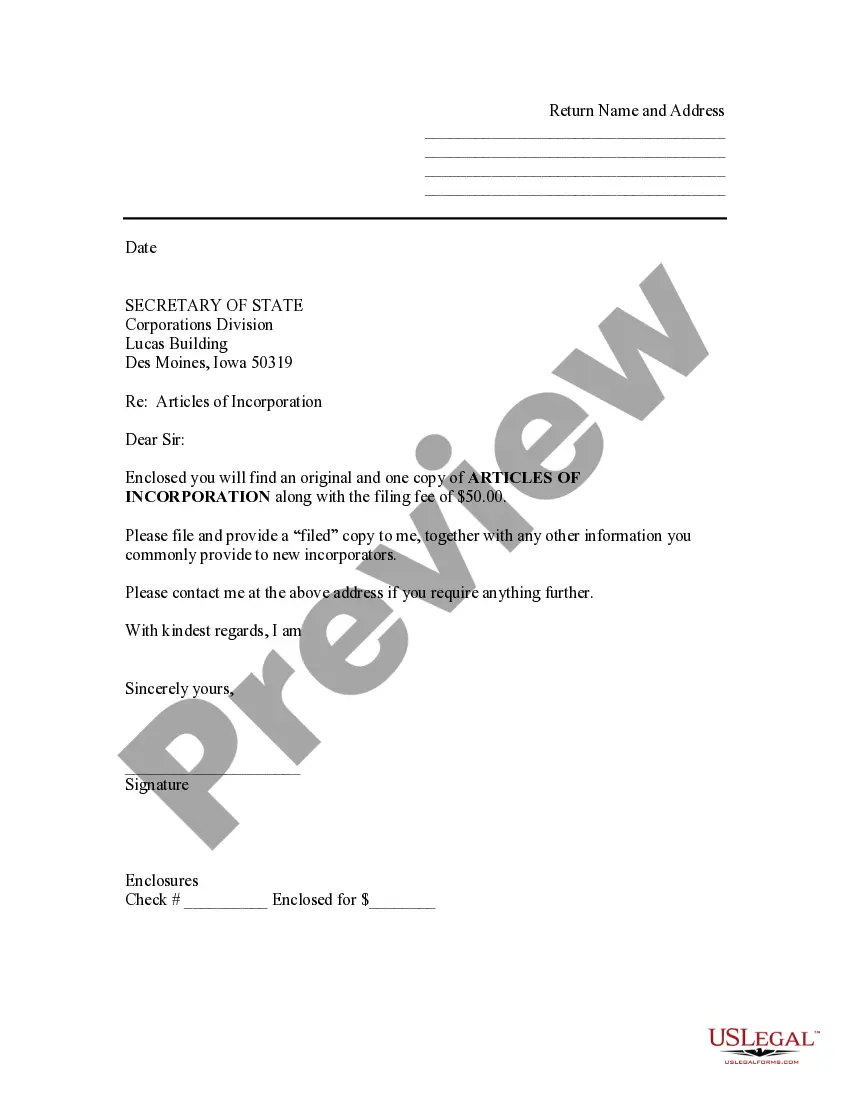

Use this sample letter as a cover sheet to accompany the Articles of Incorporation for filing with the Secretary of State's Office.

Cedar Rapids Sample Transmittal Letter to Secretary of State's Office for Filing Articles of Incorporation — Iowa Dear Secretary of State, I am writing to transmit the following documents for filing the Articles of Incorporation on behalf of [Company Name]: 1. Completed Articles of Incorporation form 2. Certified copy of the Company's Articles of Organization (if applicable) 3. Certificate of Good Standing from the Company's home state (if applicable) 4. Consent of Registered Agent 5. Filing fee payment in the amount of [insert fee amount] [Company Name] is a corporation seeking to incorporate in the state of Iowa. The purpose of this letter is to request the filing of the Articles of Incorporation with the Secretary of State's Office. The Articles of Incorporation outline the basic structure and details of the corporation, including the company's name, registered agent's information, purpose, duration, capital stock, initial directors, and any additional provisions deemed necessary. Attaching a certified copy of the Company's Articles of Organization, if applicable, helps to provide the Secretary of State's Office with background information about the company's prior formation and any amendments made to its governing documents. Furthermore, we have included a Certificate of Good Standing issued by the Company's home state. This document demonstrates that the company is in good standing and compliant with all requirements in its home jurisdiction. It proves that the company has not been administratively dissolved, suspended, or revoked. Please find enclosed the Consent of Registered Agent, which confirms the registered agent's acceptance of the appointment and their willingness to fulfill the required duties on behalf of the corporation. The registered agent plays a crucial role in receiving legal documents and important notices on behalf of the company. Lastly, as per the state's guidelines, we have included the appropriate filing fee payment. Kindly refer to the fee schedule provided by the Secretary of State's Office for the current filing fee amount. We trust that all the enclosed documents are in order and comply with the requirements set forth by the state of Iowa. Please notify us promptly if any additional information or documentation is needed to complete the filing process successfully. Thank you for your attention to this matter. We look forward to receiving confirmation of filing and the Certified Copy of the Articles of Incorporation. Sincerely, [Your Name] [Position] [Company Name] Additional Types of Cedar Rapids Sample Transmittal Letter to Secretary of State's Office to File Articles of Incorporation — Iowa: 1. Cedar Rapids Sample Transmittal Letter to Secretary of State's Office for Amendment of Articles of Incorporation — Iowa 2. Cedar Rapids Sample Transmittal Letter to Secretary of State's Office for Dissolution of Corporation — Iowa 3. Cedar Rapids Sample Transmittal Letter to Secretary of State's Office for Annual Report Filing — Iowa 4. Cedar Rapids Sample Transmittal Letter to Secretary of State's Office for Reinstatement of Corporation Iowa.wa