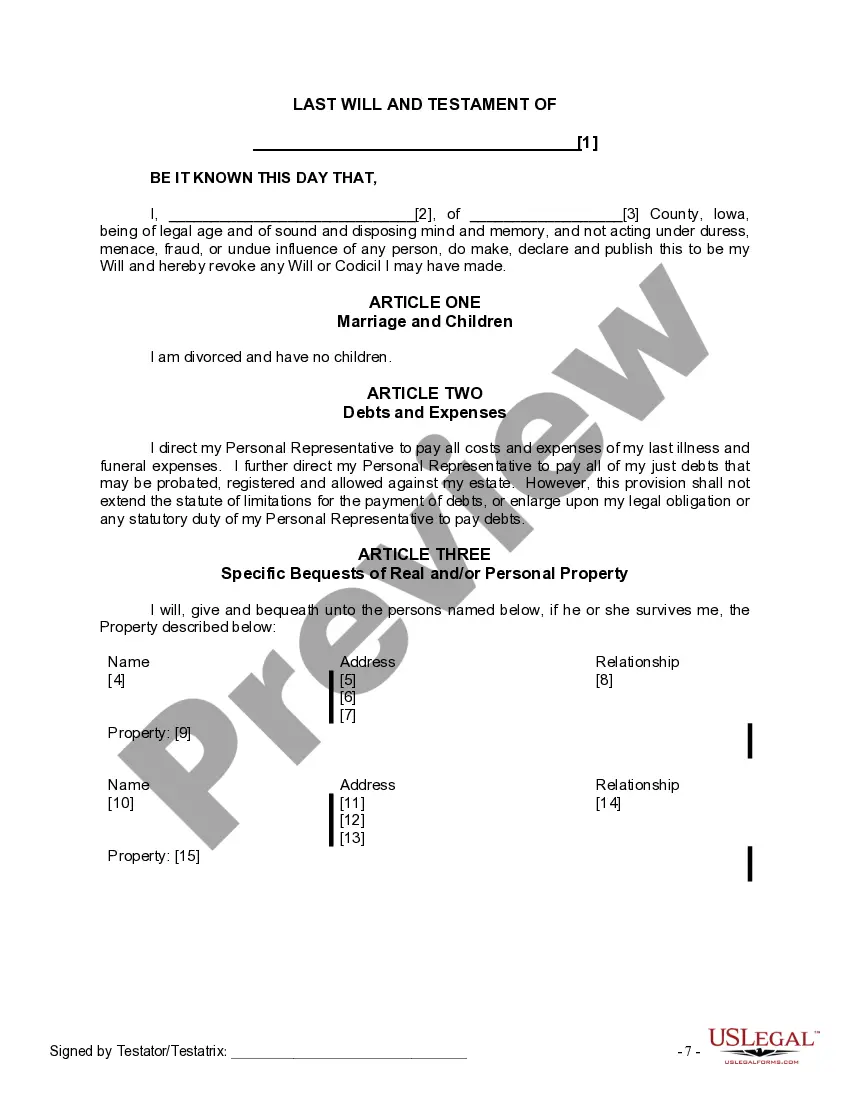

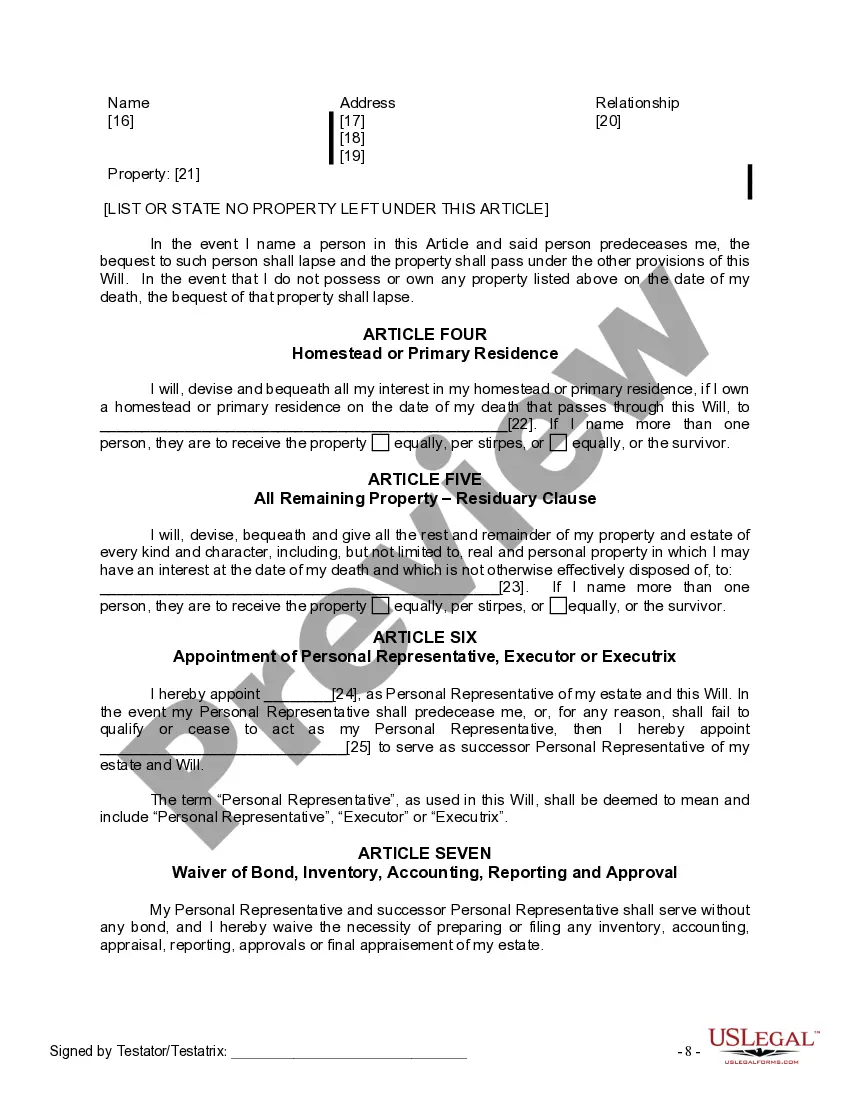

The Will you have found is for a divorced person, not remarried with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

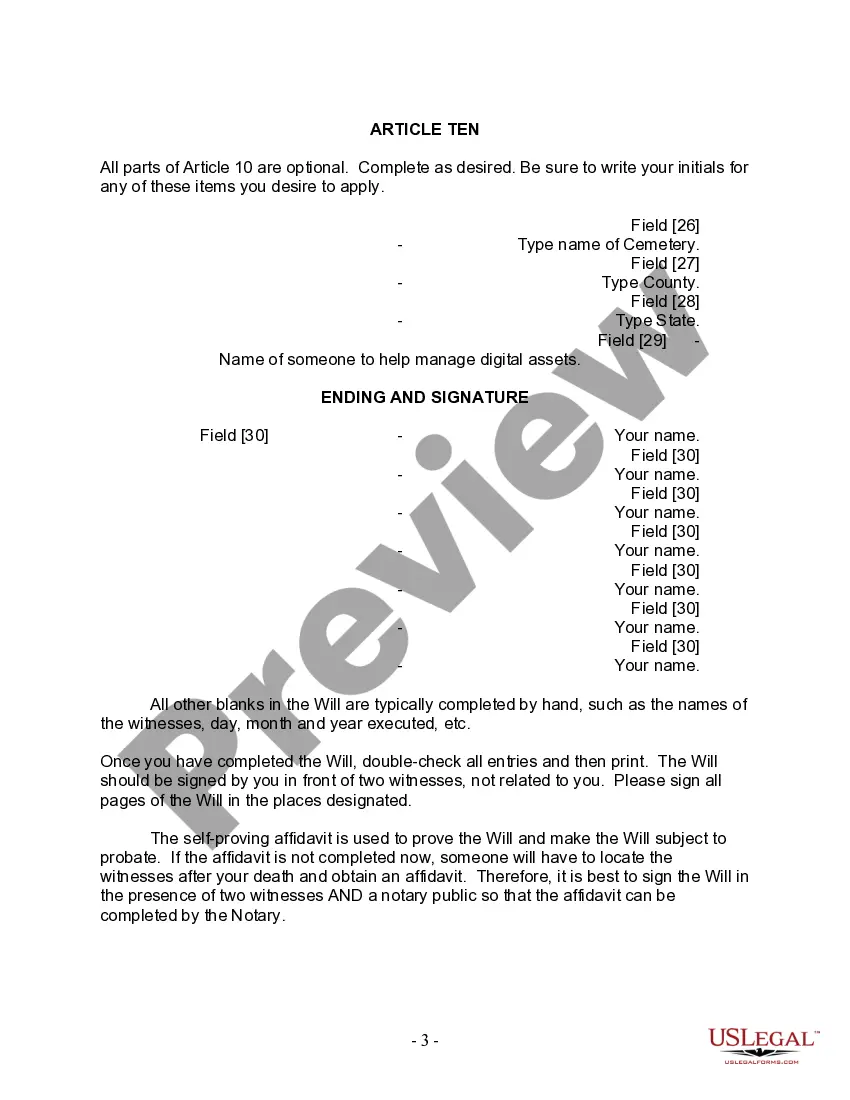

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

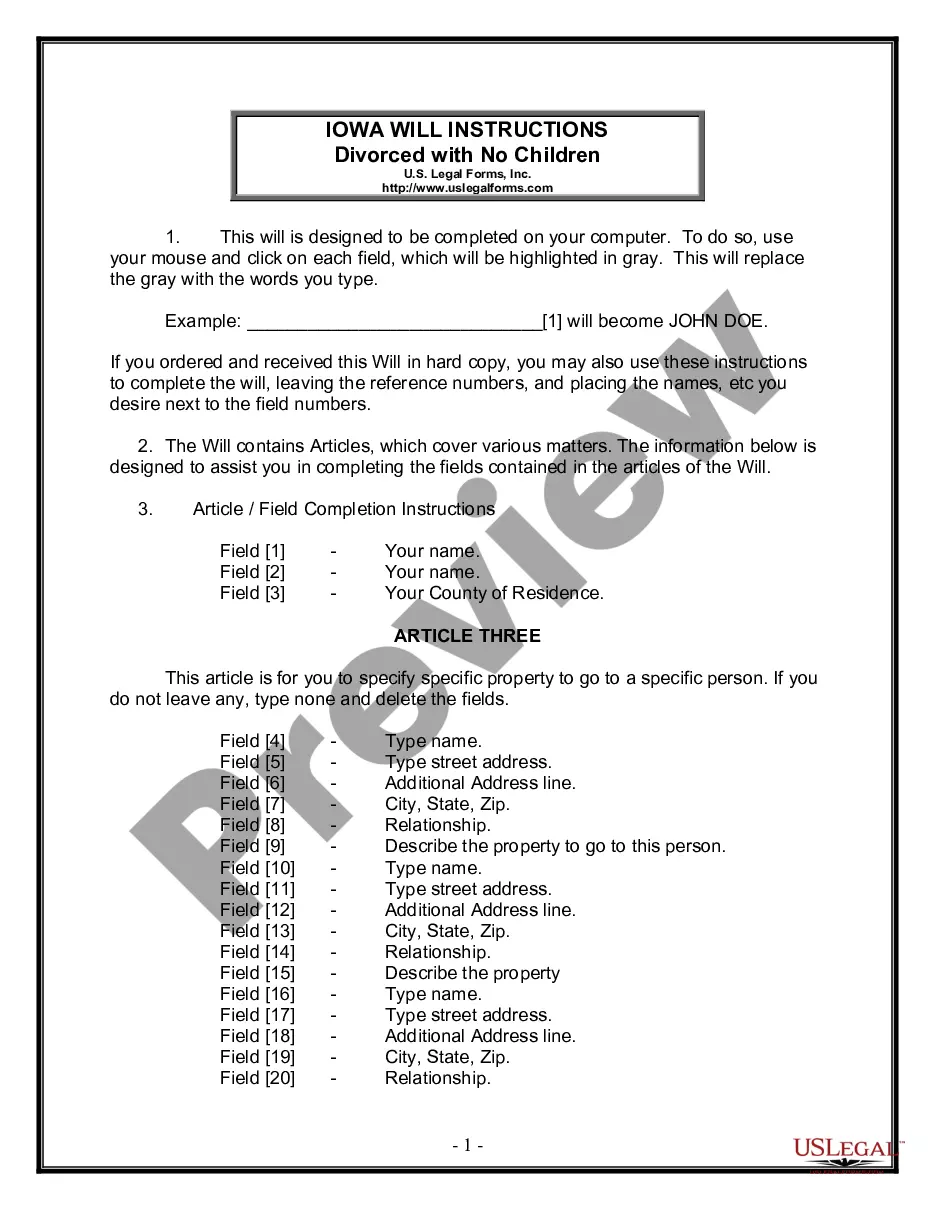

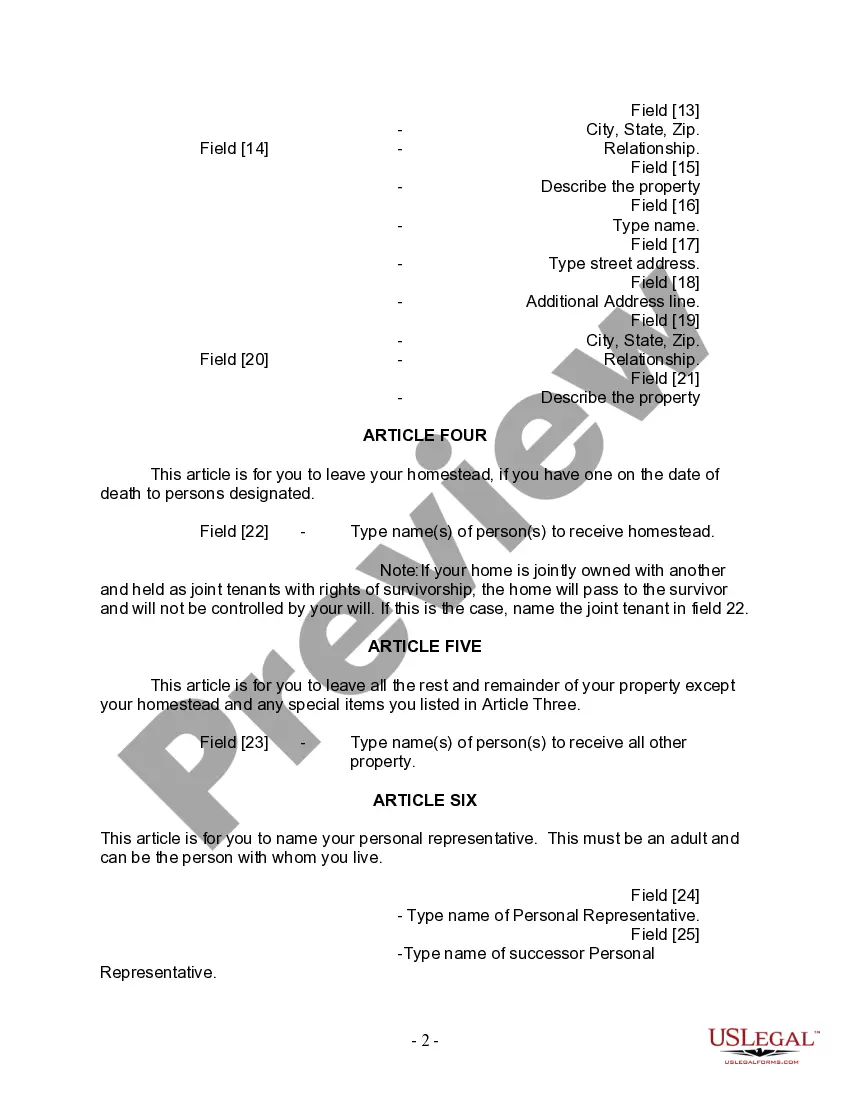

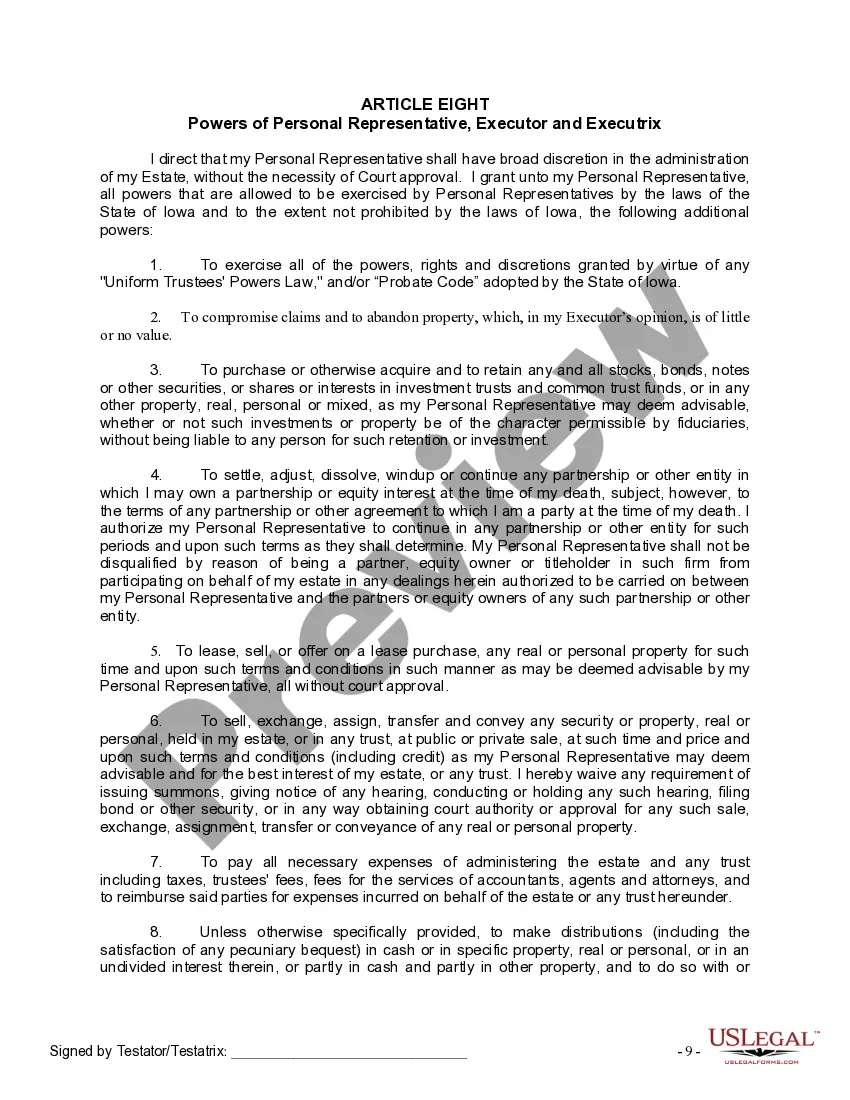

The Cedar Rapids Iowa Legal Last Will and Testament Form for a Divorced Person Not Remarried with No Children is a legally binding document that outlines the distribution of assets and personal wishes after death. This specific form is tailored to individuals who have been divorced and are not remarried, and who do not have any children. Cedar Rapids, Iowa recognizes the importance of having a carefully prepared Last Will and Testament to ensure that your assets are distributed according to your wishes. By using this legal form, you can provide specific instructions on how your property, funds, and possessions should be allocated after your passing. Key features of this Cedar Rapids Iowa Last Will and Testament Form for Divorced Person Not Remarried with No Children include: 1. Personal Information: You will need to provide your full name, address, and other identifying details at the start of the form. 2. Executor/Personal Representative: This form allows you to appoint an executor or personal representative who will be responsible for carrying out the instructions stated in your will after your demise. It is essential to choose someone trustworthy and capable of handling your affairs. 3. Asset Distribution: In this section, you can specify how your assets, including real estate, bank accounts, investments, and personal property, should be distributed. This may include leaving specific items or sums of money to particular individuals, charitable organizations, or other beneficiaries. 4. Debts and Expenses: The will also addresses any outstanding debts, loans, and funeral expenses. You can indicate how these should be settled and if they should be deducted from your estate. 5. Alternative Beneficiaries: It's wise to include alternative beneficiaries, in case your primary beneficiaries pass away before you. This ensures that your assets are not left unallocated. 6. Residual Estate: The residual estate refers to any remaining assets, or the portion not explicitly allocated in the will. You can specify who should inherit this residual portion. 7. Witness and Notarization: To validate the will, it must be signed by two witnesses who are not beneficiaries or closely related to you. In some cases, notarization may also be required. Remember, there might be additional variations of the Cedar Rapids Iowa Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children, such as ones that include specific provisions, conditions, or different templates. However, it is critical to consult with a qualified lawyer or estate planner to ensure that your will complies with the legal requirements in Cedar Rapids, Iowa, and accurately reflects your wishes.The Cedar Rapids Iowa Legal Last Will and Testament Form for a Divorced Person Not Remarried with No Children is a legally binding document that outlines the distribution of assets and personal wishes after death. This specific form is tailored to individuals who have been divorced and are not remarried, and who do not have any children. Cedar Rapids, Iowa recognizes the importance of having a carefully prepared Last Will and Testament to ensure that your assets are distributed according to your wishes. By using this legal form, you can provide specific instructions on how your property, funds, and possessions should be allocated after your passing. Key features of this Cedar Rapids Iowa Last Will and Testament Form for Divorced Person Not Remarried with No Children include: 1. Personal Information: You will need to provide your full name, address, and other identifying details at the start of the form. 2. Executor/Personal Representative: This form allows you to appoint an executor or personal representative who will be responsible for carrying out the instructions stated in your will after your demise. It is essential to choose someone trustworthy and capable of handling your affairs. 3. Asset Distribution: In this section, you can specify how your assets, including real estate, bank accounts, investments, and personal property, should be distributed. This may include leaving specific items or sums of money to particular individuals, charitable organizations, or other beneficiaries. 4. Debts and Expenses: The will also addresses any outstanding debts, loans, and funeral expenses. You can indicate how these should be settled and if they should be deducted from your estate. 5. Alternative Beneficiaries: It's wise to include alternative beneficiaries, in case your primary beneficiaries pass away before you. This ensures that your assets are not left unallocated. 6. Residual Estate: The residual estate refers to any remaining assets, or the portion not explicitly allocated in the will. You can specify who should inherit this residual portion. 7. Witness and Notarization: To validate the will, it must be signed by two witnesses who are not beneficiaries or closely related to you. In some cases, notarization may also be required. Remember, there might be additional variations of the Cedar Rapids Iowa Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children, such as ones that include specific provisions, conditions, or different templates. However, it is critical to consult with a qualified lawyer or estate planner to ensure that your will complies with the legal requirements in Cedar Rapids, Iowa, and accurately reflects your wishes.