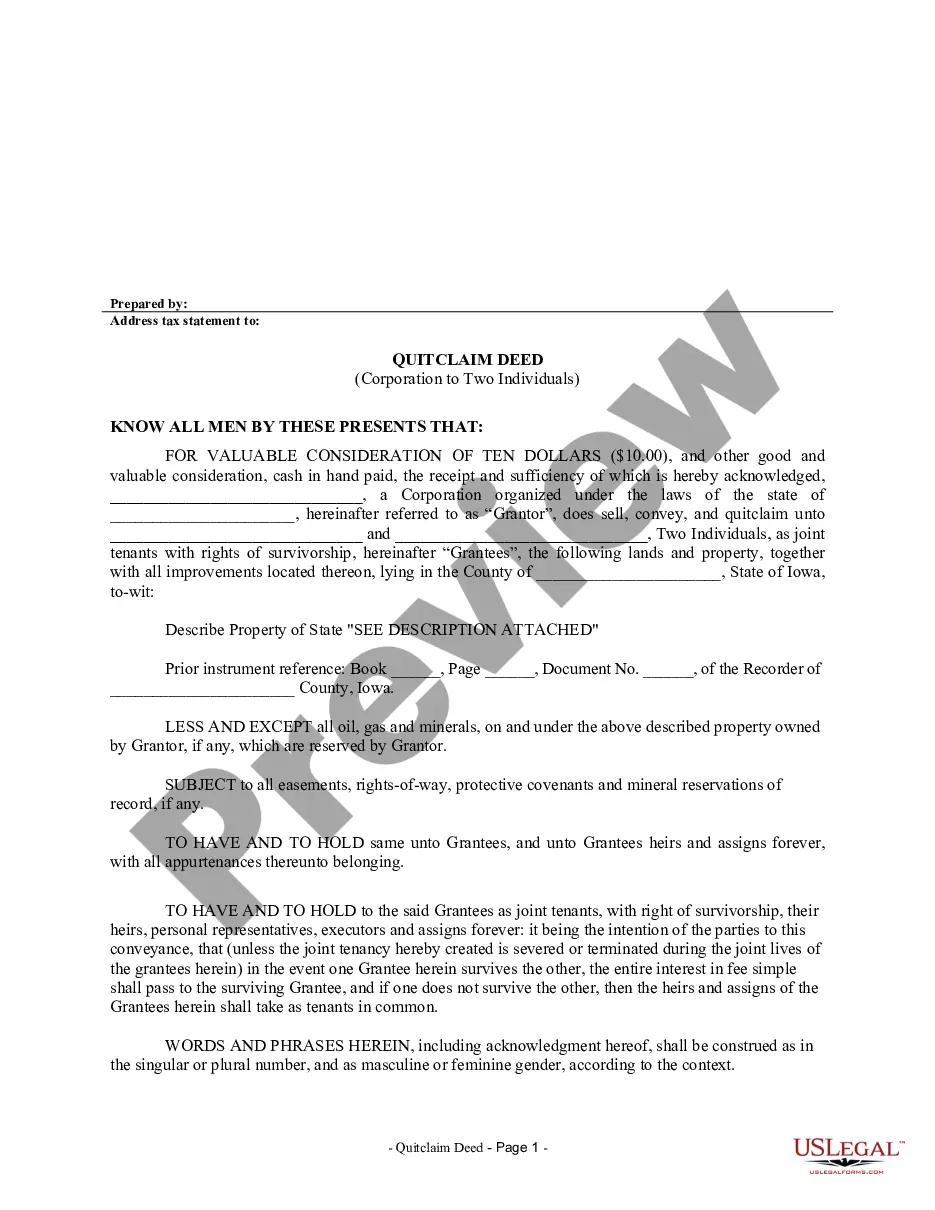

This Quitclaim Deed from Corporation to Two Individuals form is a Quitclaim Deed where the Grantor is a corporation and the Grantees are two individuals. Grantor conveys and quitclaims the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

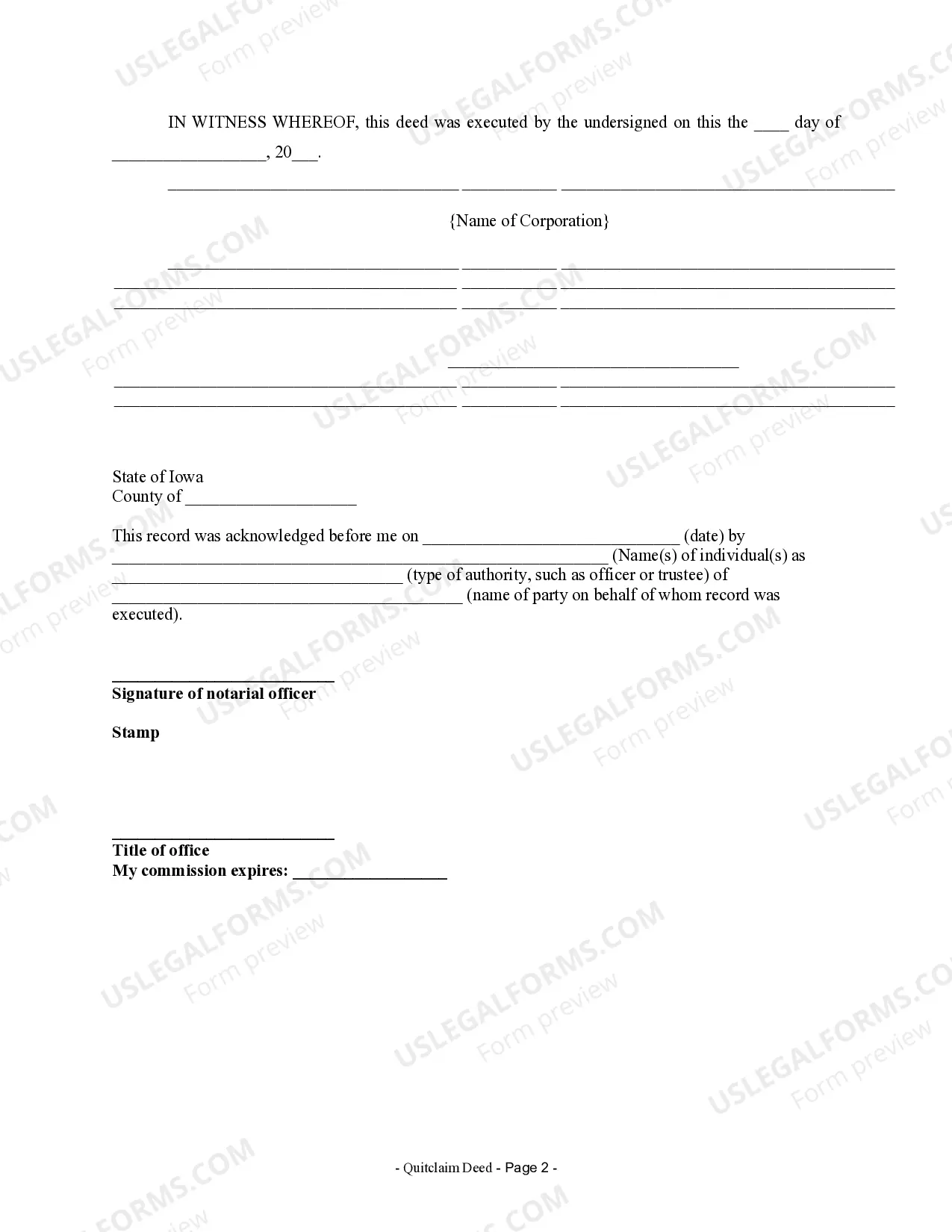

A Cedar Rapids Iowa quitclaim deed from corporation to two individuals is a legal document that transfers the ownership of property from a corporation to two individuals, without any warranties regarding the title or any claims that may exist on the property. This type of deed is commonly used in real estate transactions where a corporation owns the property and intends to transfer it to two specific individuals. The Cedar Rapids Iowa quitclaim deed from corporation to two individuals is a legally binding agreement that is executed to ensure a smooth and transparent transfer of property rights. By using this deed, the corporation is essentially conveying whatever interest it possesses in the property to the two individuals. It is important to note that this type of deed does not provide any guarantee or promise about the property's ownership history or any encumbrances, such as liens, mortgages, or claims that may be attached to the property. There are a few different types of Cedar Rapids Iowa quitclaim deeds from a corporation to two individuals that may exist, varying according to the specific circumstances of the transfer: 1. Voluntary Quitclaim Deed: This type of deed occurs when a corporation willingly and voluntarily transfers the ownership of the property to two individuals without any legal disputes or controversies. 2. Court-Ordered Quitclaim Deed: In cases where a court orders a corporation to transfer its property to two individuals, a court-ordered quitclaim deed is used to facilitate the transfer. This may happen due to a legal dispute or as a result of a court judgment. 3. Tax Sale Quitclaim Deed: If a corporation fails to pay property taxes, the property may be sold at a tax sale. In such cases, a tax sale quitclaim deed is executed to convey the ownership of the property to the winning bidders or individuals who have acquired the property through the tax sale process. 4. Estate Planning Quitclaim Deed: Sometimes, a corporation may use a quitclaim deed to transfer property to two individuals as part of an estate planning strategy. This type of deed is typically used in cases where the corporation wants to distribute its property among specific individuals, such as family members or business partners, without going through the probate process. It is essential to consult with a legal professional or a real estate attorney in Cedar Rapids, Iowa, to ensure that the quitclaim deed is properly prepared, executed, and recorded. Additionally, conducting a thorough title search and obtaining title insurance is strongly recommended mitigating any potential risks associated with the transfer of property ownership.