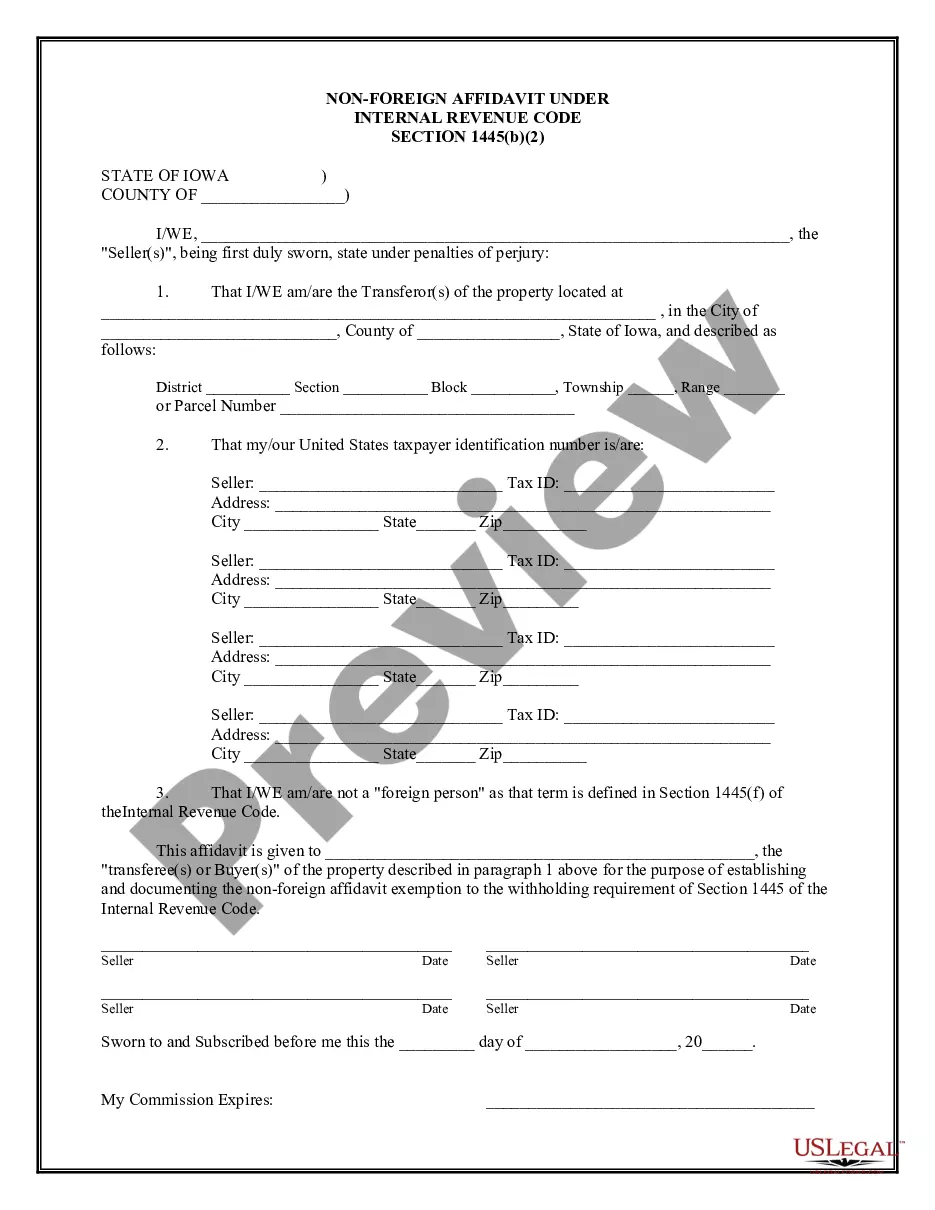

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Davenport Iowa Non-Foreign Affidavit Under IRC 1445: A Comprehensive Overview In Davenport, Iowa, individuals involved in real estate transactions may come across the term "Non-Foreign Affidavit Under IRC 1445." This affidavit is an important legal document used to verify the non-foreign status of a seller or transferor in a real estate transaction. In this article, we will provide a detailed description of what a Davenport Iowa Non-Foreign Affidavit Under IRC 1445 entails, along with relevant keywords to help you grasp the concept fully. What is a Non-Foreign Affidavit Under IRC 1445? A Non-Foreign Affidavit Under IRC 1445 is a form used to comply with Internal Revenue Code (IRC) regulations when it comes to the sale or transfer of U.S. real property interests by non-foreign individuals/entities. IRC section 1445 mandates that the buyer or transferee must withhold a specific percentage from the total amount realized from the property disposition if the seller is a foreign person. However, this withholding requirement does not apply to U.S. individuals or entities, and the Non-Foreign Affidavit serves as a means to verify their non-foreign status. Keywords: — Davenport, Iowa: The city located in Scott County, Iowa, where the Non-Foreign Affidavit Under IRC 1445 is relevant. — Non-Foreign Affidavit: A legal document used to prove that an individual/entity is not considered "foreign" for the purposes of real estate transactions. — IRC 1445: The specific section of the Internal Revenue Code that establishes the withholding requirement for buyers or transferees when dealing with foreign sellers. — Real estate transaction: Buying, selling, or transferring ownership of property, land, buildings, or any real estate assets. — Seller or Transferor: The party disposing of the real estate property or interest. — Non-Foreign Status: The status of being classified as a U.S. individual or entity, exempt from the IRC 1445 withholding requirements. — U.S. real property interests: Ownership rights or interests in U.S. real estate assets, such as land, buildings, or property. — Foreign person: An individual or entity that is not considered a U.S. person under tax laws. Different Types of Davenport Iowa Non-Foreign Affidavit Under IRC 1445: While there may not be distinct types of Davenport Iowa Non-Foreign Affidavits Under IRC 1445, it is important to note that the affidavit can be adapted to various real estate transactions. For instance, the affidavit may be used in residential property sales, commercial property transfers, land exchanges, or any other sale involving U.S. real estate interests. In summary, a Davenport Iowa Non-Foreign Affidavit Under IRC 1445 is an essential document used in real estate transactions to verify that the seller or transferor is not a foreign person. By complying with IRC regulations, this affidavit ensures that the withholding requirements for foreign sellers do not apply. Understanding the significance of this affidavit can greatly assist individuals involved in real estate transactions in Davenport, Iowa.Davenport Iowa Non-Foreign Affidavit Under IRC 1445: A Comprehensive Overview In Davenport, Iowa, individuals involved in real estate transactions may come across the term "Non-Foreign Affidavit Under IRC 1445." This affidavit is an important legal document used to verify the non-foreign status of a seller or transferor in a real estate transaction. In this article, we will provide a detailed description of what a Davenport Iowa Non-Foreign Affidavit Under IRC 1445 entails, along with relevant keywords to help you grasp the concept fully. What is a Non-Foreign Affidavit Under IRC 1445? A Non-Foreign Affidavit Under IRC 1445 is a form used to comply with Internal Revenue Code (IRC) regulations when it comes to the sale or transfer of U.S. real property interests by non-foreign individuals/entities. IRC section 1445 mandates that the buyer or transferee must withhold a specific percentage from the total amount realized from the property disposition if the seller is a foreign person. However, this withholding requirement does not apply to U.S. individuals or entities, and the Non-Foreign Affidavit serves as a means to verify their non-foreign status. Keywords: — Davenport, Iowa: The city located in Scott County, Iowa, where the Non-Foreign Affidavit Under IRC 1445 is relevant. — Non-Foreign Affidavit: A legal document used to prove that an individual/entity is not considered "foreign" for the purposes of real estate transactions. — IRC 1445: The specific section of the Internal Revenue Code that establishes the withholding requirement for buyers or transferees when dealing with foreign sellers. — Real estate transaction: Buying, selling, or transferring ownership of property, land, buildings, or any real estate assets. — Seller or Transferor: The party disposing of the real estate property or interest. — Non-Foreign Status: The status of being classified as a U.S. individual or entity, exempt from the IRC 1445 withholding requirements. — U.S. real property interests: Ownership rights or interests in U.S. real estate assets, such as land, buildings, or property. — Foreign person: An individual or entity that is not considered a U.S. person under tax laws. Different Types of Davenport Iowa Non-Foreign Affidavit Under IRC 1445: While there may not be distinct types of Davenport Iowa Non-Foreign Affidavits Under IRC 1445, it is important to note that the affidavit can be adapted to various real estate transactions. For instance, the affidavit may be used in residential property sales, commercial property transfers, land exchanges, or any other sale involving U.S. real estate interests. In summary, a Davenport Iowa Non-Foreign Affidavit Under IRC 1445 is an essential document used in real estate transactions to verify that the seller or transferor is not a foreign person. By complying with IRC regulations, this affidavit ensures that the withholding requirements for foreign sellers do not apply. Understanding the significance of this affidavit can greatly assist individuals involved in real estate transactions in Davenport, Iowa.