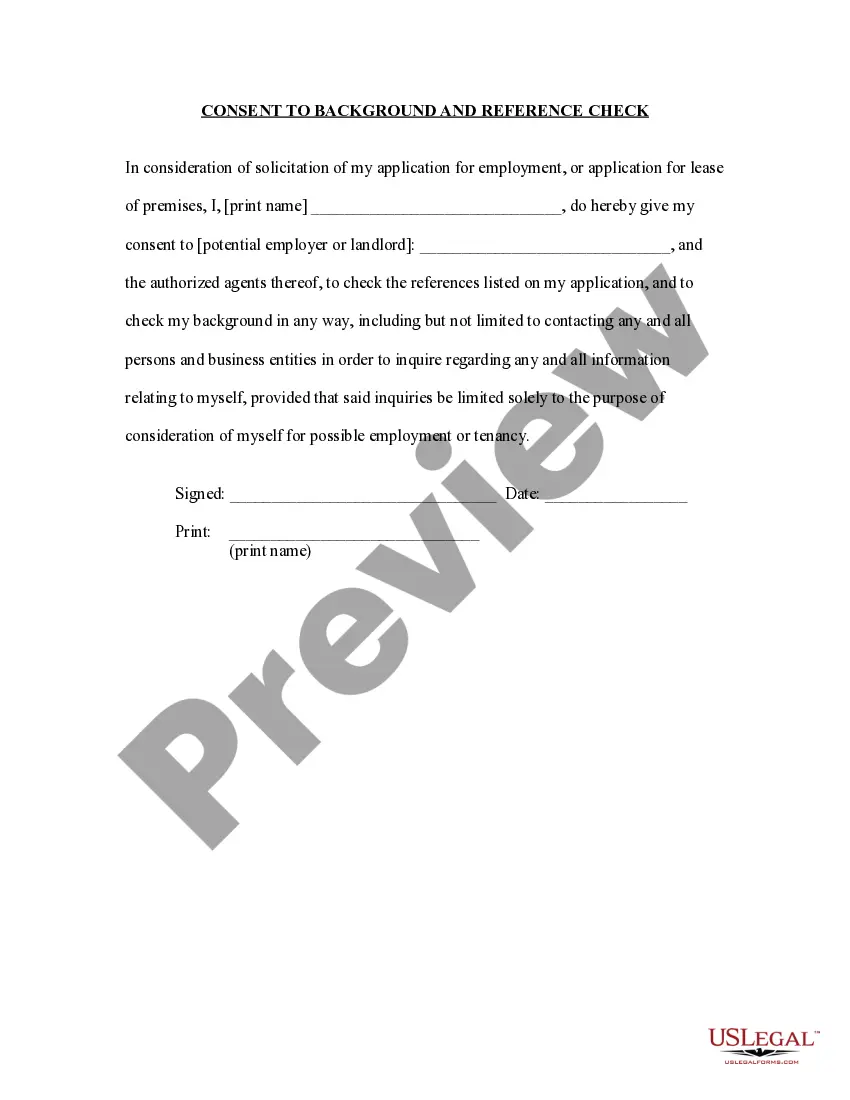

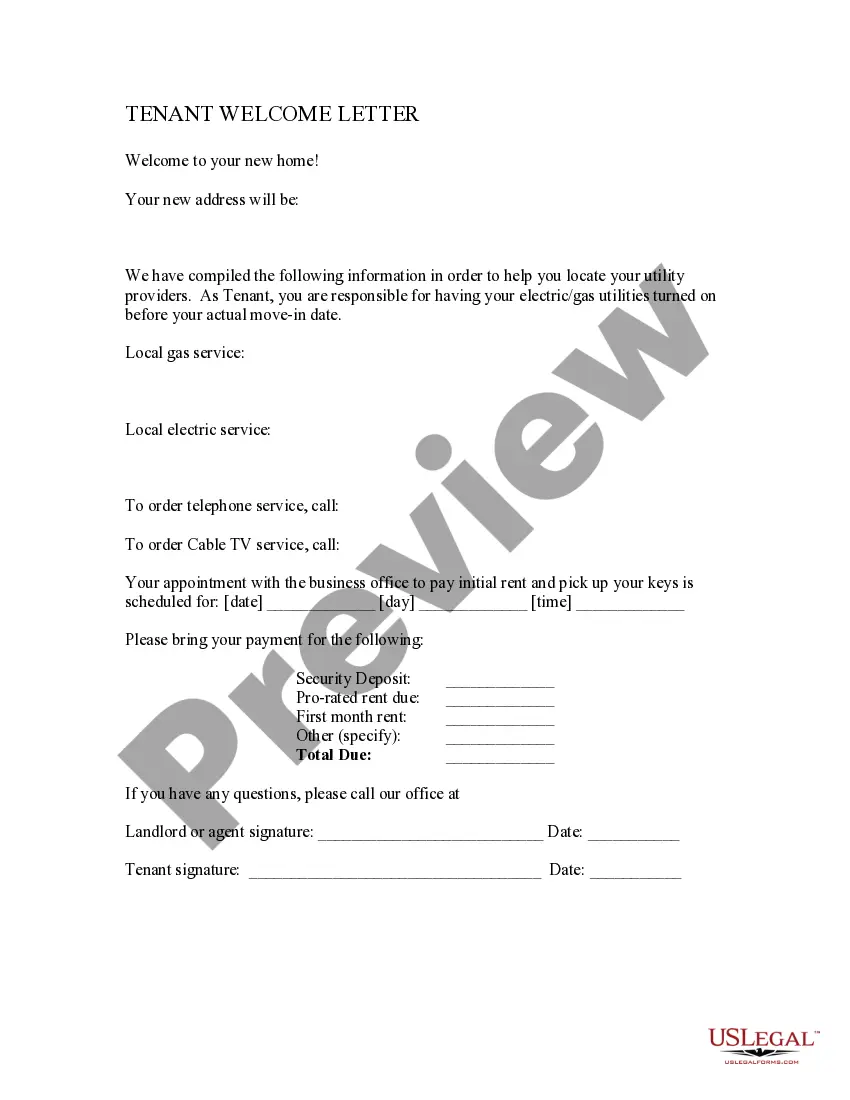

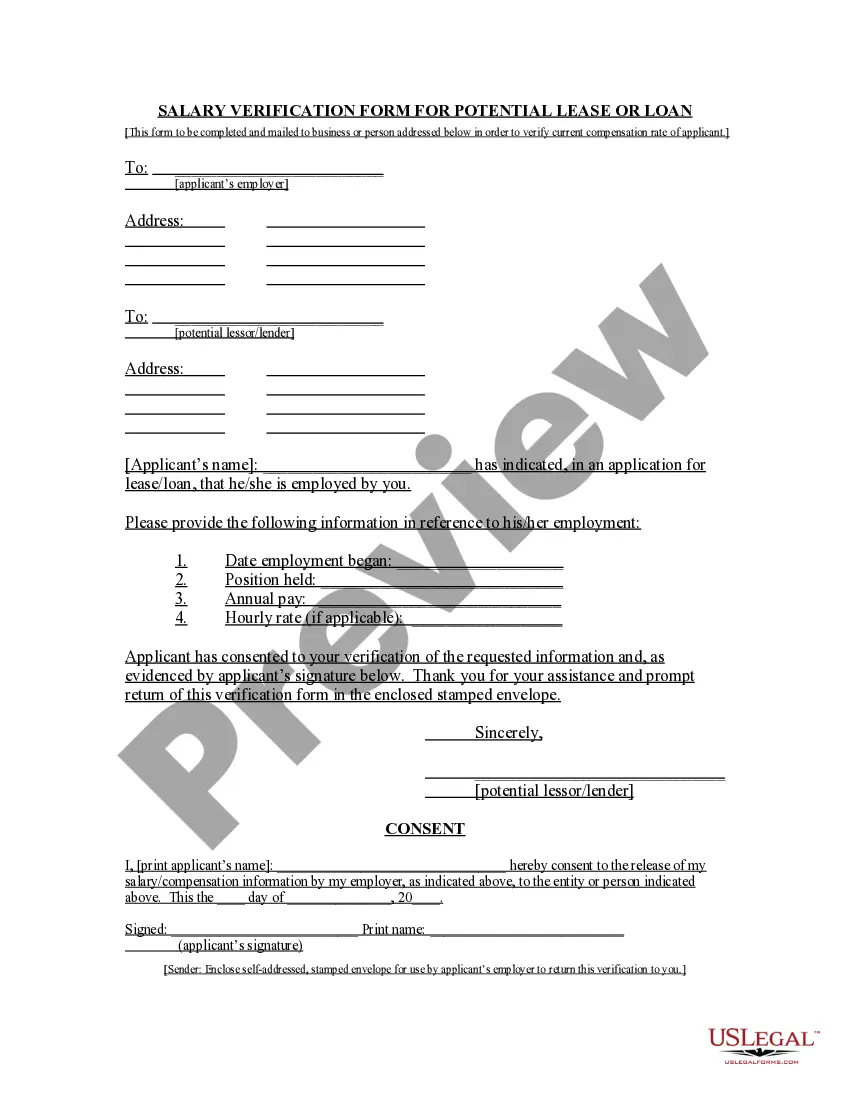

This Salary Verification form for Potential Lease is a form to be sent to a potential tenant's employer, in order for the Landlord to verify the lease applicant's income as reported on an application for lease (please see Form -827LT "Application for Residential Lease"). A Tenant Consent Form comes with the Salary Verification Form, and should also be sent to the employer.

Davenport Iowa Salary Verification Form for Potential Lease: Everything You Need to Know When it comes to leasing a property in Davenport, Iowa, landlords often require applicants to provide a salary verification form to ensure the tenant's ability to meet the rental payment obligations. A salary verification form is a document that confirms an individual's earnings and employment details. It empowers landlords to make informed decisions based on the applicant's financial stability. The Davenport Iowa Salary Verification Form for Potential Lease typically includes several important sections: 1. Personal Information: This section collects basic details about the tenant, such as full name, contact information, social security number, and the desired property address. 2. Employment Information: In this section, the tenant is required to provide information about their current and previous employment. Details such as the employer's name, address, phone number, job title, and duration of employment may be requested. Some forms may also ask for additional income sources, such as investments or side businesses. 3. Salary Details: Here, tenants are required to disclose their salary and any other regular income sources. Landlords need to know the frequency of payments (e.g., monthly, bi-weekly) and the exact amount received to assess the applicant's ability to meet rental obligations. Recent pay stubs or income tax returns may also be requested as supporting documents. 4. Consent for Verification: Tenants are typically required to sign a consent section that grants the landlord permission to verify the provided information with the employer or third-party verification services. This allows the landlord to verify the accuracy of the tenant's income and employment details. Types of Davenport Iowa Salary Verification Forms for Potential Lease: 1. Basic Salary Verification Form: This is the standard form that most landlords utilize to assess applicants' income and employment. It typically includes the sections mentioned above. 2. Enhanced Salary Verification Form: Some landlords may require additional information to gain a more comprehensive understanding of an applicant's financial stability. This form may include sections for rental history, credit check authorization, and references. It provides a more holistic evaluation of the tenant's suitability for a lease. 3. Online/Electronic Salary Verification Form: With advancements in technology, some landlords may utilize online platforms or electronic forms for the salary verification process. This streamlines the application process and allows for seamless sharing and verification of information. Overall, the Davenport Iowa Salary Verification Form for Potential Lease is an essential document that plays a crucial role in establishing a tenant's financial credibility. It helps landlords make informed decisions, minimize potential risks, and ensure a smooth leasing experience.Davenport Iowa Salary Verification Form for Potential Lease: Everything You Need to Know When it comes to leasing a property in Davenport, Iowa, landlords often require applicants to provide a salary verification form to ensure the tenant's ability to meet the rental payment obligations. A salary verification form is a document that confirms an individual's earnings and employment details. It empowers landlords to make informed decisions based on the applicant's financial stability. The Davenport Iowa Salary Verification Form for Potential Lease typically includes several important sections: 1. Personal Information: This section collects basic details about the tenant, such as full name, contact information, social security number, and the desired property address. 2. Employment Information: In this section, the tenant is required to provide information about their current and previous employment. Details such as the employer's name, address, phone number, job title, and duration of employment may be requested. Some forms may also ask for additional income sources, such as investments or side businesses. 3. Salary Details: Here, tenants are required to disclose their salary and any other regular income sources. Landlords need to know the frequency of payments (e.g., monthly, bi-weekly) and the exact amount received to assess the applicant's ability to meet rental obligations. Recent pay stubs or income tax returns may also be requested as supporting documents. 4. Consent for Verification: Tenants are typically required to sign a consent section that grants the landlord permission to verify the provided information with the employer or third-party verification services. This allows the landlord to verify the accuracy of the tenant's income and employment details. Types of Davenport Iowa Salary Verification Forms for Potential Lease: 1. Basic Salary Verification Form: This is the standard form that most landlords utilize to assess applicants' income and employment. It typically includes the sections mentioned above. 2. Enhanced Salary Verification Form: Some landlords may require additional information to gain a more comprehensive understanding of an applicant's financial stability. This form may include sections for rental history, credit check authorization, and references. It provides a more holistic evaluation of the tenant's suitability for a lease. 3. Online/Electronic Salary Verification Form: With advancements in technology, some landlords may utilize online platforms or electronic forms for the salary verification process. This streamlines the application process and allows for seamless sharing and verification of information. Overall, the Davenport Iowa Salary Verification Form for Potential Lease is an essential document that plays a crucial role in establishing a tenant's financial credibility. It helps landlords make informed decisions, minimize potential risks, and ensure a smooth leasing experience.