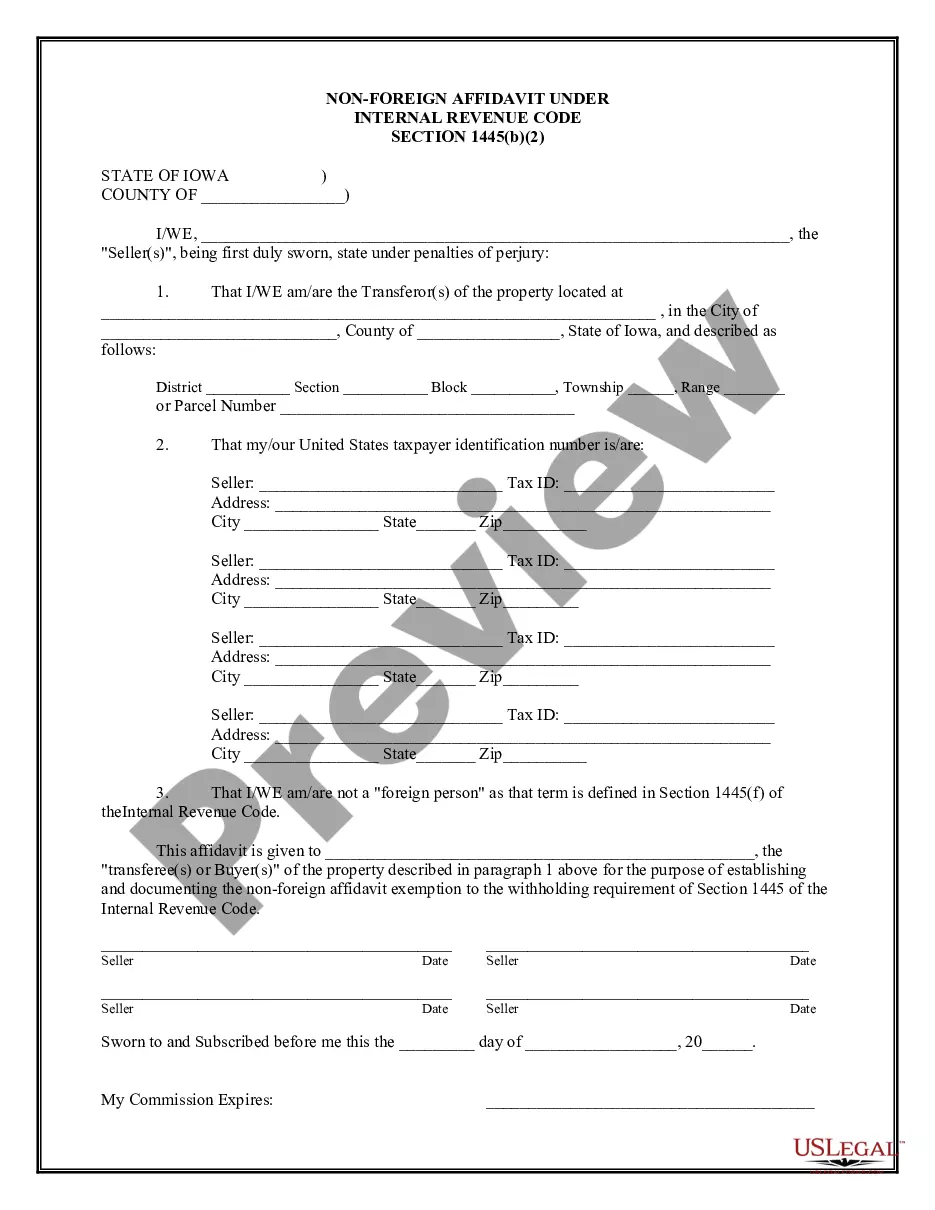

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Cedar Rapids Iowa Non-Foreign Affidavit Under IRC 1445: A Comprehensive Overview Introduction: In Cedar Rapids, Iowa, the Non-Foreign Affidavit Under IRC 1445 plays a crucial role in real estate transactions involving foreign sellers. This affidavit requires foreign individuals or entities to declare their status as either a foreign or non-foreign person to comply with the Internal Revenue Code (IRC) Section 1445. This code pertains specifically to the disposition of US real property interests by foreign individuals or entities. Understanding the different types of Cedar Rapids Iowa Non-Foreign Affidavits Under IRC 1445 is essential to navigate the legal complexities of any transaction involving foreign sellers. Types of Cedar Rapids Iowa Non-Foreign Affidavit Under IRC 1445: 1. Cedar Rapids Iowa Non-Foreign Affidavit Under IRC 1445 for Individuals: This type of affidavit is relevant when a foreign individual is selling their US real property interests in Cedar Rapids, Iowa. Foreign individuals must complete this affidavit to confirm their non-foreign status before the transaction can proceed. 2. Cedar Rapids Iowa Non-Foreign Affidavit Under IRC 1445 for Entities: When a foreign entity, such as a corporation or partnership, is involved in a real estate transaction, this affidavit becomes necessary. Similar to the individual affidavit, foreign entities must provide an accurate declaration of their non-foreign status to meet the requirements of IRC 1445. Key Elements of Cedar Rapids Iowa Non-Foreign Affidavit Under IRC 1445: 1. Identification Information: The affidavit requires detailed identification information about the filer, including their name, address, taxpayer identification number (TIN), and any relevant supporting documentation, such as a copy of the passport for individuals or proof of entity formation for entities. 2. Declaration of Non-Foreign Status: The affidavit mandates a clear declaration by the filer stating their non-foreign status, affirming that they are not subject to withholding or any other requirements under IRC 1445 for foreign sellers. 3. Attached Documentation: To substantiate the claims made in the affidavit, filers must attach necessary supporting documentation, such as residency certifications or exemption documentation, which prove their non-foreign status under the IRC guidelines. 4. Certification of the Accuracy of Information: The filer must certify, under penalties of perjury, that all the information provided in the affidavit is true, correct, and complete to the best of their knowledge and belief. Conclusion: When engaging in a real estate transaction involving foreign sellers in Cedar Rapids, Iowa, the Cedar Rapids Iowa Non-Foreign Affidavit Under IRC 1445 becomes an indispensable tool to ensure compliance with US tax laws. By accurately completing this affidavit while adhering to the specified guidelines, sellers can confidently demonstrate their non-foreign status and facilitate the smooth progression of the transaction. It is crucial to seek professional advice from tax experts or legal counsel to navigate the intricacies and obligations concerning IRC 1445 before maneuvering through any real estate transaction involving foreign sellers.