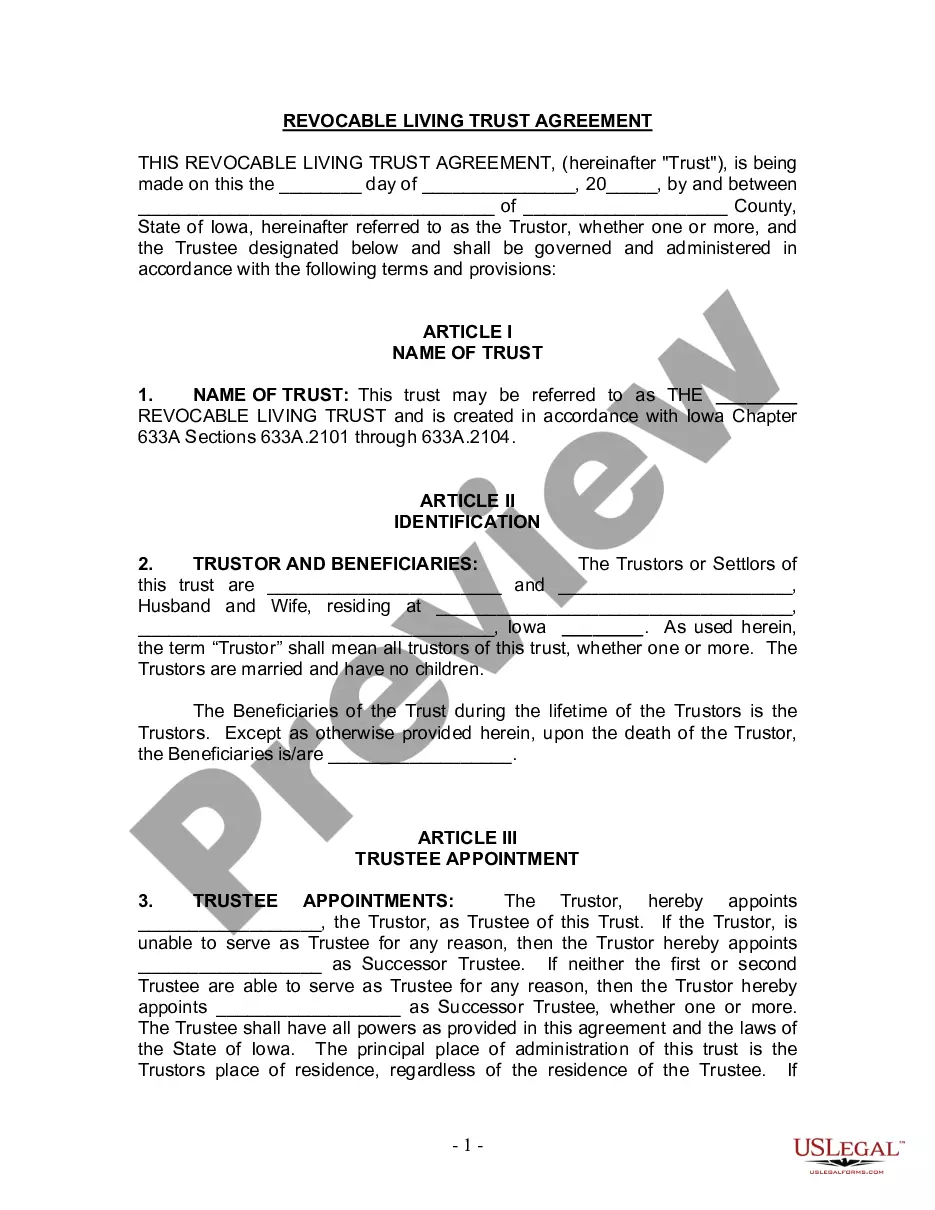

This Living Trust form is a living trust prepared for your state. It is for a husband and wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

A Davenport Iowa Living Trust for Husband and Wife with No Children is a legal document created to manage and distribute assets for a married couple in the event of their incapacitation or death. This type of trust is specifically designed for couples without children, but it can also be customized to meet the unique needs and preferences of the couple. In a Davenport Iowa Living Trust for Husband and Wife with No Children, the couple, acting as granters, transfers their assets into the trust for the benefit of themselves during their lifetime and ultimately for the beneficiaries, which could include extended family members, friends, or charitable organizations. The trust allows them to retain control over their assets while avoiding probate and ensuring a seamless transfer of their estate. There are a few different types of Davenport Iowa Living Trusts for Husband and Wife with No Children that couples can consider: 1. Revocable Living Trust: This is the most common type of trust, allowing the couple to maintain control over their assets and modify or revoke the trust at any time during their lifetime. It offers flexibility and avoids probate but still provides for the transfer of assets upon the couple's death. 2. Irrevocable Living Trust: Unlike revocable trusts, an irrevocable living trust cannot be easily modified or revoked. Once assets are transferred into this type of trust, they no longer belong to the couple, providing potential tax benefits and protection from creditors. However, the couple should carefully consider the implications before choosing this option. 3. Testamentary Trust: Unlike the aforementioned living trusts, this trust is created through a will and only goes into effect upon the death of the surviving spouse. It allows the couple to maintain control over their assets during their lifetime, but the transfer of assets occurs through the probate process. 4. Special Needs Trust: For couples with specific circumstances, such as having a disabled dependent, a special needs trust ensures that the disabled individual receives necessary care and support without jeopardizing government benefits. Creating a Davenport Iowa Living Trust for Husband and Wife with No Children requires the assistance of an experienced estate planning attorney who can guide the couple through the process, ensuring their wishes are properly documented and legally binding. It is crucial to consider the couple's specific financial situation, goals, and desires in order to choose the most suitable type of trust.A Davenport Iowa Living Trust for Husband and Wife with No Children is a legal document created to manage and distribute assets for a married couple in the event of their incapacitation or death. This type of trust is specifically designed for couples without children, but it can also be customized to meet the unique needs and preferences of the couple. In a Davenport Iowa Living Trust for Husband and Wife with No Children, the couple, acting as granters, transfers their assets into the trust for the benefit of themselves during their lifetime and ultimately for the beneficiaries, which could include extended family members, friends, or charitable organizations. The trust allows them to retain control over their assets while avoiding probate and ensuring a seamless transfer of their estate. There are a few different types of Davenport Iowa Living Trusts for Husband and Wife with No Children that couples can consider: 1. Revocable Living Trust: This is the most common type of trust, allowing the couple to maintain control over their assets and modify or revoke the trust at any time during their lifetime. It offers flexibility and avoids probate but still provides for the transfer of assets upon the couple's death. 2. Irrevocable Living Trust: Unlike revocable trusts, an irrevocable living trust cannot be easily modified or revoked. Once assets are transferred into this type of trust, they no longer belong to the couple, providing potential tax benefits and protection from creditors. However, the couple should carefully consider the implications before choosing this option. 3. Testamentary Trust: Unlike the aforementioned living trusts, this trust is created through a will and only goes into effect upon the death of the surviving spouse. It allows the couple to maintain control over their assets during their lifetime, but the transfer of assets occurs through the probate process. 4. Special Needs Trust: For couples with specific circumstances, such as having a disabled dependent, a special needs trust ensures that the disabled individual receives necessary care and support without jeopardizing government benefits. Creating a Davenport Iowa Living Trust for Husband and Wife with No Children requires the assistance of an experienced estate planning attorney who can guide the couple through the process, ensuring their wishes are properly documented and legally binding. It is crucial to consider the couple's specific financial situation, goals, and desires in order to choose the most suitable type of trust.