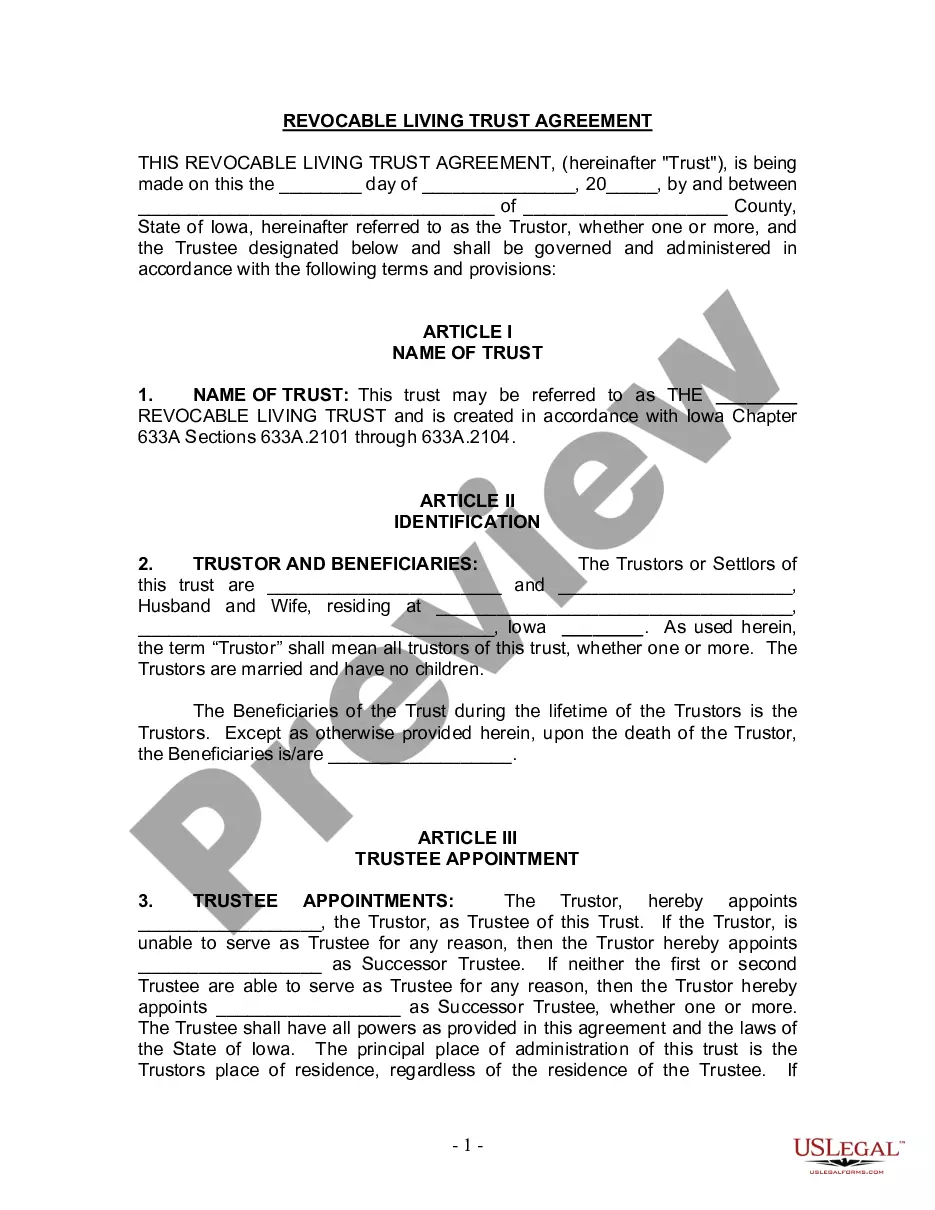

This Living Trust form is a living trust prepared for your state. It is for a husband and wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Title: Understanding Cedar Rapids Iowa Living Trust for Husband and Wife with No Children Introduction: In Cedar Rapids, Iowa, a living trust offers married couples without children an effective estate planning tool that ensures their assets are protected and distributed according to their wishes. This article delves into the details of a Cedar Rapids Iowa Living Trust for Husband and Wife with No Children, outlining its benefits and variations. Key Benefits: 1. Asset Protection: A living trust safeguards assets from potential claims, creditors, or lawsuits, providing a secure way to manage and distribute property. 2. Probate Avoidance: Establishing a living trust helps bypass the probate process, allowing for faster and more private asset distribution. 3. Incapacity Planning: A living trust allows appointed trustees to manage the couple's affairs in the event of incapacity, ensuring their financial and personal matters are taken care of. 4. Flexibility: The trust can be altered or revoked during the couple's lifetime, allowing them to update beneficiaries, assets, and terms as needed. Types of Cedar Rapids Iowa Living Trust for Husband and Wife with No Children: 1. Revocable Living Trust: This common type of trust provides flexibility as it can be modified or dissolved by the couple at any time. It allows the couple to retain full control over their assets while alive and to designate how the assets will be managed and distributed upon their death. 2. Irrevocable Living Trust: Once established, this trust cannot be modified or dissolved without the consent of the beneficiaries. It offers additional asset protection and may have potential tax advantages, but it limits the couple's control over the trust assets during their lifetime. 3. Joint Living Trust: This type of living trust involves joint ownership of assets by the husband and wife. It simplifies trust administration and ensures seamless asset transfer upon the death of the first spouse, as the assets pass directly to the surviving spouse. 4. Testamentary Trust: Rather than being created during the couple's lifetime, a testamentary trust is established through the couple's will. It takes effect upon the death of one or both spouses and offers a way to manage and distribute assets while ensuring their intended use. Conclusion: A Cedar Rapids Iowa Living Trust for Husband and Wife with No Children is an essential estate planning tool that provides asset protection, probate avoidance, and flexibility to married couples without children. Consulting an experienced estate planning attorney is crucial to understanding the intricacies of living trusts and choosing the most appropriate one for individual circumstances. Remember, a well-structured Cedar Rapids Iowa Living Trust ensures that your assets are managed and distributed according to your wishes, providing peace of mind for you and your spouse.Title: Understanding Cedar Rapids Iowa Living Trust for Husband and Wife with No Children Introduction: In Cedar Rapids, Iowa, a living trust offers married couples without children an effective estate planning tool that ensures their assets are protected and distributed according to their wishes. This article delves into the details of a Cedar Rapids Iowa Living Trust for Husband and Wife with No Children, outlining its benefits and variations. Key Benefits: 1. Asset Protection: A living trust safeguards assets from potential claims, creditors, or lawsuits, providing a secure way to manage and distribute property. 2. Probate Avoidance: Establishing a living trust helps bypass the probate process, allowing for faster and more private asset distribution. 3. Incapacity Planning: A living trust allows appointed trustees to manage the couple's affairs in the event of incapacity, ensuring their financial and personal matters are taken care of. 4. Flexibility: The trust can be altered or revoked during the couple's lifetime, allowing them to update beneficiaries, assets, and terms as needed. Types of Cedar Rapids Iowa Living Trust for Husband and Wife with No Children: 1. Revocable Living Trust: This common type of trust provides flexibility as it can be modified or dissolved by the couple at any time. It allows the couple to retain full control over their assets while alive and to designate how the assets will be managed and distributed upon their death. 2. Irrevocable Living Trust: Once established, this trust cannot be modified or dissolved without the consent of the beneficiaries. It offers additional asset protection and may have potential tax advantages, but it limits the couple's control over the trust assets during their lifetime. 3. Joint Living Trust: This type of living trust involves joint ownership of assets by the husband and wife. It simplifies trust administration and ensures seamless asset transfer upon the death of the first spouse, as the assets pass directly to the surviving spouse. 4. Testamentary Trust: Rather than being created during the couple's lifetime, a testamentary trust is established through the couple's will. It takes effect upon the death of one or both spouses and offers a way to manage and distribute assets while ensuring their intended use. Conclusion: A Cedar Rapids Iowa Living Trust for Husband and Wife with No Children is an essential estate planning tool that provides asset protection, probate avoidance, and flexibility to married couples without children. Consulting an experienced estate planning attorney is crucial to understanding the intricacies of living trusts and choosing the most appropriate one for individual circumstances. Remember, a well-structured Cedar Rapids Iowa Living Trust ensures that your assets are managed and distributed according to your wishes, providing peace of mind for you and your spouse.