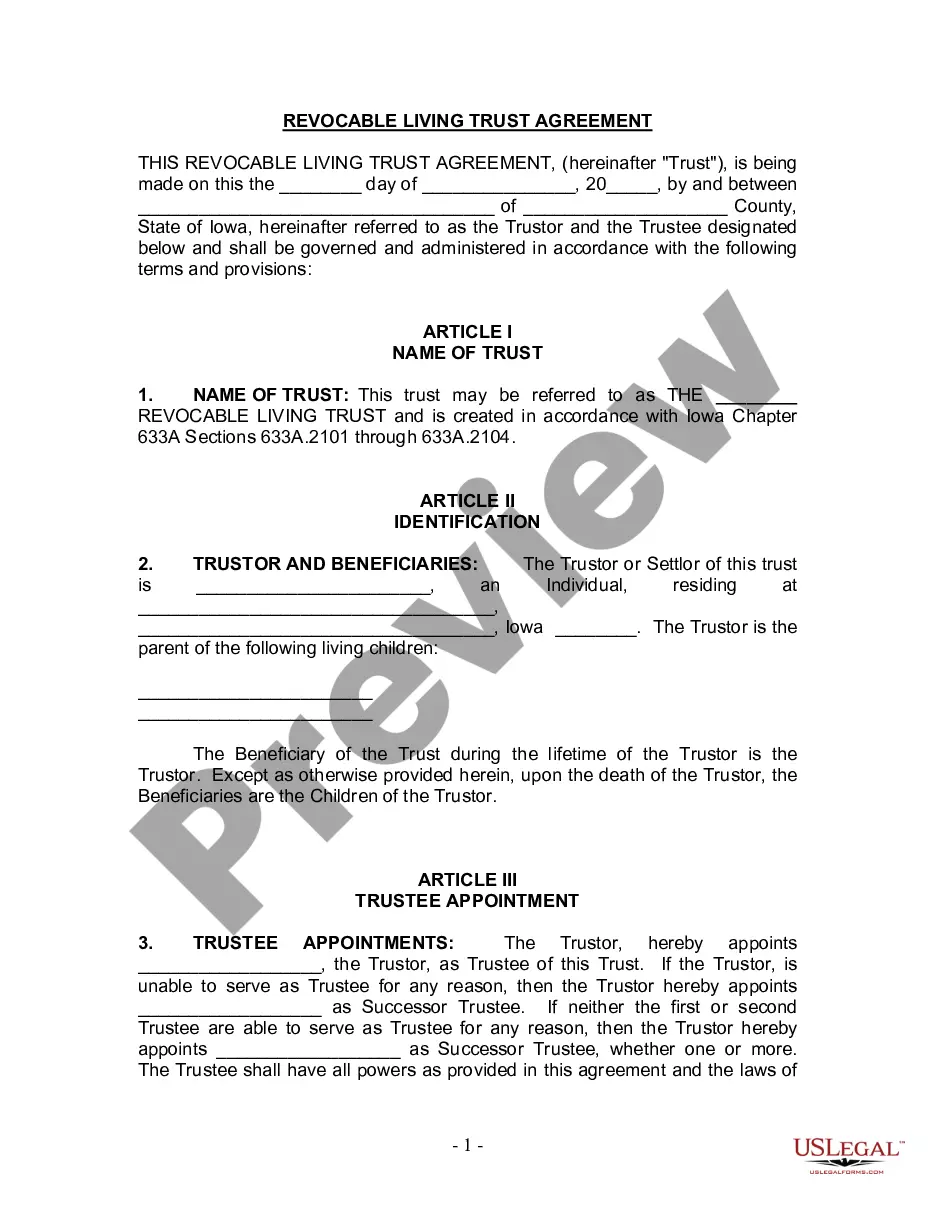

This form is a living trust form prepared for your state. It is for an individual who is either single, divorced or widowed with one or more children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

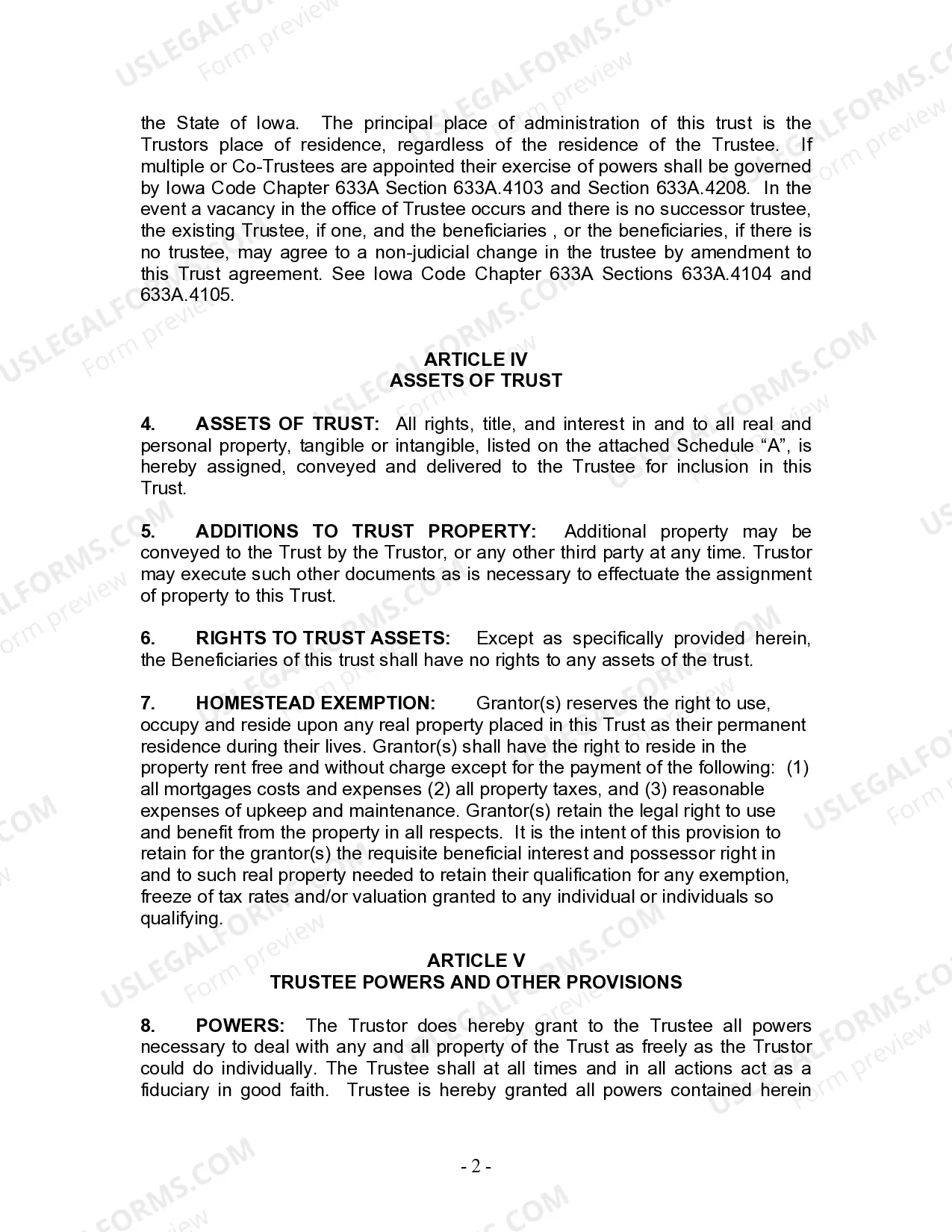

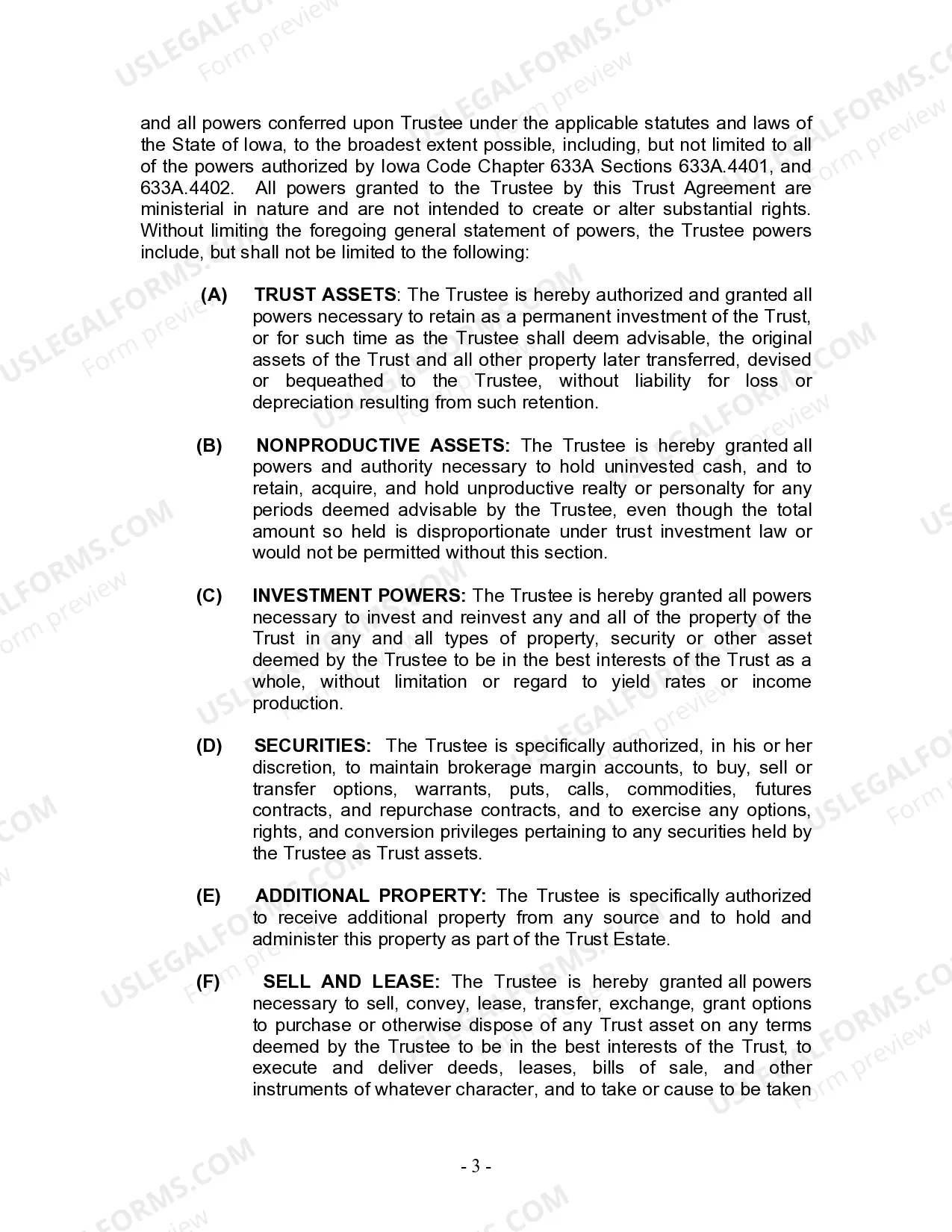

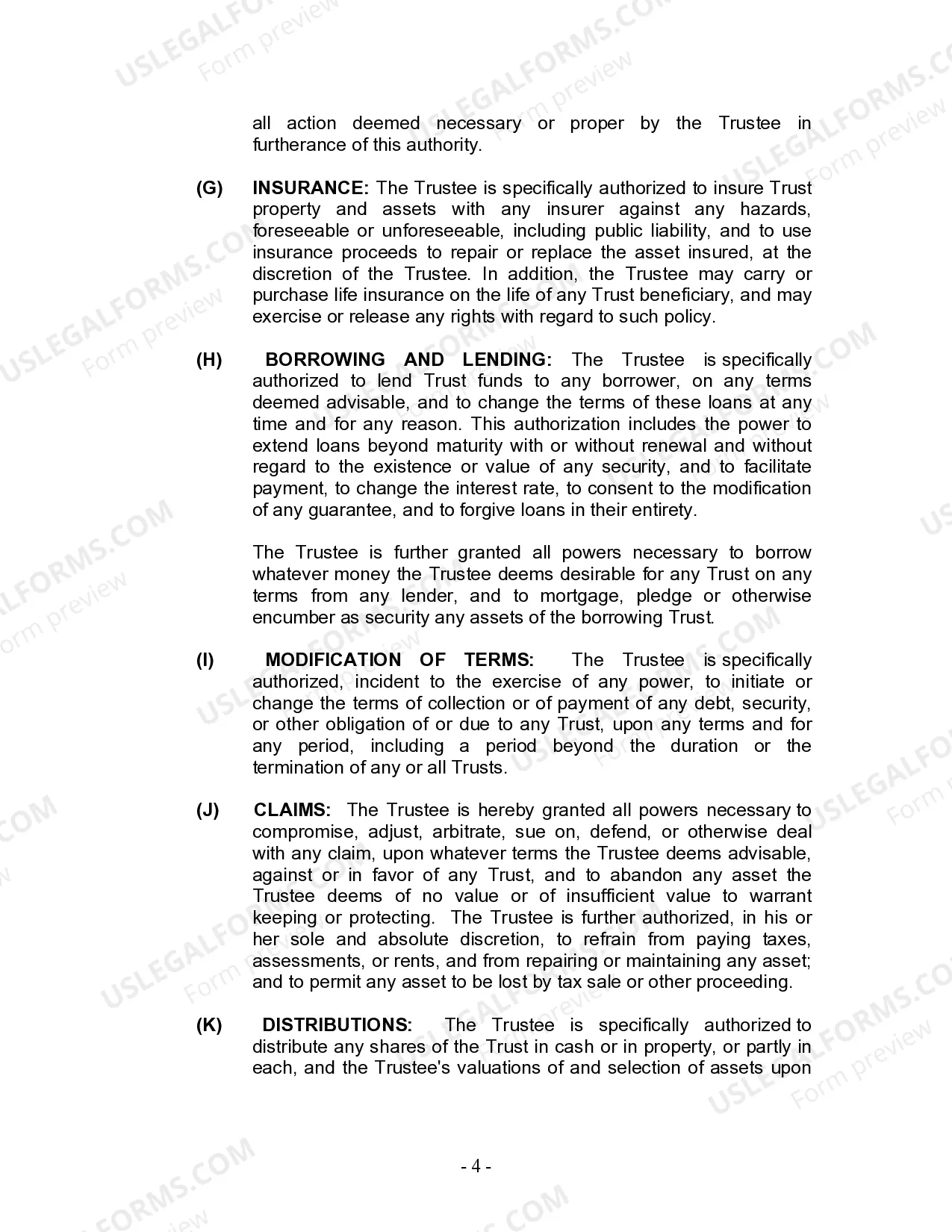

At the heart of estate planning for individuals who are single, divorced, or widowed (or widower) with children in Cedar Rapids, Iowa, lies the Cedar Rapids Iowa Living Trust. This legal instrument offers a range of benefits tailored to the unique circumstances of these individuals, ensuring the protection and distribution of their assets. Here's a detailed description of the Cedar Rapids Iowa Living Trust, its key features, and different types: 1. Cedar Rapids Iowa Living Trust Overview: — A Cedar Rapids Iowa Living Trust is a legal arrangement where an individual, known as the granter or settler, establishes a trust to hold and manage their assets during their lifetime and for the benefit of their children. — Thgranteror designates themselves as the initial trustee, maintaining control and decision-making authority over the trust assets. — Upon thgranteror's passing or incapacity, a successor trustee steps in to manage and distribute the trust assets according to the granter's instructions. 2. Benefits of Cedar Rapids Iowa Living Trust for Single, Divorced, or Widowed Individuals with Children: — Asset Protection: By transferring ownership to the trust, the individual shields their assets from potential creditors or legal disputes, ensuring their intended beneficiaries are protected. — Probate Avoidance: One of the primary advantages of a living trust is that it bypasses the probate process, which can be time-consuming, expensive, and public. This allows for a smoother and quicker transfer of assets to the intended beneficiaries. — Smooth Succession Planning: A living trust enables clear instructions on how assets should be distributed upon the granter's passing, eliminating uncertainty and potential conflicts. — Continuity: In the event of thgranteror's incapacity, a successor trustee named in the trust can continue managing the assets without the need for a court-appointed conservator. — Tax Efficiency: A living trust can help minimize estate taxes and provide tax-saving opportunities based on individual circumstances. 3. Types of Cedar Rapids Iowa Living Trust for Single, Divorced, or Widowed Individuals with Children: — Revocable Living Trust: This type of trust allows the granter to make changes, amendments, or even revoke the trust entirely during their lifetime, offering maximum flexibility and control. — Irrevocable Living Trust: Unlike a revocable trust, an irrevocable trust cannot be altered or revoked once established. It provides added protection against creditors but limits the granter's control over the assets. — Testamentary Trust: While not strictly a living trust, a testamentary trust is established within a will and only takes effect after the granter's passing. This type of trust can provide instructions for the management and distribution of assets for the benefit of children. In conclusion, a Cedar Rapids Iowa Living Trust is an essential estate planning tool for single, divorced, or widowed individuals with children. Whether it's a revocable, irrevocable, or testamentary trust, these instruments offer numerous advantages, including asset protection, probate avoidance, and smoother succession planning. Consulting with a qualified estate planning attorney in Cedar Rapids can help individuals determine the most suitable living trust for their specific needs and circumstances.At the heart of estate planning for individuals who are single, divorced, or widowed (or widower) with children in Cedar Rapids, Iowa, lies the Cedar Rapids Iowa Living Trust. This legal instrument offers a range of benefits tailored to the unique circumstances of these individuals, ensuring the protection and distribution of their assets. Here's a detailed description of the Cedar Rapids Iowa Living Trust, its key features, and different types: 1. Cedar Rapids Iowa Living Trust Overview: — A Cedar Rapids Iowa Living Trust is a legal arrangement where an individual, known as the granter or settler, establishes a trust to hold and manage their assets during their lifetime and for the benefit of their children. — Thgranteror designates themselves as the initial trustee, maintaining control and decision-making authority over the trust assets. — Upon thgranteror's passing or incapacity, a successor trustee steps in to manage and distribute the trust assets according to the granter's instructions. 2. Benefits of Cedar Rapids Iowa Living Trust for Single, Divorced, or Widowed Individuals with Children: — Asset Protection: By transferring ownership to the trust, the individual shields their assets from potential creditors or legal disputes, ensuring their intended beneficiaries are protected. — Probate Avoidance: One of the primary advantages of a living trust is that it bypasses the probate process, which can be time-consuming, expensive, and public. This allows for a smoother and quicker transfer of assets to the intended beneficiaries. — Smooth Succession Planning: A living trust enables clear instructions on how assets should be distributed upon the granter's passing, eliminating uncertainty and potential conflicts. — Continuity: In the event of thgranteror's incapacity, a successor trustee named in the trust can continue managing the assets without the need for a court-appointed conservator. — Tax Efficiency: A living trust can help minimize estate taxes and provide tax-saving opportunities based on individual circumstances. 3. Types of Cedar Rapids Iowa Living Trust for Single, Divorced, or Widowed Individuals with Children: — Revocable Living Trust: This type of trust allows the granter to make changes, amendments, or even revoke the trust entirely during their lifetime, offering maximum flexibility and control. — Irrevocable Living Trust: Unlike a revocable trust, an irrevocable trust cannot be altered or revoked once established. It provides added protection against creditors but limits the granter's control over the assets. — Testamentary Trust: While not strictly a living trust, a testamentary trust is established within a will and only takes effect after the granter's passing. This type of trust can provide instructions for the management and distribution of assets for the benefit of children. In conclusion, a Cedar Rapids Iowa Living Trust is an essential estate planning tool for single, divorced, or widowed individuals with children. Whether it's a revocable, irrevocable, or testamentary trust, these instruments offer numerous advantages, including asset protection, probate avoidance, and smoother succession planning. Consulting with a qualified estate planning attorney in Cedar Rapids can help individuals determine the most suitable living trust for their specific needs and circumstances.