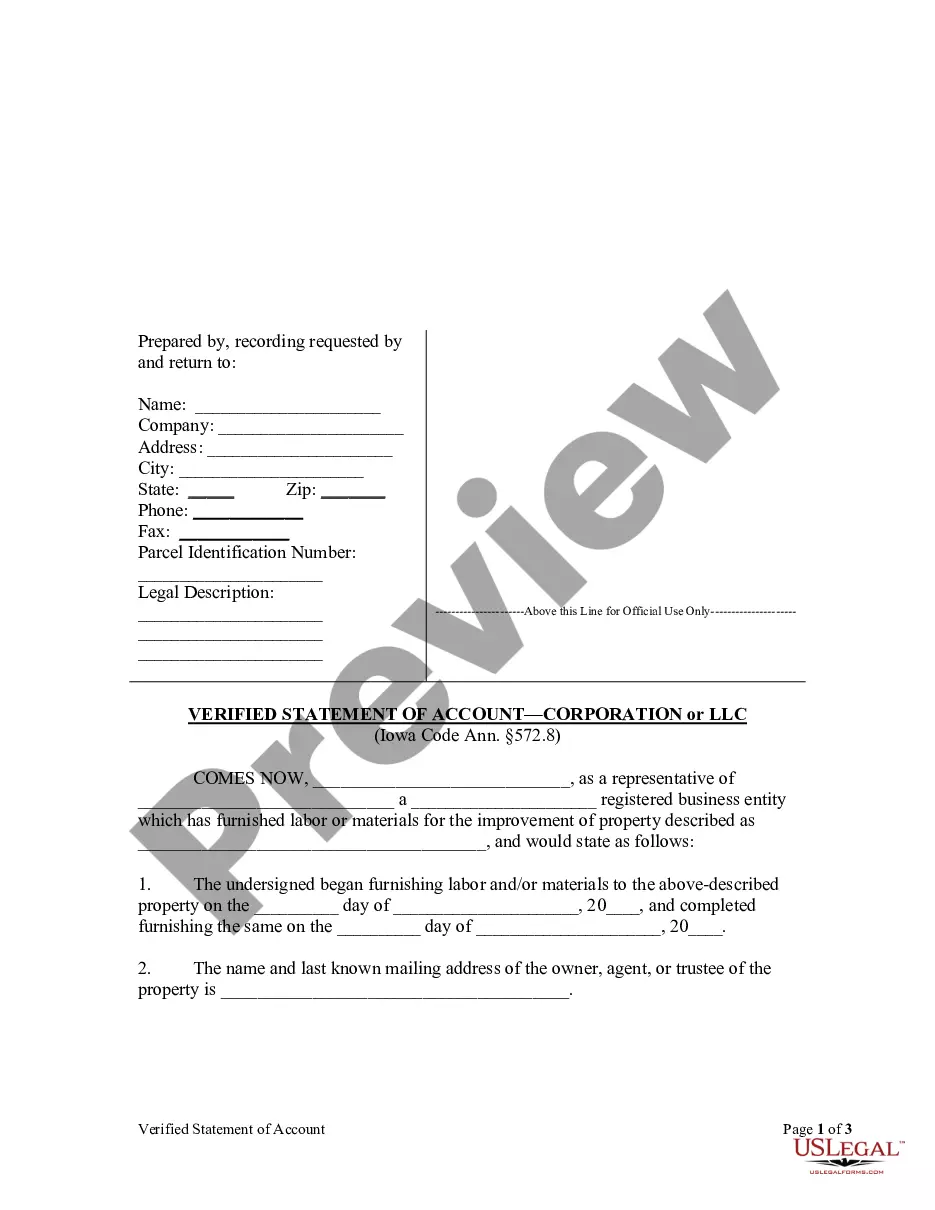

Iowa law requires a party seeking to perfect a mechanic's lien to file a verified statement with the clerk of the district court of the county in which the building, land, or improvement is situated. The verified statement contains a description of the property and the name and address of the property owner. It is the responsibility of the district court clerk to forward a copy of the lien to the property owner after filing. The verified statement must be filed within ninety (90) days from the date on which the last material was furnished or labor performed.

Cedar Rapids Iowa Verified Statement of Account by Corporation or LLC is a legal document that serves as an official record of financial transactions conducted by a corporation or limited liability company (LLC) in Cedar Rapids, Iowa. It provides detailed information about the company's income, expenses, and financial position. This statement is an essential part of financial reporting, as it helps businesses assess the accuracy and completeness of their financial records, ensuring compliance with local regulations and tax requirements. The statement includes key financial data, such as balances held in checking and savings accounts, outstanding debts, accounts receivable, accounts payable, and any other relevant financial information. Having a verified statement of account is crucial for corporations and LCS in Cedar Rapids, as it helps them maintain transparency and accountability in their financial operations. The document can be used for various purposes, including tax reporting, securing loans or credit lines, auditing processes, and legal disputes. There are different types of Cedar Rapids Iowa Verified Statement of Account by Corporation or LLC, depending on their specific purpose. Some common variations include: 1. Annual Verified Statement of Account: This type of statement is prepared annually and provides a comprehensive overview of the corporation's or LLC's financial activities throughout the year. It includes a detailed breakdown of all income and expenses, assets and liabilities, and other financial metrics. 2. Quarterly Verified Statement of Account: This statement is prepared on a quarterly basis, typically serving as an intermediate assessment of the company's financial performance. It helps monitor the business's cash flow, identify potential issues, and make informed decisions based on current financial trends. 3. Interim Verified Statement of Account: Sometimes, corporations or LCS may need to present a statement of account between annual or quarterly intervals, such as for specific transactions or when requested by financial institutions or government agencies. These statements focus on a particular period and provide a snapshot of the company's financial status for that specific period. 4. Special Purpose Verified Statement of Account: In certain situations, entities may require a customized statement of account to fulfill specific requirements, such as during a merger or acquisition, bankruptcy proceedings, or legal disputes. These statements are tailored to address specific concerns and often involve more detailed financial information and analysis. In conclusion, the Cedar Rapids Iowa Verified Statement of Account by Corporation or LLC is a crucial financial document that ensures accurate record-keeping for businesses operating in Cedar Rapids. These statements come in various types, such as annual, quarterly, interim, and special purpose, each serving its unique purpose in evaluating a company's financial health and complying with legal and regulatory obligations.Cedar Rapids Iowa Verified Statement of Account by Corporation or LLC is a legal document that serves as an official record of financial transactions conducted by a corporation or limited liability company (LLC) in Cedar Rapids, Iowa. It provides detailed information about the company's income, expenses, and financial position. This statement is an essential part of financial reporting, as it helps businesses assess the accuracy and completeness of their financial records, ensuring compliance with local regulations and tax requirements. The statement includes key financial data, such as balances held in checking and savings accounts, outstanding debts, accounts receivable, accounts payable, and any other relevant financial information. Having a verified statement of account is crucial for corporations and LCS in Cedar Rapids, as it helps them maintain transparency and accountability in their financial operations. The document can be used for various purposes, including tax reporting, securing loans or credit lines, auditing processes, and legal disputes. There are different types of Cedar Rapids Iowa Verified Statement of Account by Corporation or LLC, depending on their specific purpose. Some common variations include: 1. Annual Verified Statement of Account: This type of statement is prepared annually and provides a comprehensive overview of the corporation's or LLC's financial activities throughout the year. It includes a detailed breakdown of all income and expenses, assets and liabilities, and other financial metrics. 2. Quarterly Verified Statement of Account: This statement is prepared on a quarterly basis, typically serving as an intermediate assessment of the company's financial performance. It helps monitor the business's cash flow, identify potential issues, and make informed decisions based on current financial trends. 3. Interim Verified Statement of Account: Sometimes, corporations or LCS may need to present a statement of account between annual or quarterly intervals, such as for specific transactions or when requested by financial institutions or government agencies. These statements focus on a particular period and provide a snapshot of the company's financial status for that specific period. 4. Special Purpose Verified Statement of Account: In certain situations, entities may require a customized statement of account to fulfill specific requirements, such as during a merger or acquisition, bankruptcy proceedings, or legal disputes. These statements are tailored to address specific concerns and often involve more detailed financial information and analysis. In conclusion, the Cedar Rapids Iowa Verified Statement of Account by Corporation or LLC is a crucial financial document that ensures accurate record-keeping for businesses operating in Cedar Rapids. These statements come in various types, such as annual, quarterly, interim, and special purpose, each serving its unique purpose in evaluating a company's financial health and complying with legal and regulatory obligations.