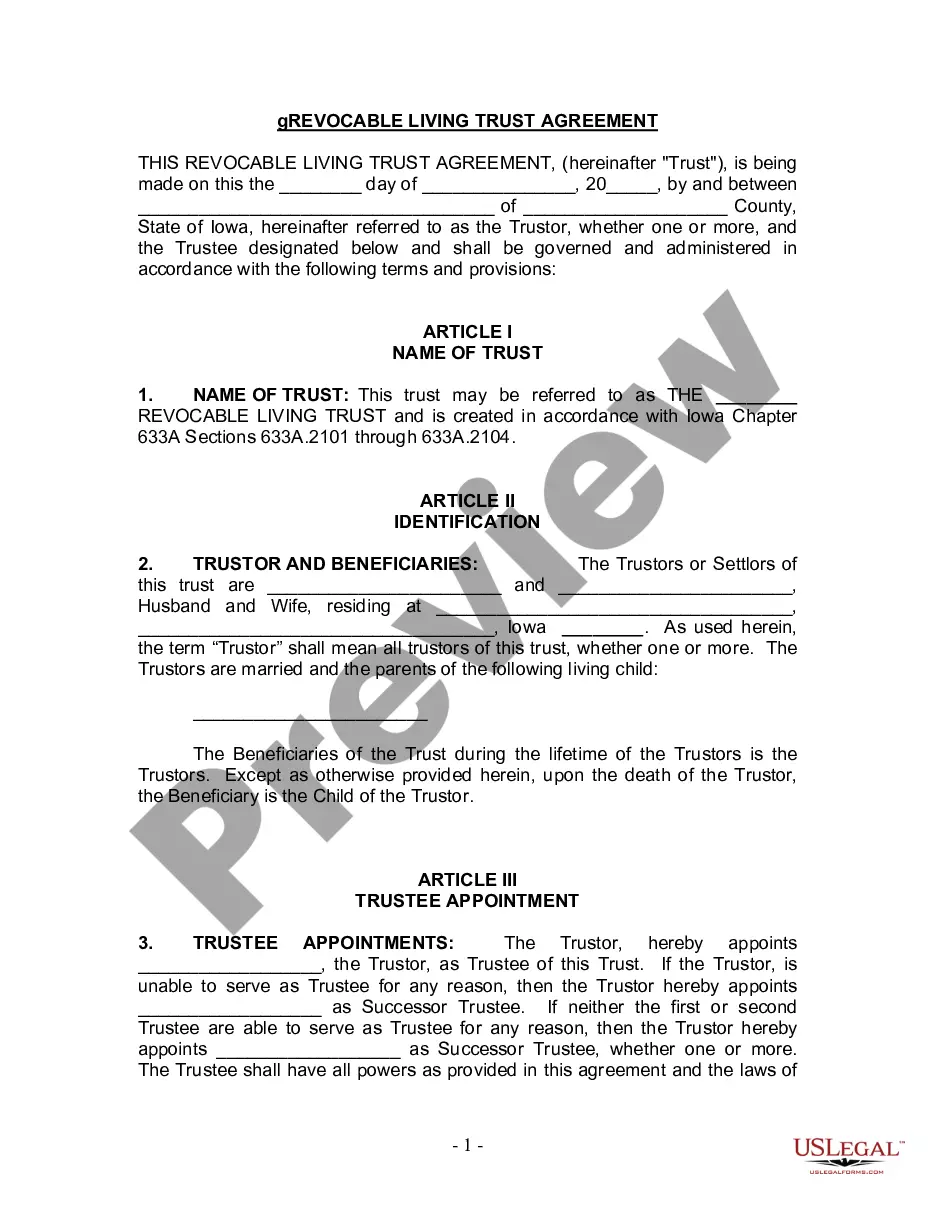

This form is a living trust form prepared for your state. It is for a husband and wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Cedar Rapids Iowa Living Trust for Husband and Wife with One Child: A living trust is a legal document that helps individuals protect their assets and ensure their wishes are carried out during their lifetime and after their passing. In Cedar Rapids, Iowa, creating a living trust for a husband and wife with one child is a popular estate planning strategy. This type of trust offers several benefits, including asset management, privacy, and avoiding probate. In a Cedar Rapids Iowa Living Trust for Husband and Wife with One Child, the couple acts as the granter(s) or trustee(s), who maintain control over the assets and can make changes to the trust during their lifetime. They transfer their assets, such as property, investments, and savings, into the trust, naming themselves as the beneficiaries. The trust document then outlines instructions on how these assets will be managed and distributed. There are different types of Cedar Rapids Iowa Living Trusts for Husband and Wife with One Child, depending on the specific goals and needs of the family. Some common types include: 1. Revocable Living Trust: This trust provides flexibility as it can be modified or revoked entirely during the lifetime of the granter(s). Granters retain control over their assets, and the trust can be amended to include or exclude beneficiaries as the circumstances change. 2. Irrevocable Living Trust: This type of trust offers asset protection and estate tax benefits. Once established, it cannot be altered or revoked without the consent of all involved parties. Assets transferred to an irrevocable trust are no longer owned by the granter, which may offer tax advantages and safeguard against creditors. 3. Testamentary Trust: Unlike the traditional living trust, this trust is created within a will and does not become active until after the death of the granter(s). Testamentary trusts are designed to protect and distribute assets according to the wishes stated in the will. They are often used to provide for minor children or beneficiaries with special needs. The Cedar Rapids Iowa Living Trust for Husband and Wife with One Child can help ensure the financial well-being of the family and simplifies the distribution of assets upon the passing of the granter(s). By avoiding probate, these trusts can minimize costs, delays, and maintain privacy. Seeking guidance from an experienced estate planning attorney is crucial to tailor the living trust to individual circumstances while adhering to Cedar Rapids, Iowa, laws and regulations.Cedar Rapids Iowa Living Trust for Husband and Wife with One Child: A living trust is a legal document that helps individuals protect their assets and ensure their wishes are carried out during their lifetime and after their passing. In Cedar Rapids, Iowa, creating a living trust for a husband and wife with one child is a popular estate planning strategy. This type of trust offers several benefits, including asset management, privacy, and avoiding probate. In a Cedar Rapids Iowa Living Trust for Husband and Wife with One Child, the couple acts as the granter(s) or trustee(s), who maintain control over the assets and can make changes to the trust during their lifetime. They transfer their assets, such as property, investments, and savings, into the trust, naming themselves as the beneficiaries. The trust document then outlines instructions on how these assets will be managed and distributed. There are different types of Cedar Rapids Iowa Living Trusts for Husband and Wife with One Child, depending on the specific goals and needs of the family. Some common types include: 1. Revocable Living Trust: This trust provides flexibility as it can be modified or revoked entirely during the lifetime of the granter(s). Granters retain control over their assets, and the trust can be amended to include or exclude beneficiaries as the circumstances change. 2. Irrevocable Living Trust: This type of trust offers asset protection and estate tax benefits. Once established, it cannot be altered or revoked without the consent of all involved parties. Assets transferred to an irrevocable trust are no longer owned by the granter, which may offer tax advantages and safeguard against creditors. 3. Testamentary Trust: Unlike the traditional living trust, this trust is created within a will and does not become active until after the death of the granter(s). Testamentary trusts are designed to protect and distribute assets according to the wishes stated in the will. They are often used to provide for minor children or beneficiaries with special needs. The Cedar Rapids Iowa Living Trust for Husband and Wife with One Child can help ensure the financial well-being of the family and simplifies the distribution of assets upon the passing of the granter(s). By avoiding probate, these trusts can minimize costs, delays, and maintain privacy. Seeking guidance from an experienced estate planning attorney is crucial to tailor the living trust to individual circumstances while adhering to Cedar Rapids, Iowa, laws and regulations.