Iowa law states that a property owner is not obligated to pay an original contractor until ninety (90) days from the completion of the building or improvement, unless the contractor provides waivers of lien signed by all parties who might claim a lien against the property.

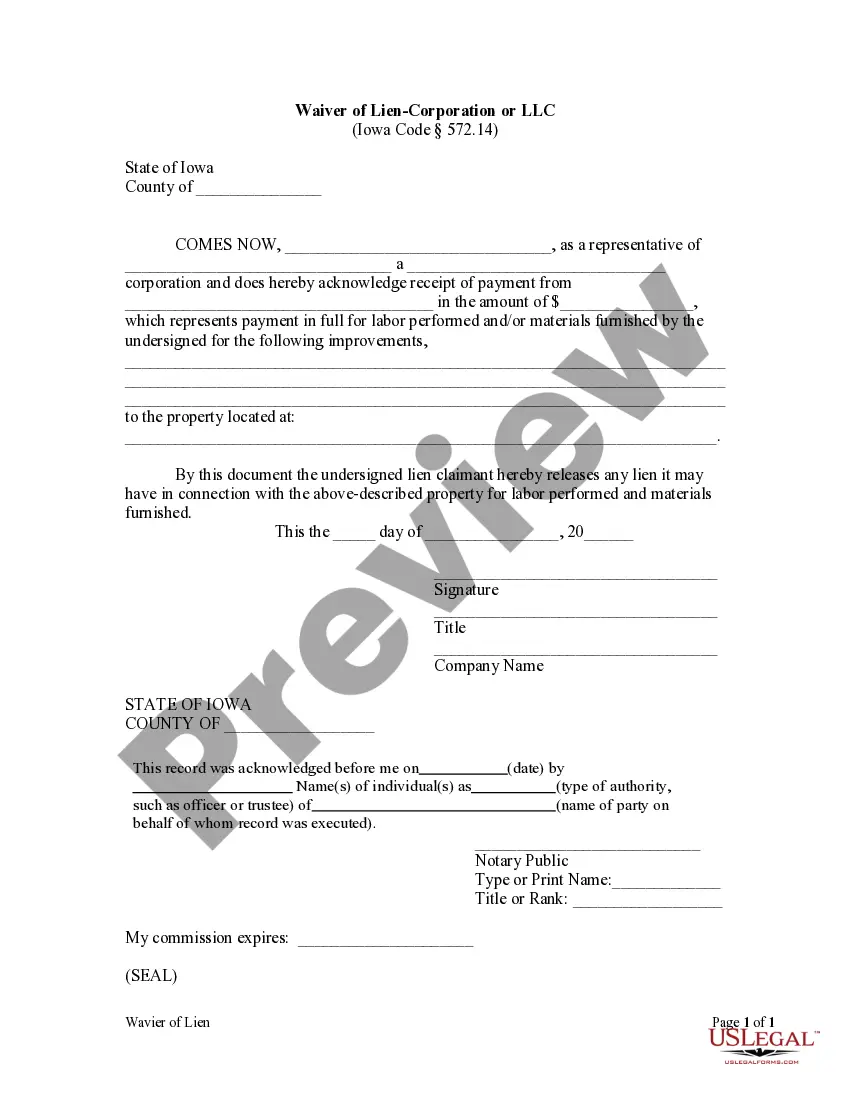

A Davenport Iowa Waiver of Lien by Corporation or LLC is a legal document that relinquishes the rights of a corporation or limited liability company (LLC) to place a lien on a property or project for unpaid debts or services. This waiver serves as a legally binding agreement between the company and the property owner, ensuring that the company will not pursue any claims against the property in the event of non-payment. In Davenport, Iowa, there are different types of Waiver of Lien documents that may be used depending on the specific circumstances. Here are a few common types: 1. Partial Conditional Waiver of Lien by Corporation or LLC: This type of waiver is issued by the corporation or LLC when they receive a partial payment for their services or materials. By signing this waiver, the company agrees to waive its right to place a lien on the property for the amount received, but retains the right to place a lien for any remaining unpaid balance. 2. Full Conditional Waiver of Lien by Corporation or LLC: This waiver is used when a corporation or LLC has received a full payment for their services or materials. By signing this waiver, the company agrees to waive its right to place a lien on the property for the entire amount received, but only if the payment is successfully processed and cleared. 3. Partial Unconditional Waiver of Lien by Corporation or LLC: This type of waiver is issued by the corporation or LLC when they have received a partial payment, and they are confident that the payment will be honored. By signing this waiver, the company permanently waives its right to place a lien on the property for the amount received. 4. Full Unconditional Waiver of Lien by Corporation or LLC: This type of waiver is used when the corporation or LLC has received a full payment and is certain that the payment is valid. By signing this waiver, the company waives its right to place a lien on the property for the entire amount received, unconditionally and permanently. These Davenport Iowa Waiver of Lien documents are legally significant and must be carefully reviewed and signed by both parties involved. It is recommended to seek legal advice or consult an attorney when dealing with such waivers to ensure compliance with local laws and regulations. Keywords: Davenport Iowa, Waiver of Lien, Corporation, LLC, legal document, property, project, unpaid debts, services, limited liability company, binding agreement, non-payment, partial conditional waiver, full conditional waiver, partial unconditional waiver, full unconditional waiver, legal significance, local laws, regulationsA Davenport Iowa Waiver of Lien by Corporation or LLC is a legal document that relinquishes the rights of a corporation or limited liability company (LLC) to place a lien on a property or project for unpaid debts or services. This waiver serves as a legally binding agreement between the company and the property owner, ensuring that the company will not pursue any claims against the property in the event of non-payment. In Davenport, Iowa, there are different types of Waiver of Lien documents that may be used depending on the specific circumstances. Here are a few common types: 1. Partial Conditional Waiver of Lien by Corporation or LLC: This type of waiver is issued by the corporation or LLC when they receive a partial payment for their services or materials. By signing this waiver, the company agrees to waive its right to place a lien on the property for the amount received, but retains the right to place a lien for any remaining unpaid balance. 2. Full Conditional Waiver of Lien by Corporation or LLC: This waiver is used when a corporation or LLC has received a full payment for their services or materials. By signing this waiver, the company agrees to waive its right to place a lien on the property for the entire amount received, but only if the payment is successfully processed and cleared. 3. Partial Unconditional Waiver of Lien by Corporation or LLC: This type of waiver is issued by the corporation or LLC when they have received a partial payment, and they are confident that the payment will be honored. By signing this waiver, the company permanently waives its right to place a lien on the property for the amount received. 4. Full Unconditional Waiver of Lien by Corporation or LLC: This type of waiver is used when the corporation or LLC has received a full payment and is certain that the payment is valid. By signing this waiver, the company waives its right to place a lien on the property for the entire amount received, unconditionally and permanently. These Davenport Iowa Waiver of Lien documents are legally significant and must be carefully reviewed and signed by both parties involved. It is recommended to seek legal advice or consult an attorney when dealing with such waivers to ensure compliance with local laws and regulations. Keywords: Davenport Iowa, Waiver of Lien, Corporation, LLC, legal document, property, project, unpaid debts, services, limited liability company, binding agreement, non-payment, partial conditional waiver, full conditional waiver, partial unconditional waiver, full unconditional waiver, legal significance, local laws, regulations