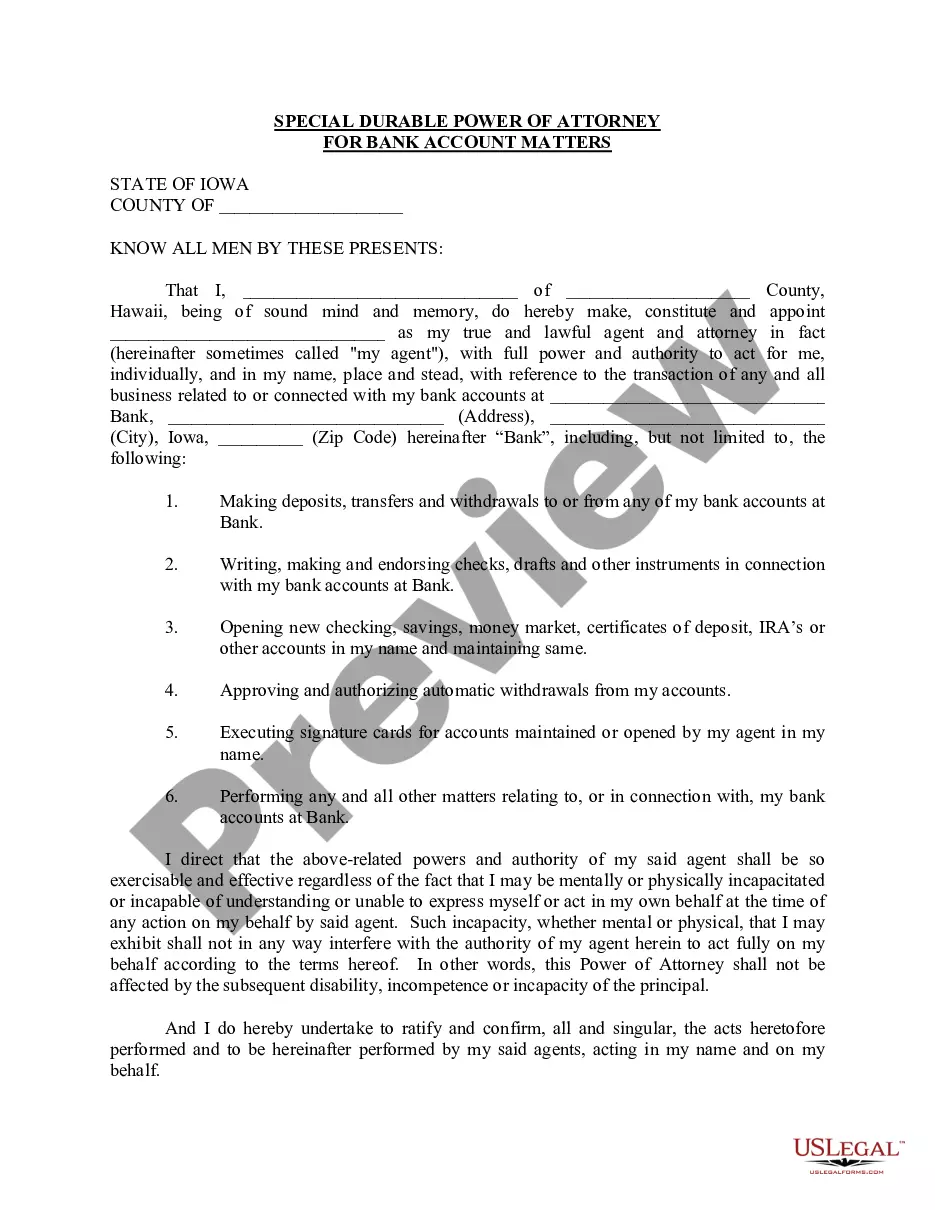

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

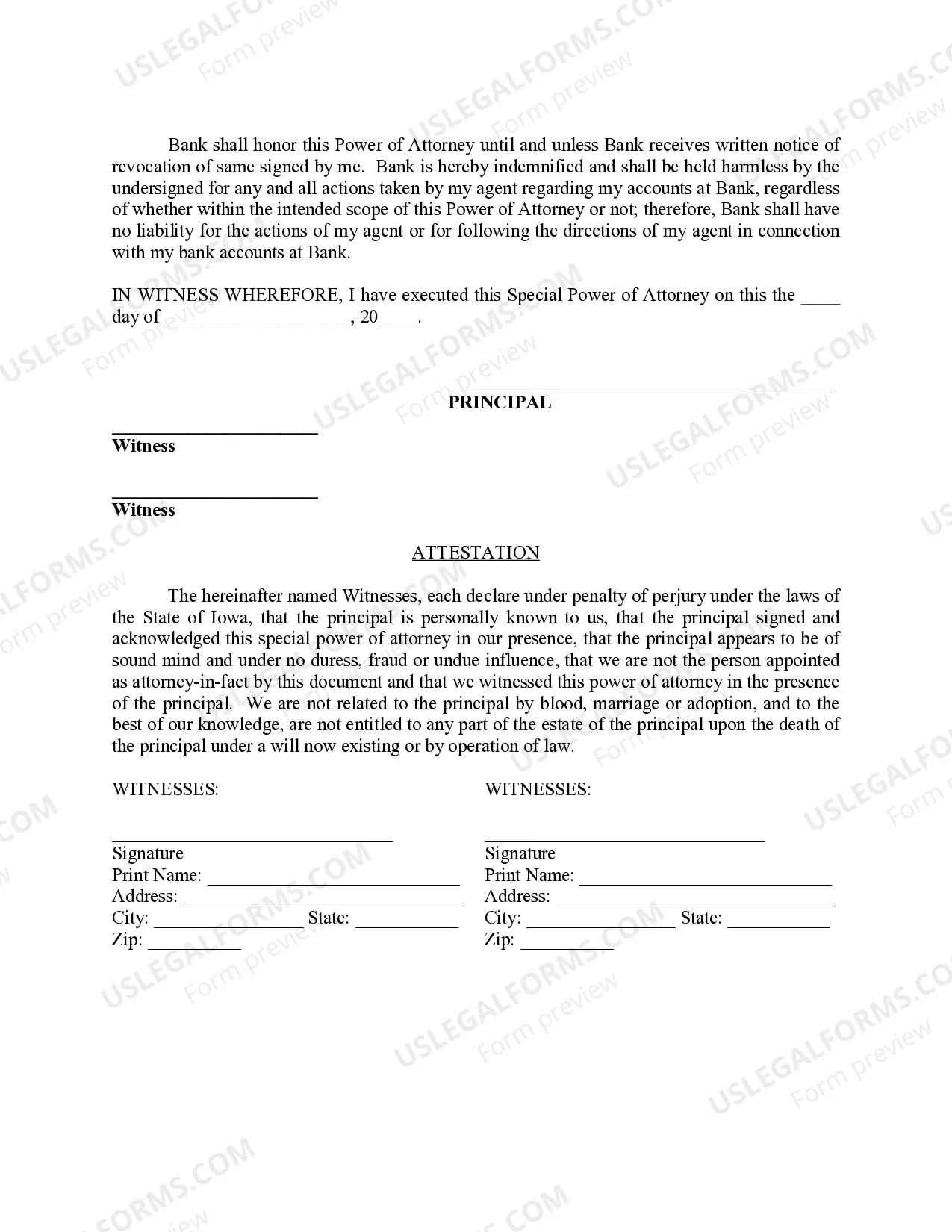

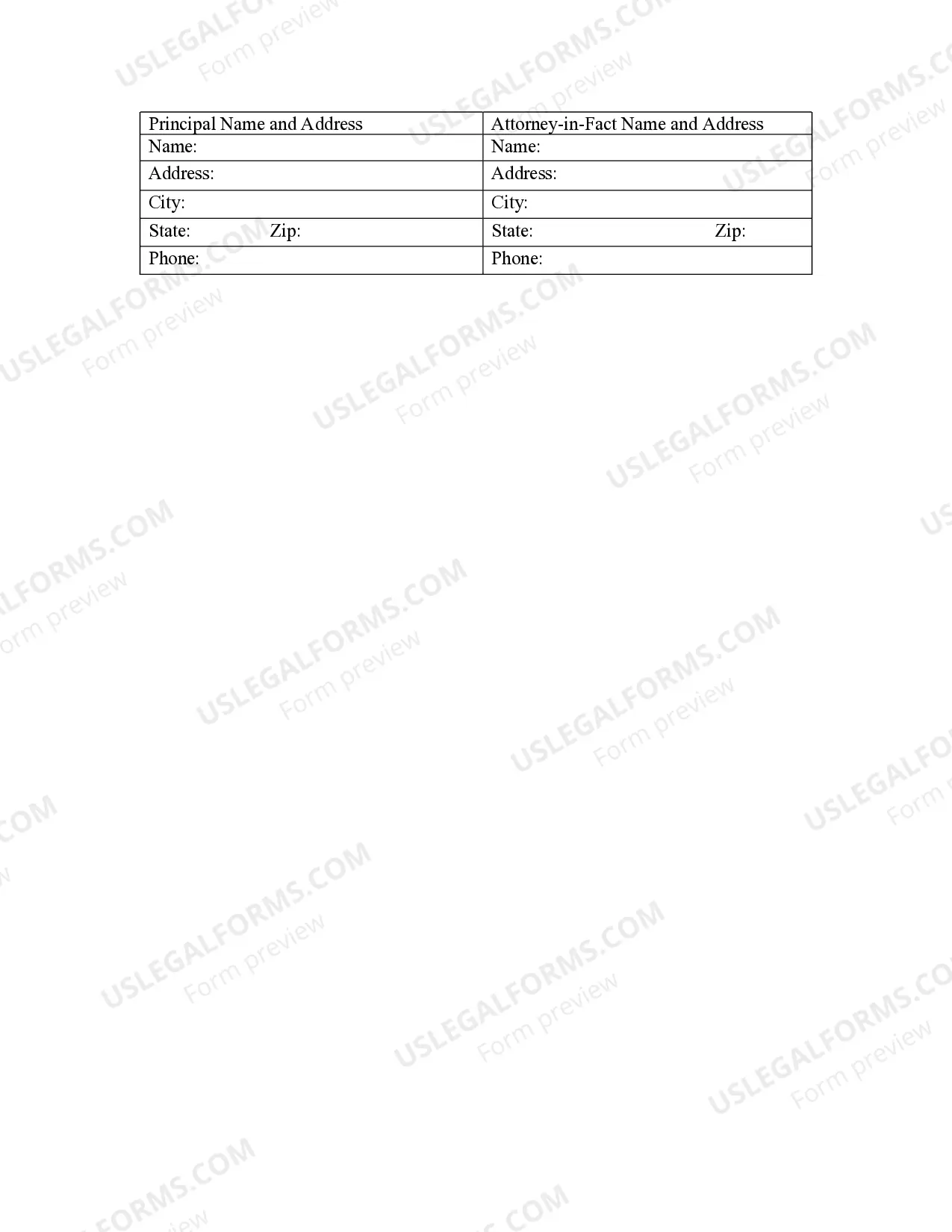

Cedar Rapids Iowa Special Durable Power of Attorney for Bank Account Matters is a legal document that grants specific powers to an appointed individual or entity to handle bank account-related matters on behalf of another person, referred to as the principal. This type of power of attorney provides a robust and lasting authority to manage financial affairs in Cedar Rapids, Iowa. The Cedar Rapids Iowa Special Durable Power of Attorney for Bank Account Matters enables the assigned agent, also known as the attorney-in-fact, to make banking transactions, monitor account activity, and perform various tasks related to the principal's bank accounts. The powers conferred by this document are tailored specifically for managing bank-related matters, making it ideal for individuals who need assistance in handling their financial affairs. Some common powers granted to the attorney-in-fact under Cedar Rapids Iowa Special Durable Power of Attorney for Bank Account Matters may include: 1. Making deposits and withdrawals: The agent is authorized to deposit and withdraw funds from the principal's bank accounts, ensuring the seamless management of financial resources. 2. Paying bills and expenses: The attorney-in-fact can handle the payment of bills, loans, and other financial obligations on behalf of the principal, ensuring timely and accurate transactions. 3. Managing investments: If specified in the power of attorney, the agent can handle investment-related matters such as buying or selling securities and managing investment accounts on behalf of the principal. 4. Accessing account information: The attorney-in-fact can review account statements, access online banking platforms, and collect necessary financial information to help the principal make informed decisions. 5. Opening and closing accounts: With proper authorization, the agent can open or close bank accounts in the principal's name as per their instructions or requirements. It is important to note that the Cedar Rapids Iowa Special Durable Power of Attorney for Bank Account Matters can vary in scope and specificity, depending on the individual's needs and preferences. Some people may require broader authority, while others may only need limited powers for specific banking matters. Different types of Cedar Rapids Iowa Special Durable Power of Attorney for Bank Account Matters can include: 1. Limited Scope Power of Attorney for Bank Account Matters: This type of power of attorney grants the agent specific powers for a defined set of banking tasks, allowing them to handle only those specified responsibilities. 2. General Power of Attorney for Bank Account Matters: Unlike the limited scope power of attorney, this provides broader powers to the agent, allowing them to manage a wider range of bank account-related matters on behalf of the principal. 3. Financial Institution-Specific Power of Attorney: This type of power of attorney is designed to meet the requirements of a particular financial institution. It ensures that the agent possesses the necessary authority acceptable by the bank to handle the principal's accounts. When drafting a Cedar Rapids Iowa Special Durable Power of Attorney for Bank Account Matters, it is crucial to consult with a qualified attorney who can guide you through the legal requirements and tailor the document to suit your specific needs and circumstances.