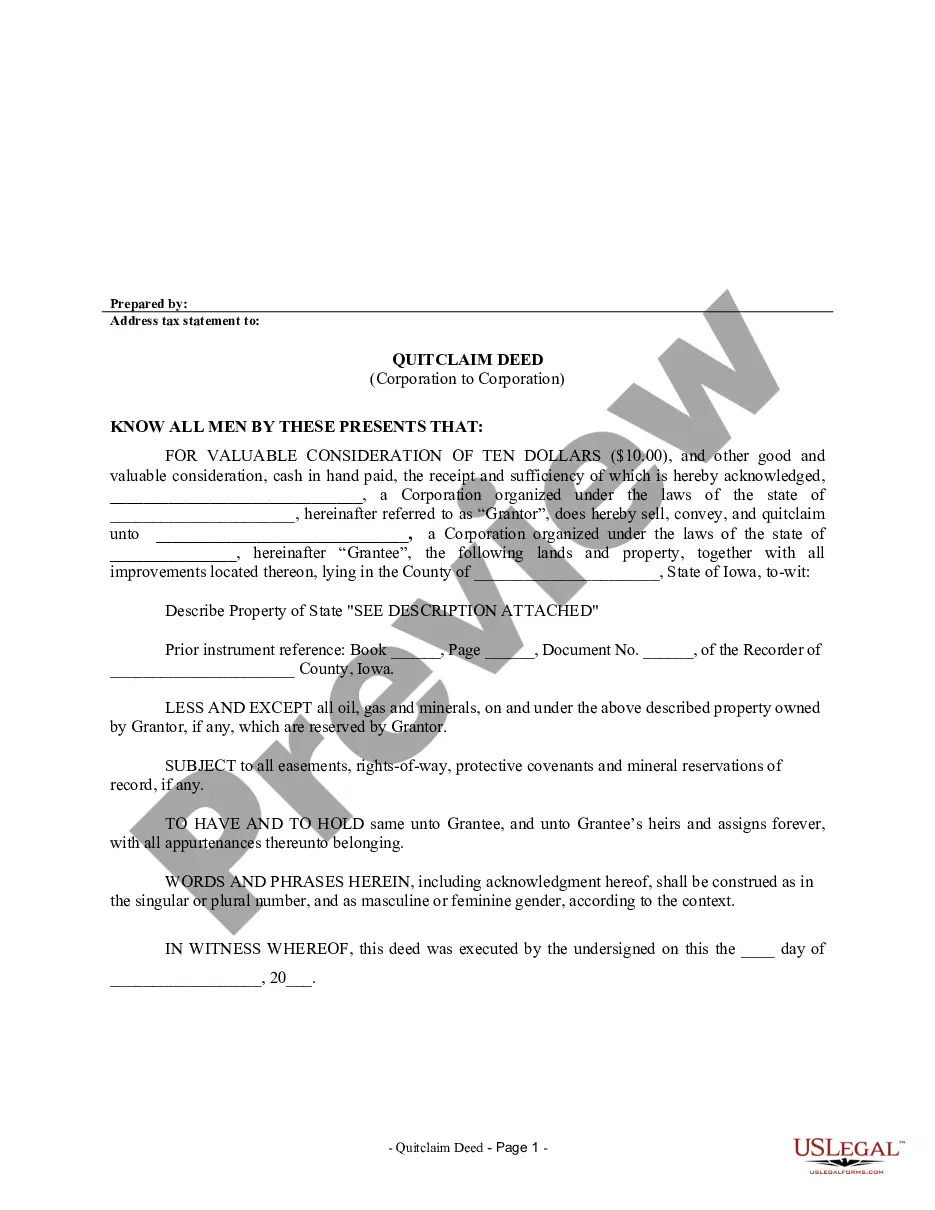

This Quitclaim Deed from Corporation to Corporation form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a corporation. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Cedar Rapids Iowa Quitclaim Deed from Corporation to Corporation is a legal document used when a corporation transfers ownership of a property or real estate to another corporation without making any guarantee about the property's title. This deed essentially transfers the corporation's interest in the property to the receiving corporation, without providing any warranties or claims. In Cedar Rapids, Iowa, there are various types of Quitclaim Deeds that corporations may use to transfer property ownership. Some of these include: 1. Standard Cedar Rapids Iowa Quitclaim Deed from Corporation to Corporation: This is the most common type of deed used for transferring property between corporations. It clearly outlines the names of the involved corporations, the property details (such as legal description and address), and confirms that the transferring corporation is releasing all claims and interests in the property. 2. Cedar Rapids Iowa Quitclaim Deed with Consideration: This type of deed includes a provision for the receiving corporation to pay a certain amount of consideration (usually monetary) in exchange for the transfer of the property. It establishes a clear agreement between the parties involved, ensuring a lawful transfer of property rights. 3. Cedar Rapids Iowa Partial Quitclaim Deed from Corporation to Corporation: In certain cases, corporations may choose to transfer only a portion of their interest in a property to another corporation. This type of deed specifies the exact portion being transferred and ensures there is no confusion regarding ownership rights. 4. Cedar Rapids Iowa Quitclaim Deed in Lieu of Foreclosure from Corporation to Corporation: In situations where a corporation defaults on a loan or mortgage, resulting in potential foreclosure, this deed can be used to transfer the property to the creditor corporation instead. It serves as an alternative solution to avoid foreclosure proceedings. When executing a Cedar Rapids Iowa Quitclaim Deed from Corporation to Corporation, it is essential to consult with legal professionals to ensure compliance with state laws and regulations. It is also recommended conducting a thorough title search or obtain title insurance to identify any potential issues with the property's ownership and mitigate future risks. Properly completing and recording the deed with the Line County Recorder's Office is crucial to establish a valid and enforceable transfer of property rights.