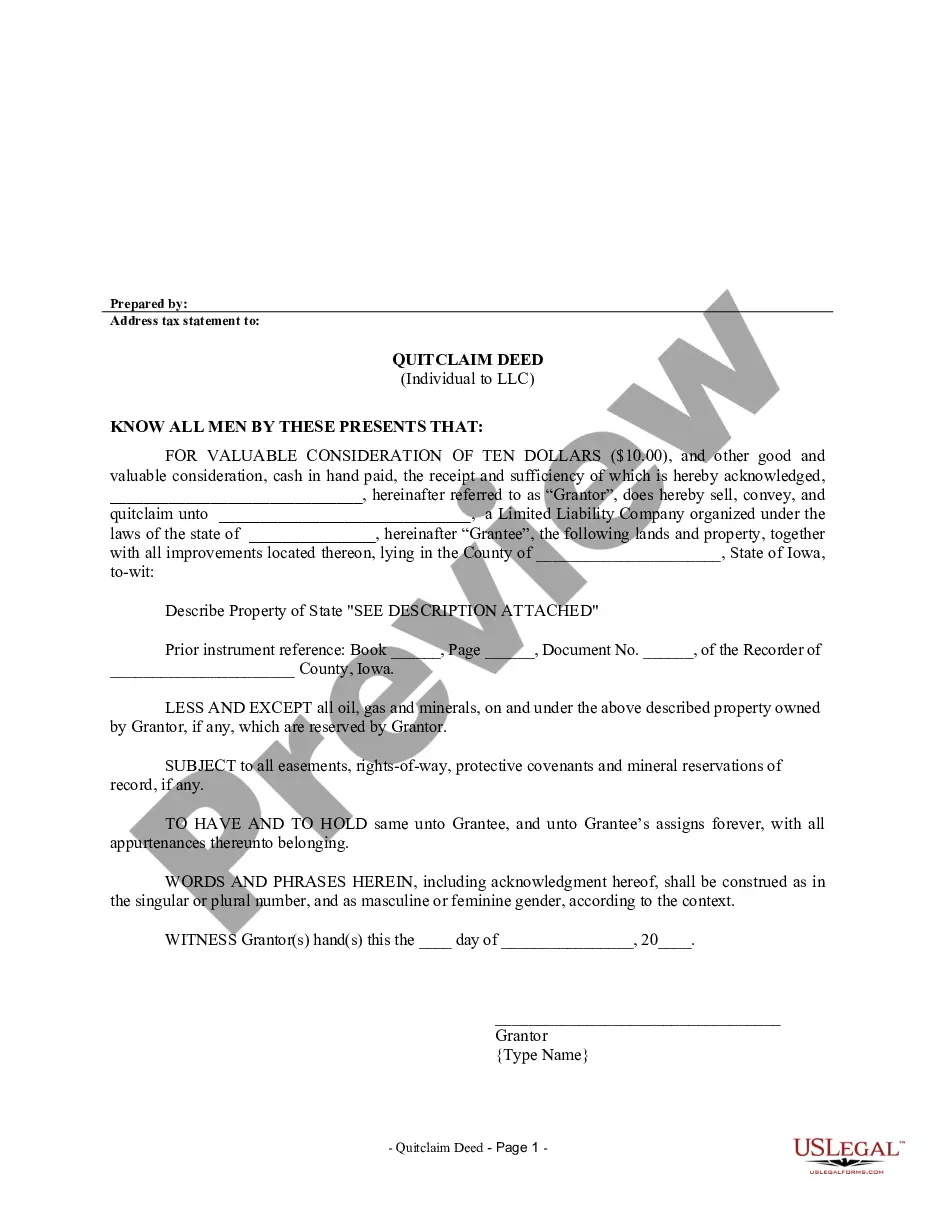

This Quitclaim Deed from Individual to LLC form is a Quitclaim Deed where the grantor is an individual and the grantee is a limited liability company. Grantor conveys and quitclaims the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor.

Davenport Iowa Quitclaim Deed from Individual to LLC

Description

How to fill out Iowa Quitclaim Deed From Individual To LLC?

We consistently endeavor to reduce or avert legal complications when engaging with intricate legal or financial matters.

To achieve this, we seek legal remedies that are generally quite expensive.

However, not every legal problem is quite so complicated; many can be managed independently.

US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to incorporation articles and dissolution petitions.

Simply Log In to your account and click the Get button next to it. If you misplace the form, you can always re-download it from the My documents section. The process is equally straightforward for newcomers to the site! You can establish your account within minutes. Ensure that the Davenport Iowa Quitclaim Deed from Individual to LLC aligns with your state's and area's laws and regulations. Additionally, it's crucial to review the form's structure (if available), and if you notice any differences from what you initially sought, look for an alternative template. Once you've confirmed that the Davenport Iowa Quitclaim Deed from Individual to LLC is suitable for your situation, you can choose a subscription plan and proceed to payment. You can then download the form in any available format. For over 24 years, we have assisted millions by providing ready-to-customize and current legal documents. Take advantage of US Legal Forms now to save time and resources!

- Our repository empowers you to handle your matters autonomously without relying on legal representation.

- We offer access to legal document templates that aren't always readily available to the public.

- Our templates are tailored to specific states and regions, which greatly eases the search process.

- Benefit from US Legal Forms any time you need to quickly and securely find and download the Davenport Iowa Quitclaim Deed from Individual to LLC, or any other document.

Form popularity

FAQ

Many wealthy individuals choose to buy houses under an LLC for various strategic reasons. One primary benefit is liability protection; an LLC can shield personal assets from legal claims associated with the property. Additionally, purchasing under an LLC can offer tax advantages and simplify the transfer process. Ultimately, these factors make the Davenport Iowa quitclaim deed from individual to LLC a popular choice among affluent buyers.

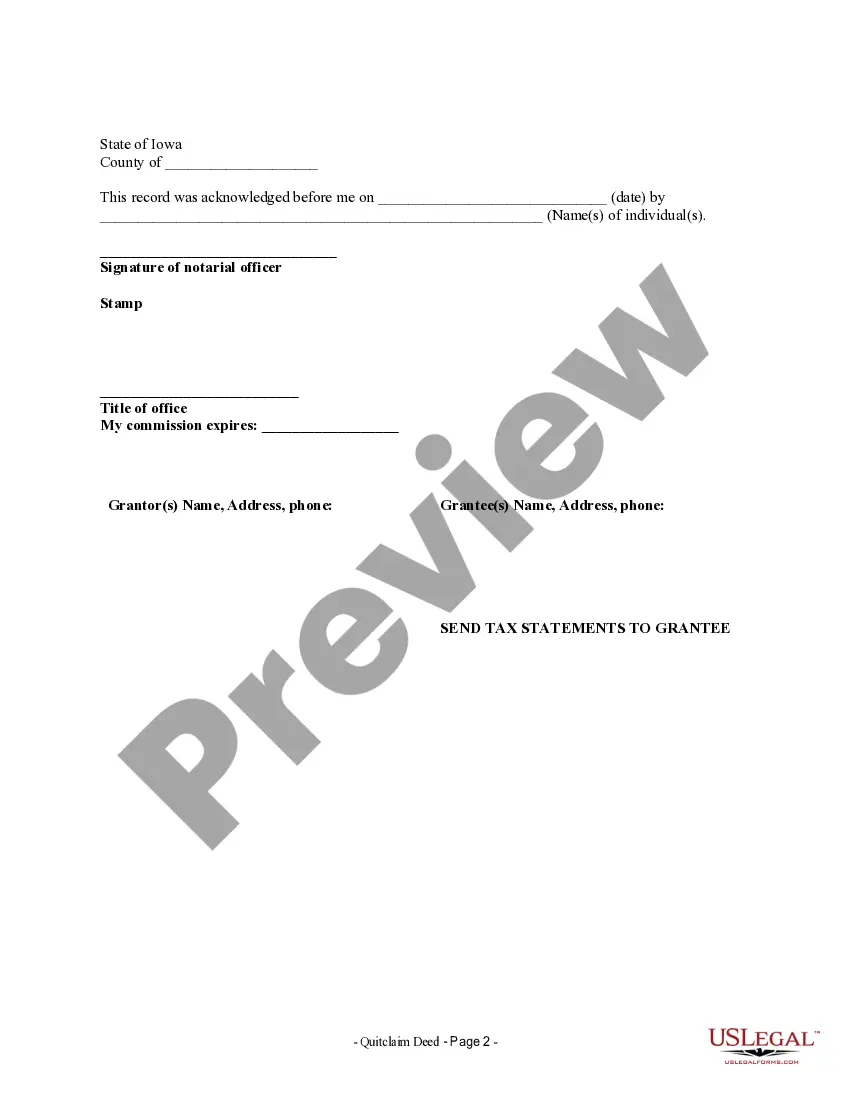

Filing a quitclaim deed in Iowa is a straightforward process. First, you need to prepare the quitclaim deed form with accurate details about the property and the parties involved. Once you complete the form, you should sign it in the presence of a notary. After that, submit the quitclaim deed to your local county recorder's office to make the transfer official. For further assistance, US Legal Forms offers templates and guidance for filing a Davenport Iowa quitclaim deed from individual to LLC.

Yes, you can complete a quit claim deed yourself using user-friendly resources like US Legal Forms. The platform provides templates that guide you through the process without needing a lawyer. Just ensure you follow Iowa's legal requirements, especially for a Davenport Iowa Quitclaim Deed from Individual to LLC. Taking this route can save you costs while still achieving a valid property transfer.

Creating a quit claim deed in Iowa involves a few straightforward steps. Gather the necessary information, including the property description and the names of all parties involved. Complete the deed form, ensuring it complies with Iowa legal requirements, then sign it in front of a notary. After that, submit the document to the local county recorder's office to finalize the process for a Davenport Iowa Quitclaim Deed from Individual to LLC.

While a quit claim deed can simplify property transfers, it comes with risks. The deed does not guarantee that the individual transferring the property holds clear title. Additionally, it can potentially expose the new owner to legal disputes if any claims arise after the transfer. Understanding these drawbacks is important when considering a Davenport Iowa Quitclaim Deed from Individual to LLC.

To transfer a deed from an individual to an LLC, you typically need to execute a quit claim deed. This document should include details about the property and the names of the individual and the LLC. After executing the deed, file it with the county recorder's office. This process is crucial for a Davenport Iowa Quitclaim Deed from Individual to LLC to ensure legal recognition of the LLC as the new property owner.

One main disadvantage of using an LLC for property ownership is the initial and ongoing costs associated with forming and maintaining the LLC. You may also face challenges with financing, as some lenders prefer personal guarantees over LLCs. Additionally, transferring property to an LLC can be complex, especially for real estate registered under a Davenport Iowa Quitclaim Deed from Individual to LLC. Understanding these factors can help you make an informed decision.

To get a quit claim deed in Iowa, start by obtaining the appropriate form from a reliable source, such as US Legal Forms. You will need to fill out the form with the necessary information about the property and the parties involved. Once completed, the deed must be signed in front of a notary public. Finally, file the quit claim deed with the local county recorder's office to formalize the transfer, especially if you're handling a Davenport Iowa Quitclaim Deed from Individual to LLC.

One disadvantage of placing a property in an LLC includes the potential for increased taxes or fees, as LLCs may face different tax rules than individuals. Additionally, transferring property into an LLC can be complex and may involve legal costs. It is essential to assess whether the benefits of asset protection outweigh these potential drawbacks when executing a Davenport Iowa Quitclaim Deed from Individual to LLC.

An example of a quitclaim would be when a property owner transfers their interest in a house to their LLC to protect assets or simplify ownership. This deed merely conveys the owner's interest without guaranteeing that the title is clear from any claims or encumbrances. Therefore, it is advisable to conduct due diligence before making such a transfer through a Davenport Iowa Quitclaim Deed from Individual to LLC.