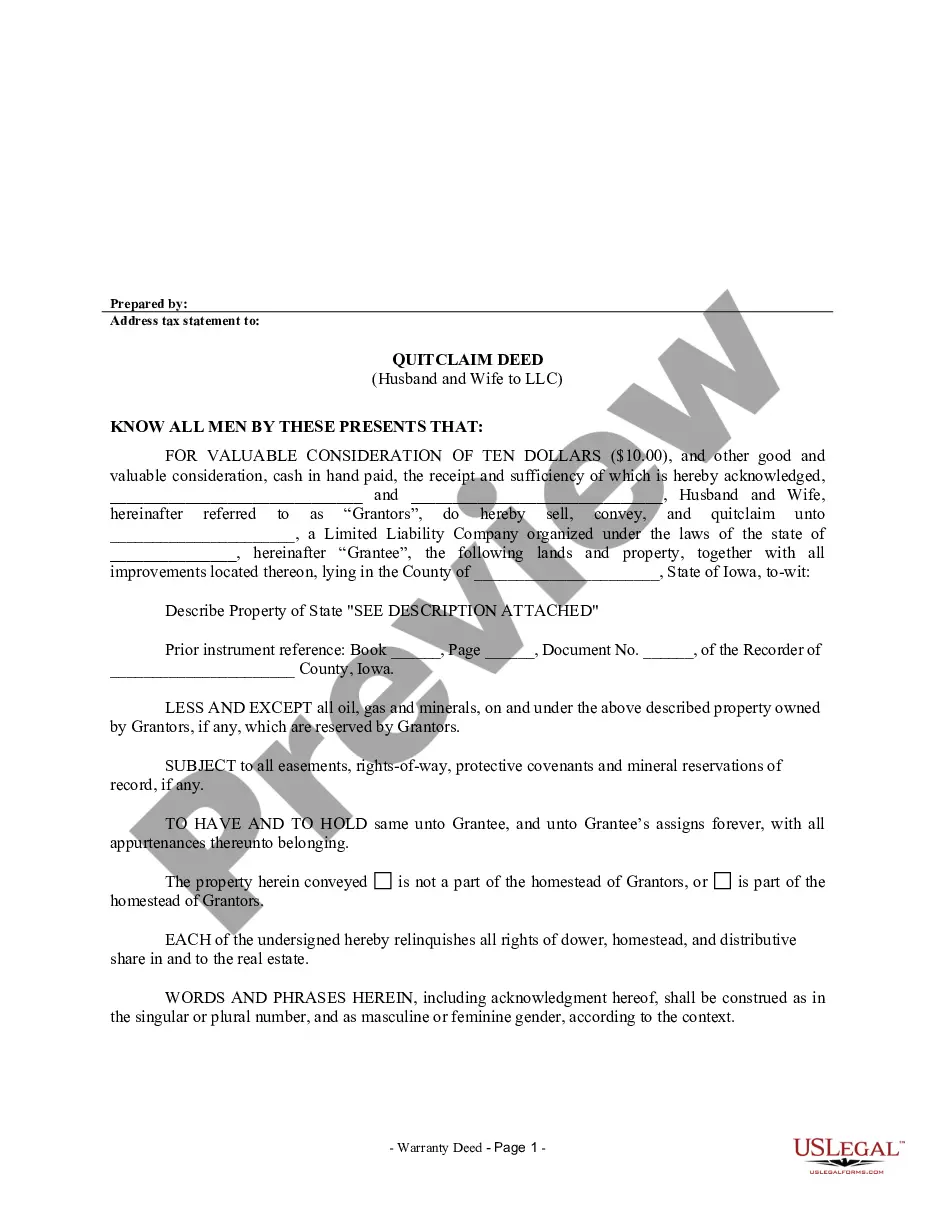

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A Davenport, Iowa Quitclaim Deed from Husband and Wife to LLC is a legal document used to transfer ownership of a property from a married couple to a limited liability company (LLC) in Davenport, Iowa. This type of deed is commonly employed when a couple wishes to transfer their property into an LLC for various reasons, such as asset protection, tax benefits, or business purposes. The Quitclaim Deed is a legal instrument that enables the transfer of ownership rights, interest, and title to real estate from the granters (husband and wife) to the LLC, referred to as the grantee. Unlike a warranty deed, a quitclaim deed does not guarantee that the granter has clear ownership of the property or that there are no liens or encumbrances. Instead, it simply conveys whatever ownership interest the granter holds, if any, to the grantee. There are different types of Davenport, Iowa Quitclaim Deeds from Husband and Wife to LLC, depending on the specific circumstances of the property transfer: 1. Voluntary Quitclaim Deed: This type of quitclaim deed is executed willingly by the husband and wife, indicating their agreement to transfer ownership to the LLC. It is commonly used for estate planning purposes or when the couple wishes to protect their personal assets from potential liabilities associated with the property. 2. Divorce or Dissolution Quitclaim Deed: In cases of divorce or marriage dissolution, a quitclaim deed may be used to transfer ownership of the property from the husband and wife to an LLC. This allows for a clean break and limits future issues related to the property that may arise after the divorce. 3. Business Transfer Quitclaim Deed: When a husband and wife decide to convert their personally-owned property into a property owned by their LLC, a business transfer quitclaim deed is used. This type of deed allows for the seamless transition of ownership into the LLC, which can provide added legal protection and tax advantages for the couple's business ventures. Regardless of the specific type, executing a Davenport, Iowa Quitclaim Deed from Husband and Wife to LLC typically involves several steps. These include preparing the deed, signing it in the presence of a notary public, and recording it with the appropriate County Recorder's Office to make the transfer of ownership official and legally binding. In conclusion, a Davenport, Iowa Quitclaim Deed from Husband and Wife to LLC is an essential legal document used to transfer ownership of a property from a married couple to an LLC in Davenport, Iowa. It is a means of protecting assets, obtaining tax benefits, and facilitating business ventures. The various types of quitclaim deeds serve different purposes, including voluntary transfers, divorce or dissolution situations, and business transfers. It is crucial to follow the appropriate legal procedures to execute and record the deed to ensure a valid and enforceable property transfer.A Davenport, Iowa Quitclaim Deed from Husband and Wife to LLC is a legal document used to transfer ownership of a property from a married couple to a limited liability company (LLC) in Davenport, Iowa. This type of deed is commonly employed when a couple wishes to transfer their property into an LLC for various reasons, such as asset protection, tax benefits, or business purposes. The Quitclaim Deed is a legal instrument that enables the transfer of ownership rights, interest, and title to real estate from the granters (husband and wife) to the LLC, referred to as the grantee. Unlike a warranty deed, a quitclaim deed does not guarantee that the granter has clear ownership of the property or that there are no liens or encumbrances. Instead, it simply conveys whatever ownership interest the granter holds, if any, to the grantee. There are different types of Davenport, Iowa Quitclaim Deeds from Husband and Wife to LLC, depending on the specific circumstances of the property transfer: 1. Voluntary Quitclaim Deed: This type of quitclaim deed is executed willingly by the husband and wife, indicating their agreement to transfer ownership to the LLC. It is commonly used for estate planning purposes or when the couple wishes to protect their personal assets from potential liabilities associated with the property. 2. Divorce or Dissolution Quitclaim Deed: In cases of divorce or marriage dissolution, a quitclaim deed may be used to transfer ownership of the property from the husband and wife to an LLC. This allows for a clean break and limits future issues related to the property that may arise after the divorce. 3. Business Transfer Quitclaim Deed: When a husband and wife decide to convert their personally-owned property into a property owned by their LLC, a business transfer quitclaim deed is used. This type of deed allows for the seamless transition of ownership into the LLC, which can provide added legal protection and tax advantages for the couple's business ventures. Regardless of the specific type, executing a Davenport, Iowa Quitclaim Deed from Husband and Wife to LLC typically involves several steps. These include preparing the deed, signing it in the presence of a notary public, and recording it with the appropriate County Recorder's Office to make the transfer of ownership official and legally binding. In conclusion, a Davenport, Iowa Quitclaim Deed from Husband and Wife to LLC is an essential legal document used to transfer ownership of a property from a married couple to an LLC in Davenport, Iowa. It is a means of protecting assets, obtaining tax benefits, and facilitating business ventures. The various types of quitclaim deeds serve different purposes, including voluntary transfers, divorce or dissolution situations, and business transfers. It is crucial to follow the appropriate legal procedures to execute and record the deed to ensure a valid and enforceable property transfer.