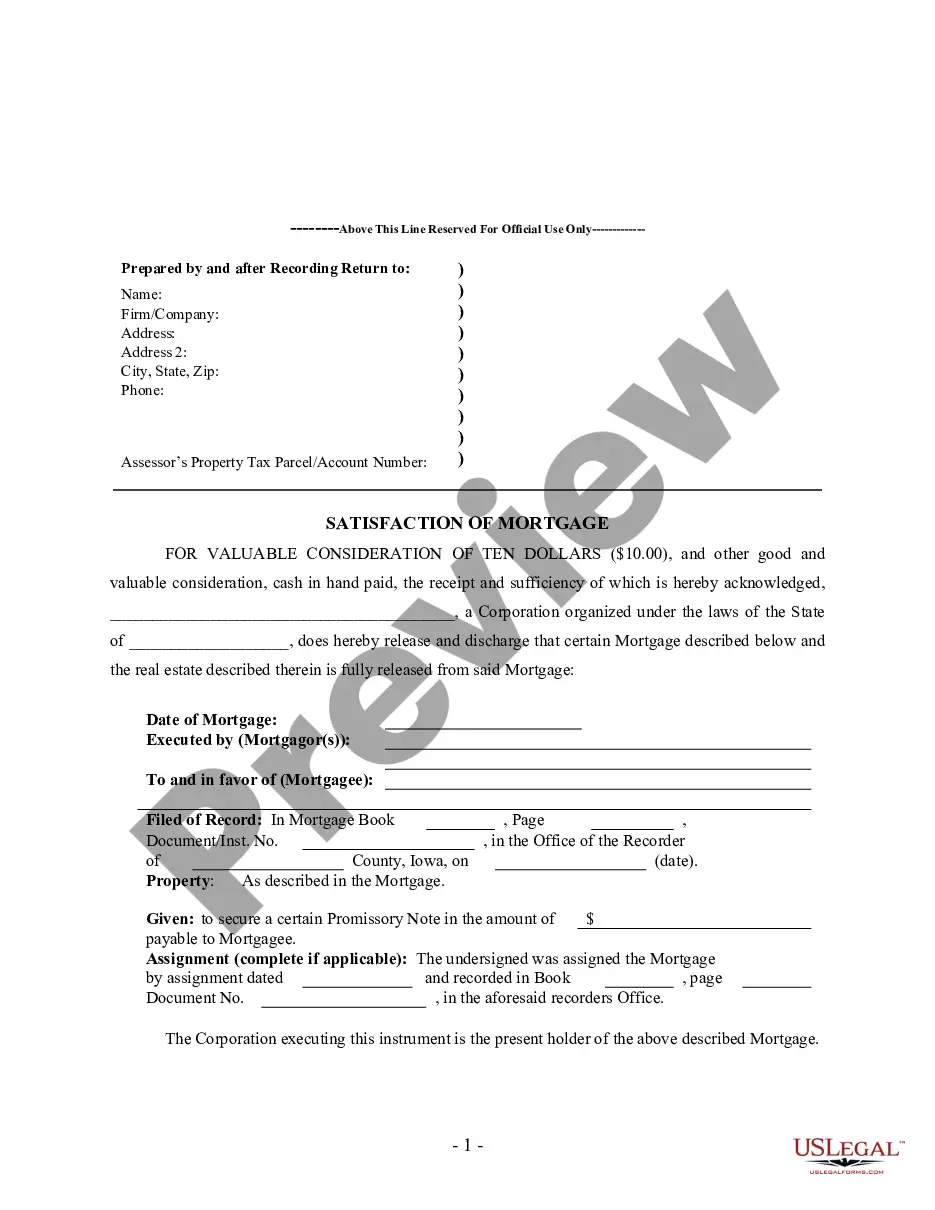

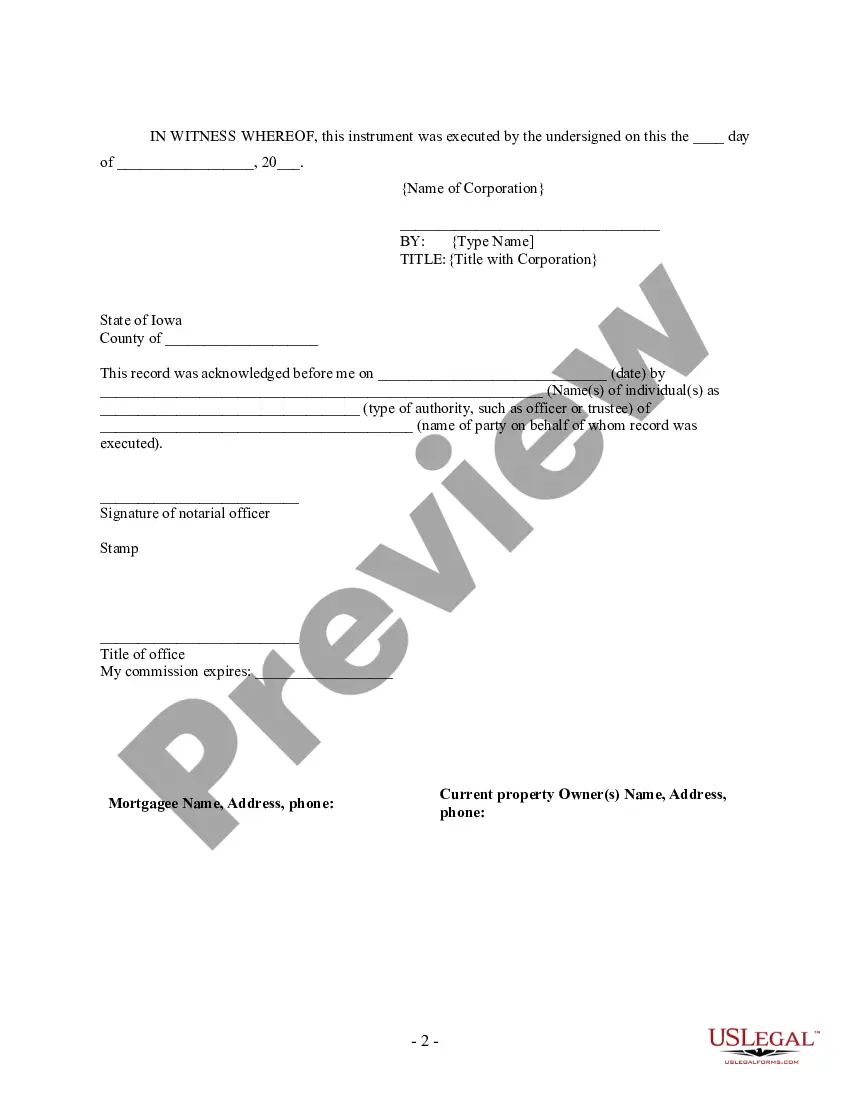

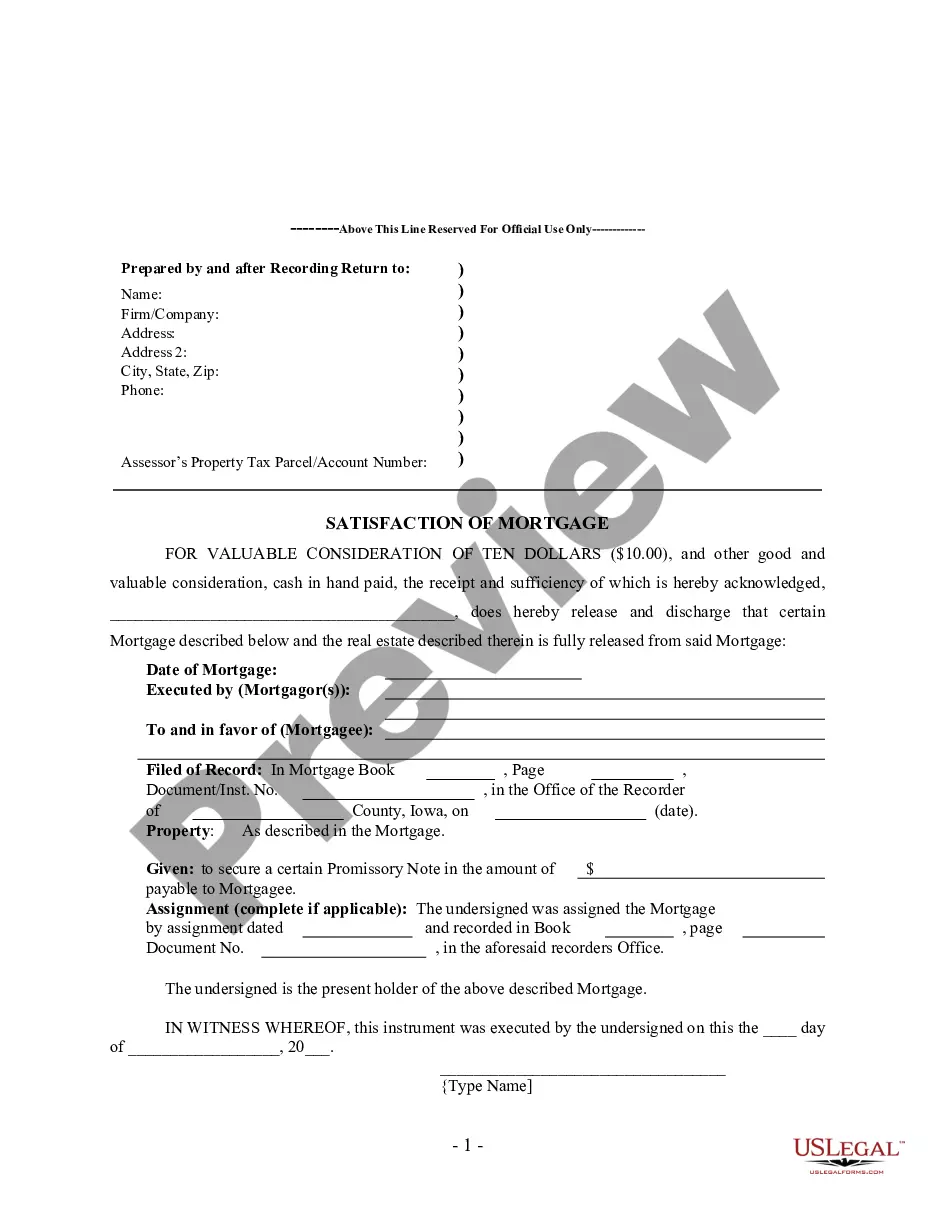

This Release - Satisfaction - Cancellation Deed of Trust - by Corporate Lender is for the satisfaction or release of a mortgage for the state of Iowa by a Corporation. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Title: A Comprehensive Guide to Cedar Rapids, Iowa Satisfaction, Release, and Cancellation of Mortgage by Corporation Intro: In the vibrant city of Cedar Rapids, Iowa, mortgage transactions are an integral part of the local real estate landscape. This article aims to provide a detailed description of Satisfaction, Release, and Cancellation of Mortgage by Corporation in Cedar Rapids, Iowa. We will explore the significance of these processes, how they work, and shed light on any distinct types that may exist. Join us as we dive into the world of mortgages within Cedar Rapids, Iowa! Keywords: Cedar Rapids, Iowa, satisfaction of mortgage, release of mortgage, cancellation of mortgage, corporation, types 1. Understanding Mortgage Satisfaction: When a corporation originating a mortgage loan in Cedar Rapids, Iowa, successfully receives full repayment, they issue a Satisfaction of Mortgage document. This document serves as proof that the borrower has fulfilled their financial obligations, releasing any claim the corporation had on the property. Keywords: mortgage satisfaction, repayment, proof, financial obligations, property claim 2. Unveiling Mortgage Release: The process of mortgage release entails a corporation relinquishing their interest or claim on a property, often when a loan is partially paid off or refinanced. A Release of Mortgage document is drawn up, stating that the corporation no longer has a legal right to the property. Keywords: mortgage release, relinquishing interest, claim on property, partial payment, refinancing, legal right 3. The Significance of Mortgage Cancellation: When a corporation cancels a mortgage in Cedar Rapids, Iowa, it denotes the termination of the mortgage agreement before its full repayment. This can occur due to various reasons, such as errors in the initial documentation, refinancing, or restructuring of the loan. Keywords: mortgage cancellation, termination, repayment, agreement, documentation errors, refinancing, loan restructuring 4. Differentiating Types of Satisfaction, Release, and Cancellation: Though Satisfaction, Release, and Cancellation of Mortgages by a corporation essentially serve the same purpose, they may differ in specifics. Some possible variations may include: a) Partial Satisfaction, Release, or Cancellation: In situations where a borrower repays only a portion of the loan amount, corporations may issue documents reflecting partial satisfaction, release, or cancellation. This provides clarity on what part of the original loan is fully settled. b) Voluntary Satisfaction, Release, or Cancellation: When a borrower fulfills their repayment obligations willingly, the satisfaction, release, or cancellation process falls under this category. It distinguishes from situations where it occurs due to external factors, such as foreclosure or court orders. c) Satisfaction, Release, or Cancellation of Multiple Mortgages: In certain cases, individuals or corporations may have multiple mortgages on a single property. In such scenarios, the satisfaction, release, or cancellation procedures can be more complex, involving the management of multiple documents and considerations. Keywords: partial satisfaction, partial release, partial cancellation, voluntary satisfaction, voluntary release, voluntary cancellation, multiple mortgages, complex procedures, document management Conclusion: Understanding Cedar Rapids, Iowa Satisfaction, Release, and Cancellation of Mortgage by Corporation is crucial for both borrowers and corporations involved in real estate transactions. By grasping the significance of these processes and potential variations, individuals can navigate mortgage agreements with confidence. Whether it be complete satisfaction, release, or cancellation, these actions play a vital role in the mortgage landscape of Cedar Rapids, Iowa. Keywords: Cedar Rapids, Iowa, mortgage landscape, real estate transactions, complete satisfaction, complete release, complete cancellation.Title: A Comprehensive Guide to Cedar Rapids, Iowa Satisfaction, Release, and Cancellation of Mortgage by Corporation Intro: In the vibrant city of Cedar Rapids, Iowa, mortgage transactions are an integral part of the local real estate landscape. This article aims to provide a detailed description of Satisfaction, Release, and Cancellation of Mortgage by Corporation in Cedar Rapids, Iowa. We will explore the significance of these processes, how they work, and shed light on any distinct types that may exist. Join us as we dive into the world of mortgages within Cedar Rapids, Iowa! Keywords: Cedar Rapids, Iowa, satisfaction of mortgage, release of mortgage, cancellation of mortgage, corporation, types 1. Understanding Mortgage Satisfaction: When a corporation originating a mortgage loan in Cedar Rapids, Iowa, successfully receives full repayment, they issue a Satisfaction of Mortgage document. This document serves as proof that the borrower has fulfilled their financial obligations, releasing any claim the corporation had on the property. Keywords: mortgage satisfaction, repayment, proof, financial obligations, property claim 2. Unveiling Mortgage Release: The process of mortgage release entails a corporation relinquishing their interest or claim on a property, often when a loan is partially paid off or refinanced. A Release of Mortgage document is drawn up, stating that the corporation no longer has a legal right to the property. Keywords: mortgage release, relinquishing interest, claim on property, partial payment, refinancing, legal right 3. The Significance of Mortgage Cancellation: When a corporation cancels a mortgage in Cedar Rapids, Iowa, it denotes the termination of the mortgage agreement before its full repayment. This can occur due to various reasons, such as errors in the initial documentation, refinancing, or restructuring of the loan. Keywords: mortgage cancellation, termination, repayment, agreement, documentation errors, refinancing, loan restructuring 4. Differentiating Types of Satisfaction, Release, and Cancellation: Though Satisfaction, Release, and Cancellation of Mortgages by a corporation essentially serve the same purpose, they may differ in specifics. Some possible variations may include: a) Partial Satisfaction, Release, or Cancellation: In situations where a borrower repays only a portion of the loan amount, corporations may issue documents reflecting partial satisfaction, release, or cancellation. This provides clarity on what part of the original loan is fully settled. b) Voluntary Satisfaction, Release, or Cancellation: When a borrower fulfills their repayment obligations willingly, the satisfaction, release, or cancellation process falls under this category. It distinguishes from situations where it occurs due to external factors, such as foreclosure or court orders. c) Satisfaction, Release, or Cancellation of Multiple Mortgages: In certain cases, individuals or corporations may have multiple mortgages on a single property. In such scenarios, the satisfaction, release, or cancellation procedures can be more complex, involving the management of multiple documents and considerations. Keywords: partial satisfaction, partial release, partial cancellation, voluntary satisfaction, voluntary release, voluntary cancellation, multiple mortgages, complex procedures, document management Conclusion: Understanding Cedar Rapids, Iowa Satisfaction, Release, and Cancellation of Mortgage by Corporation is crucial for both borrowers and corporations involved in real estate transactions. By grasping the significance of these processes and potential variations, individuals can navigate mortgage agreements with confidence. Whether it be complete satisfaction, release, or cancellation, these actions play a vital role in the mortgage landscape of Cedar Rapids, Iowa. Keywords: Cedar Rapids, Iowa, mortgage landscape, real estate transactions, complete satisfaction, complete release, complete cancellation.