Last Will and Testament for a Married Person with No Children

Note: This summary is not intended to be an all-inclusive

discussion of the law of wills in Iowa, but does contain basic and other

provisions. It does not discuss handwritten wills or wills where

the testator cannot sign his or her name.

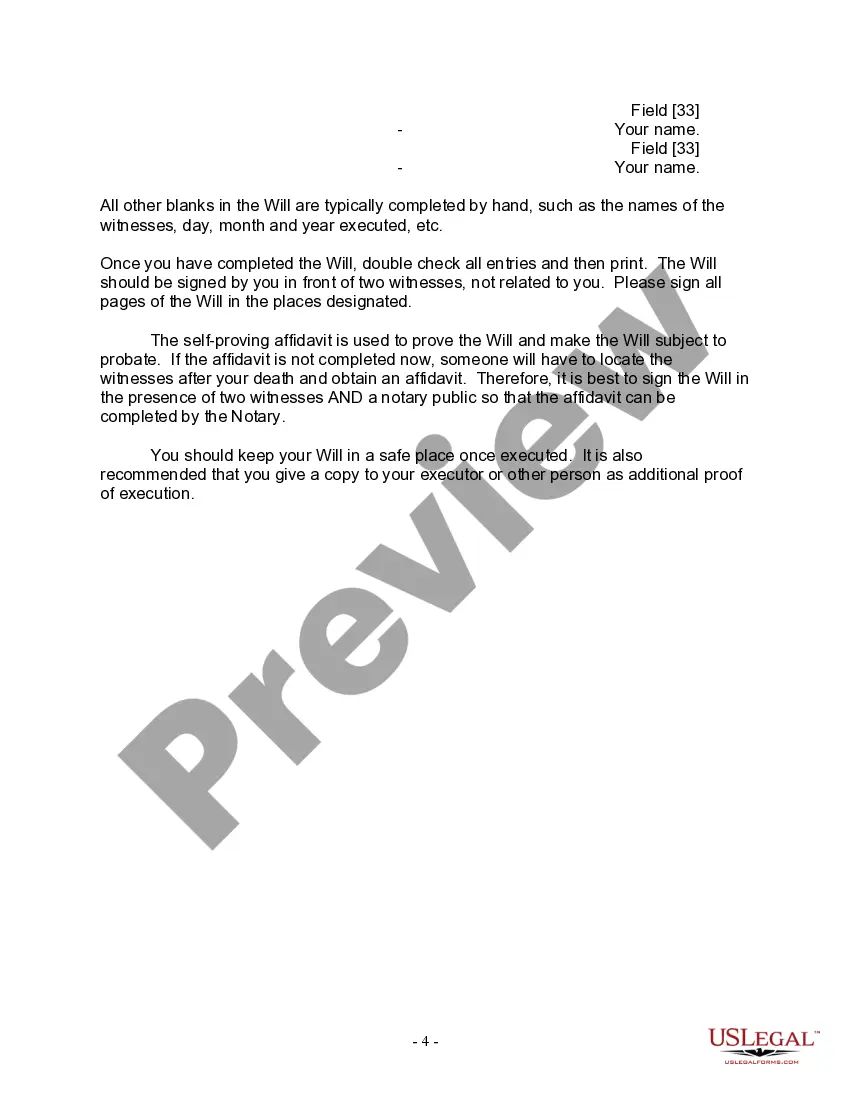

Execution and witnessing of wills: A will must be signed

by the testator and declared by the testator to be the testator's will,

and witnessed, at the testator's request, by two competent persons who

must sign the will as witnesses in the presence of the testator and in

the presence of each other. 633.279

Who may witness; interested witnesses: Any person who

is sixteen years of age, or older, and who is competent to be a witness

generally in this state, may act as an attesting witness to a will. 633.280

No will is invalidated because attested by an interested witness;

but any interested witness shall, unless the will is also attested by two

competent and disinterested witnesses, forfeit so much of the provisions

therein made for the interested witness as in the aggregate exceeds in

value, as of the date of the decedent's death, that which the interested

witness would have received had the testator died intestate. No attesting

witness is interested unless the witness is devised or bequeathed some

portion of the testator's estate. 633.281

Self-proving will: An attested will may be made self-proved

at the time of its execution, or at any subsequent date, by the acknowledgment

thereof by the testator and the affidavits of the witnesses, each made

before a person authorized to administer oaths and take acknowledgments

under the laws of this state, and evidenced by such person's certificate,

under seal, attached or annexed to the will. The will form you have located

contains the self-proving affidavit. 633.279

Defect cured by codicil: If a codicil to a defectively

executed will is duly executed, and such will is clearly identified in

said codicil, the will and the codicil shall be considered as one instrument

and the execution of both shall be deemed sufficient. 633.282

Foreign wills: A will executed outside this state,

in the mode prescribed by the law, either of the place where executed or

of the testator's domicile, shall be deemed to be legally executed, and

shall be of the same force and effect as if executed in the mode prescribed

by the laws of this state, provided said will is in writing and subscribed

by the testator. 633.283

Revocation; cancellation; revival: A will can be revoked

in whole or in part only by being canceled or destroyed by the act or direction

of the testator, with the intention of revoking it, or by the execution

of a subsequent will. When done by cancellation, the revocation must be

witnessed in the same manner as the making of a new will. No will, nor

any part thereof, which shall be in any manner revoked, or which shall

be or become invalid, can be revived otherwise than by a reexecution thereof,

or by the execution of another will or codicil in which the revoked or

invalid will, or part thereof, is incorporated by reference. 633.284

Custodian of will; filing with Court; penalties: After

being informed of the death of the testator, the person having custody

of the testator's will shall deliver it to the court having jurisdiction

of the testator's estate. Every person who willfully refuses or fails to

deliver a will after being ordered by the court to do so shall be guilty

of contempt of court. The person shall also be liable to any person aggrieved

for the damages which may be sustained by such refusal or failure. 633.285

Deposit of will with clerk: The clerk shall maintain

a file for the safekeeping of wills. There shall be placed therein wills

deposited with the clerk by living testators or by persons on their behalf,

and wills of deceased testators not accompanied by petitions for the probate

thereof, when deposited with the clerk by persons having custody thereof

as provided in section 633.285 of this Code. 633.286

Manner of deposit: Every such will shall be enclosed

in a sealed wrapper. The clerk shall indorse thereon the name of the testator,

the name of the depositor, the date of deposit, and, if provided, the name

of the person to be notified of the deposit of such will upon the death

of the testator. The clerk shall hold such will until disposed of as provided

in section 633.288 or 633.289. 633.287

Delivery by clerk during lifetime of testator: During

the lifetime of the testator, such will shall be delivered only to the

testator, or to some person authorized by the testator by an order in writing

duly acknowledged. 633.288

Delivery by clerk after death of testator: After being

informed of the death of a testator, the clerk shall notify the person,

if any, named in the indorsement on the wrapper of said will. If no petition

for the probate thereof has been filed within thirty days after the death

of the testator, it shall be publicly opened, and the court shall make

such orders as it deems appropriate for the disposition of said will. The

clerk shall notify the executor named therein and such other persons as

the court shall designate of such action. If the proper venue is in another

court, the clerk, upon request, shall transmit such will to such court,

but before such transmission, the clerk shall make a true copy thereof

and retain the same in the clerk's files. 633.289