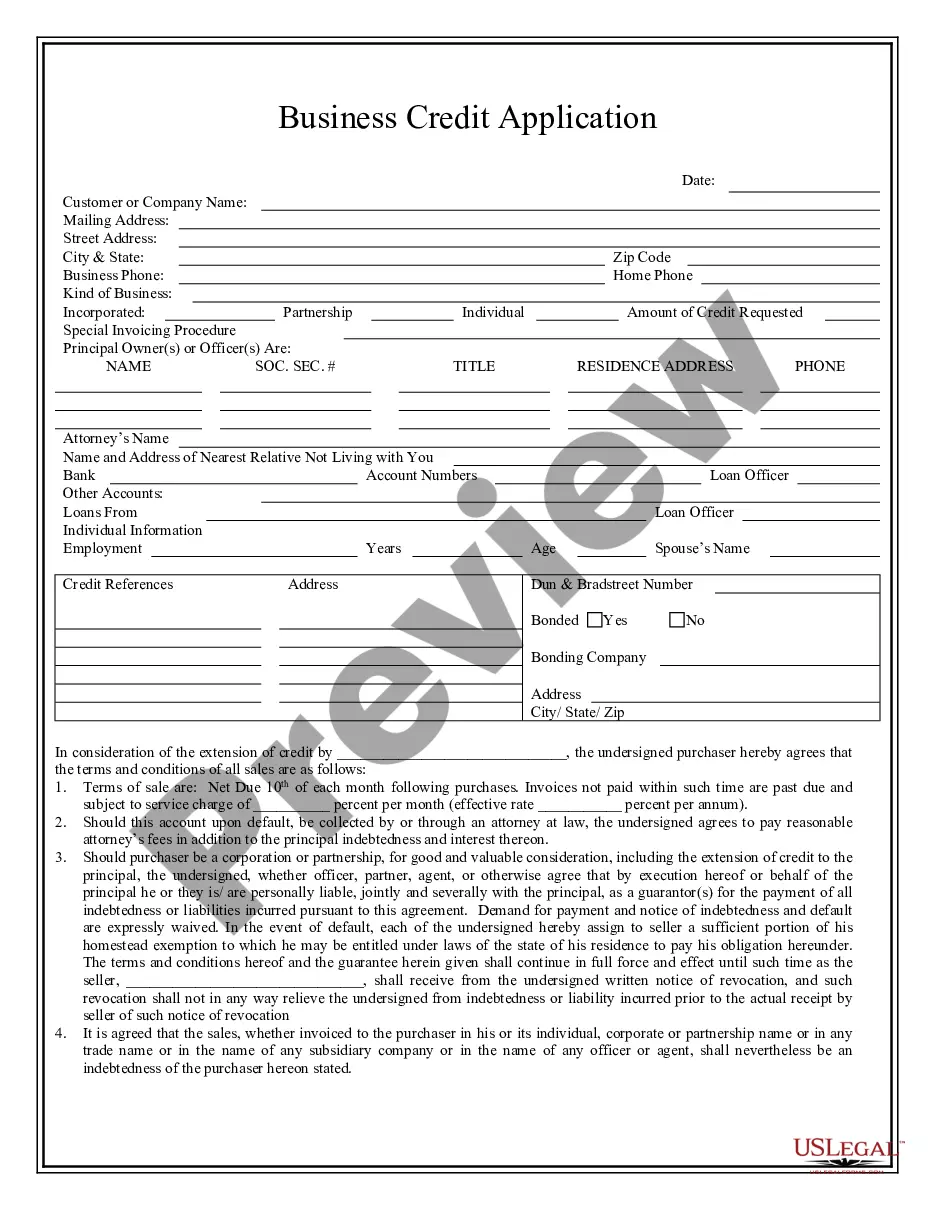

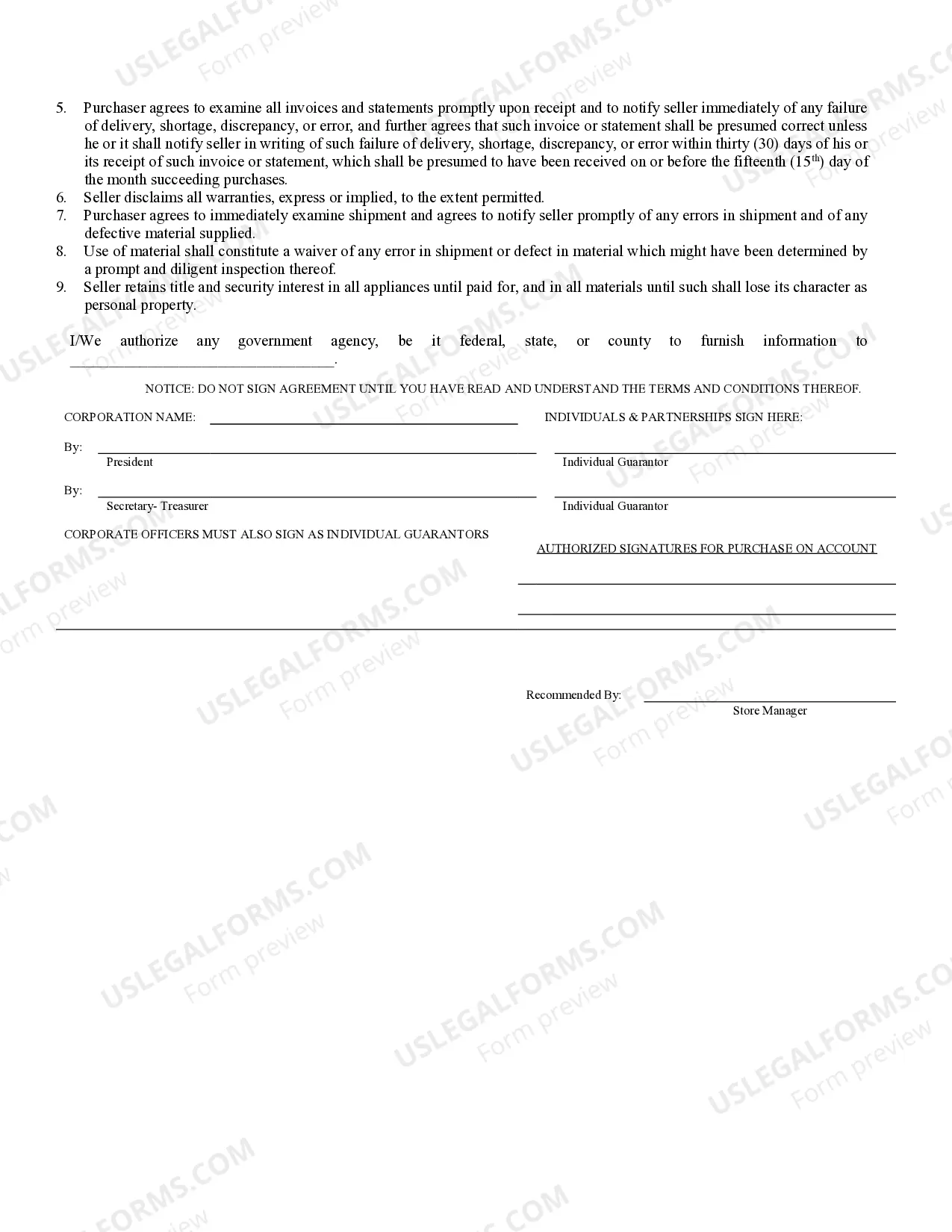

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Cedar Rapids Iowa Business Credit Application is a comprehensive and efficient process designed to help businesses in Cedar Rapids, Iowa, in obtaining credit for their operations and growth. This application is available for various types of businesses, including small enterprises, startups, and established corporations. The Cedar Rapids Iowa Business Credit Application seeks to gather essential information about the business, its financial stability, and creditworthiness, enabling financial institutions or lenders to assess the risk involved in extending credit. By utilizing this application, businesses can apply for various types of credit facilities, such as business loans, lines of credit, or equipment financing. The application typically requires important details about the business, such as its legal name, physical address, contact information, and ownership structure. It also requests information about the business's financial standing, including income statements, balance sheets, cash flow projections, and tax returns. Additionally, the Cedar Rapids Iowa Business Credit Application might require businesses to provide details regarding their industry, years in operation, number of employees, and business history. This information helps lenders evaluate the stability and market position of the business, contributing to their credit decision-making process. Furthermore, businesses may be required to disclose any existing debts, outstanding loans, or financial obligations as part of the credit application. This provides lenders a clearer picture of the business's existing financial commitments and its ability to manage additional credit. Different types of Cedar Rapids Iowa Business Credit Applications may include: 1. Small Business Credit Application: Designed specifically for small businesses, this application caters to the unique needs and requirements of these enterprises, considering factors like revenue, business size, and industry-specific criteria. 2. Startup Business Credit Application: Tailored for newly established businesses, this application focuses on evaluating the business's potential for growth, market viability, and management team expertise, as they may not have an extensive operating history to assess. 3. Commercial Real Estate Credit Application: Geared towards businesses seeking credit for real estate ventures, this application concentrates on the specific requirements and risks associated with commercial properties, such as rental income, property valuation, and associated expenses. 4. Equipment Financing Credit Application: This application is ideal for businesses looking to acquire equipment or machinery. It emphasizes evaluating the equipment's value, lifespan, expected return on investment, and the business's ability to generate revenue through its usage. In summary, the Cedar Rapids Iowa Business Credit Application serves as a crucial tool for businesses seeking credit for their operational and growth needs. It streamlines the process by gathering pertinent information about the business, its financials, and potential risks. With different types of credit applications available, businesses can choose the one that aligns best with their specific needs and objectives.Cedar Rapids Iowa Business Credit Application is a comprehensive and efficient process designed to help businesses in Cedar Rapids, Iowa, in obtaining credit for their operations and growth. This application is available for various types of businesses, including small enterprises, startups, and established corporations. The Cedar Rapids Iowa Business Credit Application seeks to gather essential information about the business, its financial stability, and creditworthiness, enabling financial institutions or lenders to assess the risk involved in extending credit. By utilizing this application, businesses can apply for various types of credit facilities, such as business loans, lines of credit, or equipment financing. The application typically requires important details about the business, such as its legal name, physical address, contact information, and ownership structure. It also requests information about the business's financial standing, including income statements, balance sheets, cash flow projections, and tax returns. Additionally, the Cedar Rapids Iowa Business Credit Application might require businesses to provide details regarding their industry, years in operation, number of employees, and business history. This information helps lenders evaluate the stability and market position of the business, contributing to their credit decision-making process. Furthermore, businesses may be required to disclose any existing debts, outstanding loans, or financial obligations as part of the credit application. This provides lenders a clearer picture of the business's existing financial commitments and its ability to manage additional credit. Different types of Cedar Rapids Iowa Business Credit Applications may include: 1. Small Business Credit Application: Designed specifically for small businesses, this application caters to the unique needs and requirements of these enterprises, considering factors like revenue, business size, and industry-specific criteria. 2. Startup Business Credit Application: Tailored for newly established businesses, this application focuses on evaluating the business's potential for growth, market viability, and management team expertise, as they may not have an extensive operating history to assess. 3. Commercial Real Estate Credit Application: Geared towards businesses seeking credit for real estate ventures, this application concentrates on the specific requirements and risks associated with commercial properties, such as rental income, property valuation, and associated expenses. 4. Equipment Financing Credit Application: This application is ideal for businesses looking to acquire equipment or machinery. It emphasizes evaluating the equipment's value, lifespan, expected return on investment, and the business's ability to generate revenue through its usage. In summary, the Cedar Rapids Iowa Business Credit Application serves as a crucial tool for businesses seeking credit for their operational and growth needs. It streamlines the process by gathering pertinent information about the business, its financials, and potential risks. With different types of credit applications available, businesses can choose the one that aligns best with their specific needs and objectives.