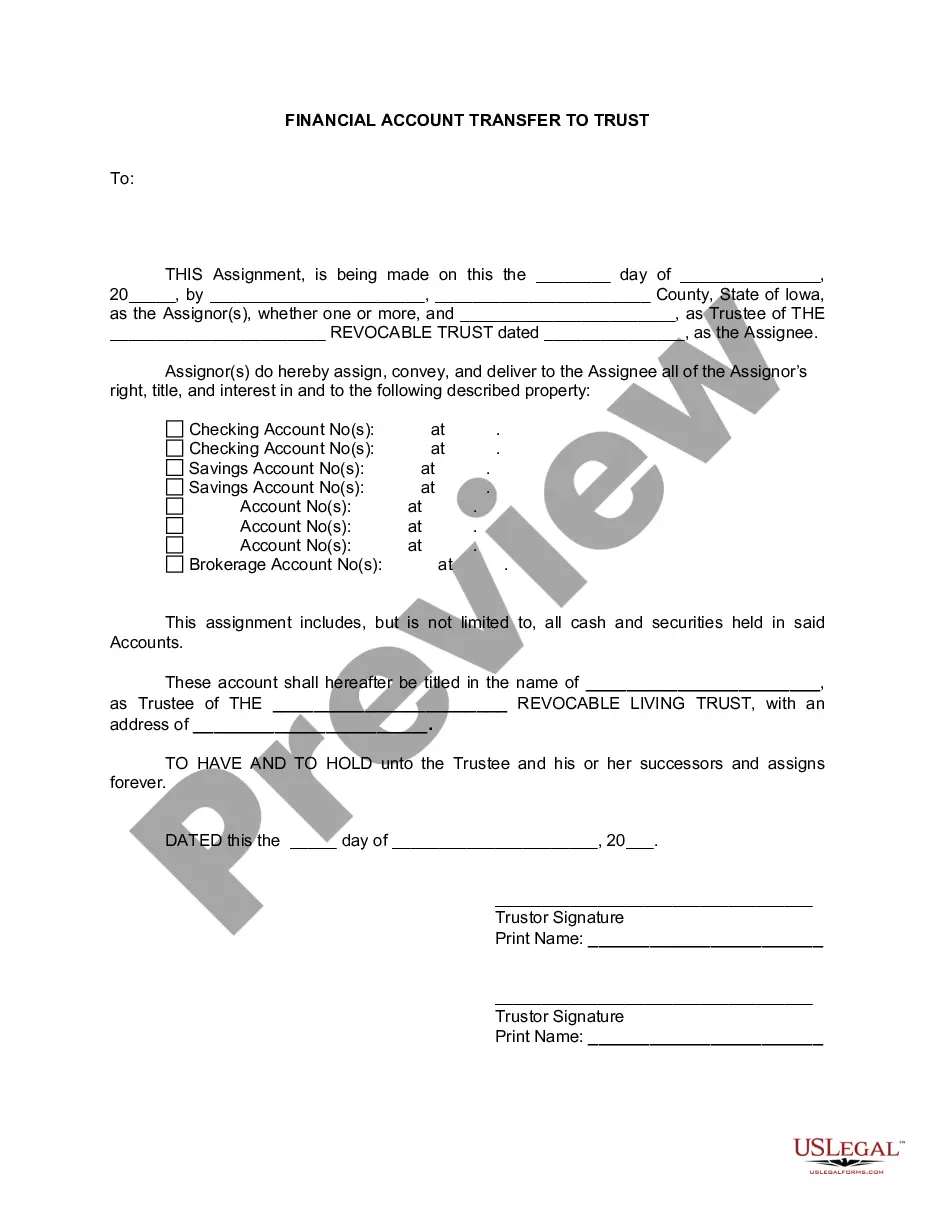

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Davenport Iowa Financial Account Transfer to Living Trust: A Comprehensive Guide on How to Transfer Your Financial Accounts to a Living Trust If you reside in Davenport, Iowa, and have been considering the transfer of your financial accounts to a living trust, this comprehensive guide will provide you with all the information you need to make an informed decision. With the relevant keywords in mind, let's delve into the details of this process, including the types of transfers available to Davenport residents. What is a Living Trust? A living trust, also known as a revocable trust or inter vivos trust, is a legal instrument that allows individuals in Davenport, Iowa, to transfer their assets, including financial accounts, to a trust while still maintaining control and benefiting from those assets during their lifetime. A living trust also ensures a seamless transfer of those assets to designated beneficiaries upon the granter's passing, avoiding probate. Why Transfer Financial Accounts to a Living Trust? There are several compelling reasons residents of Davenport, Iowa, choose to transfer their financial accounts to a living trust. Firstly, it enables them to maintain control over their accounts even if they become incapacitated, as a successor trustee can step in and manage the accounts on their behalf. Secondly, it streamlines the distribution of assets, bypassing probate and potentially saving time and money for both the granter and their beneficiaries. Types of Davenport Iowa Financial Account Transfers to Living Trust: 1. Checking and Savings Accounts: Davenport residents can transfer their checking and savings accounts to a living trust, ensuring seamless management and distribution of funds. 2. Retirement Accounts: IRAs, 401(k)s, and other retirement accounts can also be transferred to a living trust, providing flexibility in managing and distributing these crucial assets. 3. Investment Accounts: Individuals in Davenport can transfer their investment accounts, including stocks, bonds, mutual funds, and other securities, to their living trust. This enables the granter or successor trustee to retain control and make investment decisions. 4. Real Estate: While not a financial account, transferring real estate properties to a living trust can be done to consolidate assets. This way, the trust holds both financial accounts and property, avoiding the need for separate transfers. How to Transfer Financial Accounts to a Living Trust in Davenport, Iowa: 1. Consult with an Estate Planning Attorney: Seek the guidance of an experienced estate planning attorney in Davenport, Iowa, who can draft a living trust specific to your needs and assist in the transfer process. 2. Create a Living Trust Agreement: Work with your attorney to create a comprehensive living trust agreement, specifying which financial accounts you wish to transfer to the trust. 3. Update Account Titles and Beneficiary Designations: Contact your financial institutions to update the account titles and beneficiary designations to reflect the living trust as the new owner and beneficiary. 4. Provide Copies of Trust Documents: Furnish the financial institutions with copies of the living trust agreement and any supporting documents they require to complete the transfer. 5. Ensure Proper Funding and Management: Coordinate with your attorney and financial institutions to ensure that all financial accounts are properly funded into the living trust and that ongoing management aligns with the trust's terms. Conclusion: Transferring your financial accounts to a living trust in Davenport, Iowa, offers many advantages in terms of asset management, incapacity planning, and smooth distribution to beneficiaries. By engaging with an estate planning attorney and following the necessary steps, you can establish a living trust that suits your specific needs and secures the seamless transfer of your financial assets for both your and your loved ones' peace of mind.Davenport Iowa Financial Account Transfer to Living Trust: A Comprehensive Guide on How to Transfer Your Financial Accounts to a Living Trust If you reside in Davenport, Iowa, and have been considering the transfer of your financial accounts to a living trust, this comprehensive guide will provide you with all the information you need to make an informed decision. With the relevant keywords in mind, let's delve into the details of this process, including the types of transfers available to Davenport residents. What is a Living Trust? A living trust, also known as a revocable trust or inter vivos trust, is a legal instrument that allows individuals in Davenport, Iowa, to transfer their assets, including financial accounts, to a trust while still maintaining control and benefiting from those assets during their lifetime. A living trust also ensures a seamless transfer of those assets to designated beneficiaries upon the granter's passing, avoiding probate. Why Transfer Financial Accounts to a Living Trust? There are several compelling reasons residents of Davenport, Iowa, choose to transfer their financial accounts to a living trust. Firstly, it enables them to maintain control over their accounts even if they become incapacitated, as a successor trustee can step in and manage the accounts on their behalf. Secondly, it streamlines the distribution of assets, bypassing probate and potentially saving time and money for both the granter and their beneficiaries. Types of Davenport Iowa Financial Account Transfers to Living Trust: 1. Checking and Savings Accounts: Davenport residents can transfer their checking and savings accounts to a living trust, ensuring seamless management and distribution of funds. 2. Retirement Accounts: IRAs, 401(k)s, and other retirement accounts can also be transferred to a living trust, providing flexibility in managing and distributing these crucial assets. 3. Investment Accounts: Individuals in Davenport can transfer their investment accounts, including stocks, bonds, mutual funds, and other securities, to their living trust. This enables the granter or successor trustee to retain control and make investment decisions. 4. Real Estate: While not a financial account, transferring real estate properties to a living trust can be done to consolidate assets. This way, the trust holds both financial accounts and property, avoiding the need for separate transfers. How to Transfer Financial Accounts to a Living Trust in Davenport, Iowa: 1. Consult with an Estate Planning Attorney: Seek the guidance of an experienced estate planning attorney in Davenport, Iowa, who can draft a living trust specific to your needs and assist in the transfer process. 2. Create a Living Trust Agreement: Work with your attorney to create a comprehensive living trust agreement, specifying which financial accounts you wish to transfer to the trust. 3. Update Account Titles and Beneficiary Designations: Contact your financial institutions to update the account titles and beneficiary designations to reflect the living trust as the new owner and beneficiary. 4. Provide Copies of Trust Documents: Furnish the financial institutions with copies of the living trust agreement and any supporting documents they require to complete the transfer. 5. Ensure Proper Funding and Management: Coordinate with your attorney and financial institutions to ensure that all financial accounts are properly funded into the living trust and that ongoing management aligns with the trust's terms. Conclusion: Transferring your financial accounts to a living trust in Davenport, Iowa, offers many advantages in terms of asset management, incapacity planning, and smooth distribution to beneficiaries. By engaging with an estate planning attorney and following the necessary steps, you can establish a living trust that suits your specific needs and secures the seamless transfer of your financial assets for both your and your loved ones' peace of mind.