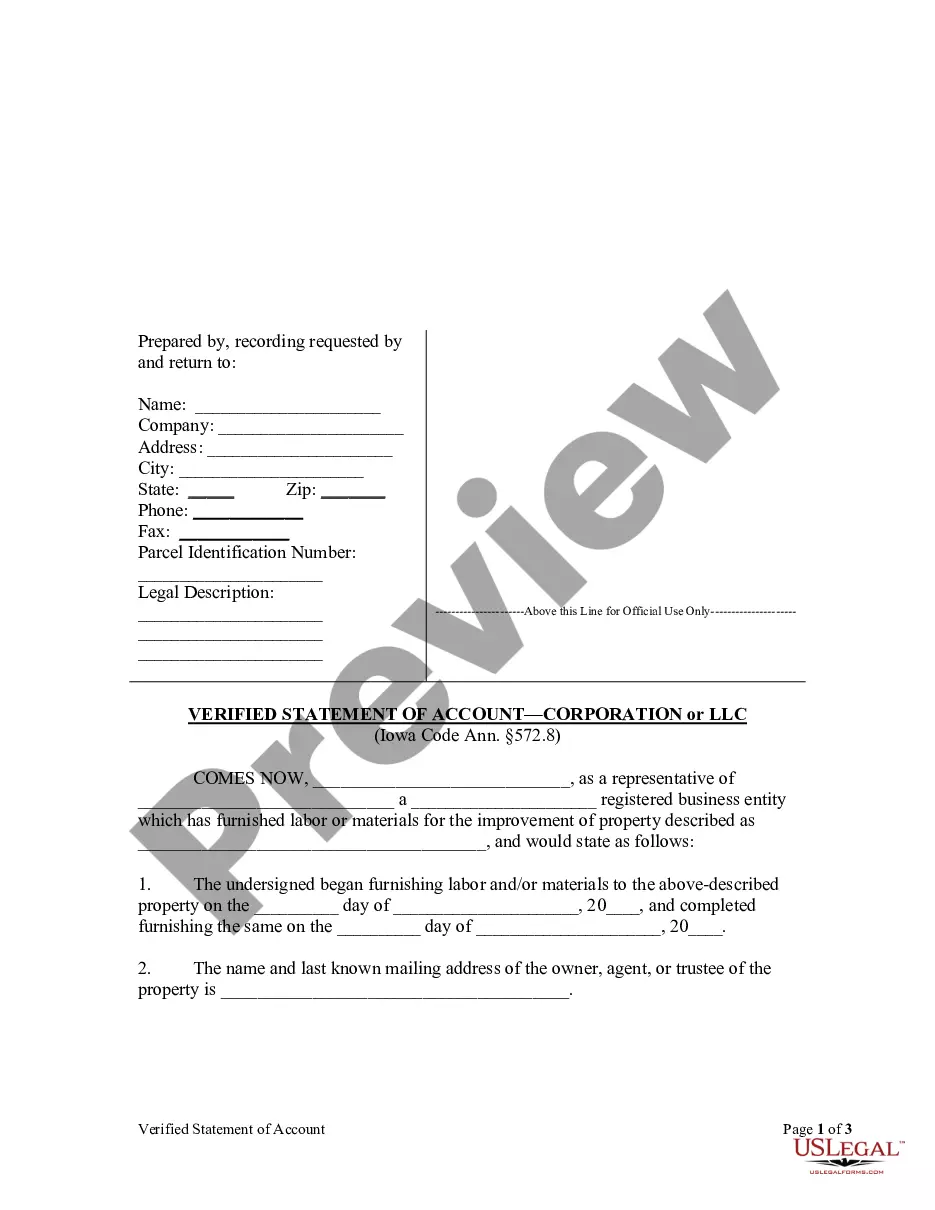

Iowa law requires a party seeking to perfect a mechanic's lien to file a verified statement with the clerk of the district court of the county in which the building, land, or improvement is situated. The verified statement contains a description of the property and the name and address of the property owner. It is the responsibility of the district court clerk to forward a copy of the lien to the property owner after filing. The verified statement must be filed within ninety (90) days from the date on which the last material was furnished or labor performed.

Davenport Iowa Verified Statement of Account by Corporation or LLC is a legal document that provides a detailed breakdown of financial transactions and outstanding debts between a corporation or limited liability company (LLC) and its clients or vendors. This statement serves as an official record, verifying the accuracy and validity of the account balance held by the corporation or LLC. Keywords: Davenport Iowa, Verified Statement of Account, Corporation, LLC, financial transactions, outstanding debts, clients, vendors, official record, accuracy, validity, account balance. There are several types of Davenport Iowa Verified Statement of Account by Corporation or LLC that can be categorized based on their purposes and recipients: 1. Customer Statement of Account: This type of statement is issued by a corporation or LLC to its customers, providing a comprehensive summary of all transactions related to their account. It includes details of payments received, outstanding invoices, credits, and any adjustments made to the account balance. 2. Vendor Statement of Account: A vendor statement is prepared by a corporation or LLC for its vendors or suppliers. It documents all transactions involving payments made to vendors, outstanding bills, and any credits or outstanding balance owed. 3. Client Statement of Account: This statement is typically used by professional service providers, such as law firms or accounting firms. It outlines detailed information about the services rendered, hours worked, expenses incurred, and any outstanding balance due from the client. 4. Debtor Statement of Account: In cases where a corporation or LLC is owed money by another party, a debtor statement of account is generated. It provides a comprehensive report of all outstanding debts, including the dates, amounts, and nature of the transactions, ensuring transparency and accurate record-keeping. Regardless of the specific type, a Davenport Iowa Verified Statement of Account by Corporation or LLC plays a crucial role in maintaining transparency, ensuring accurate financial reporting, and facilitating smooth business operations. It serves as a reliable reference for resolving any financial disputes, tracking payment history, and establishing credibility between the corporation or LLC and its stakeholders.Davenport Iowa Verified Statement of Account by Corporation or LLC is a legal document that provides a detailed breakdown of financial transactions and outstanding debts between a corporation or limited liability company (LLC) and its clients or vendors. This statement serves as an official record, verifying the accuracy and validity of the account balance held by the corporation or LLC. Keywords: Davenport Iowa, Verified Statement of Account, Corporation, LLC, financial transactions, outstanding debts, clients, vendors, official record, accuracy, validity, account balance. There are several types of Davenport Iowa Verified Statement of Account by Corporation or LLC that can be categorized based on their purposes and recipients: 1. Customer Statement of Account: This type of statement is issued by a corporation or LLC to its customers, providing a comprehensive summary of all transactions related to their account. It includes details of payments received, outstanding invoices, credits, and any adjustments made to the account balance. 2. Vendor Statement of Account: A vendor statement is prepared by a corporation or LLC for its vendors or suppliers. It documents all transactions involving payments made to vendors, outstanding bills, and any credits or outstanding balance owed. 3. Client Statement of Account: This statement is typically used by professional service providers, such as law firms or accounting firms. It outlines detailed information about the services rendered, hours worked, expenses incurred, and any outstanding balance due from the client. 4. Debtor Statement of Account: In cases where a corporation or LLC is owed money by another party, a debtor statement of account is generated. It provides a comprehensive report of all outstanding debts, including the dates, amounts, and nature of the transactions, ensuring transparency and accurate record-keeping. Regardless of the specific type, a Davenport Iowa Verified Statement of Account by Corporation or LLC plays a crucial role in maintaining transparency, ensuring accurate financial reporting, and facilitating smooth business operations. It serves as a reliable reference for resolving any financial disputes, tracking payment history, and establishing credibility between the corporation or LLC and its stakeholders.