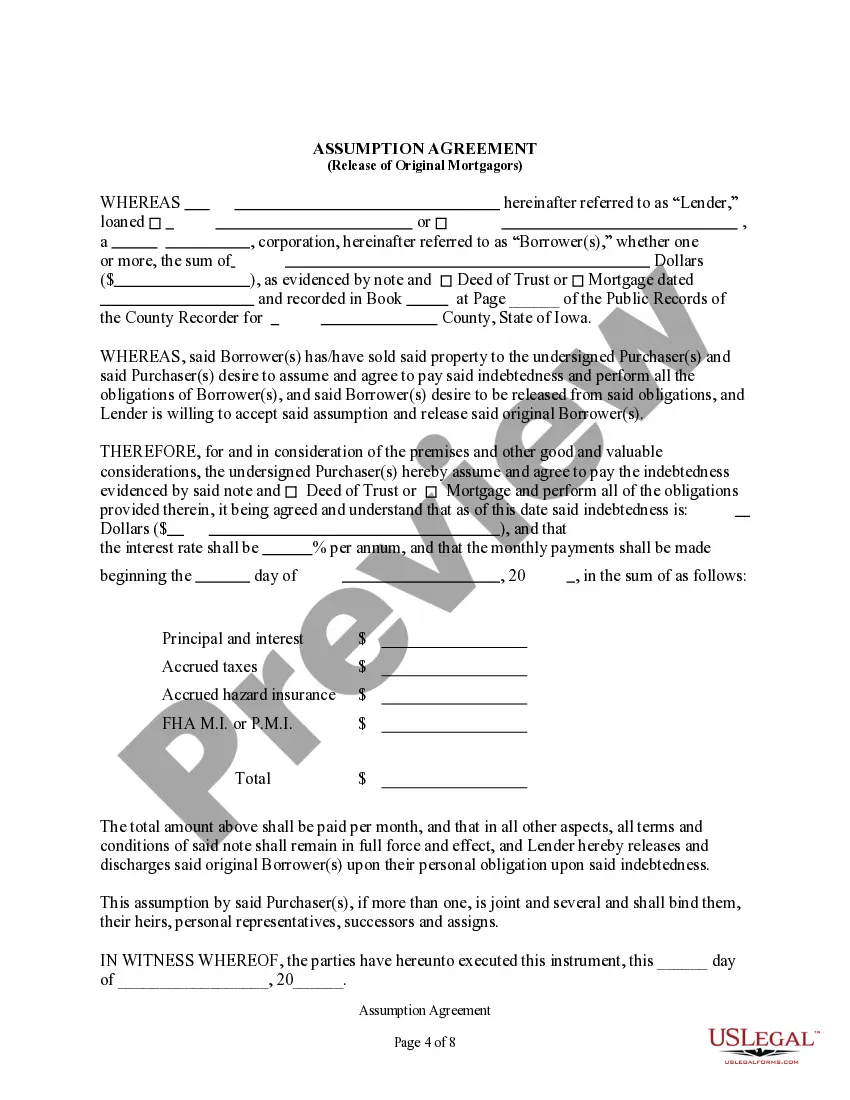

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

The Cedar Rapids Iowa Assumption Agreement of Mortgage and Release of Original Mortgagors is a legal document that outlines the terms and conditions for the transfer of a mortgage from one party to another. This agreement allows a new borrower to assume the existing mortgage, taking over the obligations and responsibilities of the original mortgagors. The purpose of this document is to protect the interests of all parties involved in the mortgage transaction. It sets forth the terms of the assumption, including the agreed-upon interest rate, principal balance, and repayment schedule. By executing this agreement, the original mortgagors are released from any further liability or obligation to the mortgage, and the new borrower becomes solely responsible for fulfilling the terms of the loan. There are a few different types of Cedar Rapids Iowa Assumption Agreement of Mortgage and Release of Original Mortgagors that may be encountered, depending on the specific circumstances of the mortgage transfer: 1. Assumption with novation: This type of agreement not only transfers the mortgage to the new borrower but also releases the original mortgagors from all liability. The new borrower assumes full responsibility for the mortgage, and the lender agrees to release the original mortgagors from any further obligations. 2. Assumption without novation: In this case, the mortgage is transferred to the new borrower, but the original mortgagors remain co-liable for the debt. This means that if the new borrower defaults on the mortgage payments, the lender can pursue both the new borrower and the original mortgagors for payment. 3. Substitution of liability: This type of assumption agreement replaces the original mortgagors' liability with that of the new borrower. The new borrower assumes the debt and becomes solely responsible for the repayment, while the original mortgagors are fully released from the mortgage obligations. It is crucial for all parties involved in the Cedar Rapids Iowa Assumption Agreement of Mortgage and Release of Original Mortgagors to thoroughly review and understand the terms of the agreement before signing. Consulting with a qualified attorney or real estate professional is highly recommended ensuring compliance with state laws and to protect the rights and interests of all parties.