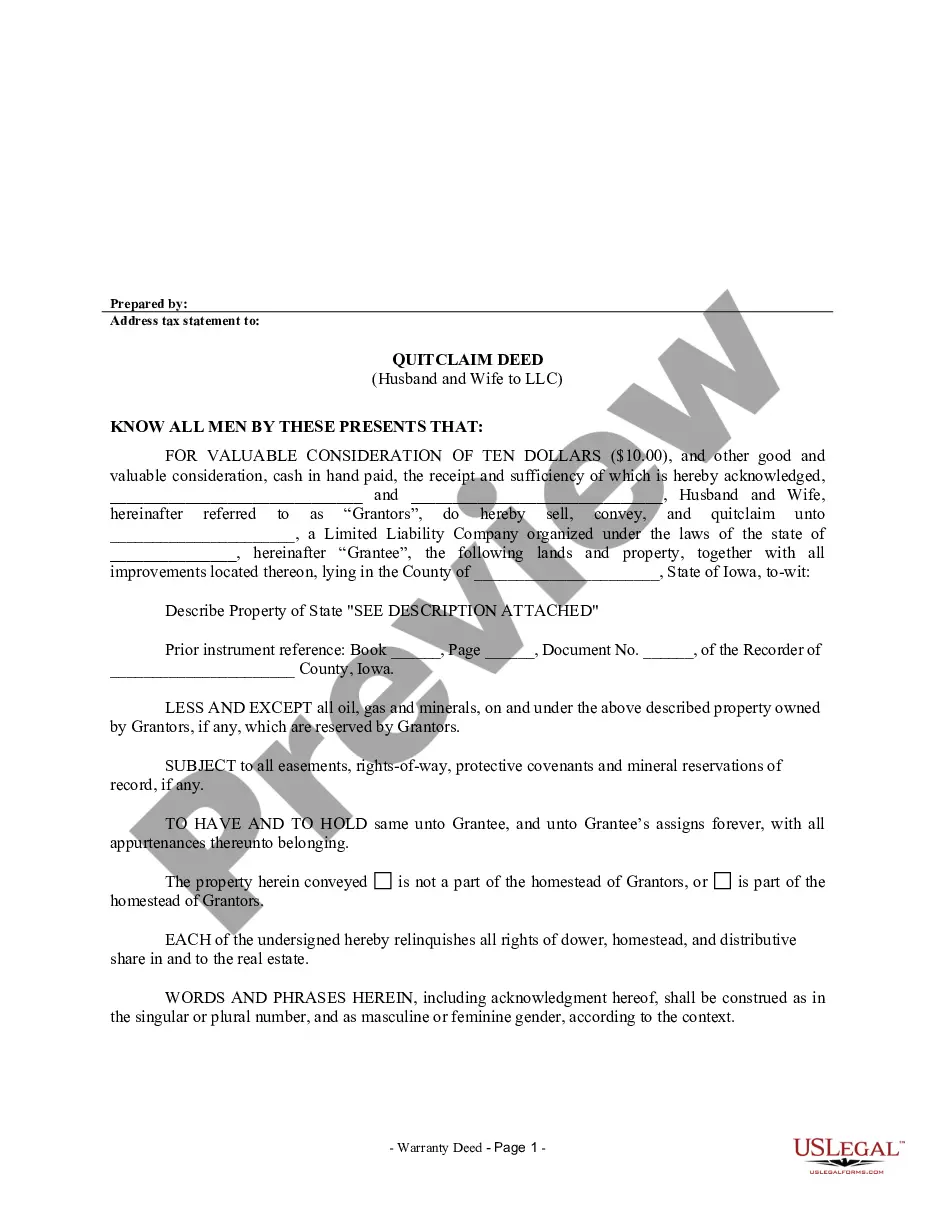

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

Cedar Rapids Iowa Quitclaim Deed from Husband and Wife to LLC

Description

How to fill out Iowa Quitclaim Deed From Husband And Wife To LLC?

Obtaining authenticated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms library. This is an online repository of over 85,000 legal forms for personal and professional requirements and various real-world scenarios.

All the documents are appropriately categorized by usage area and jurisdictional regions, which makes finding the Cedar Rapids Iowa Quitclaim Deed from Husband and Wife to LLC as straightforward as one, two, three.

For those already acquainted with our service and have previously utilized it, acquiring the Cedar Rapids Iowa Quitclaim Deed from Husband and Wife to LLC requires merely a few clicks.

Maintaining organized paperwork that complies with legal requirements is critically important. Take advantage of the US Legal Forms library to always have essential document templates readily available for any needs!

- Log In to your account.

- Select the document.

- Click Download to save it on your device.

- For new users, the process involves a few additional steps.

- Follow the instructions below to begin with the most comprehensive online form catalog.

Form popularity

FAQ

You should file a quitclaim deed in Iowa at the county recorder’s office where the property is located. This step is crucial for making the transfer of ownership public and legal. Many residents in Cedar Rapids opt to use online resources, such as US Legal Forms, to prepare their documents before visiting the office. This ensures you have all the right paperwork ready for a successful filing of a Cedar Rapids Iowa Quitclaim Deed from Husband and Wife to LLC.

While a quitclaim deed provides a quick means to transfer property, it comes with notable disadvantages, such as the lack of warranties. The grantee receives only what the grantor owns, if anything, which might leave them with uncertain claims. In cases like a Cedar Rapids Iowa Quitclaim Deed from Husband and Wife to LLC, potential risks associated with title issues can leave the receiver vulnerable. It’s important to conduct thorough checks before proceeding.

Transferring a property title to a family member in Iowa involves preparing a quitclaim deed or warranty deed, depending on your needs. First, you should locate the appropriate form through services such as US Legal Forms, ensuring it is properly filled out. After gathering the necessary signatures, file the deed with the local county recorder’s office. This process allows for efficient transfers, including scenarios like a Cedar Rapids Iowa Quitclaim Deed from Husband and Wife to LLC.

To file a quitclaim deed in Iowa, start by completing the necessary form, which can be found on platforms like US Legal Forms. Ensure that both the grantor and grantee sign the document. Once signed, take the deed to your local county recorder’s office in Cedar Rapids to officially file it. With this process, you will effectively transfer property ownership, like a Cedar Rapids Iowa Quitclaim Deed from Husband and Wife to LLC.

To transfer personal assets to your LLC, first identify the assets you wish to move. Next, complete a Cedar Rapids Iowa Quitclaim Deed from Husband and Wife to LLC to formalize the transfer. It's vital to retain copies of this deed for your records and estate planning. By executing this process, you ensure a clear and legal transition of ownership.

Transferring assets from personal ownership to a business structure involves several steps. You can utilize a Cedar Rapids Iowa Quitclaim Deed from Husband and Wife to LLC for real property transfers. Additionally, maintain accurate records of these transactions. This practice not only simplifies accounting but also clarifies ownership in the eyes of the law.

Consider putting personal assets in an LLC if you seek liability protection. By executing a Cedar Rapids Iowa Quitclaim Deed from Husband and Wife to LLC, you can shield personal assets from business liabilities. This decision can also streamline your finances, making it easier to manage your business. However, consulting a legal or financial advisor is wise to ensure this aligns with your goals.

Certainly, you can transfer personal funds to your LLC. This transfer often occurs when you want to fund your business operations or investments. Just like with personal assets, be sure to document these transactions accurately, possibly using a Cedar Rapids Iowa Quitclaim Deed from Husband and Wife to LLC for clarity. This practice helps maintain clear boundaries between your personal and business finances.

Yes, you can transfer personal assets to an LLC. A Cedar Rapids Iowa Quitclaim Deed from Husband and Wife to LLC can facilitate this process. By executing this deed, you officially move your ownership rights from personal names to the LLC, which can offer liability protection. It's essential to document this transfer properly to ensure legal compliance.

Transferring property to an LLC in California can trigger tax consequences, such as property tax reassessment under certain conditions. However, if structured correctly, you may avoid immediate tax implications. Professional consultation is crucial to navigate these complexities. If you're considering a similar strategy with a Cedar Rapids Iowa Quitclaim Deed from Husband and Wife to LLC, it's advisable to seek expert advice.