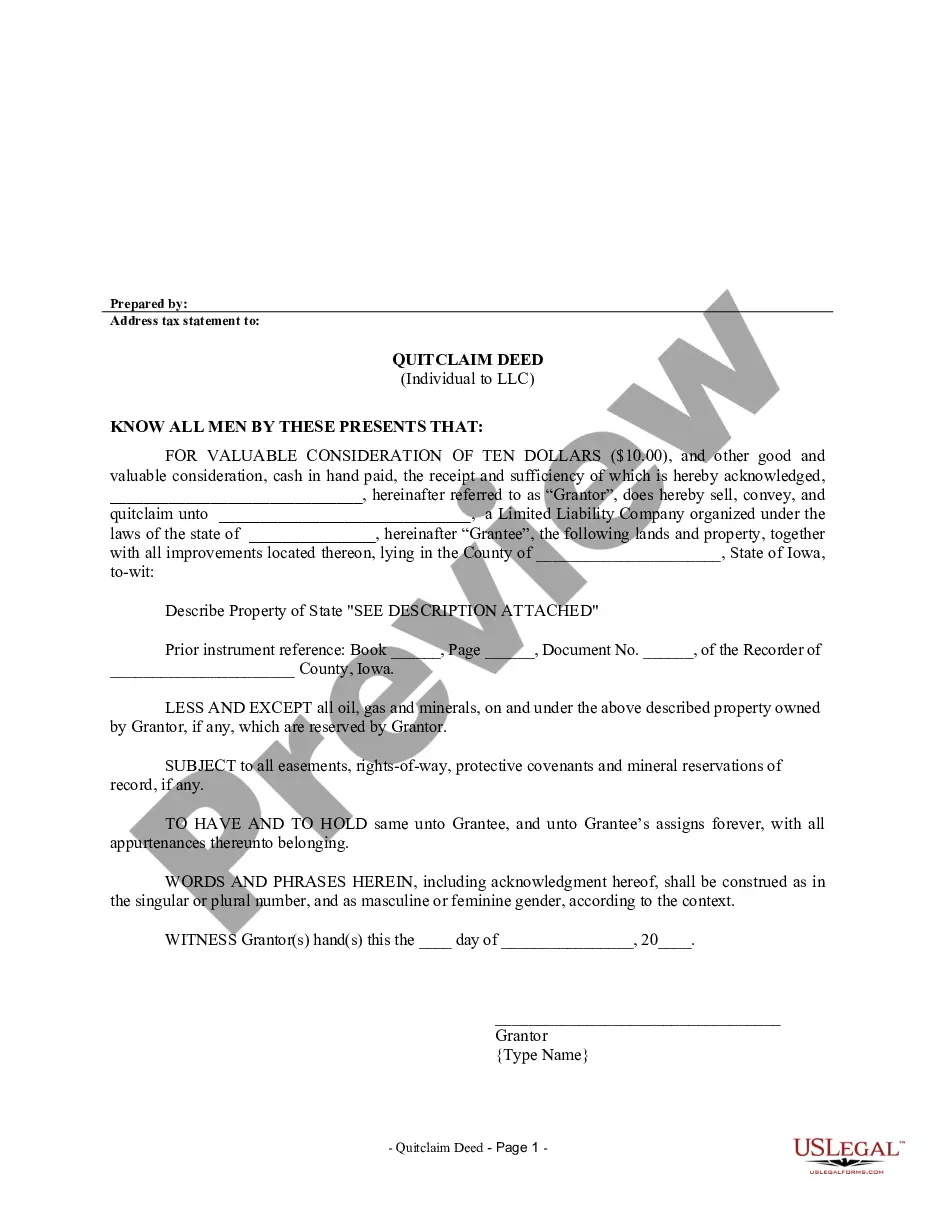

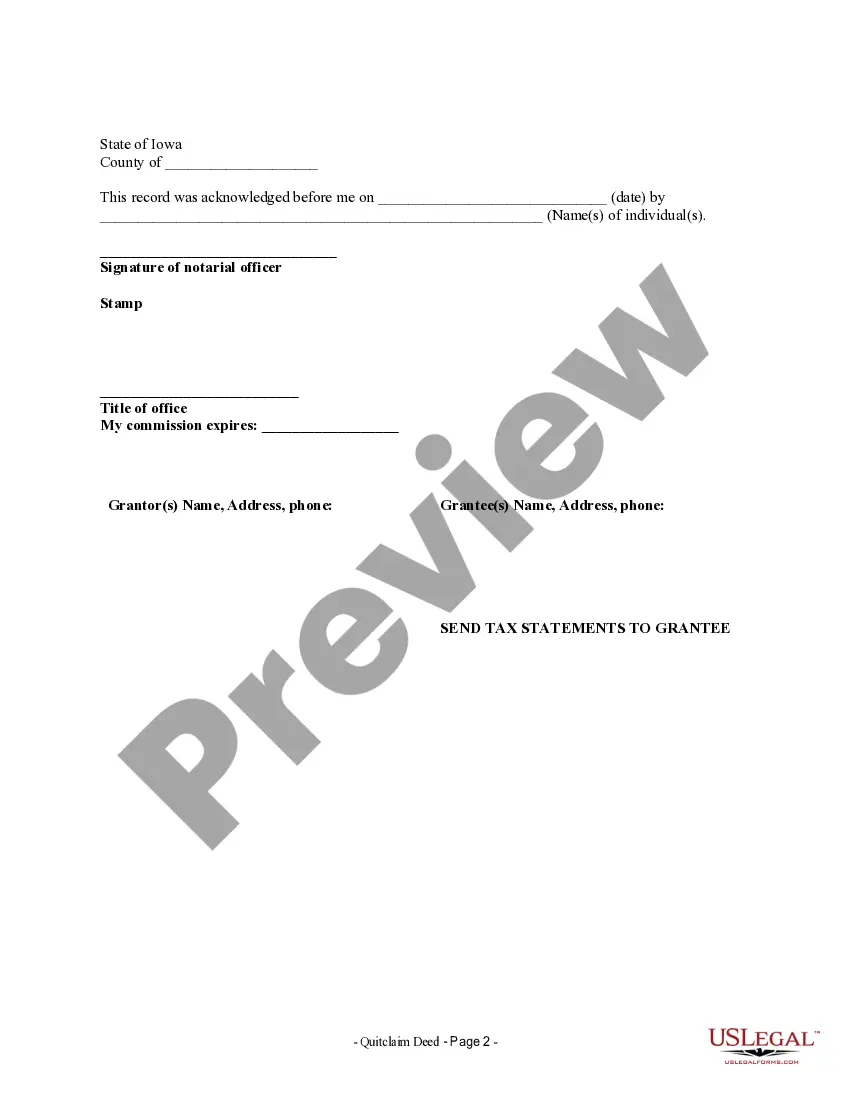

This Quitclaim Deed from Individual to LLC form is a Quitclaim Deed where the grantor is an individual and the grantee is a limited liability company. Grantor conveys and quitclaims the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor.

A detailed description of Cedar Rapids Iowa Quitclaim Deed from Individual to LLC: A Cedar Rapids Iowa Quitclaim Deed from Individual to LLC is a legal document used to transfer ownership of real property from an individual to a limited liability company (LLC) located in Cedar Rapids, Iowa. This type of deed provides a simple and efficient way of transferring property without any guarantees or warranties of title. The Cedar Rapids Iowa Quitclaim Deed from Individual to LLC involves a conveyance where the individual, known as the granter, willingly releases their interest and rights in the property to the LLC, known as the grantee. This transfer typically occurs when an individual wishes to transfer ownership of real estate, such as residential or commercial property, to an LLC for various reasons, including business purposes, liability protection, or tax advantages. The key feature of a Quitclaim Deed is that it contains no warranties or guarantees regarding the title of the property being transferred. This means that the granter does not provide any assurance that they own the property or that there are no encumbrances on the property, such as liens or other claims. The grantee receives the property "as is," assuming any risks associated with the title. Different types of Cedar Rapids Iowa Quitclaim Deed from Individual to LLC may include: 1. Residential Quitclaim Deed from Individual to LLC: This type of deed is used when an individual wants to transfer ownership of a residential property, such as a house or condominium, to an LLC located in Cedar Rapids, Iowa. It is often used by homeowners who want to protect their personal assets by transferring property ownership to a separate business entity. 2. Commercial Quitclaim Deed from Individual to LLC: This type of deed is employed when an individual wishes to transfer ownership of a commercial property, such as an office building, retail space, or industrial facility, to an LLC in Cedar Rapids, Iowa. This allows business owners to separate personal and business assets while providing liability protection. 3. Investment Property Quitclaim Deed from Individual to LLC: This particular deed is used when an individual wants to transfer ownership of an investment property, such as rental units or vacant land, to an LLC in Cedar Rapids, Iowa. This offers additional liability protection and tax advantages, especially for investors seeking to diversify their holdings. In conclusion, a Cedar Rapids Iowa Quitclaim Deed from Individual to LLC is a legal instrument that allows individuals in Cedar Rapids, Iowa, to transfer ownership of real property to an LLC. Whether it's residential, commercial, or an investment property, utilizing a Quitclaim Deed can provide various benefits, including liability protection and potential tax advantages. However, it is essential to consult with a qualified legal professional before proceeding with any property transfer to ensure compliance with applicable laws and regulations.