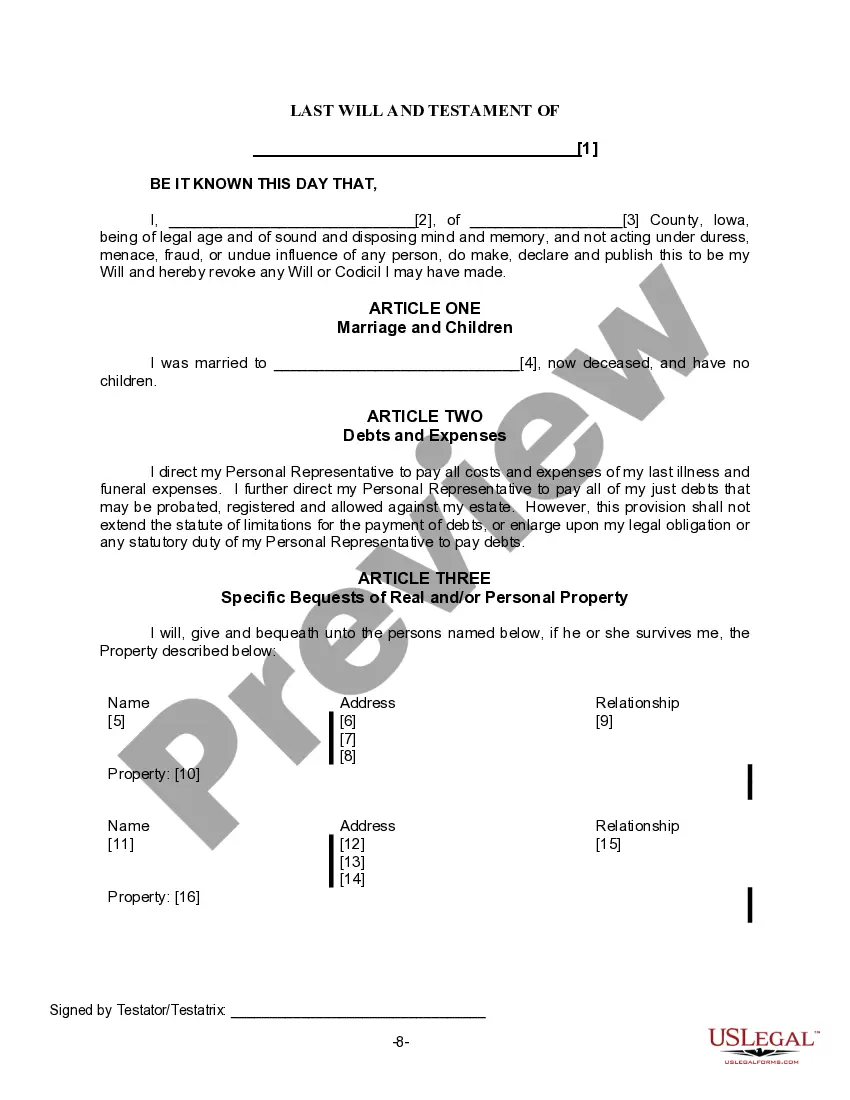

The Legal Last Will Form and Instructions you have found is for a widow or widower with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

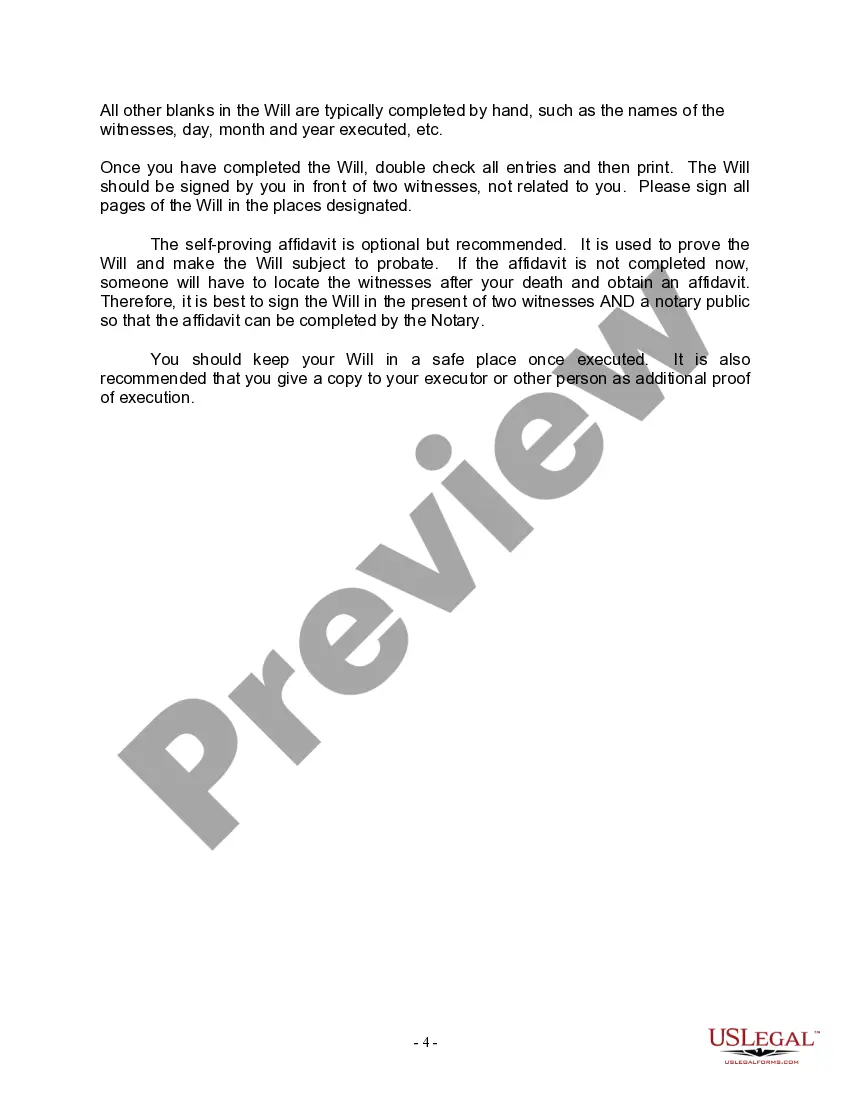

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

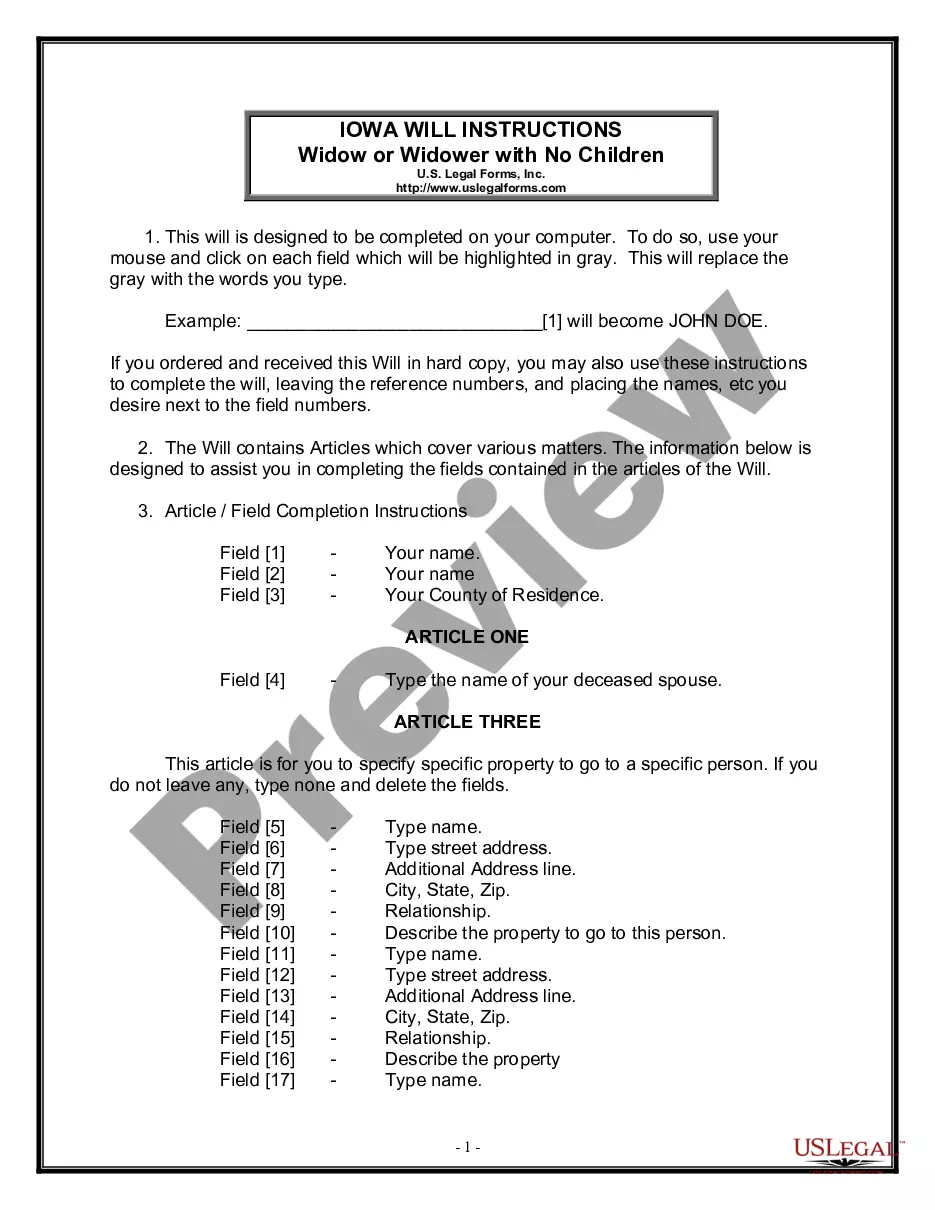

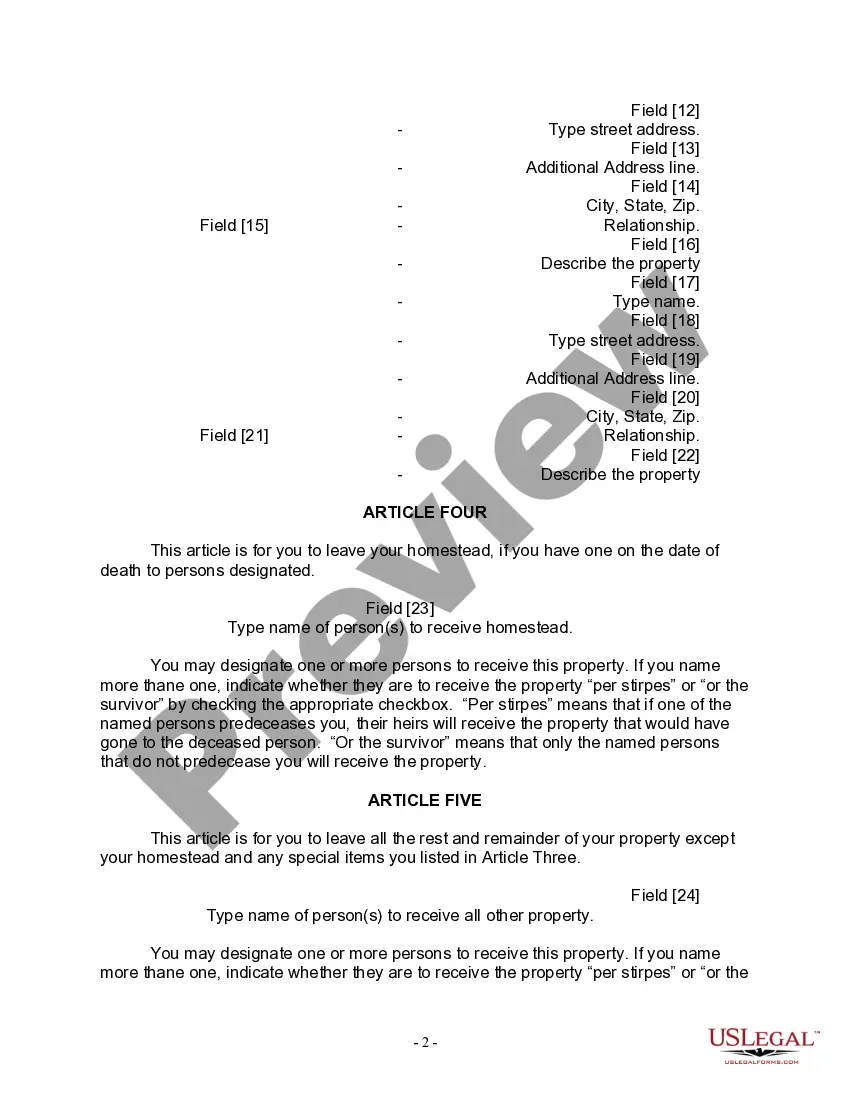

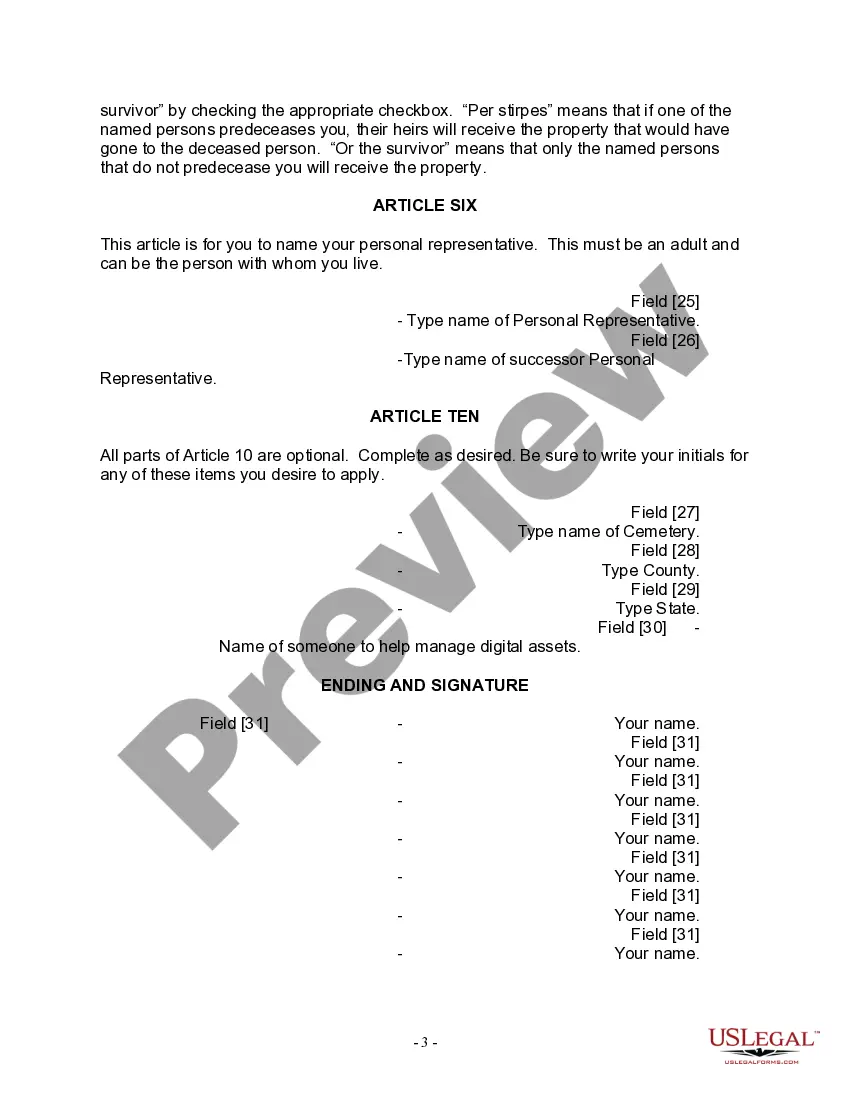

Cedar Rapids Iowa Legal Last Will Form for a Widow or Widower with no Children A Cedar Rapids Iowa Legal Last Will Form for a Widow or Widower with no Children is a legal document that allows individuals who are widowed and do not have any children to outline their final wishes and distribute their assets upon their passing. This document holds significant importance in ensuring that the wishes of the deceased are respected and followed. Creating a Last Will and Testament is a crucial step in estate planning, especially for individuals who do not have any immediate family members. By clearly expressing your desires for the distribution of your estate, you can alleviate any confusion or disputes that may arise after your passing. The Cedar Rapids Iowa Legal Last Will Form for a Widow or Widower with no Children typically includes key provisions and information such as: 1. Identification: The document begins by providing personal information about the testator, including their full legal name, date of birth, and current address. 2. Executor: The testator can appoint an executor, who will be responsible for administering the estate and ensuring that the instructions outlined in the will are carried out accordingly. Usually, a trusted family member, close friend, or a professional executor is chosen for this role. 3. Beneficiaries: This section outlines the individuals or organizations that will inherit the assets mentioned in the will. In the case of a widow or widower with no children, the beneficiaries could be other family members, close friends, or charitable organizations. 4. Distribution of Assets: The Last Will Form allows the testator to specify how their assets, including money, real estate, investments, personal belongings, and any other properties, should be distributed among the beneficiaries. This section may also include provisions for specific bequests or conditional gifts. 5. Appointment of Guardians: In the event that the widow or widower has dependents, such as pets or dependent adults, the will can also name a guardian to take care of these individuals and ensure their well-being. It is important to note that there may be different variations or alternatives to the Cedar Rapids Iowa Legal Last Will Form for a Widow or Widower with no Children. These could include: 1. Simple Cedar Rapids Iowa Legal Last Will Form: This form may be suitable for individuals with straightforward estates and uncomplicated distribution plans. 2. Living Will Form: A living will, also known as an advance healthcare directive, allows individuals to outline their medical treatment preferences in the event they become incapacitated and are unable to communicate their wishes. 3. Combined Will and Testament: Some individuals may choose to create a joint will with their spouse, outlining their joint wishes for the distribution of assets. However, it is important to understand that joint wills become irrevocable upon the death of one spouse, so it may not be suitable for everyone. As with any legal document, it is highly recommended consulting with an attorney to ensure the Last Will Form aligns with the specific laws and regulations of Cedar Rapids, Iowa. Professional guidance can help ensure that your document is legally valid and provides clear instructions for the distribution of your estate.Cedar Rapids Iowa Legal Last Will Form for a Widow or Widower with no Children A Cedar Rapids Iowa Legal Last Will Form for a Widow or Widower with no Children is a legal document that allows individuals who are widowed and do not have any children to outline their final wishes and distribute their assets upon their passing. This document holds significant importance in ensuring that the wishes of the deceased are respected and followed. Creating a Last Will and Testament is a crucial step in estate planning, especially for individuals who do not have any immediate family members. By clearly expressing your desires for the distribution of your estate, you can alleviate any confusion or disputes that may arise after your passing. The Cedar Rapids Iowa Legal Last Will Form for a Widow or Widower with no Children typically includes key provisions and information such as: 1. Identification: The document begins by providing personal information about the testator, including their full legal name, date of birth, and current address. 2. Executor: The testator can appoint an executor, who will be responsible for administering the estate and ensuring that the instructions outlined in the will are carried out accordingly. Usually, a trusted family member, close friend, or a professional executor is chosen for this role. 3. Beneficiaries: This section outlines the individuals or organizations that will inherit the assets mentioned in the will. In the case of a widow or widower with no children, the beneficiaries could be other family members, close friends, or charitable organizations. 4. Distribution of Assets: The Last Will Form allows the testator to specify how their assets, including money, real estate, investments, personal belongings, and any other properties, should be distributed among the beneficiaries. This section may also include provisions for specific bequests or conditional gifts. 5. Appointment of Guardians: In the event that the widow or widower has dependents, such as pets or dependent adults, the will can also name a guardian to take care of these individuals and ensure their well-being. It is important to note that there may be different variations or alternatives to the Cedar Rapids Iowa Legal Last Will Form for a Widow or Widower with no Children. These could include: 1. Simple Cedar Rapids Iowa Legal Last Will Form: This form may be suitable for individuals with straightforward estates and uncomplicated distribution plans. 2. Living Will Form: A living will, also known as an advance healthcare directive, allows individuals to outline their medical treatment preferences in the event they become incapacitated and are unable to communicate their wishes. 3. Combined Will and Testament: Some individuals may choose to create a joint will with their spouse, outlining their joint wishes for the distribution of assets. However, it is important to understand that joint wills become irrevocable upon the death of one spouse, so it may not be suitable for everyone. As with any legal document, it is highly recommended consulting with an attorney to ensure the Last Will Form aligns with the specific laws and regulations of Cedar Rapids, Iowa. Professional guidance can help ensure that your document is legally valid and provides clear instructions for the distribution of your estate.