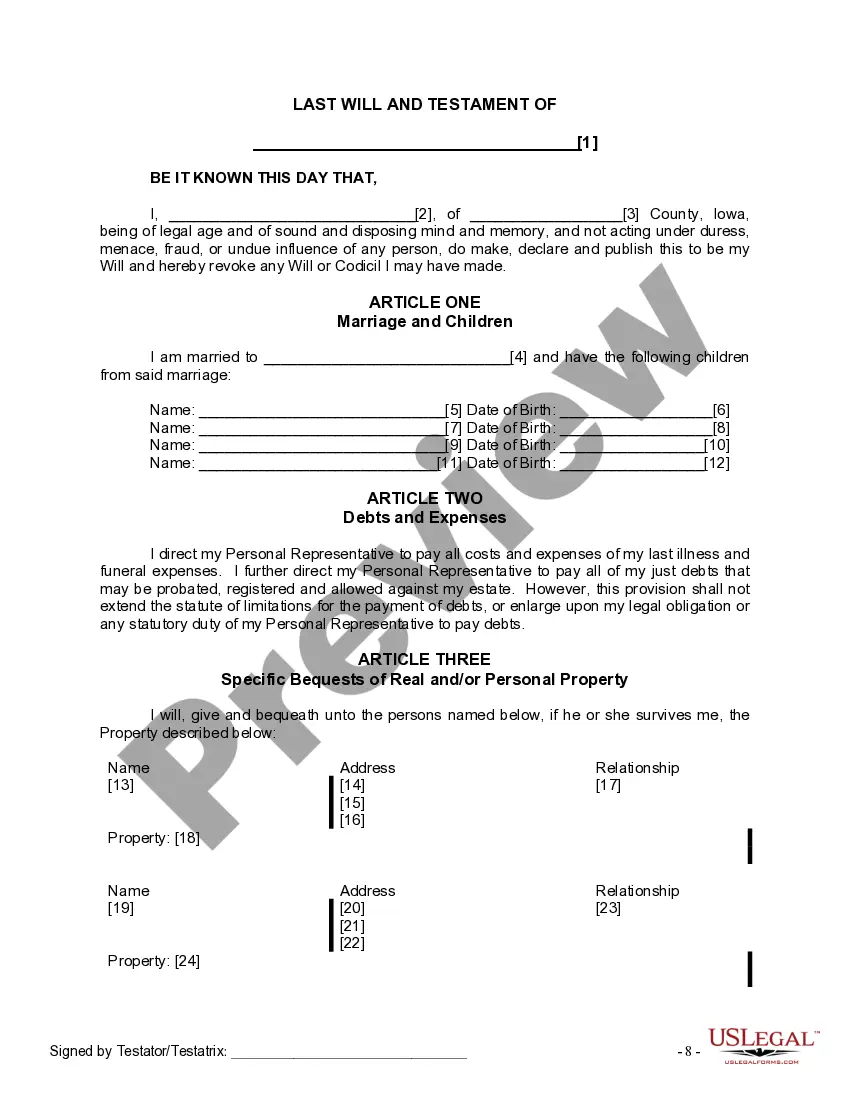

The Will you have found is for a married person with minor children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions, including provisions for your sopuse and children children.

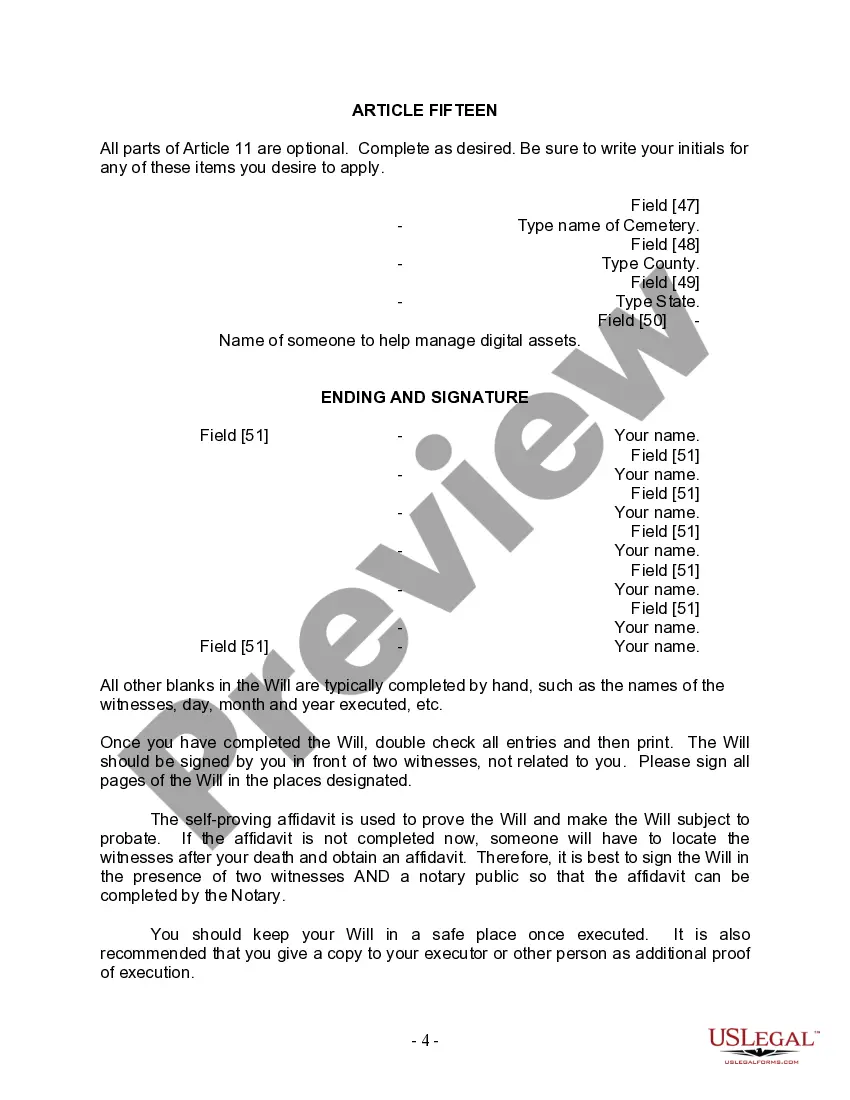

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

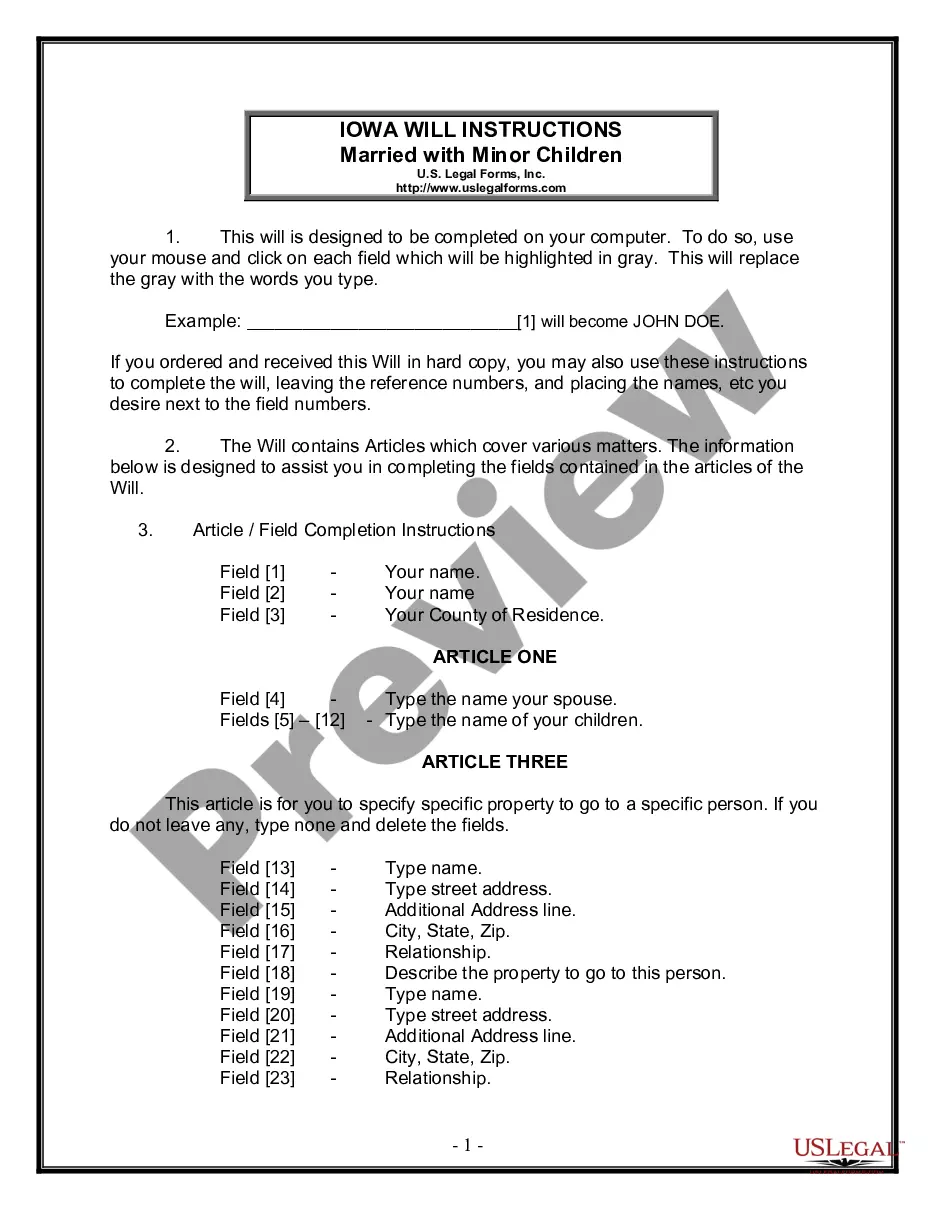

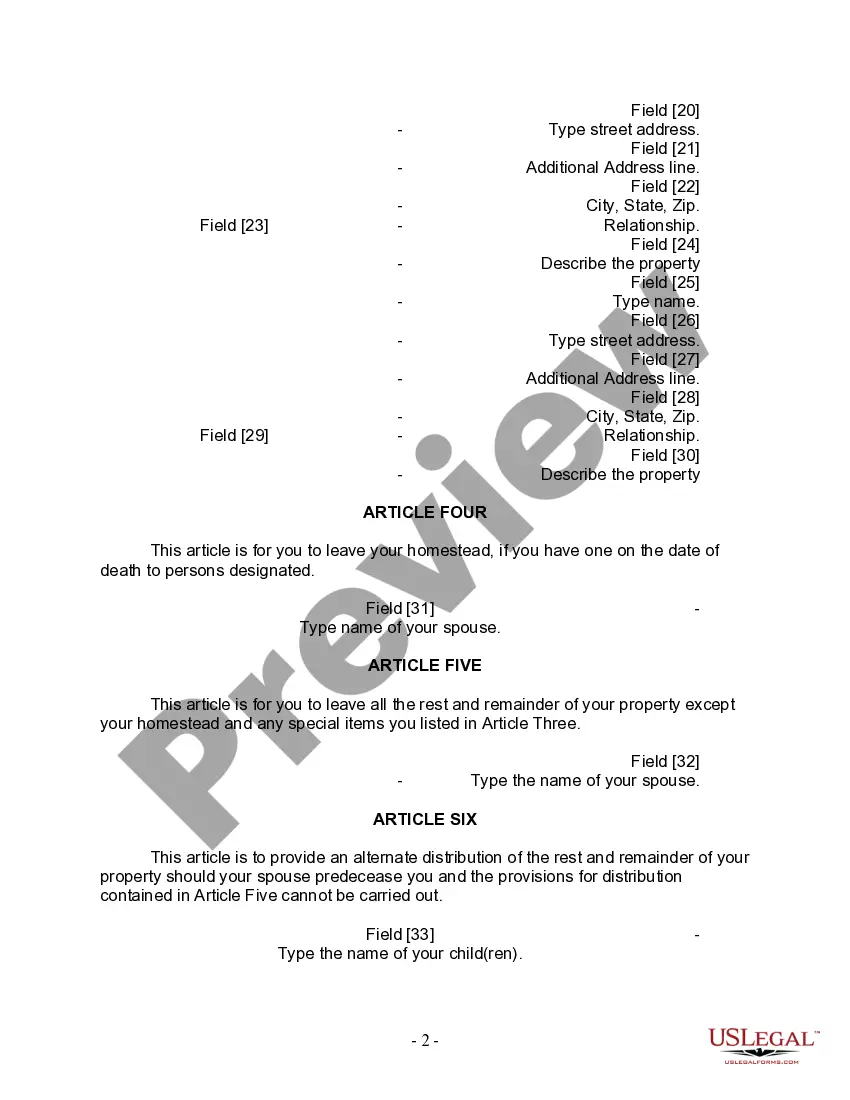

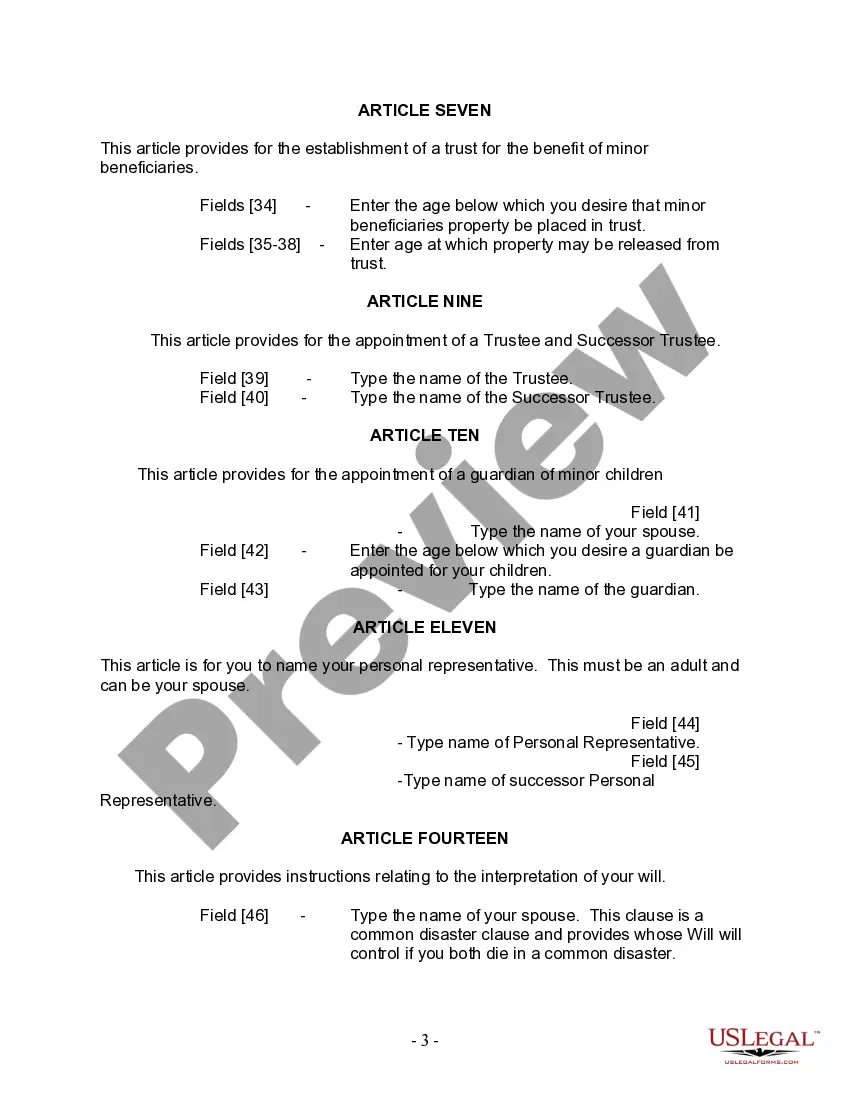

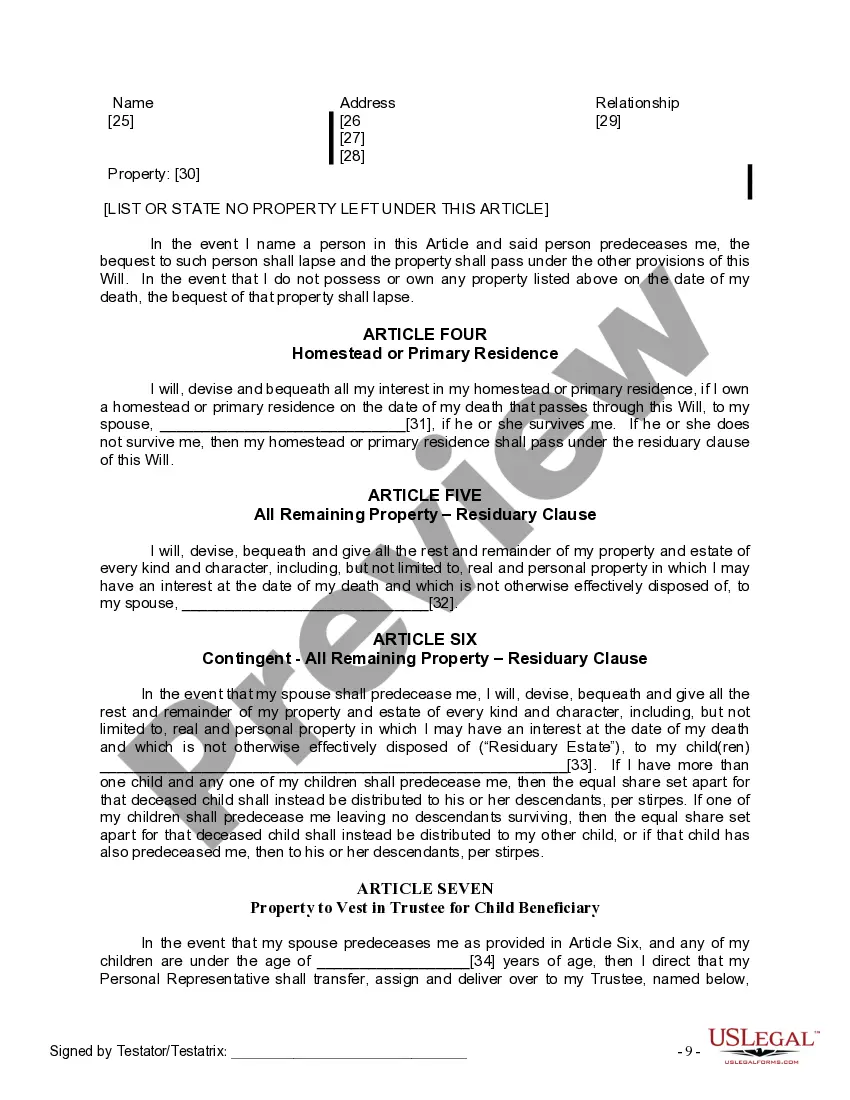

The Davenport Iowa Legal Last Will and Testament Form for Married person with Minor Children is a crucial legal document that allows married individuals residing in Davenport, Iowa, to outline their final wishes and instructions regarding the distribution of their assets and the care of their minor children in the event of their death. This comprehensive form ensures that your loved ones and children are provided for and that your wishes are respected. Key features of the Davenport Iowa Legal Last Will and Testament Form for Married person with Minor Children include: 1. Asset Distribution: The form enables you to designate how your assets, such as property, investments, savings, and personal belongings, will be distributed among your chosen beneficiaries. You can specify precise individuals or organizations, such as charities, to receive specific assets. 2. Appointment of Personal Representative: You can appoint a trusted individual, known as the executor or personal representative, to ensure that your wishes are carried out and that your estate is properly managed and distributed according to your instructions. 3. Guardian for Minor Children: One of the most crucial aspects of this form is the ability to name a guardian for your minor children. By legally appointing a guardian, you have the peace of mind in knowing that your children will be cared for by someone you trust in the unfortunate event that you and your spouse pass away. 4. Trust Establishment: If you want to establish a trust for the benefit of your minor children, you can do so through this form. The trust allows you to appoint a trustee who will manage and distribute the funds for the well-being and education of your children until they reach a specified age or milestone. Variations of the Davenport Iowa Legal Last Will and Testament Form for Married person with Minor Children may include: 1. Davenport Iowa Legal Last Will and Testament Form with Disinheriting Provisions: This type of form allows individuals to explicitly disinherit certain family members or beneficiaries and ensure that they do not receive any portion of their estate. 2. Davenport Iowa Legal Last Will and Testament Form with Special Needs Child Provisions: This form takes into account the specific needs and requirements of a child with disabilities. It allows parents to establish a trust or provide for the care of their special needs child even after their demise. In conclusion, the Davenport Iowa Legal Last Will and Testament Form for Married person with Minor Children is a comprehensive legal document that allows married individuals in Davenport to protect their assets and ensure the well-being of their minor children. It is imperative to consult with a knowledgeable estate planning attorney to properly understand and execute this form to safeguard your family's future.The Davenport Iowa Legal Last Will and Testament Form for Married person with Minor Children is a crucial legal document that allows married individuals residing in Davenport, Iowa, to outline their final wishes and instructions regarding the distribution of their assets and the care of their minor children in the event of their death. This comprehensive form ensures that your loved ones and children are provided for and that your wishes are respected. Key features of the Davenport Iowa Legal Last Will and Testament Form for Married person with Minor Children include: 1. Asset Distribution: The form enables you to designate how your assets, such as property, investments, savings, and personal belongings, will be distributed among your chosen beneficiaries. You can specify precise individuals or organizations, such as charities, to receive specific assets. 2. Appointment of Personal Representative: You can appoint a trusted individual, known as the executor or personal representative, to ensure that your wishes are carried out and that your estate is properly managed and distributed according to your instructions. 3. Guardian for Minor Children: One of the most crucial aspects of this form is the ability to name a guardian for your minor children. By legally appointing a guardian, you have the peace of mind in knowing that your children will be cared for by someone you trust in the unfortunate event that you and your spouse pass away. 4. Trust Establishment: If you want to establish a trust for the benefit of your minor children, you can do so through this form. The trust allows you to appoint a trustee who will manage and distribute the funds for the well-being and education of your children until they reach a specified age or milestone. Variations of the Davenport Iowa Legal Last Will and Testament Form for Married person with Minor Children may include: 1. Davenport Iowa Legal Last Will and Testament Form with Disinheriting Provisions: This type of form allows individuals to explicitly disinherit certain family members or beneficiaries and ensure that they do not receive any portion of their estate. 2. Davenport Iowa Legal Last Will and Testament Form with Special Needs Child Provisions: This form takes into account the specific needs and requirements of a child with disabilities. It allows parents to establish a trust or provide for the care of their special needs child even after their demise. In conclusion, the Davenport Iowa Legal Last Will and Testament Form for Married person with Minor Children is a comprehensive legal document that allows married individuals in Davenport to protect their assets and ensure the well-being of their minor children. It is imperative to consult with a knowledgeable estate planning attorney to properly understand and execute this form to safeguard your family's future.