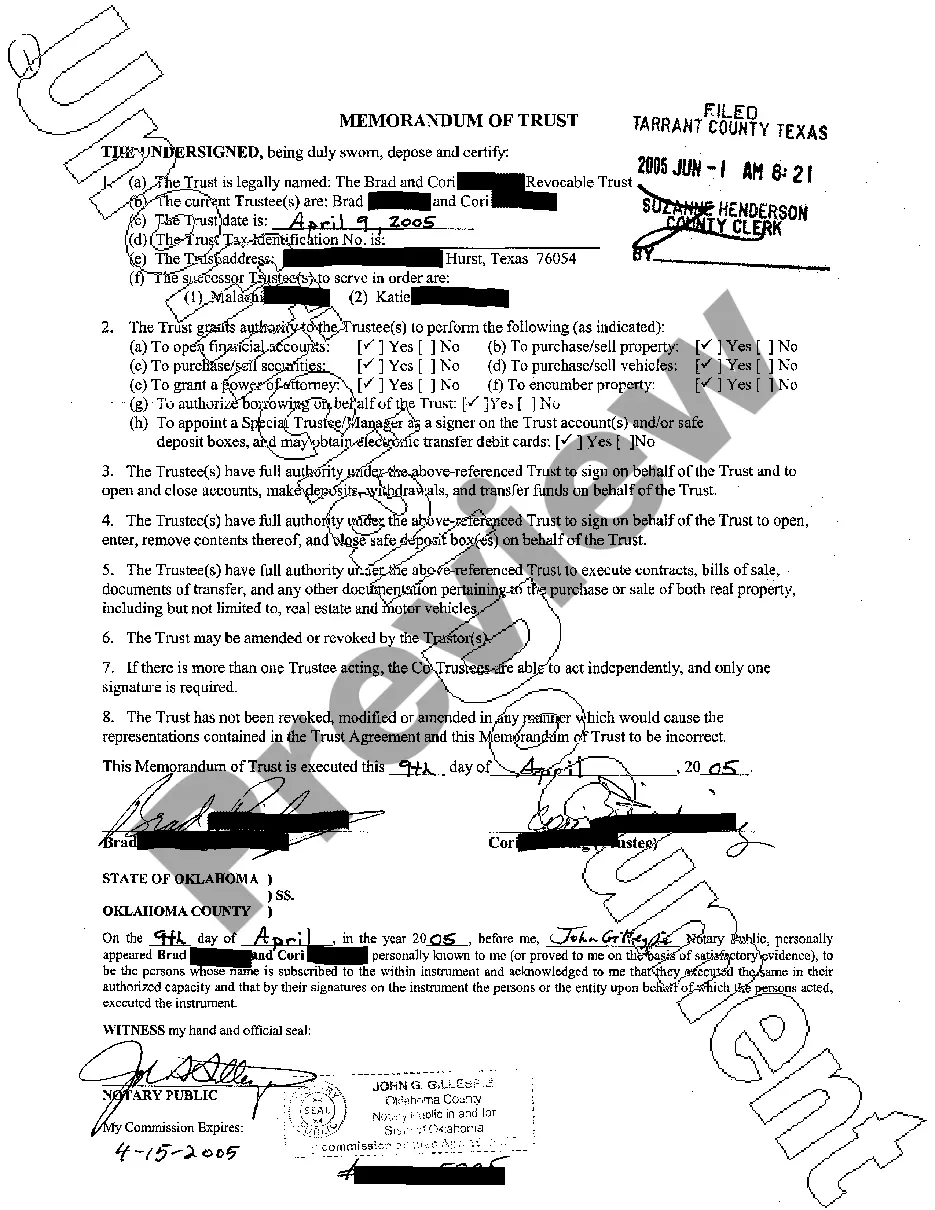

This form is a living trust form prepared for your state. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

A Davenport Iowa Living Trust for Husband and Wife with Minor and/or Adult Children is a legal arrangement designed to protect and distribute assets for the benefit of a couple and their children. This type of trust allows individuals to control and manage their assets during their lifetime, while also providing flexibility and protection for their loved ones. A living trust for husband and wife with minor children, commonly known as a Revocable Living Trust, allows parents to establish a plan for the management and distribution of their assets in the event of their incapacity or death. This trust type enables parents to name a successor trustee to manage assets on behalf of their minor children until they reach adulthood. By placing assets in a trust, parents can ensure that their children's needs are met financially, while also maintaining control over how the assets are distributed. In the case of minor children, a living trust can be further divided into two sub-types: Testamentary Trust and a Standalone Trust. A Testamentary Trust is established through a will and comes into effect after the parents' death. This type of trust can specify how assets should be managed and distributed for the benefit of minor children. Conversely, a Standalone Trust is established during the parents' lifetime and can be revocable or irrevocable, allowing more control and flexibility. When it comes to adult children, a Davenport Iowa Living Trust for Husband and Wife can also be advantageous. It ensures the smooth transfer of assets and minimizes the probate process, enabling heirs to receive their inheritance more quickly. Additionally, a living trust can incorporate spendthrift provisions, providing protection for adult children who may be creditors or have financial challenges. By setting up a living trust, parents can control the distribution of their assets, protecting them from potential creditors or poor financial decisions. Overall, a Davenport Iowa Living Trust for Husband and Wife with Minor and/or Adult Children is a customizable estate planning tool that allows couples to establish a comprehensive plan to protect and manage their assets during their lifetime, as well as ensure a smooth transfer to their children. By utilizing the various sub-types available, such as Testamentary Trusts and Standalone Trusts, individuals can tailor their trust to their specific needs and goals.A Davenport Iowa Living Trust for Husband and Wife with Minor and/or Adult Children is a legal arrangement designed to protect and distribute assets for the benefit of a couple and their children. This type of trust allows individuals to control and manage their assets during their lifetime, while also providing flexibility and protection for their loved ones. A living trust for husband and wife with minor children, commonly known as a Revocable Living Trust, allows parents to establish a plan for the management and distribution of their assets in the event of their incapacity or death. This trust type enables parents to name a successor trustee to manage assets on behalf of their minor children until they reach adulthood. By placing assets in a trust, parents can ensure that their children's needs are met financially, while also maintaining control over how the assets are distributed. In the case of minor children, a living trust can be further divided into two sub-types: Testamentary Trust and a Standalone Trust. A Testamentary Trust is established through a will and comes into effect after the parents' death. This type of trust can specify how assets should be managed and distributed for the benefit of minor children. Conversely, a Standalone Trust is established during the parents' lifetime and can be revocable or irrevocable, allowing more control and flexibility. When it comes to adult children, a Davenport Iowa Living Trust for Husband and Wife can also be advantageous. It ensures the smooth transfer of assets and minimizes the probate process, enabling heirs to receive their inheritance more quickly. Additionally, a living trust can incorporate spendthrift provisions, providing protection for adult children who may be creditors or have financial challenges. By setting up a living trust, parents can control the distribution of their assets, protecting them from potential creditors or poor financial decisions. Overall, a Davenport Iowa Living Trust for Husband and Wife with Minor and/or Adult Children is a customizable estate planning tool that allows couples to establish a comprehensive plan to protect and manage their assets during their lifetime, as well as ensure a smooth transfer to their children. By utilizing the various sub-types available, such as Testamentary Trusts and Standalone Trusts, individuals can tailor their trust to their specific needs and goals.