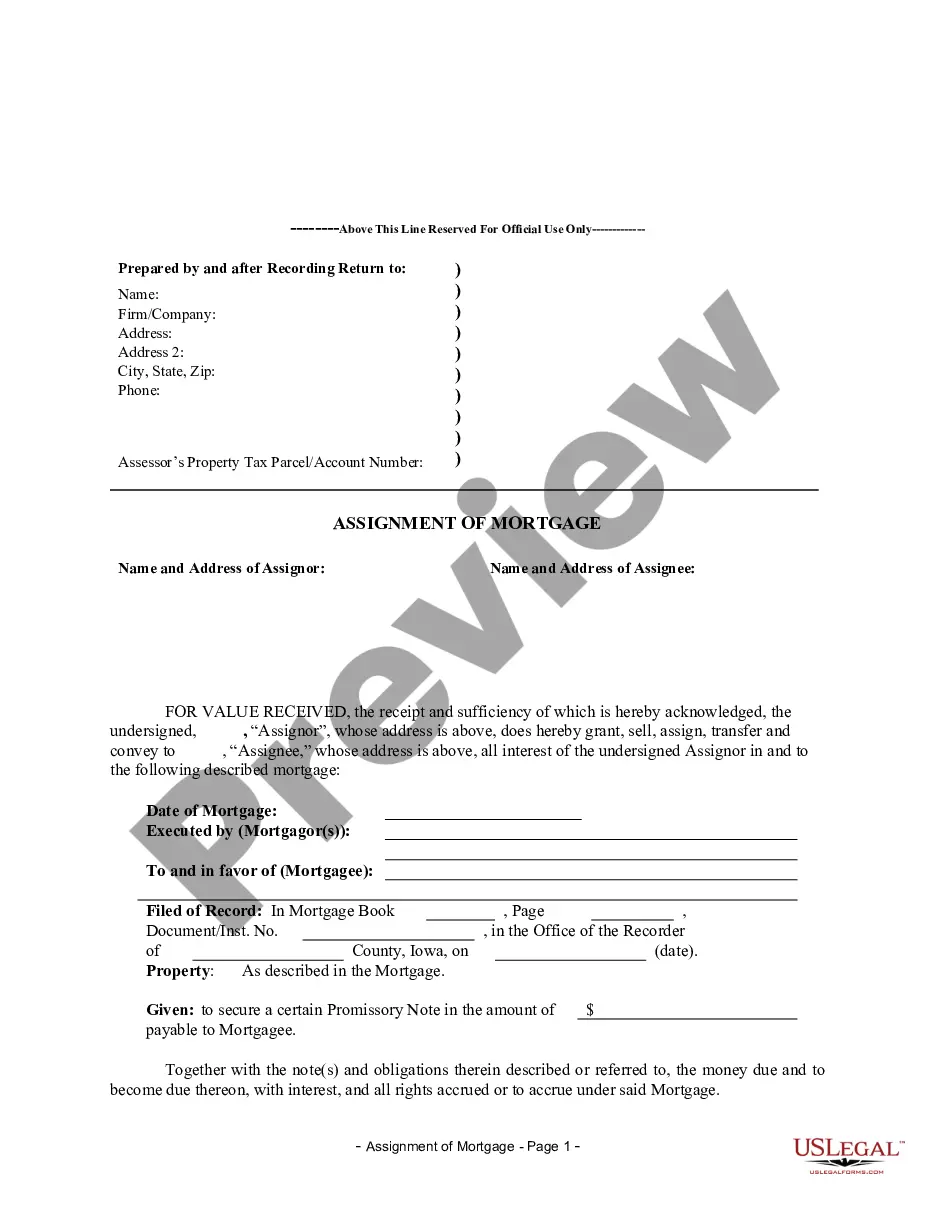

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Cedar Rapids Iowa is known for its active real estate market and mortgage industry. As part of the mortgage process, the Assignment of Mortgage by a Corporate Mortgage Holder is a common occurrence. This assignment involves the transfer of a mortgage from one lender to another or from a lender to a corporate entity. The Cedar Rapids Iowa Assignment of Mortgage by Corporate Mortgage Holder is a legal document that outlines the transfer of rights and obligations associated with a mortgage. It is important for homeowners and potential buyers to understand its implications and the various types of assignments that can occur. One common type of assignment is the transfer of mortgage servicing. In this scenario, a corporate mortgage holder acquires the rights and responsibilities for collecting loan payments, managing escrow accounts, and dealing with the borrower regarding any issues or concerns. Another type of assignment involves the transfer of ownership of the mortgage itself. A corporate mortgage holder may acquire the mortgage from the original lender, often as part of a business merger or acquisition. This transfer entails the rights to receive principal and interest payments from the borrower. It is crucial to note that while the assignment of mortgage may change the administrative and financial responsibilities associated with the loan, the terms and conditions of the mortgage itself typically remain unchanged. The borrower's obligations, such as making regular payments and adhering to the terms of the loan agreement, generally remain the same. The Assignment of Mortgage by Corporate Mortgage Holder in Cedar Rapids Iowa typically involves a detailed legal document and may require recording with the county recorder's office. This recording ensures that the transfer of the mortgage's rights and obligations is publicly documented and is an essential step in maintaining the chain of title for the property. Homeowners and potential buyers should be aware of the implications of a mortgage assignment. It is essential to review any assignment documents carefully and seek legal advice if necessary. Understanding the terms and potential changes resulting from the assignment helps protect the rights and interests of all parties involved. In conclusion, the Cedar Rapids Iowa Assignment of Mortgage by Corporate Mortgage Holder plays a significant role in the real estate market. Whether it is the transfer of mortgage servicing or the ownership of the mortgage itself, these assignments impact the administrative and financial aspects of a loan. Homeowners and potential buyers should carefully review these documents and seek legal guidance to ensure their rights and obligations are protected.Cedar Rapids Iowa is known for its active real estate market and mortgage industry. As part of the mortgage process, the Assignment of Mortgage by a Corporate Mortgage Holder is a common occurrence. This assignment involves the transfer of a mortgage from one lender to another or from a lender to a corporate entity. The Cedar Rapids Iowa Assignment of Mortgage by Corporate Mortgage Holder is a legal document that outlines the transfer of rights and obligations associated with a mortgage. It is important for homeowners and potential buyers to understand its implications and the various types of assignments that can occur. One common type of assignment is the transfer of mortgage servicing. In this scenario, a corporate mortgage holder acquires the rights and responsibilities for collecting loan payments, managing escrow accounts, and dealing with the borrower regarding any issues or concerns. Another type of assignment involves the transfer of ownership of the mortgage itself. A corporate mortgage holder may acquire the mortgage from the original lender, often as part of a business merger or acquisition. This transfer entails the rights to receive principal and interest payments from the borrower. It is crucial to note that while the assignment of mortgage may change the administrative and financial responsibilities associated with the loan, the terms and conditions of the mortgage itself typically remain unchanged. The borrower's obligations, such as making regular payments and adhering to the terms of the loan agreement, generally remain the same. The Assignment of Mortgage by Corporate Mortgage Holder in Cedar Rapids Iowa typically involves a detailed legal document and may require recording with the county recorder's office. This recording ensures that the transfer of the mortgage's rights and obligations is publicly documented and is an essential step in maintaining the chain of title for the property. Homeowners and potential buyers should be aware of the implications of a mortgage assignment. It is essential to review any assignment documents carefully and seek legal advice if necessary. Understanding the terms and potential changes resulting from the assignment helps protect the rights and interests of all parties involved. In conclusion, the Cedar Rapids Iowa Assignment of Mortgage by Corporate Mortgage Holder plays a significant role in the real estate market. Whether it is the transfer of mortgage servicing or the ownership of the mortgage itself, these assignments impact the administrative and financial aspects of a loan. Homeowners and potential buyers should carefully review these documents and seek legal guidance to ensure their rights and obligations are protected.