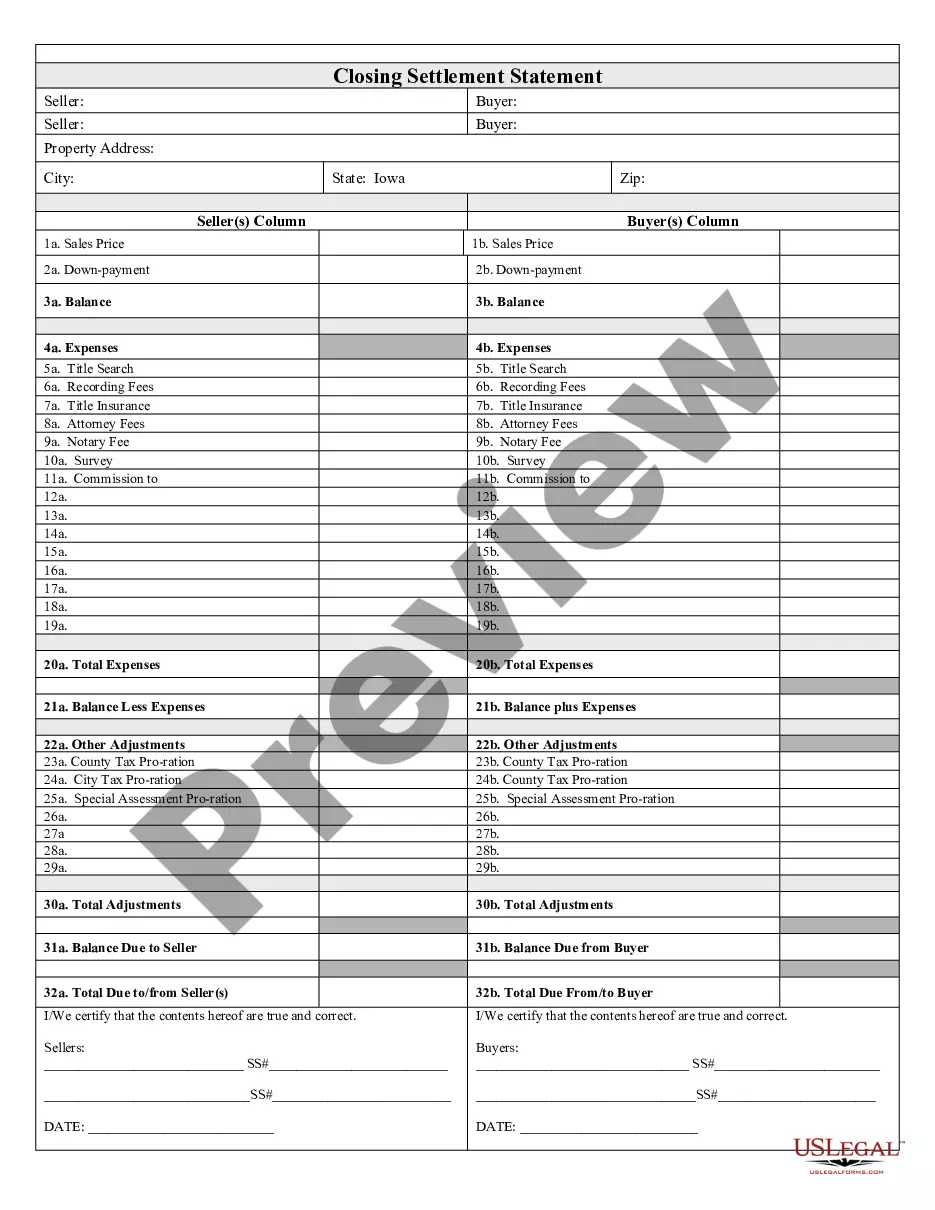

This Closing Statement is for a real estate transaction where the transaction is a cash sale or provides for owner financing. This settlement statement is verified and signed by both the seller and the buyer.

Davenport Iowa Closing Statement

Description

How to fill out Iowa Closing Statement?

If you are looking for a legitimate form, it’s hard to locate a more suitable site than the US Legal Forms portal – likely the largest online collections.

With this collection, you can acquire a vast array of document templates for corporate and personal needs organized by categories and areas, or keywords.

With our premium search capability, finding the latest Davenport Iowa Closing Statement is as straightforward as 1-2-3.

Complete the payment. Employ your credit card or PayPal account to finalize the registration process.

Obtain the template. Choose the file format and store it on your device. Edit as needed. Complete, modify, print, and sign the acquired Davenport Iowa Closing Statement.

- Additionally, the validity of each document is confirmed by a group of experienced attorneys who continuously examine the templates on our site and refresh them as per the latest state and county guidelines.

- If you are already familiar with our service and possess a registered account, all you need to do to obtain the Davenport Iowa Closing Statement is to Log In to your account and click the Download button.

- If you are accessing US Legal Forms for the first time, simply follow the instructions below.

- Ensure you have located the form you desire. Review its details and utilize the Preview feature (if available) to check its contents. If it doesn’t fulfill your requirements, use the Search function at the top of the page to find the necessary document.

- Confirm your selection. Click the Buy now button. Next, select the desired subscription plan and provide information to create an account.

Form popularity

FAQ

Your closing statement should be a clear and comprehensive summary of the financial aspects of your real estate transaction. It must include all debits and credits, breaking down amounts owed, received, and how they relate to the property. When preparing your Davenport Iowa Closing Statement, consider using resources like US Legal Forms to ensure compliance with local regulations and practices. This will help you avoid common pitfalls and ensure you have a reliable document.

At closing, you should receive several important documents, but getting a copy of your title may vary by situation. Often, you receive a title insurance policy instead. For clarity on your specific case and to ensure you have the Davenport Iowa Closing Statement, reach out to your title company or real estate agent after the closing.

Your closing statement can usually be found in the paperwork you received at closing. If you cannot locate it, contact your title company or lender for a duplicate. They can provide you with the Davenport Iowa Closing Statement to address any queries you may have about your transaction.

Getting copies of your closing documents is straightforward. First, contact the title company or lender who handled your transaction; they typically keep these records on file. Additionally, you can access the Davenport Iowa Closing Statement through your real estate agent, ensuring that you have all the necessary information for future reference.

If you lose your closing documents, don’t worry; you can still retrieve copies. You should reach out to your title company, lender, or your real estate agent who facilitated the transaction. They can help you obtain the needed documents, including the Davenport Iowa Closing Statement, which is essential for your records.

To obtain a copy of your house closing documents, start by contacting your lender or title company. They usually have copies of these documents, including the Davenport Iowa Closing Statement. If necessary, you can also reach out to your real estate agent for further assistance.

The duration to close an estate in Iowa can vary, typically ranging from six months to a year, depending on the complexity of the estate. Factors such as asset types, creditor claims, and court schedules all influence this timeline. To streamline this process and ensure your Davenport Iowa Closing Statement is handled correctly, utilizing resources from US Legal Forms can prove beneficial.

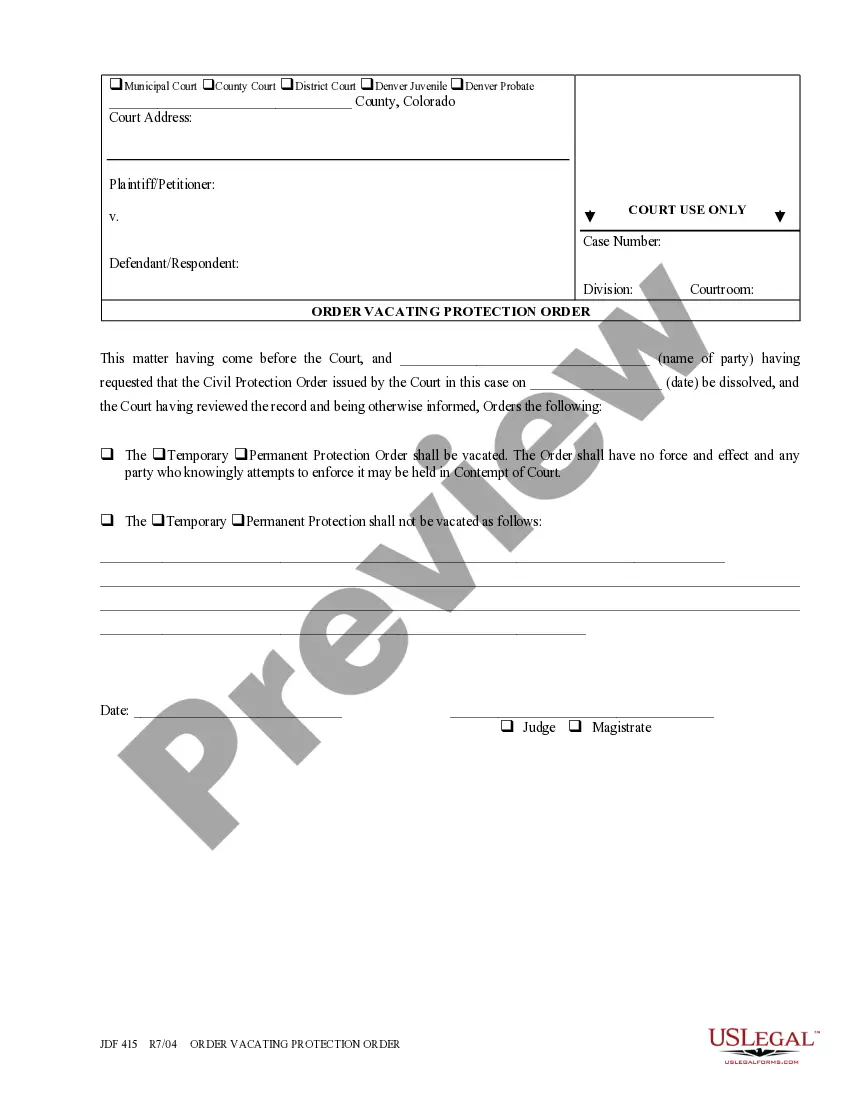

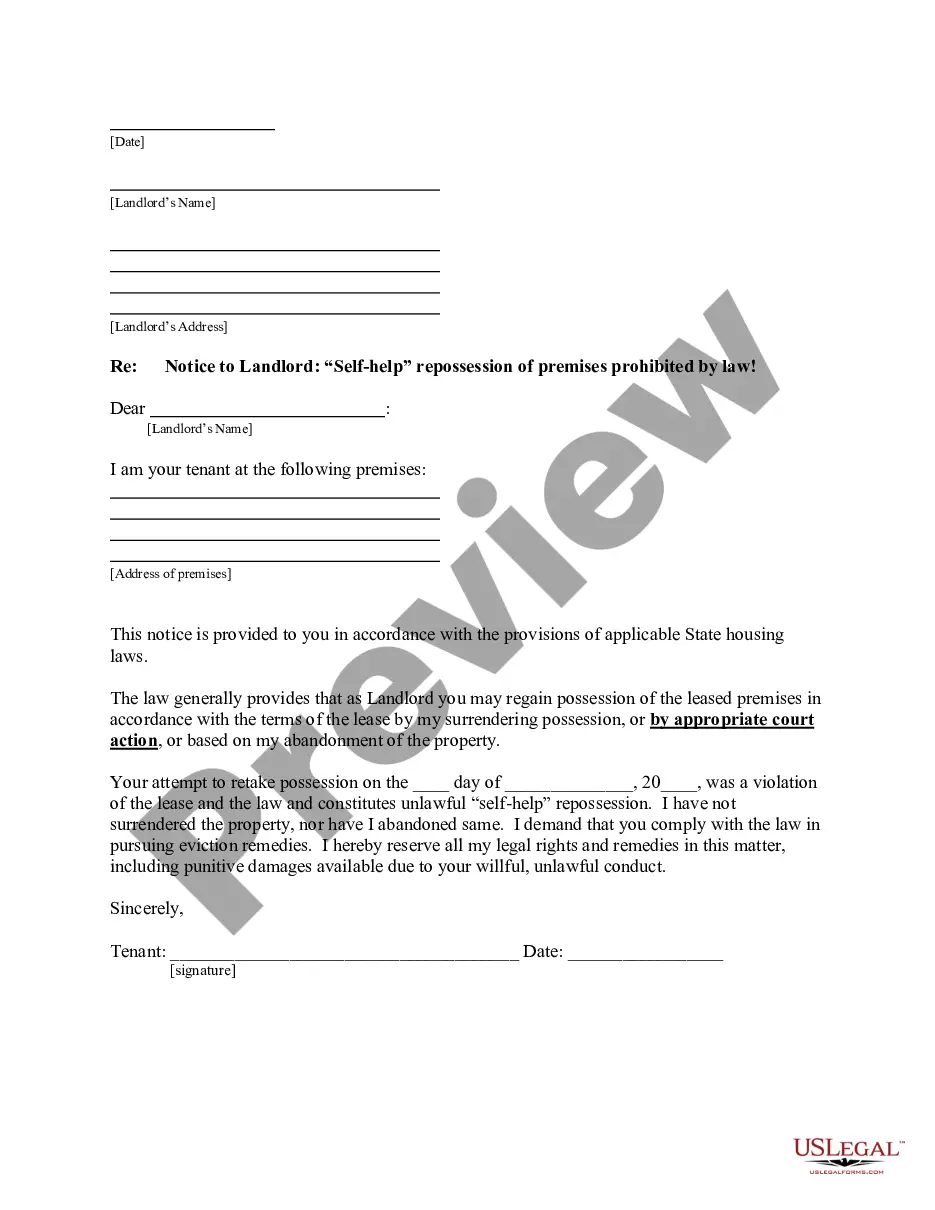

Filing a contempt in Iowa starts with drafting a motion that clearly explains how the other party has disobeyed a court order. After that, you must submit it to the appropriate court alongside any required evidence. As the legal matters grow more complex, particularly those affecting your Davenport Iowa Closing Statement, consider using platforms like US Legal Forms to navigate the legal landscape efficiently.

To file a contempt of court in Iowa, you must prepare a motion outlining the specifics of the contemptuous behavior. After completing the motion, you will file it with the court where the original order was issued. This process can become complicated, especially if it intersects with your Davenport Iowa Closing Statement, so seeking assistance from US Legal Forms could enhance your filing process and ensure accuracy.

Yes, you can file a contempt of court order yourself in Iowa. It involves submitting the proper forms to the court, detailing how the other party failed to comply with a court order. However, this process can be intricate, especially when linked to your Davenport Iowa Closing Statement. For the best outcome, you may want to utilize resources like US Legal Forms to ensure all documentation is correctly completed.