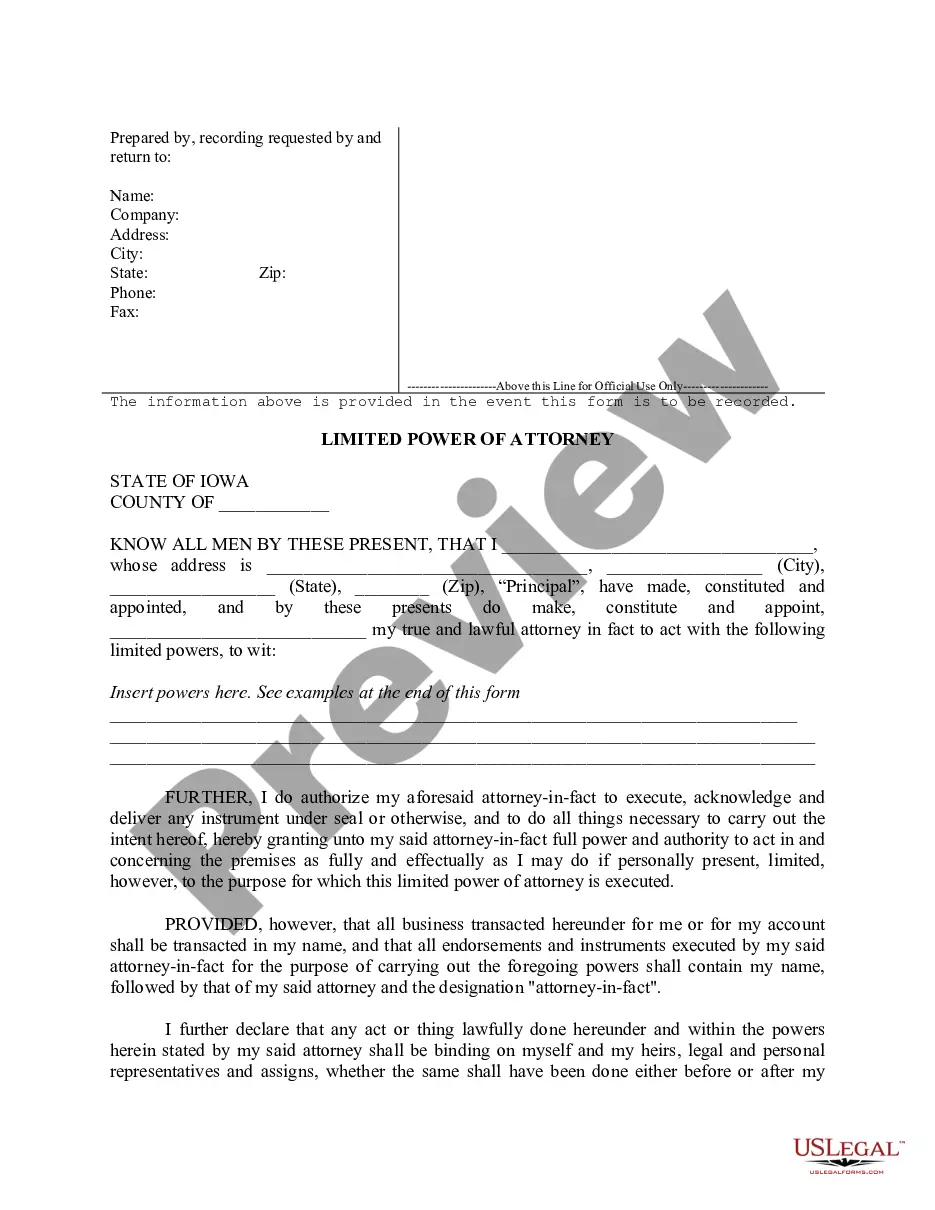

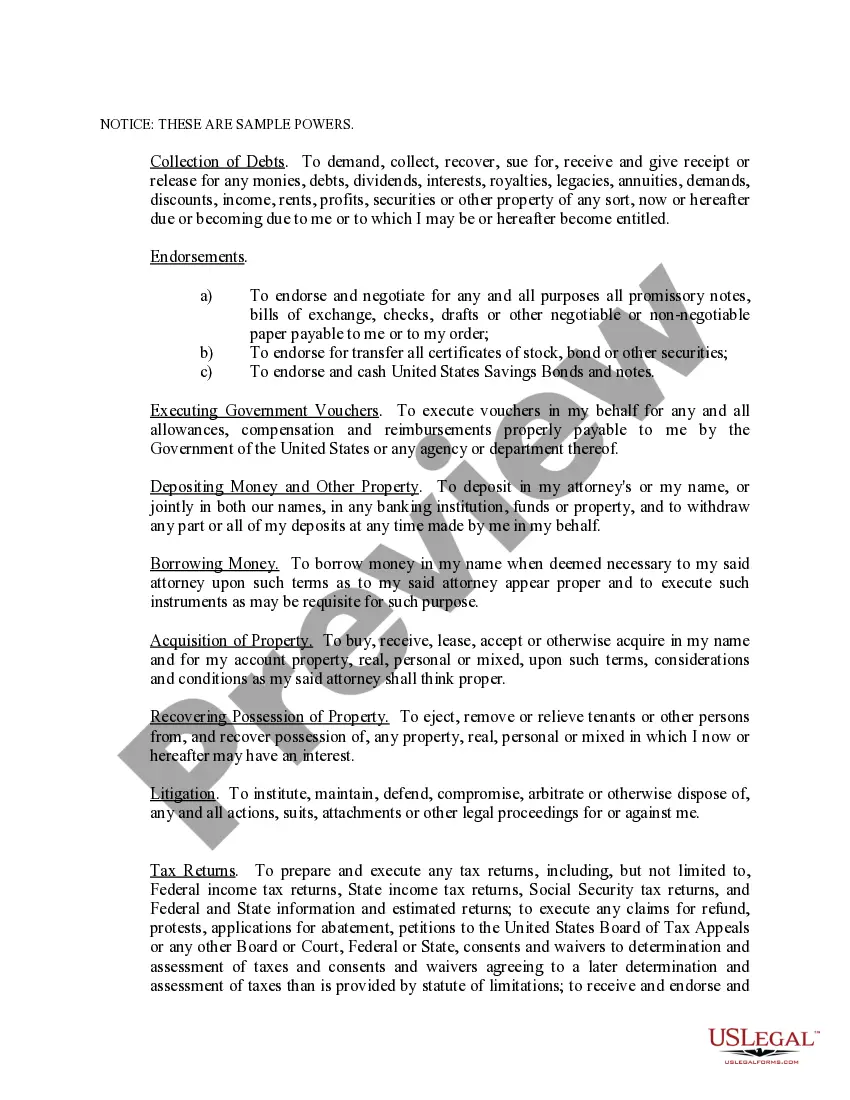

This is a limited power of attorney for Iowa. You specify the powers you desire to give to your agent. Sample powers are attached to the form for illustration only and should be deleted after you complete the form with the powers you desire. The form contains an acknowledgment in the event the form is to be recorded.

Davenport Iowa Limited Power of Attorney where you Specify Powers with Sample Powers Included

Description

How to fill out Iowa Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

Utilize the US Legal Forms and gain immediate access to any document you require.

Our valuable website featuring a vast array of document templates streamlines the process of locating and acquiring nearly any document example you need.

You can store, fill out, and endorse the Davenport Iowa Limited Power of Attorney where you Specify Powers with Sample Powers Included in just a few minutes rather than spending hours scouring the internet for the correct template.

Leveraging our collection is an excellent strategy to enhance the security of your document filing.

Visit the page with the form you require. Confirm that it is the template you seek: verify its title and description, and use the Preview feature if available. If not, utilize the Search function to find the desired document.

Initiate the saving procedure. Click Buy Now and select the pricing plan that fits you best. Then, register for an account and complete your order using a credit card or PayPal.

- Our skilled legal experts routinely review all the documents to ensure that the templates are applicable for a specific region and adhere to current laws and regulations.

- How can you obtain the Davenport Iowa Limited Power of Attorney where you Specify Powers with Sample Powers Included.

- If you already possess an account, simply Log In to your profile. The Download option will be visible on all the documents you view.

- Additionally, you can access all the documents you've saved previously in the My documents section.

- If you do not have an account yet, follow the instructions below.

Form popularity

FAQ

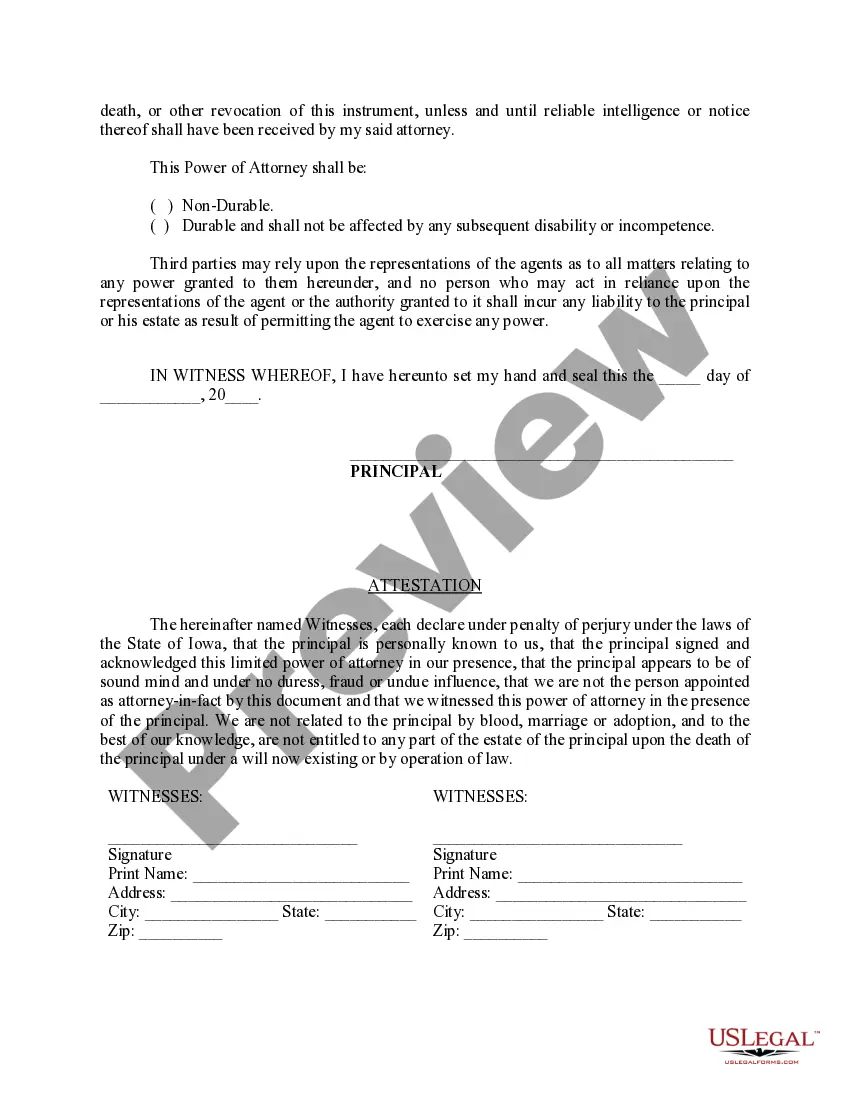

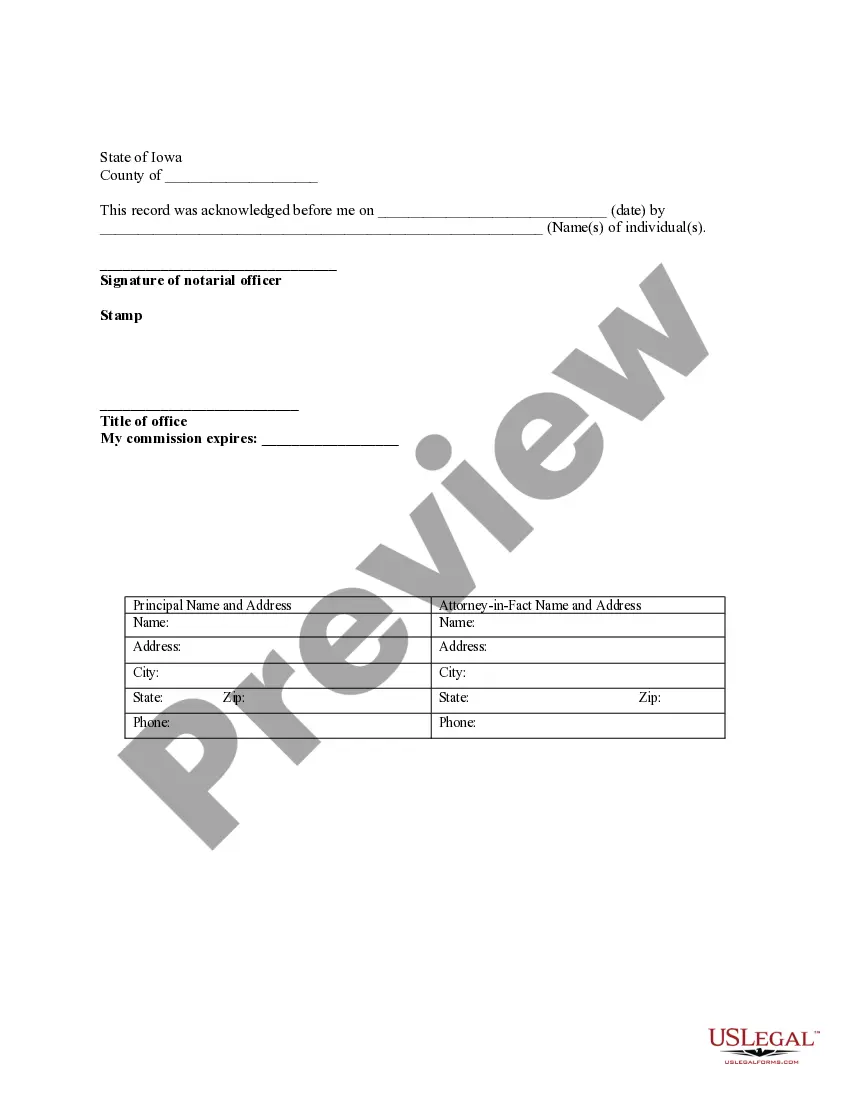

In Iowa, the power of attorney must be in writing and must clearly outline the powers granted to the agent. It’s vital that the principal be competent when signing the document. Importantly, a Davenport Iowa Limited Power of Attorney where you Specify Powers with Sample Powers Included must be notarized to be legally effective, ensuring your wishes are honored and upheld. Always consider consulting resources available on platforms like US Legal Forms for accurate and comprehensive guidance.

The most recommended type of power of attorney varies based on individual needs, but many find a limited power of attorney beneficial. This type allows you to specify the exact powers granted to your agent, giving you control over important decisions while maintaining flexibility. A Davenport Iowa Limited Power of Attorney where you Specify Powers with Sample Powers Included can ensure that your agent acts within your defined parameters, protecting your interests.

To fill out a limited power of attorney form, start by clearly identifying the principal, the agent, and the specific powers you wish to grant. You can download a sample form online, like those found on the US Legal platform, to ensure you have all necessary sections covered. Ensure both the principal and agent sign the form in front of a notary public. This careful attention to detail will help solidify your Davenport Iowa Limited Power of Attorney where you Specify Powers with Sample Powers Included.

You can obtain a Davenport Iowa Limited Power of Attorney where you Specify Powers with Sample Powers Included by completing a legal form that outlines your wishes. Utilizing an online platform like US Legal Forms can simplify this process, as they provide easy-to-follow templates tailored to meet Iowa's standards. This approach saves you time and reduces stress, allowing for a smooth experience.

Filing for a Davenport Iowa Limited Power of Attorney where you Specify Powers with Sample Powers Included involves completing the document and signing it in front of a notary. After that, you may need to submit it to the appropriate local authorities or use it as needed for specific transactions. Always consult local regulations to ensure compliance.

To set up a Davenport Iowa Limited Power of Attorney where you Specify Powers with Sample Powers Included effectively, consider outlining your intentions clearly. You should specify the powers you wish to grant, whether it involves financial matters, medical decisions, or both. Utilizing professional legal services can provide guidance and ensure that all requirements are met.

The easiest way to get a Davenport Iowa Limited Power of Attorney where you Specify Powers with Sample Powers Included is by using an online legal service. These platforms offer customizable templates that allow you to tailor the document to your specific needs. This eliminates confusion and simplifies the process, making it more efficient for you.

The four main types of power of attorney include limited power of attorney, general power of attorney, durable power of attorney, and healthcare power of attorney. Limited power of attorney allows specific actions, while general power gives broader authority. Durable power remains in effect even if you become incapacitated, and healthcare power allows agents to make medical decisions on your behalf. Every type serves various needs, and understanding these distinctions can help you create a Davenport Iowa Limited Power of Attorney where you Specify Powers with Sample Powers Included.

Limited power of attorney allows you to define precise powers granted to your agent, which can include financial or medical decisions. Specific power of attorney typically refers to powers related to specific events or transactions, such as selling a house or handling a bank account. In a Davenport Iowa Limited Power of Attorney where you Specify Powers with Sample Powers Included, both types involve careful consideration of what authority you want to bestow. This protects your interests while ensuring your agent can act effectively within those boundaries.

The terms limited power of attorney and specific power of attorney are often used interchangeably in the context of a Davenport Iowa Limited Power of Attorney where you Specify Powers with Sample Powers Included. Limited power of attorney gives an agent authority only for particular actions, while specific power of attorney usually refers to a clear designation, such as managing real estate or handling a specific financial transaction. Both serve to limit the scope of authority, but understanding the terminology helps you tailor the document to meet your needs.